percds/iStock by way of Getty Pictures

Introduction

This 12 months, YieldMax has launched a full suite of ETFs primarily based round promoting name choices in opposition to excessive beta (very risky) shares like Coinbase World, Inc. (COIN), Tesla, Inc. (TSLA), and extra.

Coinbase is a cryptocurrency trade and monetary providers firm (only a few other services, honestly), and as such, is an extremely risky inventory. This has attracted choices merchants who search to revenue from the volatility.

Enter the YieldMax COIN Choice Earnings Technique ETF (NYSEARCA:CONY), one among many covered-call-driven funds YieldMax debuted this previous September.

Each time I cowl YieldMax ETFs, the listing appears to develop by a couple of extra tickers.

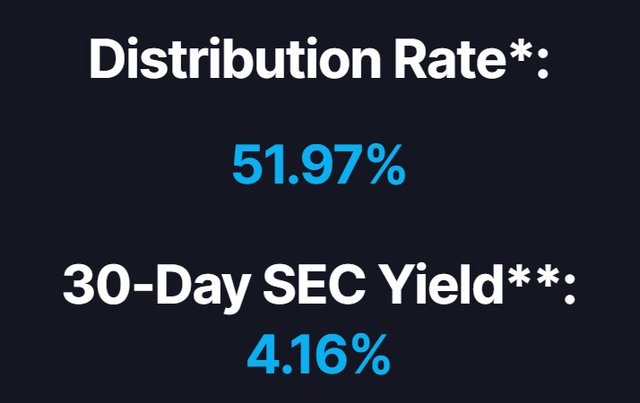

Determine 1 (YieldMax)

Final month, I coated TSLY, a sister fund to CONY. If you wish to see my protection of its comparable technique, the place I focus on TSLA surprisingly little, test it out right here.

CONY goals to, identical to the remainder of the YieldMax funds, present month-to-month revenue distributions and publicity to COIN’s upside. The fund managers state that they intention for about 80% worth upside, which means that they’re internet quick 20% or so at any given time. This fluctuates day after day, after all, because the managers commerce every day.

Determine 2 (YieldMax)

With a 4.16% 30-day yield and a 51.97% distribution charge, revenue traders could also be tempted by this fund.

Sadly, there’s extra danger than is straight away obvious in CONY, and I’m giving it a promote ranking for now. It doesn’t advantage consideration for an revenue portfolio, because it has some inherent flaws in its technique that I don’t take into account acceptable for funding.

The Technique

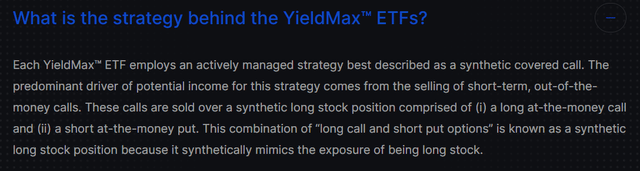

YieldMax describes the overall technique of their ETFs beneath in Determine 3.

Determine 3 (YieldMax)

A “artificial coated name” is options-speak for the capital-efficient technique of utilizing choices to copy inventory publicity.

It is capital environment friendly as a result of artificial inventory publicity might be constructed utilizing margin to safe the quick put being offered. The premium from the sale of the quick put is then used to offset the price of the lengthy name. Because of this the precise money NAV of the fund might be held in treasury bonds, offering a small enhance to yield and, assuming they’re held to maturity, absolute returns.

These are nice underlying holdings as a result of they aren’t risky and can present a steady, albeit middling, return with out inflicting giant swings in margin upkeep necessities.

As for CONY, US Treasuries, or UST, make-up 100% of the underlying holdings, and it nonetheless has 4.97% of NAV in money. That is probably money held to pay out dividends and to buy-to-close their quick choices positions ought to they want to do this as an alternative of rolling for a credit score.

Preserving choices premium in money, plus some additional to cowl losses, is prudent for actively managed funds as a result of when you’re buying and selling reside choices, UST liquidity is not sufficient to be aggressive on the extent traders count on from CONY. Execution issues rather a lot, and these funds promote 1000’s of contracts at a time. Liquidity can dry up quick on sure strikes, so having money out there to commerce on the proper second is essential.

Determine 4 (YieldMax)

Notice that one among their UST holdings (bought at a reduction, however nonetheless with an abysmal yield) is maturing in a month. Hopefully, the managers will have the ability to take part in a brand new public sale and choose up UST with a lot increased yields.

In case you’re inquisitive about maintaining with their adjustments, right here is the auction schedule. Additionally it is potential for them to roll into an current observe and shopping for it at a reduction.

These new USTs yielding upwards of 5% might give CONY an honest “yield ground.” It doesn’t matter what yield they find yourself with after their change, it’s a small buffer for CONY’s dividends, as USTs additionally pay month-to-month coupons. The larger the coupons, the much less danger the managers might want to take with choosing strikes. Because of this, I might completely wish to see them choose up extra not too long ago issued bonds or new bonds from public sale subsequent month.

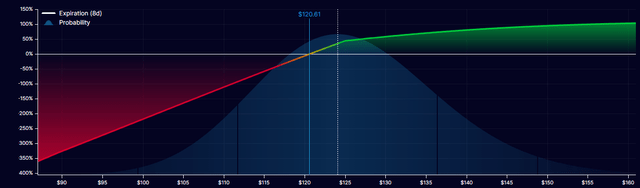

So far as the choices positions go, should you plot a payoff chart utilizing CONY’s present holdings, it appears like this:

Determine 5 (OptionsStrat)

The form of the curve on the high is because of the staggered quick calls, on 12/8 and 12/22.

With the market pricing in a 61% likelihood of success, this is not essentially a “lotto ticket” choices commerce, however it’s removed from a excessive likelihood commerce that many of us consider when they consider coated name funds. These are pretty aggressive strikes.

For these within the “Greeks” of the place, right here you’re.

Determine 6 (OptionsStrat)

Notice that the place has adverse Vega, which means {that a} rise in implied volatility would work in opposition to this place. Because of this YieldMax is betting on realized volatility being lower than implied volatility. In the event that they’re fallacious, the place might lose cash even when COIN’s worth goes up.

This introduces us to a brand new danger to contemplate for all YieldMax funds.

Drawdowns

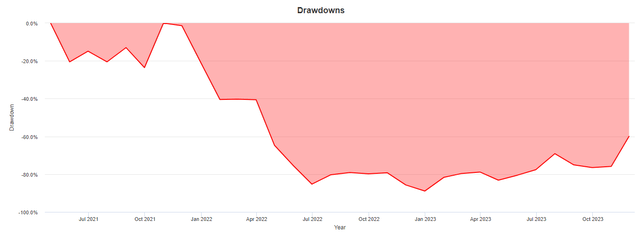

CONY is comparatively new, which means that it hasn’t had time to expertise a extreme drawdown.

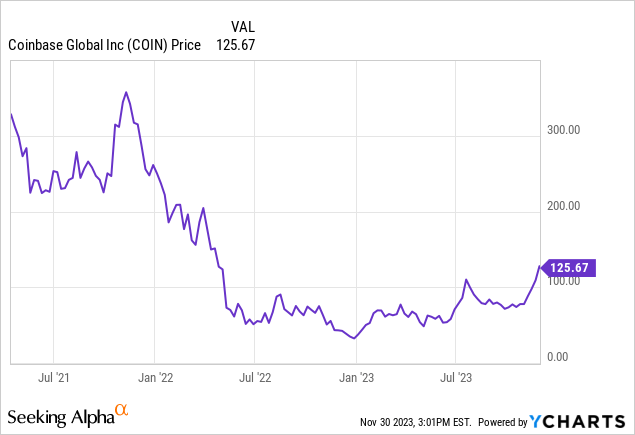

Its underlying inventory, COIN, can have very sudden drops. Right here is their all-time chart as an example.

How underwater traders are, from IPO to now, is best to see within the drawdown chart.

Determine 10 (Portfolio Visualizer)

COIN traders misplaced 24.15% from 3/31/22-4/30/22. These dates fall throughout the identical timeframe of the present choices trades. That may’ve been a really, very dangerous time to carry CONY had it been round. This fund would have seen nearly everything of that drop as nicely, since it isn’t correctly hedged in any approach aside from the quick name premium, which finally ends up being distributed to shareholders anyway, so is not very helpful for preserving NAV. This can be a danger amplified by CONY’s internet adverse Vega talked about earlier.

CONY didn’t exist for any of those drawdowns, because it launched in September this 12 months, so we have no good information on the way it could deal with one other inevitable swing to the draw back.

COIN had a max drawdown from Nov. ’21 to Dec. 22′ of 88.92%. Whereas there would’ve been some extra returns from offered calls that expired, I’m wondering how CONY would’ve finished.

As a result of their technique includes real-time, lively intervention of their trades, it is not possible to know what the managers could have finished up to now. Because of this, we solely have a imprecise concept on how CONY would’ve finished throughout these durations.

The actual query we’re all asking: So how’s it finished to date?

Efficiency

Effectively, it is okay. Underwhelming.

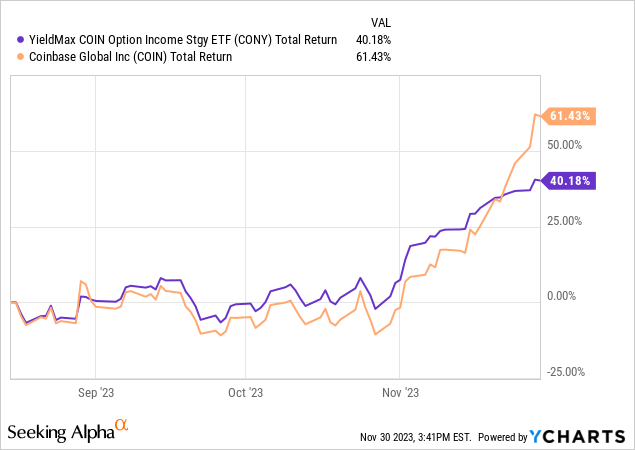

There was a strong interval of outperformance for CONY by October and into November, albeit slight outperformance. Notice the place CONY began falling quick, beginning a couple of weeks in the past. This is because of CONY’s capped upside. At the same time as COIN ran, CONY would breach its strikes and never have the ability to take part in any extra upside.

The best danger current right here is that with a capped upside and an unhedged draw back, there’s little to guard CONY from struggling one other sharp drawdown in COIN and devastating traders.

The very best half about holding excessive beta shares like COIN is that once they run up, they run up. In case you miss out on that upside, you will not have the ability to get better from the drawdowns.

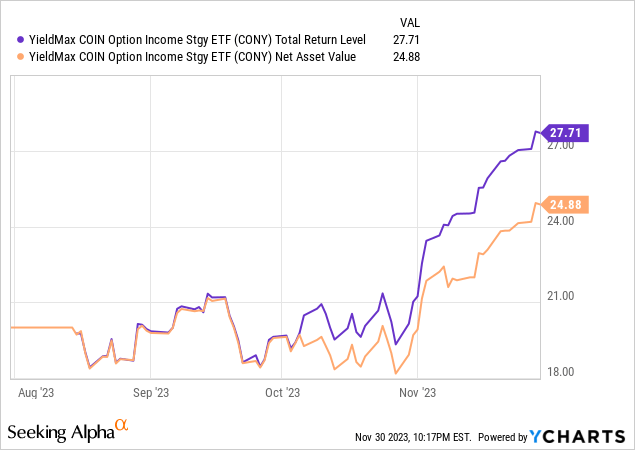

This might result in “NAV erosion,” which is the place funds might want to cannibalize their underlying property with a purpose to pay dividends to traders since their choices positions resulted in losses.

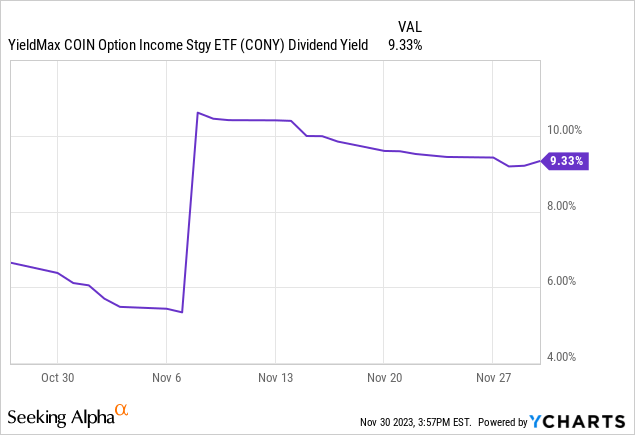

So far as dividend efficiency is worried, we do not have a lot information since there have solely been two distributions to date.

Dividend-wise, we are able to count on to see one thing near 10% as soon as it evens out. This may increasingly change, as holdings change and as COIN adjustments, however for now, that is what traders ought to count on.

This may increasingly change wildly, and I don’t count on stability from their distributions.

Abstract

The YieldMax COIN Choice Earnings ETF presents traders an eye-watering distribution yield however comes with dangers that make it an unworthy funding for income-seekers.

As a consequence of Coinbase’s risky nature and the technique’s capped upside, CONY can’t take part in the identical upside COIN traders maintain COIN for. The distributions to date have left a 20% hole in whole return between the 2.

In the end, I have to charge this fund a promote and warning traders concerning the dangers of the CONY’s technique.

P.S. How do you pronounce CONY? With TSLY, I say “tes-lee.” I do not like “coh-nee” as a result of it jogs my memory of the Ugandan militant we affiliate with 2012. “koy-nee” is what I am at the moment going with. Please inform me within the feedback in case you have one thing higher.