- Over 8 million addresses are presently holding BTC beneath the present worth stage.

- BTC has remained beneath the $60,000 worth stage.

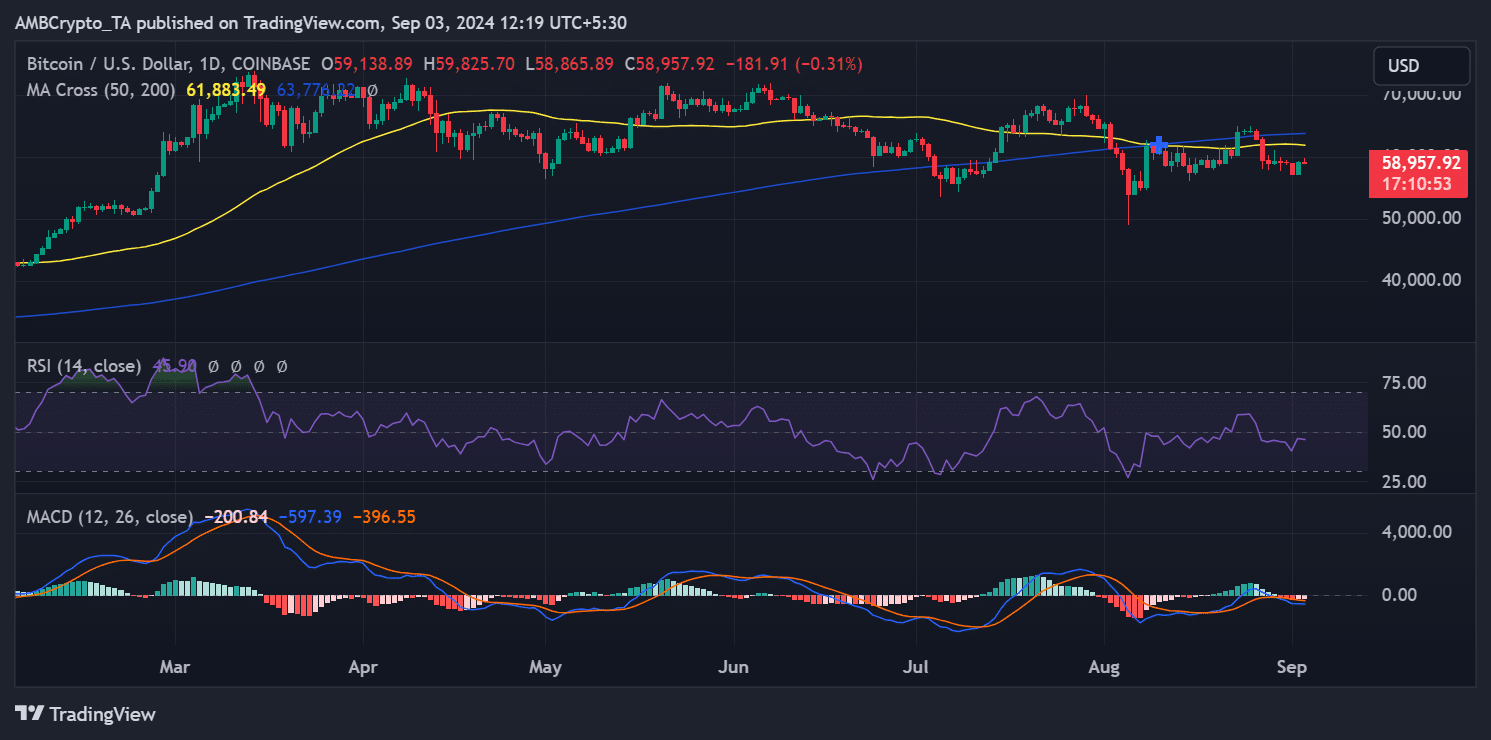

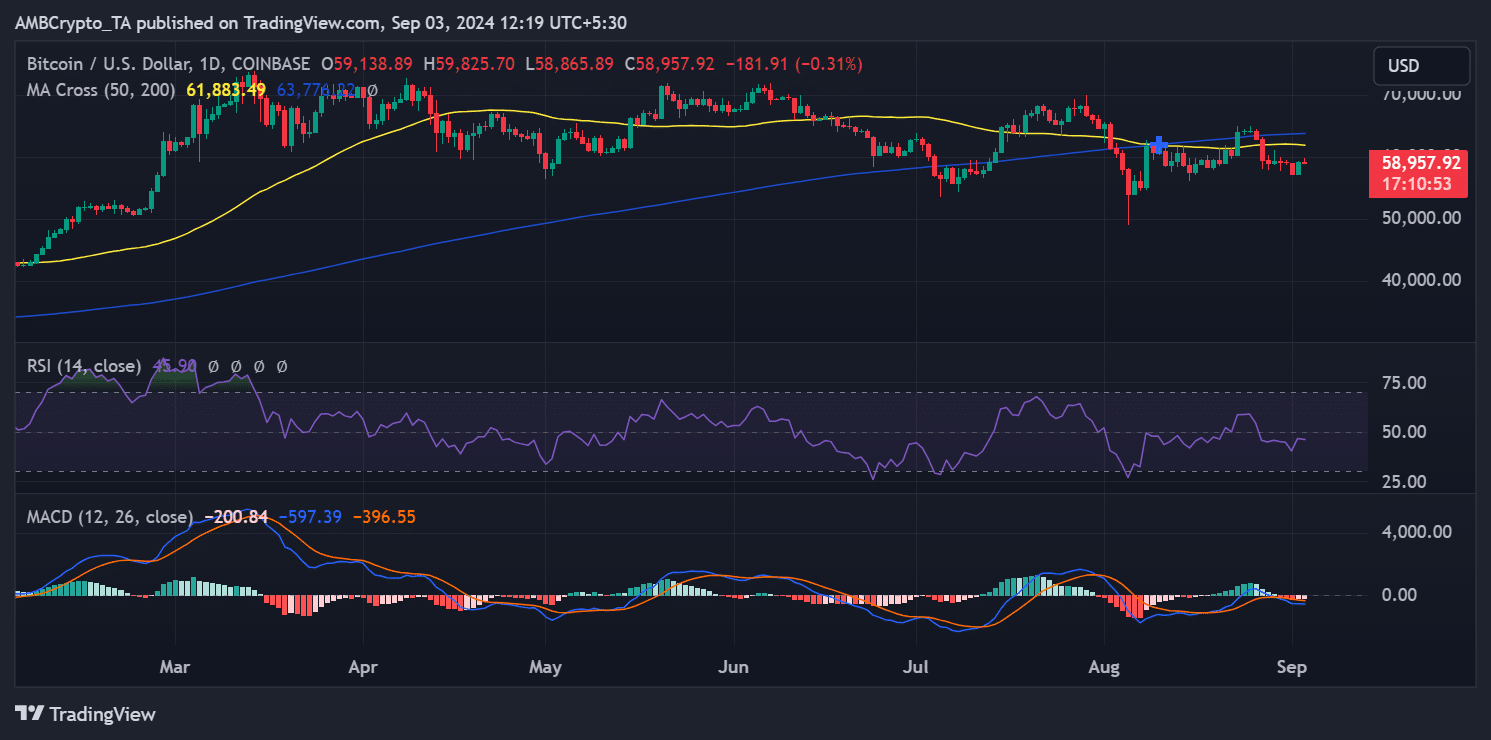

Bitcoin [BTC] has skilled important worth volatility over the previous few weeks, with its chart indicating a sample the place the worth rises and approaches the $60,000 to $61,000 vary, solely to say no shortly afterward.

Evaluation suggests the first issue behind this conduct is the substantial variety of holders presently at a loss.

Bitcoin retains falling

The current evaluation of Bitcoin’s worth chart reveals a constant volatility sample across the $60,000 worth vary. On twenty seventh August, Bitcoin fell from the $60,000 stage, beginning the day at roughly $62,840 and shutting at round $59,433.

Since then, Bitcoin has struggled to reclaim the $60,000 mark regardless of sometimes reaching that stage throughout numerous buying and selling periods.

Supply: TradingView

In subsequent periods, the very best Bitcoin managed to achieve was round $59,000, but it surely shortly declined from that vary. On the finish of the newest buying and selling session, Bitcoin closed at roughly $59,139 after a 3% improve.

Nonetheless, as of this writing, Bitcoin has once more dropped beneath the $59,000 mark, reflecting the continuing sample seen over the previous few weeks.

This repeated incapacity to keep up an uptrend at or above $60,000 suggests a major resistance stage at this worth level.

The first cause Bitcoin has been unable to maintain this uptrend is the elevated promoting stress each time the worth approaches or exceeds the $60,000 vary.

As Bitcoin’s worth rises, many holders, particularly those that purchased at greater costs, could select to promote to both break even or safe earnings.

This promoting exercise generates downward stress, stopping the worth from holding regular above these key ranges.

Sellers maintain extra stress on BTC

A current evaluation of knowledge from IntoTheBlock sheds mild on why Bitcoin has been struggling to achieve and preserve the $60,000 worth vary.

The World In/Out of the Cash chart reveals {that a} important variety of addresses bought Bitcoin at greater worth ranges, significantly within the $61,705 to $72,500 vary.

Particularly, the chart reveals that over 6.9 million addresses purchased Bitcoin inside this worth vary.

Moreover, one other substantial group of holders purchased BTC at costs between $59,000 and $61,000, totaling roughly 1.7 million addresses. Because of this over 8.6 million addresses, representing round 16.08% of all BTC holders, are presently holding their BTC at a loss.

This focus of holders at a loss explains the issue BTC has confronted in breaking and sustaining the $60,000 worth vary in current weeks.

When BTC’s worth approaches or exceeds these ranges, many of those holders could also be inclined to promote their holdings to get better their investments or decrease their losses.

This promoting stress creates a major barrier, stopping BTC from sustaining any upward momentum above the $60,000 mark.

What Bitcoin wants to interrupt resistance

The big variety of addresses holding at a loss acts as a psychological resistance stage. As Bitcoin nears these worth factors, the market experiences elevated sell-offs, which pushes the worth again down.

This sample is a key cause why BTC has been unable to ascertain a secure uptrend in current weeks regardless of sometimes reaching the $60,000 stage throughout buying and selling periods.

For BTC to interrupt by way of this resistance and preserve greater worth ranges, the market would wish to soak up this promoting stress.

This might occur if there’s a important inflow of recent patrons prepared to buy Bitcoin at these ranges or if market sentiment shifts in a manner that encourages holders to retain their positions somewhat than promote.

Learn Bitcoin (BTC) Value Prediction 2024-25

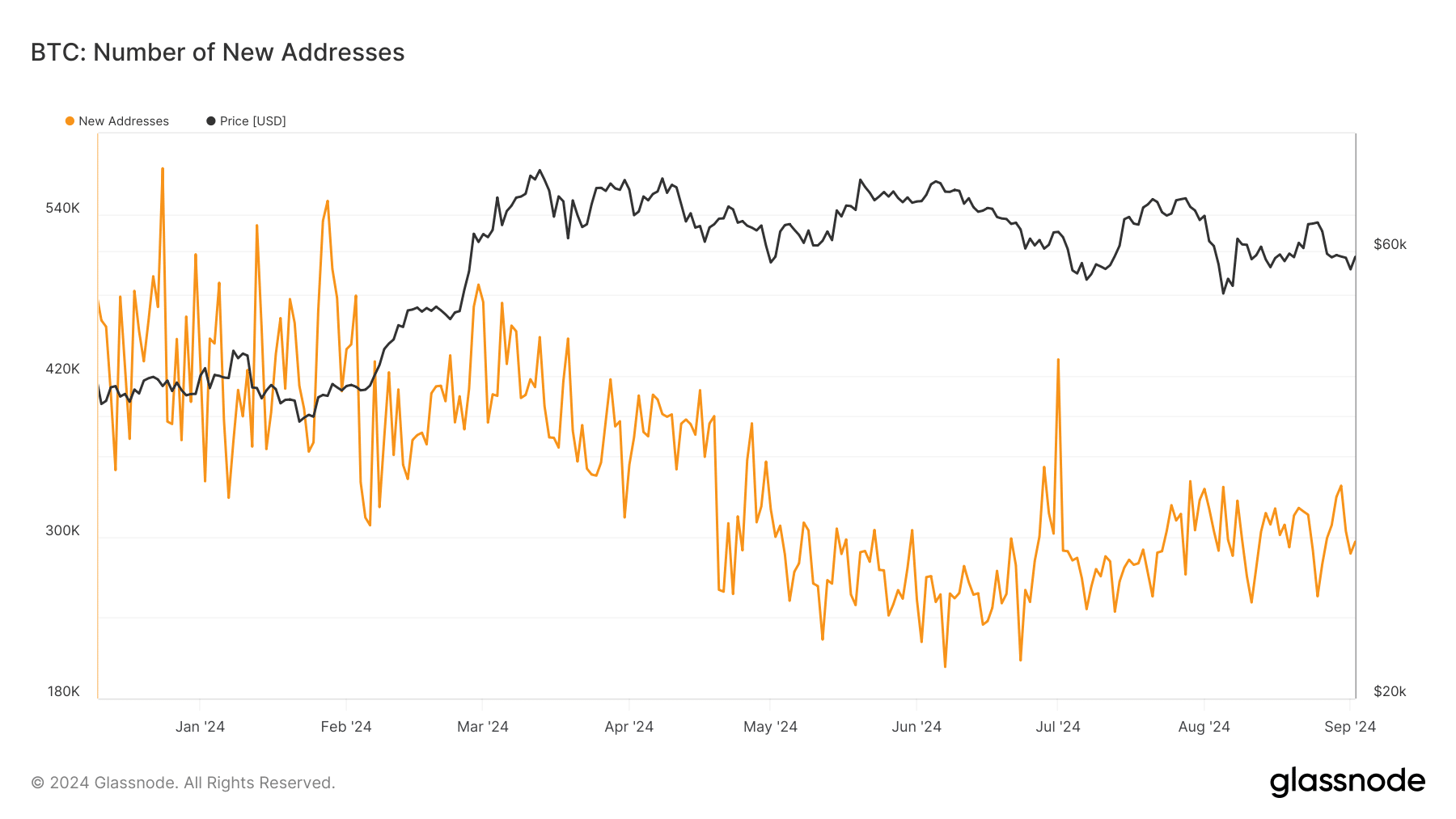

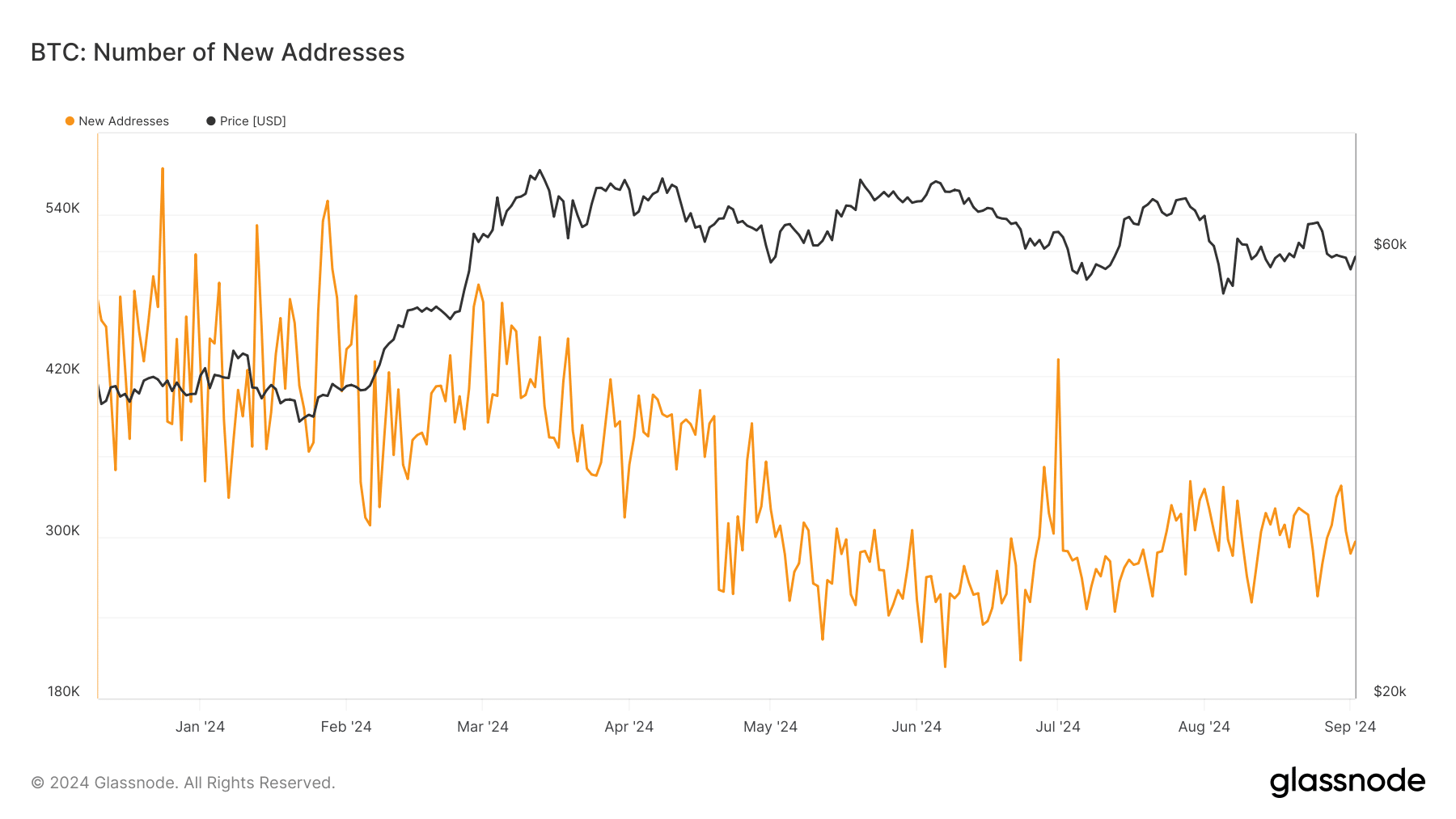

Moreover, a current evaluation of the development of recent Bitcoin addresses reveals a pointy decline in every day new addresses. In response to information from Glassnode, the variety of new addresses dropped considerably after thirtieth August, falling from roughly 338,000 to round 287,000.

As of this writing, the variety of new addresses has barely recovered to round 296,000.

Supply: Glassnode