- XRP’s worth dropped by greater than 4% within the final seven days.

- A couple of metrics and indicators hinted at a development reversal.

Like most cryptos, Ripple’s [XRP] worth additionally witnessed a correction because the market situation turned bearish. Nevertheless, there was excellent news, as a key indicator hinted that XRP would possibly quickly contact $3.

Subsequently, AMBCrypto analyzed XRP’s metrics to see whether or not that’s a viable risk.

XRP has hope

CoinMarketCap’s data revealed that the token’s worth had dropped by over 4% within the final seven days. Within the final 24 hours, the token’s worth sank by over 2%.

On the time of writing, XRP was buying and selling at $0.5055 with a market capitalization of over $27.9 billion. Throughout this era, XRP’s concern and greed index entered the concern zone, because it had a price of 38%.

Supply: CFGI.io

Although this was bearish, the upcoming weeks would possibly simply be totally different. Notably, Milkybull, a well-liked crypto analyst, just lately posted a tweet, which highlighted a specific “uncommon” indicator.

This indicator has a 100% constructive monitor report, because it precisely predicted XRP’s worth again in 2017, 2018, and 2021.

In the course of the earlier cycle, it predicted XRP’s worth to $1.9, which considerably translated into actuality because the token’s worth reached $1.79.

XRP’s conservative bull goal for this cycle is $2.4–$3.

XRP to show bullish once more?

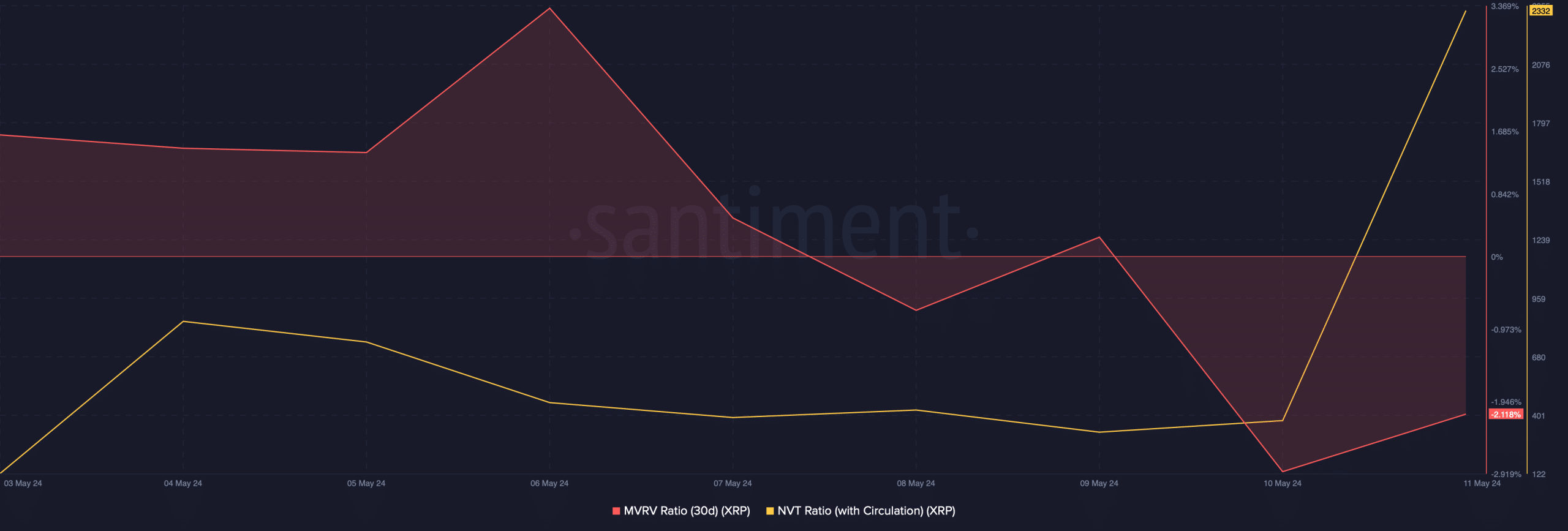

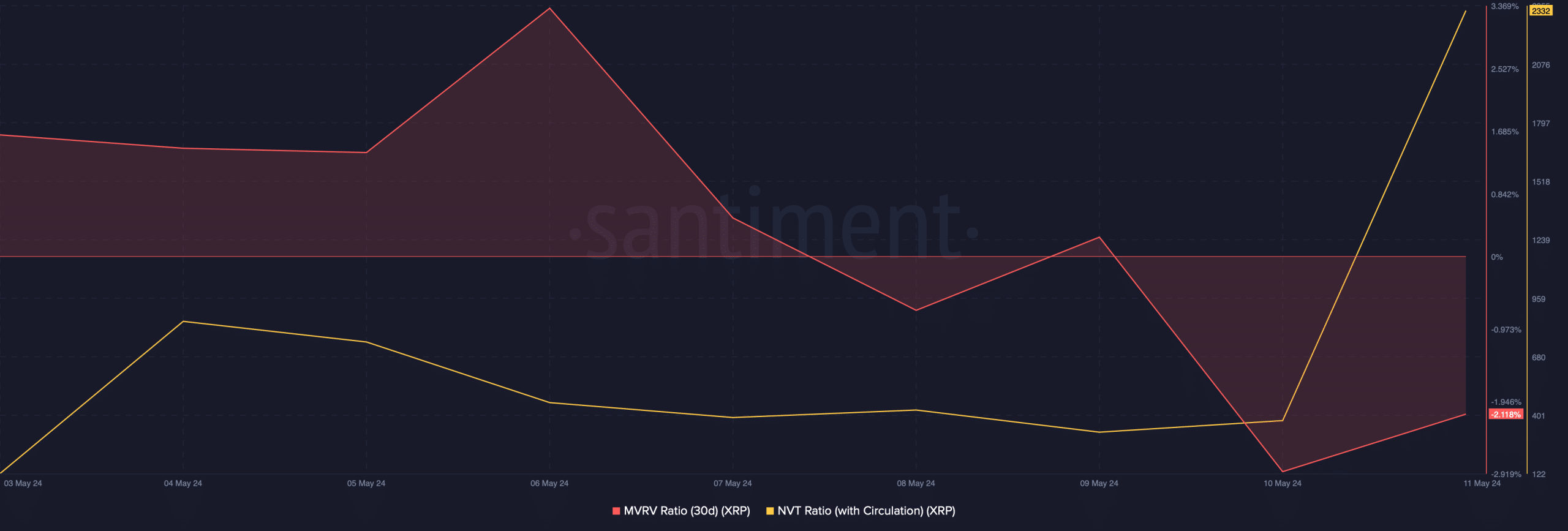

AMBCrypto’s evaluation of Santiment’s knowledge revealed that the token’s MVRV ratio remained bearish. At press time, it had a price of -2%.

Its NVT ratio spiked sharply on the eleventh of Might, suggesting that the token was nonetheless overvalued.

Supply: Santiment

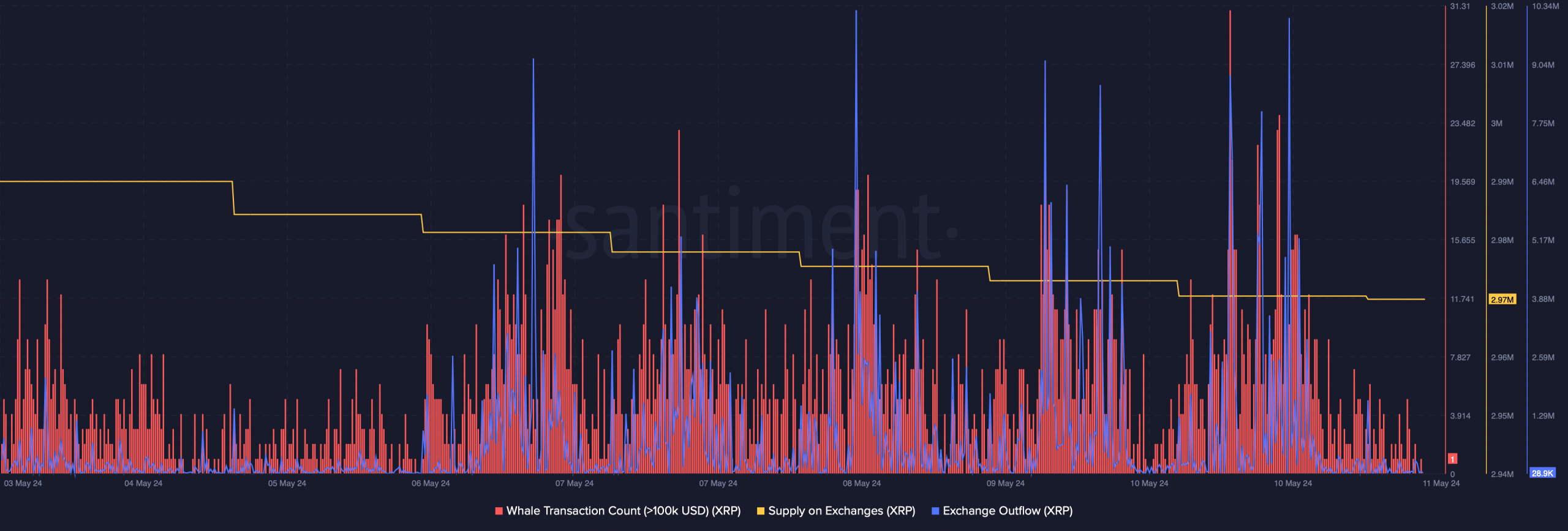

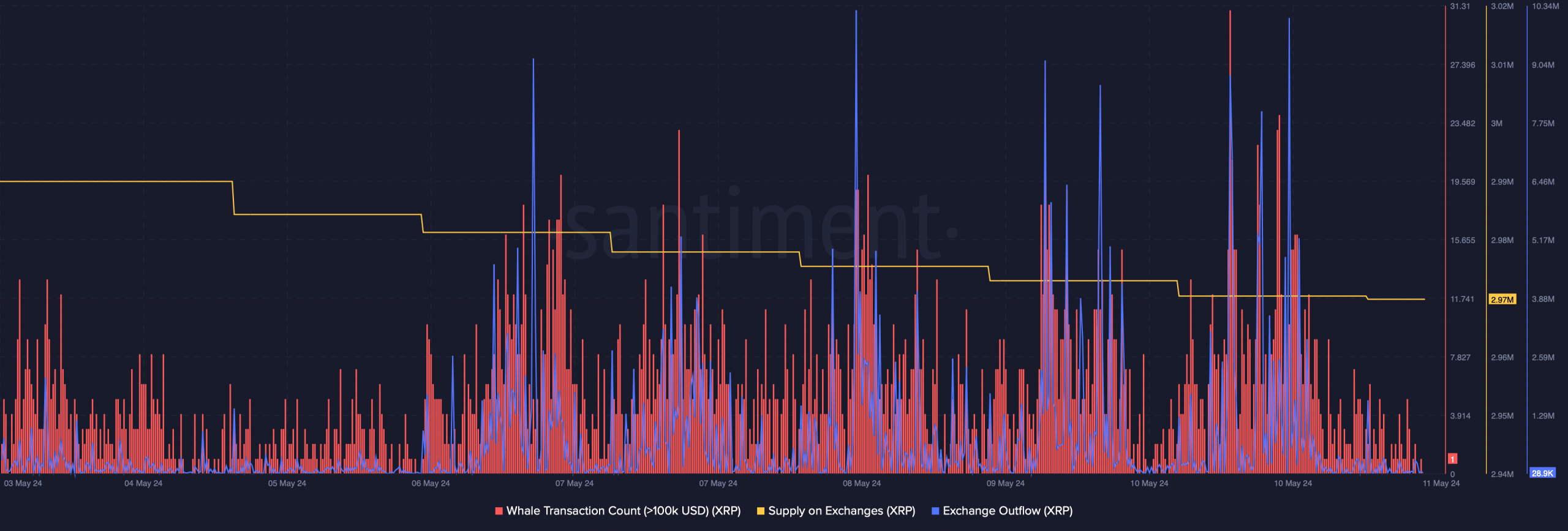

Nevertheless, shopping for strain on the token was excessive, which was evident from the rise in its Trade Outflow. The token’s Provide on Exchanges additionally dropped, exhibiting that traders had been shopping for.

Whale exercise across the token additionally remained excessive within the final week.

Supply: Santiment

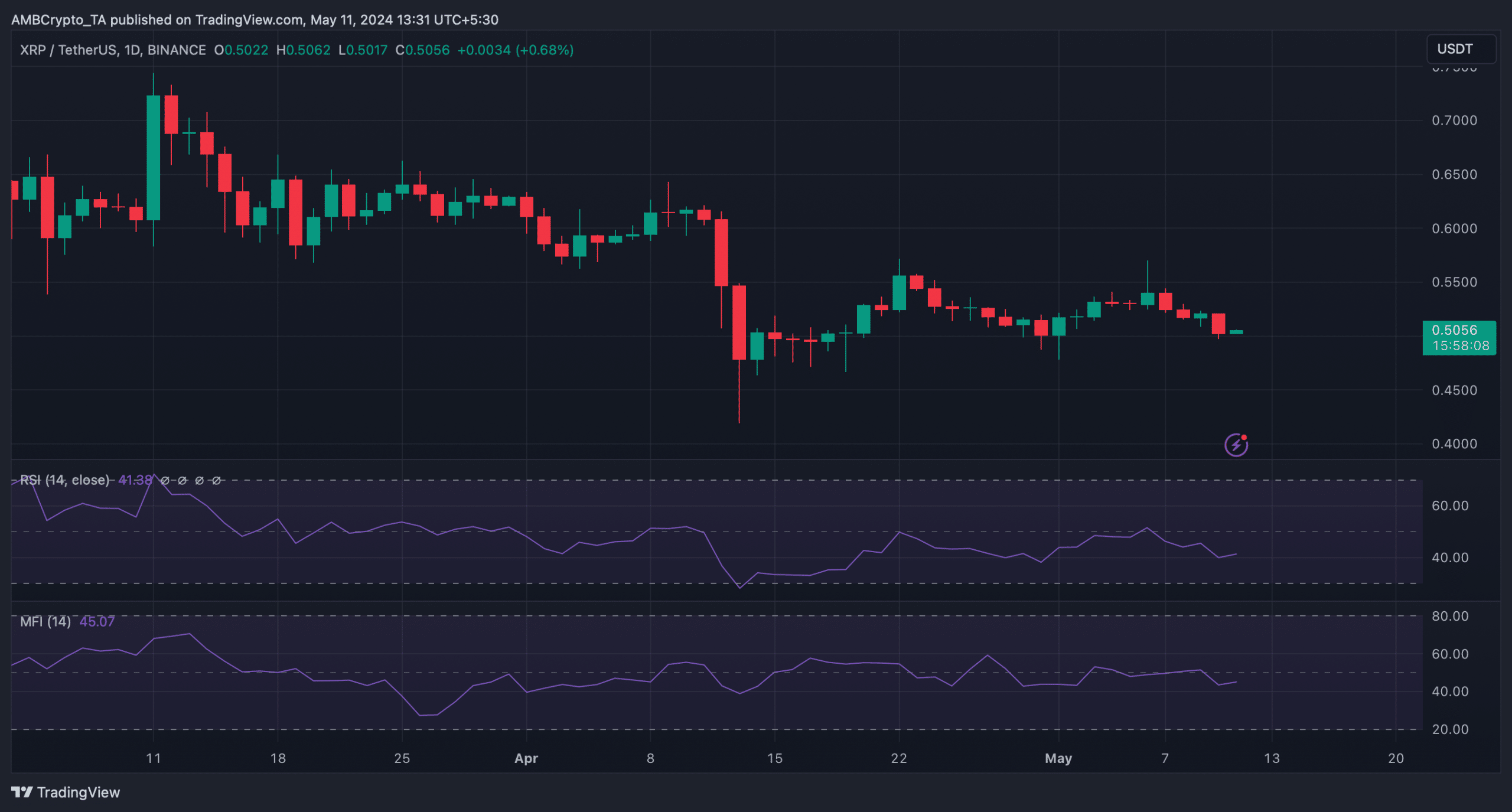

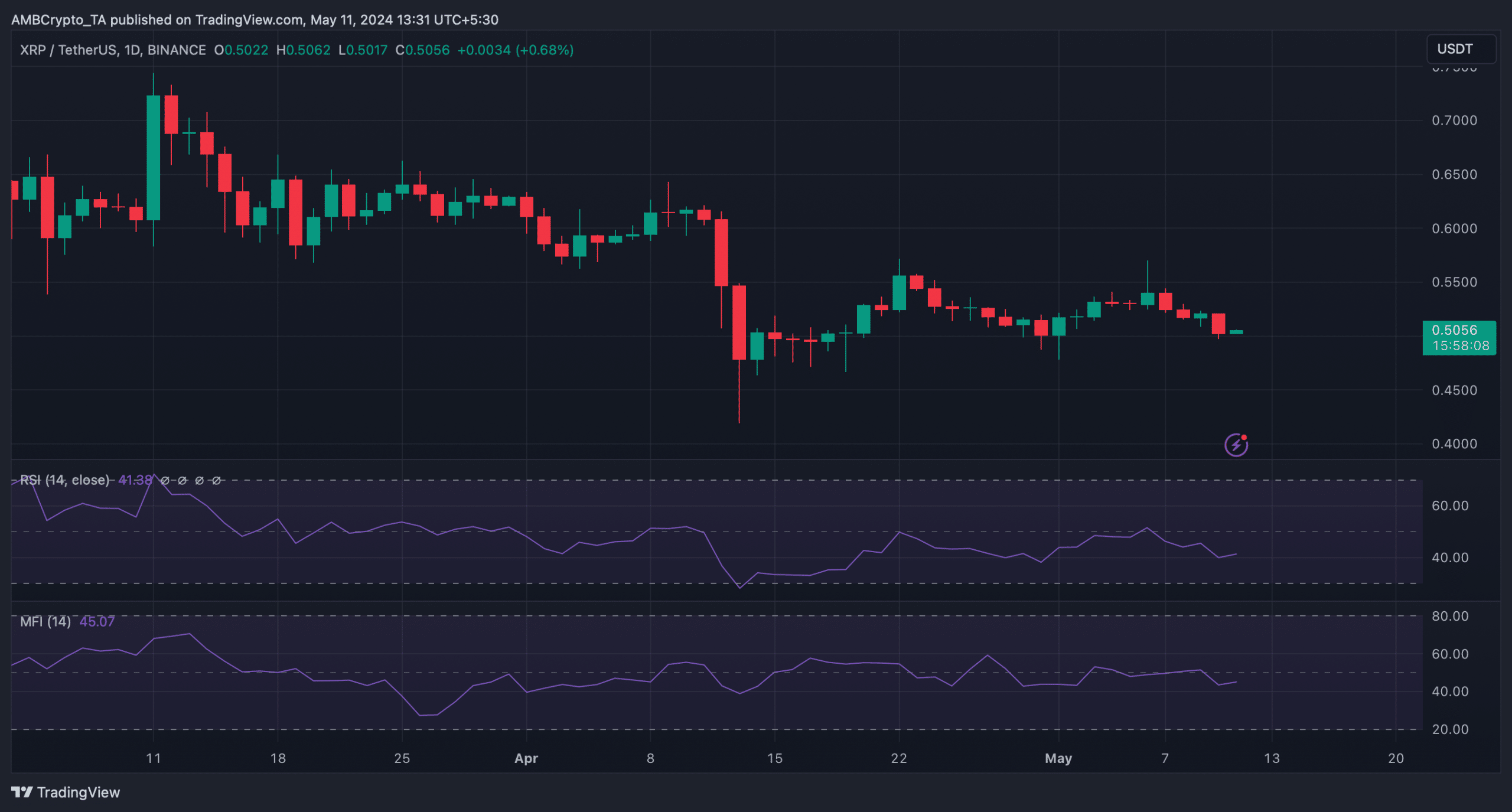

Since a number of metrics appeared bearish as properly, AMBCrypto analyzed XRP’s day by day chart to see whether or not an uptrend is feasible within the brief time period.

We discovered that its Relative Energy Index (RSI) registered a slight uptick. The token’s Cash Move Index (MFI) additionally went up barely, suggesting a attainable development reversal.

Supply: TradingView

If the market development modifications and XRP good points bullish momentum, it would then attain $3. Nevertheless, earlier than focusing on that degree, the token has to beat a problem.

Sensible or not, right here’s XRP market cap in BTC’s phrases

As per Hyblock Capital’s knowledge, the token’s liquidation would rise sharply close to $0.512, which may set off yet one more worth correction.

Subsequently, earlier than XRP begins its journey to $3, it’s essential for the token to go above the aforementioned resistance.

Supply: Hyblock Capital