A risky day for markets (comparatively talking) with crude and crypto the high- low-lights.

Goldman’s buying and selling desk (Lee Coppersmith) famous that for the primary time all yr, it feels just like the market is beginning to query the robust development narrative on the again of weaker earnings this AM: ASML -8% spilling into all Semis; JBHT a bellwether transport -7.5% and KNX -3.5% reduce their forecast; Industrial REITs (GSSIREID) -3.2% on again of a neg print within the area. All of this weighing on the Momo commerce (GSPRHIM) -2%.

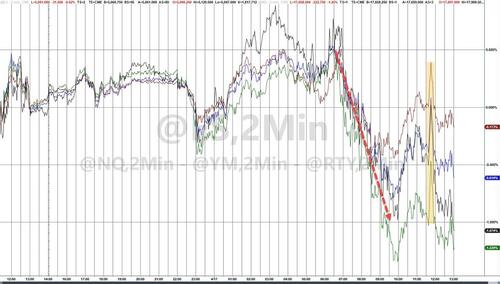

Shares have been sliding early on after the money open however at round 1055ET the next headline hit: STRIKING IRAN’S NUCLEAR FACILITIES ‘ON THE TABLE’, SAYS EX-MOSSAD INTELLIGENCE CHIEF – SKY NEWS which took shares down aggressively.

However that was reversed greater as oil costs plunged…

Supply: Bloomberg

Oil was drifting decrease early on amid a bigger crude stockpile construct however then Maduro and SPR headlines hit and the worth plummeted to three-week lows…

Who might have seen that coming?

Oil obtained the message. How lengthy earlier than inventory algos notice the SPR drain is coming

— zerohedge (@zerohedge) April 17, 2024

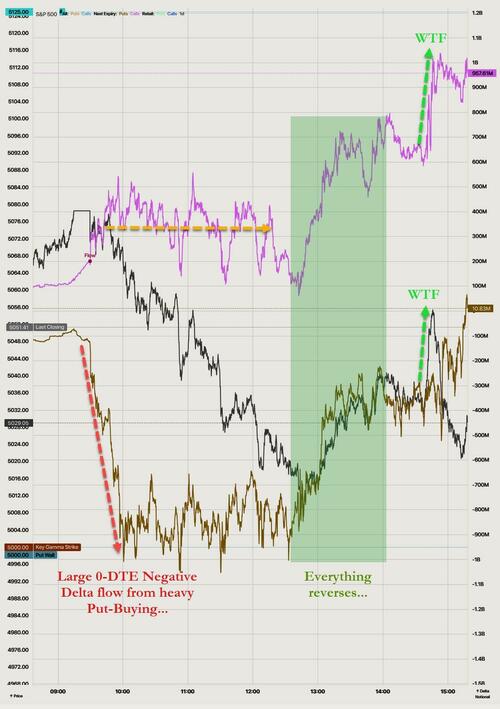

Then round 1440ET shares went vertical.. as a result of, frankly, no concept in any respect… after which reversed it simply as quick! An virtually good redux of what we noticed yesterday across the similar time…

Notably, the driving force for that spike was a sudden surge in 0-DTE call-buying…

Supply: SpotGamma

That didn’t final lengthy – identical to yesterday, and by the shut Equities have been again close to the lows of the day with Nasdaq and Small Caps the largest laggards. The S&P was down round 0.5% on the day and The Dow was unable to carry unchanged…

The bounce in shares – due to plunging crude costs – rescued shares important CTA thresholds that ought to stay on everybody’s radar: medium time period threshold = 4880 (~2.7% beneath spot). Goldman warns this may set off >$50bn in SPX provide over 1 month. As a reminder, the short-term CTA promote threshold was 5,135 yesterday.

Yet one more factor earlier than we go away equity-land, VIX ended the day unchanged, whereas shares have been down fairly notably – are we lastly seeing some call-unwinds?

Supply: Bloomberg

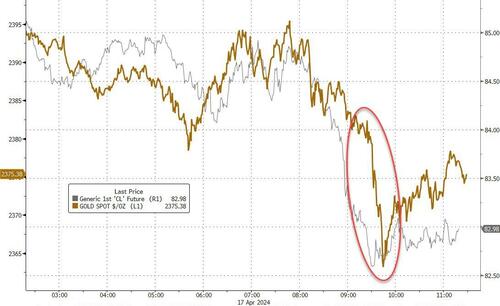

Oddly, gold additionally began to tumble across the similar time as oil plunged…

Supply: Bloomberg

Treasuries have been very properly bid right this moment with a robust 20Y public sale additional emboldening patrons this afternoon. The stomach of the curve outperformed, with 5Y -9bps, 2Y and 30Y -5bps…

Supply: Bloomberg

The 2Y Yield completely rejected 5.00% for now…

Supply: Bloomberg

Whereas yields tumbled, rate-cut expectations have been mainly unchanged…

Supply: Bloomberg

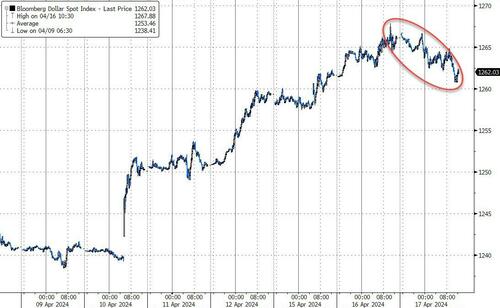

The greenback dropped for the primary time in six days – its largest drop since March seventh…

Supply: Bloomberg

However the large transfer on the day… was in crypto which puked laborious together with shares, shedding its $60k deal with briefly earlier than bouncing again a bit…

Supply: Bloomberg

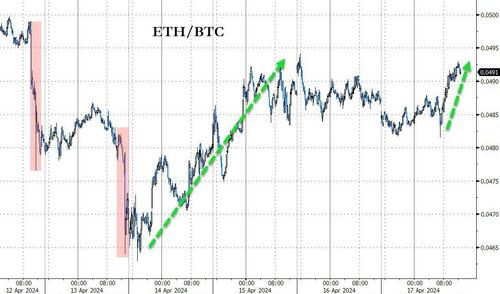

Ethereum outperformed bitcoin on the day, erasing most of its large relative puke final Friday/Saturday…

Supply: Bloomberg

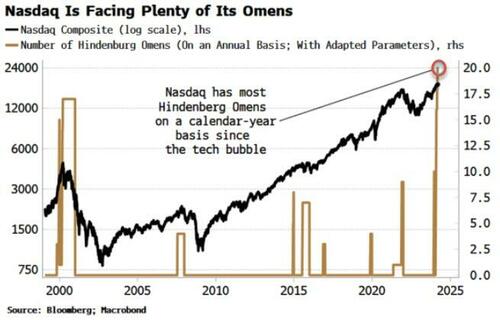

Lastly, as we detailed earlier, the market has seen extra Hindenburg Omens than in any yr because the peak of the

Supply: Bloomberg

‘Most likely nothing!’

Loading…