Solana (SOL) trended inside a horizontal channel between April 13 and Might 15. As shopping for strain gained momentum, the bulls initiated a rally above the higher line of this channel, and SOL broke above that stage on 16 Might.

The surge in demand for the altcoin pushed its value to $187 on Might 20, the place it peaked. Nonetheless, it has since trended downward and fallen again beneath the breakout stage of $162.

Solana Worth Dip Continues

At press time, Solana (SOL) trades at $154. It has fallen 5% beneath the breakout stage. The altcoin presently trades beneath its 20-day Exponential Transferring Common (EMA).

This tracks SOL’s common value over the previous 20 days. When an asset’s value falls beneath this key shifting common, it signifies that the asset trades at a stage decrease than its common value over the previous 20 days. This indicators a decline in shopping for strain and a rally in coin sell-offs.

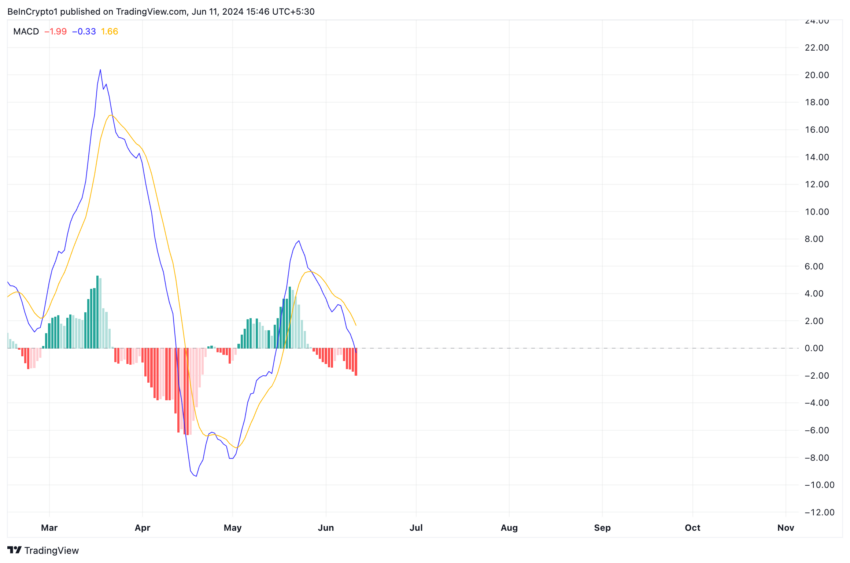

Readings from SOL’s Transferring Common Convergence Divergence (MACD) confirmed the surge in promoting strain amongst market members. The coin’s MACD line (blue) presently rested beneath the sign (orange) and trended towards the zero line as of this writing.

This indicator identifies an asset’s value power, route, and momentum modifications. When the MACD line crosses beneath the Sign line, it’s thought of a bearish sign. It means that the bears have taken management and can put downward strain on the asset’s value.

Learn Extra: What Is Solana (SOL)?

Merchants usually interpret it as an indication to exit brief and take lengthy positions.

SOL Worth Prediction: Futures Merchants Shut Out Positions

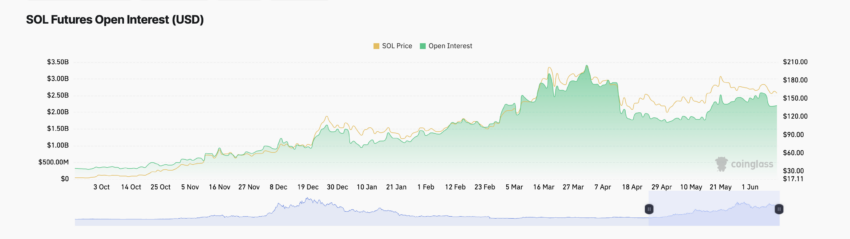

The bias isn’t any totally different amongst the coin’s futures market merchants. Because the starting of June, SOL’s futures open curiosity has trended down. At $2.2 billion, it has since declined by 15%.

An asset’s futures open curiosity tracks the overall variety of excellent futures contracts or positions that haven’t been closed or settled. When it declines on this method, it suggests an uptick within the variety of merchants closing their positions with out opening new ones.

It’s usually thought of an indicator of a shift in sentiment from bullish to bearish.

SOL’s unfavorable weighted sentiment confirms this shift. At press time, it was beneath zero at -0.32. This on-chain metric tracks the general market sentiment concerning an asset. At this worth, SOL’s weighted sentiment means that there are extra unfavorable mentions than constructive mentions surrounding it.

If this bias stays in opposition to the coin and promoting strain features momentum consequently, its worth might drop to $135.

Nonetheless, if the bulls pressure a takeover and shopping for strain spikes, SOL’s value might rally towards $17.03.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.