- XRP would hit the $20 mark by 2026 amidst ongoing authorized points with the SEC.

- Evaluation urged continued downward value stress, which metrics present elevated curiosity.

Ripple [XRP], a number one cryptocurrency, has confronted vital challenges on account of an ongoing lawsuit with the U.S. Securities and Trade Fee.

Up to now, the asset has skilled a drastic 84.7% decline from its all-time excessive of $3.40 in 2018 and has but to get better a fraction of its peak worth.

This constant drop in value has prolonged: Over the previous 30 days, XRP’s worth has dropped practically 20%.

Though there was a minor uptick final week, the cryptocurrency has began to lose these good points, at the moment displaying a 2.3% lower over the previous 24 hours.

Nevertheless, regardless of the bearish stress, an analyst has predicted that XRP has a shiny future.

A bullish case for XRP

Armando Pantoja, a famous crypto analyst, stays optimistic about XRP’s potential, estimating its worth to succeed in between $8 and $20 by 2026.

This projection implies a dramatic improve of as much as 3,557.6% from its present ranges.

Pantoja cites the explanation why this surge may very well be doable, citing the 2017 bull run, the place XRP surged over 650 occasions to its peak, as a “Historic Precedent Powerhouse” for such progress.

Institutional adoption is a robust driver for XRP’s future value. Up to now, Ripple, the corporate behind XRP, has seen vital integration into main monetary establishments like Financial institution of America and Royal Financial institution of Canada.

Moreover, Ripple’s latest partnership with HashKey DX to introduce XRP Ledger-based options in Japan, and collaboration with SBI Ripple Asia, might propel XRP’s value upward.

Regardless of these adoptions, motion remains to be being made to speed up additional adoptions.

As an illustration, RippleX, Ripple’s improvement arm, has introduced vital upgrades to the XRP Ledger (XRPL), such because the XLS-68d specification.

This enhancement permits platforms to cowl transaction charges for others with out distributing free XRP, simplifying the onboarding course of.

These developments are important for broadening XRP’s attraction and utility within the digital economic system.

Along with institutional adoption, Pantoja highlights the affect of market developments and the growing utility of economic companies.

He forecasts that XRP will quickly obtain authorized readability and see a major growth in partnerships.

Relating to the authorized developments with Ripple and the U.S. Securities and Trade Fee (SEC), tensions escalated in March when the SEC sought a considerable $2 billion wonderful in opposition to Ripple for purported violations associated to institutional gross sales of XRP.

Ripple has refuted these allegations, with Chief Authorized Officer Stuart Alderoty presenting the agency’s detailed rebuttal final week.

Ripple’s protection challenges the SEC’s assertions and suggests a a lot decrease wonderful, ideally beneath $10 million.

Reports have it that the US SEC has filed its remaining reply to the wonderful opposition, nevertheless, the paperwork are beneath seal and but to be inaccessible to the general public.

Because the lawsuit approaches its concluding levels, the crypto neighborhood is keenly watching to see the result and whether or not XRP can surpass its earlier highs and probably soar into double digits.

XRP’s doable short-term transfer

In the meantime, Technical evaluation signifies that XRP could proceed to face downward stress within the close to time period.

The asset has constantly damaged its construction on the each day and 4-hour charts, just lately capturing liquidity and now focusing on the swing low close to $0.48.

Supply: TradingView

This bearish short-term outlook is bolstered by a latest report from AMBCrypto, which famous that the Chaikin Cash Movement for XRP was at zero, indicating no vital influx of capital into the market.

Sensible or not, right here’s XRP’s market cap in BTC phrases

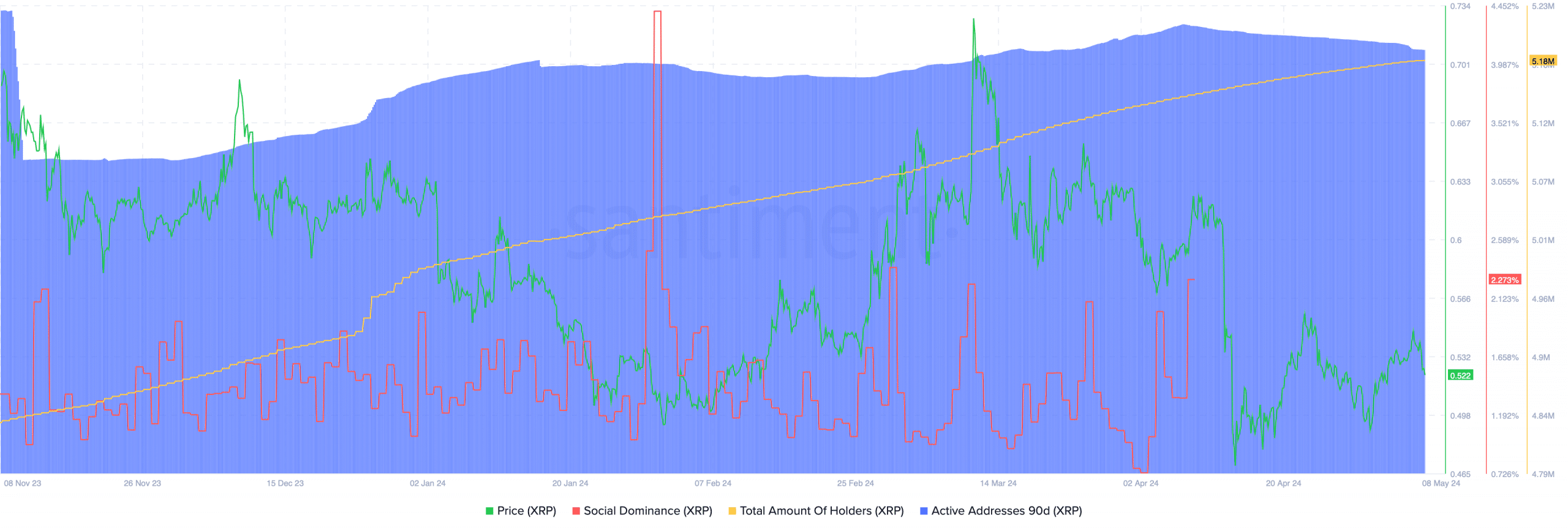

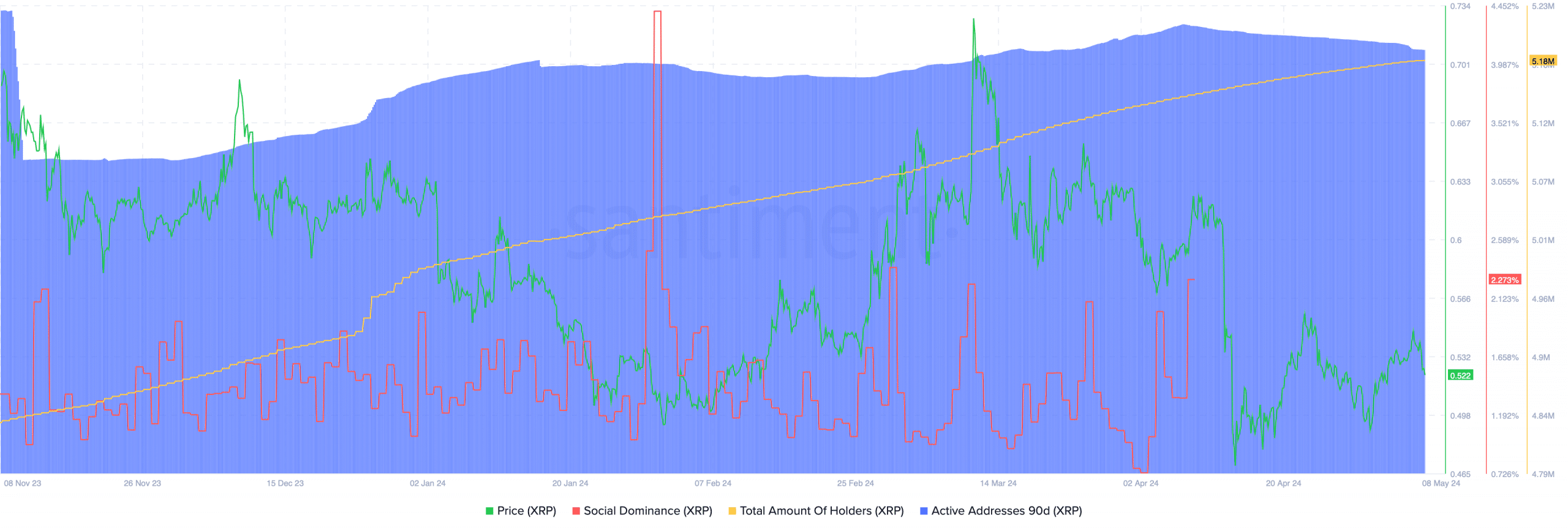

Nevertheless, regardless of these bearish indicators, data from Santiment reveals a rise in metrics comparable to social dominance, whole holders, and energetic addresses for XRP.

This means that many locally stay optimistic and assured in regards to the asset’s future.

Supply: Santiment