{An electrical} engineer works on a laptop computer.

aydinmutlu

How are you aware that you simply’re investing correctly? Effectively, the famend economist Paul Samuelson provides a solution to us: “There’s something in folks; you would possibly even name it a bit little bit of a playing intuition… I inform folks investing ought to be uninteresting. It should not be thrilling. Investing ought to be extra like watching paint dry or watching grass develop. If you’d like pleasure, take $800 and go to Las Vegas.”

When executed proper, your strategy to investing from the skin trying in ought to be very boring to different folks. That does not imply it must be boring to you: Through the years, I’ve discovered the method of slowly and absolutely constructing wealth to be fairly thrilling. However success as an investor largely is determined by emotional intelligence (e.g., endurance, reasoning, and studying from previous errors) and shopping for nice companies at enticing valuations. As soon as you start to take these actions, it is a matter of using out the storm of market volatility.

As a dividend development investor, receiving constantly rising dividend funds helps me to do exactly that with my portfolio. The electrical and pure gasoline utility Xcel Vitality (NASDAQ:XEL) flies beneath the radar of most dividend development traders. Nonetheless, I consider the inventory deserves extra respect and a focus from traders. For the primary time since Could 2022, let’s focus on why that’s the case.

The Dividend Is Sustainable

Once you consider utilities, you usually consider stodgy dividend payers. Nonetheless, having delivered 6.4% annual dividend development to shareholders over the previous 10 years, Xcel Vitality has been a decent dividend grower. Thus, the In search of Alpha Quant system grades the corporate’s dividend development at a B- versus the general utility sector.

Comparable dividend development ought to proceed sooner or later. Xcel Vitality posted $3.17 in diluted EPS in 2022. Towards the $1.92 in dividends per share that had been paid throughout that point, this equates to a 60.6% diluted EPS payout ratio. That is on the low finish of the corporate’s 60-70% focused diluted EPS payout ratio, which supplies it the pliability to ship dividend development barely larger than earnings development.

Xcel Vitality expects midpoint diluted EPS of $3.35 ($3.30 to $3.40) for 2023. In comparison with the $2.0475 in dividends per share which might be slated to be paid in 2023, this works out to a 61.1% diluted EPS payout ratio.

The consensus is that Xcel Vitality will ship annual diluted EPS development of roughly 6% over the subsequent 5 years. That is in keeping with the 6.1% common annual diluted EPS development of 6.1% that the utility has put up for practically twenty years (slide 19 of 80 of Xcel Energy Barclays Investor Presentation). That’s the reason I consider the corporate can hand out 6.5% annual dividend will increase in the long term.

Holding Up Regardless of Headwinds

Boasting an electrical buyer base of three.8 million and a pure gasoline buyer base of two.1 million, Xcel Vitality is a significant utility. The corporate operates 4 firms in eight states all through the Midwest and Southwest United States.

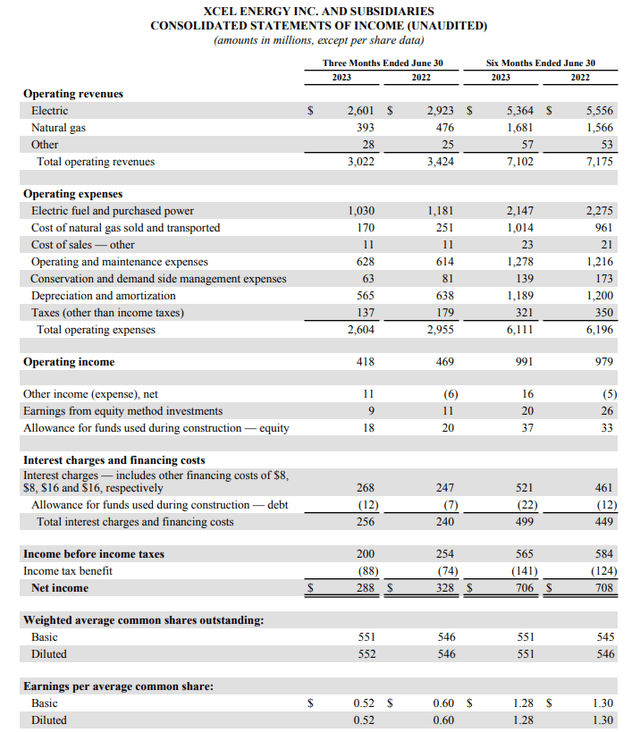

Xcel Vitality Q2 2023 Earnings Press Launch

Xcel Vitality’s working income fell 1% over the year-ago interval to $7.1 billion within the first half of 2023. Unfavorable climate and the electrical charge case in Minnesota had been primarily liable for the dip within the topline for the primary half of the yr.

Within the case of the latter, the Minnesota Public Utilities Fee gave the go-ahead to a three-year charge enhance of $311 million primarily based on a 9.25% return on fairness. This was considerably lower than the ten.2% and $498 million that Xcel Vitality filed for in its charge case.

The corporate’s diluted EPS declined by 1.5% yr over yr to $1.28 in the course of the first half of the yr. Larger rates of interest weighed on diluted EPS to the tune of $0.08 in that interval. Damaging climate impacts contributed to a different $0.04 in headwinds.

However even after these challenges, Xcel Vitality reiterated its midpoint diluted EPS steerage of $3.35. This is able to be a 5.7% development charge over its 2022 diluted EPS base of $3.17. This respectable development charge can be supported by just a few components: In the course of the earnings name, CFO Brian Van Abel pointed to gross sales development in its service territories and extra charge case income from Colorado and New Mexico that may start to happen within the second half of this yr.

Trying off into the horizon, Xcel Vitality has plans to speculate $29.5 billion into its electrical and pure gasoline infrastructure between 2023 and 2027. This ought to be made attainable by the corporate’s BBB+ credit standing from S&P and a manageable debt-to-EBITDA ratio of simply 4.9. That’s the reason Xcel Vitality believes it could actually ship 5% to 7% diluted EPS development yearly in the long run (all particulars on this part sourced from Xcel Vitality Barclays Investor Presentation and Xcel Energy Q2 2023 Investor Presentation and Xcel Vitality Q2 2023 earnings press launch).

Dangers To Contemplate

As a utility, Xcel Vitality is not as dangerous as a tech startup. Nonetheless, there are nonetheless dangers.

The disappointing regulatory final result within the Minnesota electrical charge case offered a precious reminder to utility sector traders: The sector is not less than partially depending on favorable regulatory outcomes to assist development. The excellent news for Xcel Vitality is that it’s a diversified utility, which suggests it could actually nonetheless salvage its development after a foul regulatory final result.

Xcel Vitality’s debt load is not excessive for a utility. However for a enterprise total, the corporate is being saddled with larger curiosity prices as of late. This has additionally diminished the enchantment of its inventory in monetary markets, which explains its poor efficiency for the reason that charge hike cycle started.

What A Distinction A Yr (And Change) Makes

Utilities may be fantastic investments. However after I final lined Xcel Vitality over a yr in the past, I believed that the $75 share value was merely a lot too excessive. Now that shares have bought off 20% since that point, I’m snug upgrading the inventory to a purchase once more. Let’s bounce into two valuation fashions to broaden on this argument.

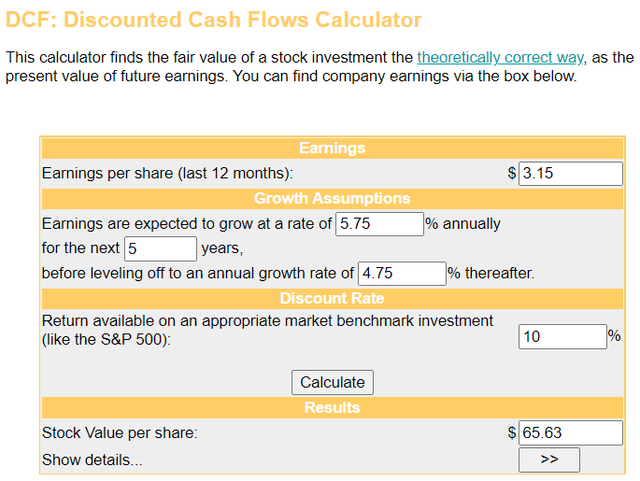

Cash Chimp

The primary valuation mannequin that I’ll make the most of to worth Xcel Vitality’s shares is the discounted money flows or DCF mannequin. This consists of three inputs.

The primary enter for the DCF mannequin is the final 12 months of diluted EPS. That is $3.15 for Xcel Vitality.

The second enter into the DCF mannequin is development projections. Since Xcel Vitality has traditionally posted annual diluted EPS development simply above 6%, I’ll use a 5.75% charge for the primary 5 years of this mannequin. I will then assume a slowdown to 4.75% within the years that comply with.

The third enter for the DCF mannequin is the low cost charge, which is the annual whole return charge. I will use 10% for this enter.

Plugging these inputs into the DCF mannequin, I get a good worth output of $65.63 a share. This suggests that shares of Xcel Vitality are buying and selling at an 8.7% low cost to honest worth and supply a 9.5% upside from the present value of $59.94 a share (as of September 22, 2023).

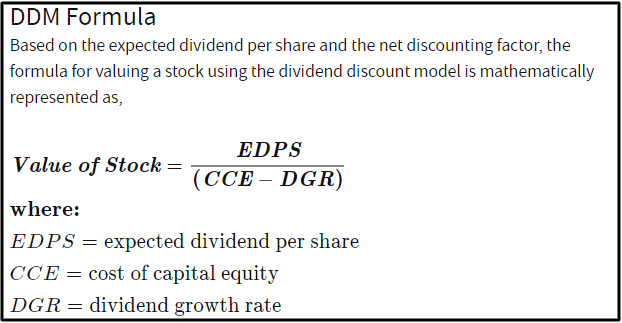

Investopedia

The opposite valuation mannequin that I will make use of to estimate the honest worth of Xcel Vitality’s shares is the dividend low cost mannequin, or DDM. Just like the DCF mannequin, this additionally has three inputs.

The primary enter into the DDM is the annualized dividend per share. Xcel Vitality’s present annualized dividend per share is $2.08.

The following enter for the DDM is the price of capital fairness or annual whole return charge. Once more, I’ll use 10%.

The ultimate enter into the DDM is the annual dividend development charge. I will use 6.5% for this enter.

Utilizing these inputs for the DDM, I arrived at a good worth of $59.43. Which means shares of Xcel Vitality are priced 0.9% above honest worth and will depreciate by 0.9%.

When averaging out these honest values, I compute a good worth of $62.53 a share. This indicators that Xcel Vitality’s shares are buying and selling at a 4.1% low cost to honest worth and supply a 4.3% upside from the present share value.

Abstract: A Dependable Dividend Payer Price Shopping for

After this yr is full, Xcel Vitality can have upped its dividend for 20 consecutive years after its dividend lower in 2002 that reshaped the enterprise. The corporate seems to be prefer it ought to have a few years of dividend development sooner or later on account of its low payout ratio and affordable earnings development potential.

To be clear, Xcel Vitality is not absurdly low-cost, or a no brainer purchase for revenue traders. Nonetheless, my valuation fashions present the inventory to be priced 4% under honest worth. That’s the reason I’m upgrading the inventory to a purchase ranking.