PM Pictures

Convexity conceptualizes bond costs’ upside and draw back potential in response to rate of interest actions. At present, convexity within the Bloomberg U.S. Mixture Index is at record-high ranges, which implies that bond costs at present have extra potential for positive factors when rates of interest fall and are much less uncovered to losses if rates of interest rise. With the Fed at or close to the height of its mountain climbing cycle, buyers ought to think about performing early by growing the length of their mounted revenue publicity to capitalize on the potential outsized positive factors when charges start to fall.

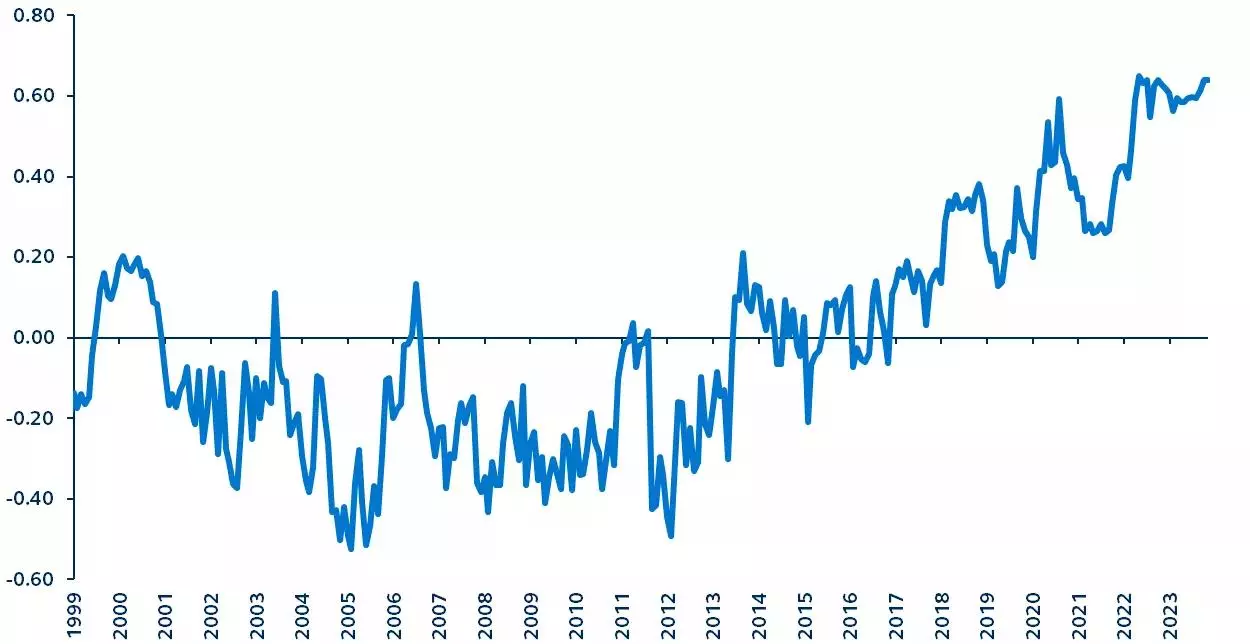

Bloomberg U.S. Mixture Index convexity 1999–current

Supply: Bloomberg, Principal Asset Administration. Information as of October 31, 2023.

The latest sell-off in U.S. Treasury yields has despatched shockwaves by way of the market, with the 10-year yield crossing the 5% threshold for the primary time since June 2007. For buyers trying to capitalize on the sell-off however are cautious of upper yields, the idea of convexity stays key.

Convexity measures the sensitivity of a bond’s length to modifications in rates of interest. In essence, it adjusts the bond’s complete return both up or down after accounting for modifications attributable to length. Optimistic convexity signifies that the potential acquire in worth appreciation ensuing from a drop in yields is extra substantial than the value depreciation attributable to an equal enhance in yields.

On the finish of October 2023, the value on the Bloomberg U.S. Mixture stood at $84.77 per $100 of face worth, considerably decrease than the $99.14 recorded in June 2007. This disparity in costs has resulted in a record-high optimistic convexity within the Index. Think about that over the subsequent 12 months, a mere 50 foundation level drop in yields may translate to an 11% larger worth appreciation on the U.S. Mixture Index.

With the Federal Reserve pausing its charge hikes and yield ranges hovering at pre-GFC highs, buyers must be contemplating extending length in high-quality mounted revenue. The advantages of performing early, due to the market’s file excessive convexity, appear to far outweigh the benefit of a wait-and-see method in mounted revenue.

Disclosure

Investing includes threat, together with attainable lack of principal. Previous efficiency isn’t any assure of future outcomes and shouldn’t be relied upon to make an funding resolution. Fastened‐revenue funding choices are topic to rate of interest threat, and their worth will decline as rates of interest rise.

The data offered has been derived from sources believed to be correct; nevertheless, we don’t independently confirm or assure its accuracy or validity. Any reference to a particular funding or safety doesn’t represent a advice to purchase, promote, or maintain such funding or safety, and doesn’t take account of any investor’s funding aims or monetary scenario and shouldn’t be construed as particular funding recommendation, a advice, or be relied on in any approach as a assure, promise, forecast or prediction of future occasions concerning an funding or the markets basically. The opinions and predictions expressed are topic to alter with out prior discover.

Principal Funds, Inc. is distributed by Principal Funds Distributor, Inc.

Securities are provided by way of Principal Securities, Inc., 800-547-7754, Member SIPC and/or unbiased dealer/sellers.

Principal Asset Administration leads world asset administration at Principal.®

For Public Distribution within the U.S. For Institutional, Skilled, Certified and/or Wholesale Investor Use solely in different permitted jurisdictions as outlined by native legal guidelines and rules.

© 2023, Principal Monetary Companies, Inc. Principal Asset AdministrationSM is a commerce identify of Principal World Buyers, LLC. Principal®, Principal Monetary Group®, Principal Asset Administration, and Principal and the logomark design are registered logos and repair marks of Principal Monetary Companies, Inc., a Principal Monetary Group firm, in numerous nations world wide and could also be used solely with the permission of Principal Monetary Companies, Inc.

Editor’s Notice: The abstract bullets for this text had been chosen by Searching for Alpha editors.