Brycia James

Evaluation Abstract

Right now I will be masking Williams-Sonoma (NYSE:WSM), within the shopper discretionary sector, subsector of retail homefurnishings.

In line with its Looking for Alpha profile, it trades on the NYSE, is predicated in San Francisco, and serves as omni-channel specialty retailer of varied merchandise for residence.

Considered one of its listed friends is Wayfair (W), however I need to point out that one other retail competitor within the US that I do know of is Crate & Barrel. The Williams-Sonoma model is a typical sight once I go to varied buying malls within the US, and as quickly as you enter considered one of their shops you’re immersed within the model which is a deal with upscale residence furnishings. Additionally, the Pottery Barn model of shops can also be owned by Williams-Sonoma.

In as we speak’s article, I gave this inventory a purchase score, as a result of having extra strengths in my evaluate than offsetting elements.

Its strengths embrace dividends, valuation, capital & liquidity, and efficiency vs S&P500.

Its offsetting elements embrace income development, internet revenue & EPS, share worth.

A draw back threat to my bullish outlook that I can foresee is the rising price of debt as a result of excessive charges.

Evaluation Methodology

My up to date score methodology as of October 2023 is to investigate the inventory holistically throughout the next 7 classes of equal weight, and if it has extra strengths than offsetting elements it will get a purchase score, in any other case will get a maintain or promote score:

dividends, valuation, income development, internet revenue and EPS, capital and liquidity, share worth vs transferring common, efficiency vs S&P 500.

All knowledge sources come from publicly out there information resembling the latest quarterly report and firm displays, Looking for Alpha knowledge, and media experiences.

The anticipated next quarterly earnings release is anticipated on Nov. sixteenth for fiscal 2023, Q3, which ends Oct. thirty first. Their most up-to-date reported quarter was fiscal 2023, Q2 which ended July thirtieth, launched in late August.

Dividends

Right here I talk about the dividend yield, 10-year dividend development, and dividend stability over the previous few years. As a dividend-focused analyst and investor, I consider these are important metrics to have a look at.

Although not all traders are dividend-oriented, together with a lot of my readers, I do suppose generally-speaking it may be a method to generate cashflow whereas holding an fairness longer-term.

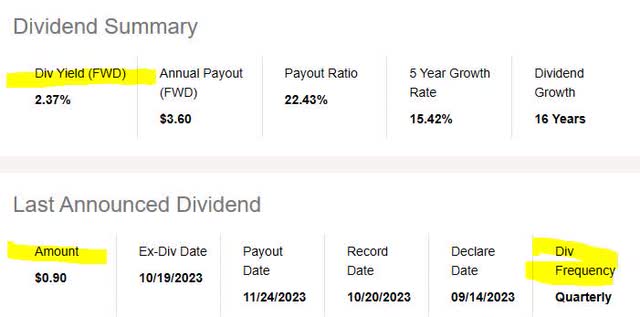

First, let’s take a look at the dividend yield, which is 2.37% as of the writing of this text, together with a dividend payout of $0.90 per share, on a quarterly foundation.

Williams Sonoma – dividend yield (Looking for Alpha)

Whether or not or not I believe it’s a good yield relies upon the way it compares to the trade it’s in, and to not different industries.

Compared to its sector common, this yield is 8.01% beneath the common. I take into account this solely a barely unfavourable level as I’m on the lookout for a yield between 2% and 4% when contemplating the sector/trade. With that stated, my goal for a yield could be 3%, so this inventory has a yield that’s barely decrease than my purpose.

I take into account yield essential as a result of it tells me a narrative: how a lot of a return I get on the capital invested, when it comes to dividend revenue. A sudden drop in share worth, as it’s possible you’ll know, may end up in a better yield if the dividend quantity stays the identical.

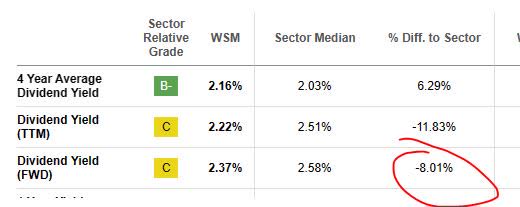

Williams Sonoma – dividend yield vs sector (Looking for Alpha)

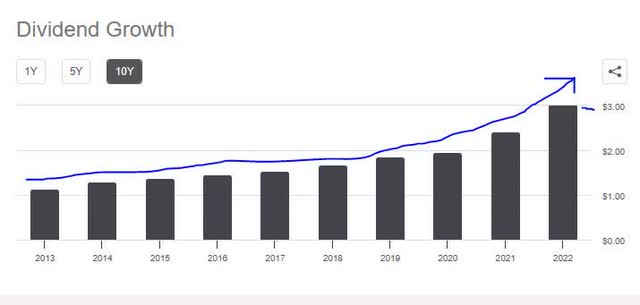

Subsequent, I’m wanting on the 10-year dividend development fee, proven within the chart beneath, which exhibits a gradual development. I believe that could be a optimistic level and I all the time search for a great dividend development story to inform, backed by the information. The story right here is considered one of development.

Williams Sonoma – 10 yr dividend development (Looking for Alpha)

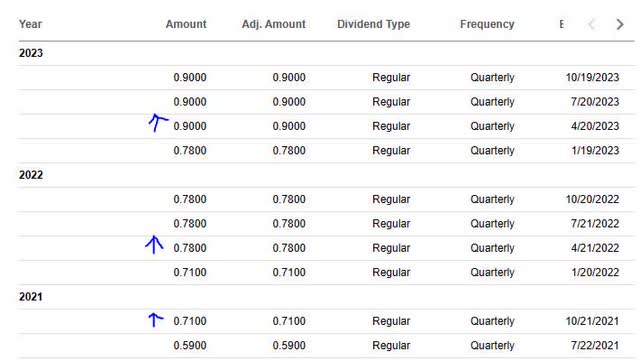

Lastly, I need to see dividend payout stability, particularly if you’re counting on the regular quarterly cashflow.

In wanting on the desk beneath, you’ll be able to see secure payouts over the previous few years, with 3 dividend will increase on this time interval. A cashflow state of affairs: if I used to be holding 1,000 shares, for instance, I might notice $900 in quarterly cashflow from the dividends on this inventory. (1,000 shares x $0.90 per share).

Williams Sonoma – dividend stability (Looking for Alpha)

Based mostly on the proof, I take into account the class of dividends a power for this inventory, on the idea of regular dividend payouts and dividend development outweighing the yield that’s barely beneath common.

Valuation

To simplify analyzing the valuation, I’ve chosen a single metric to deal with, and that’s the price-to-earnings ratio (P/E), each the trailing and ahead P/E, because it tells me what the market is pricing this inventory at in relation to its earnings.

My portfolio purpose is to discover a valuation decrease than or near the sector common, however not an excessive amount of larger. Generally a inventory is undervalued however in any other case has robust fundamentals, so that could be a firm I need to uncover.

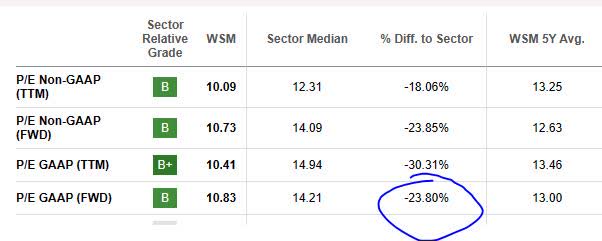

Williams Sonoma – PE ratio (Looking for Alpha)

Within the case of this inventory, the trailing P/E is 10.41, which is 30.31% beneath the sector common, and the ahead P/E of 10.83 is 23.8% beneath the sector common.

Therefore, I’d take into account this inventory undervalued in comparison with its trade, each on a trailing and ahead foundation.

Based mostly on the information, I believe this valuation metric is a power for this inventory.

Income Development

One matter many analysts and traders have a look at is the top-line income development, as a metric monitoring income generated earlier than bills, to place it merely.

Manageable development is essential, in my view, as a result of firms have competitors and are striving to seize market share of their sector.

For this firm, we are able to see from the latest quarterly outcomes that it achieved a YoY lower in whole income:

Williams Sonoma – income YoY (Looking for Alpha)

At first look, I believe this can be a unfavourable for this firm.

Trying additional into the corporate’s most up-to-date reported quarterly outcomes, the agency has really revised income projections downward.

In line with the corporate, “we now anticipate annual revenues to come back in at a variety of down 5% to down 10%.”

From a ahead perspective, they added:

Over the long-term, we proceed to anticipate mid-to-high single-digit annual internet income development with working margin above 15%.

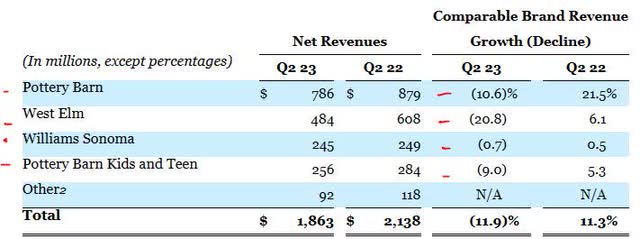

In breaking down internet income by the corporate’s varied manufacturers, we see that the entire manufacturers they personal have YoY declines in internet income. Nevertheless, the corporate didn’t present any commentary particular to what was driving headwinds to its manufacturers.

Williams Sonoma – internet income by model (firm earnings launch)

Total, I believe the information exhibits that top-line income YoY development is an offsetting issue for this inventory’s score.

Internet Earnings and EPS

Internet revenue and earnings per share are getting their very own part right here to make the evaluation simpler to know and to separate these outcomes from top-line income.

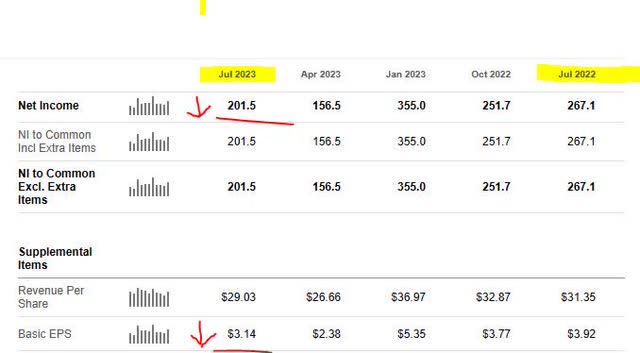

Based mostly on the latest quarterly outcomes out there, this agency achieved a YoY drop in internet revenue and the essential earnings per share “EPS” decreased on a YoY foundation.

Williams Sonoma – internet revenue & EPS (Looking for Alpha)

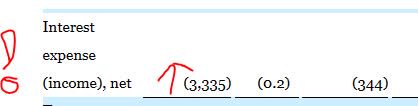

I additionally need to name out the next from the corporate’s most up-to-date earnings report, which exhibits that curiosity expense rose drastically on a YoY foundation when evaluating fiscal Q2 this 12 months vs the 12 months prior:

Williams Sonoma – curiosity expense (firm quarterly earnings)

Remember that working a sequence of upscale retail shops nationwide is a really capital-intensive enterprise with a lot overhead, so gross sales quantity is significant, but it’s evident from simply strolling into any mall or having labored seasonally in a single as a pupil that the height gross sales interval is the vacation season (November by way of New Years).

In the event you look once more on the internet revenue desk in addition to the income desk, you’ll be able to see that the quarter ending January was one of the best quarter for income and internet revenue for this firm.

I believe, due to this fact, that this class of internet revenue and EPS is an offsetting issue for this inventory’s score, and as analysts / traders we’ve got to think about the seasonality of this kind of enterprise mannequin.

Capital and Liquidity

Right here we’ll deal with a number of objects associated to capital and liquidity power of this inventory’s mum or dad firm.

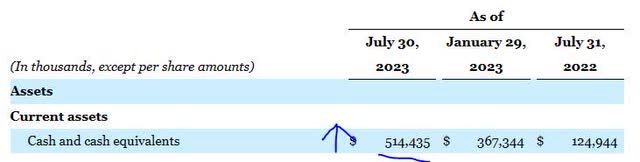

The next is related knowledge from the corporate’s quarterly earnings outcomes that I need to name out, which is a gradual enhance in firm money, which I believe is a optimistic pattern. Bear in mind the saying, money is king, particularly in a enterprise mannequin with such excessive overhead:

Williams Sonoma – money place (firm earnings report)

Additional, right here is extra knowledge of curiosity, which factors to a lower in whole liabilities because the 12 months prior, additionally a optimistic I believe.

Williams Sonoma – liabilities (firm quarterly report)

From its cashflow assertion we are able to see that the agency has optimistic free money move each levered and unlevered in addition to optimistic free cashflow per share. This can be a good route I believe.

I believe that the fairness together with the cashflow undoubtedly provides confidence to this inventory’s score, backed up by robust firm monetary well being.

Based mostly on the proof discovered, I take into account this agency’s capital and liquidity scenario a power to its general score.

Share Value vs Transferring Common

Now we have come to the half the place I like to speak in regards to the share worth and whether or not I believe it is a shopping for alternative proper now or not.

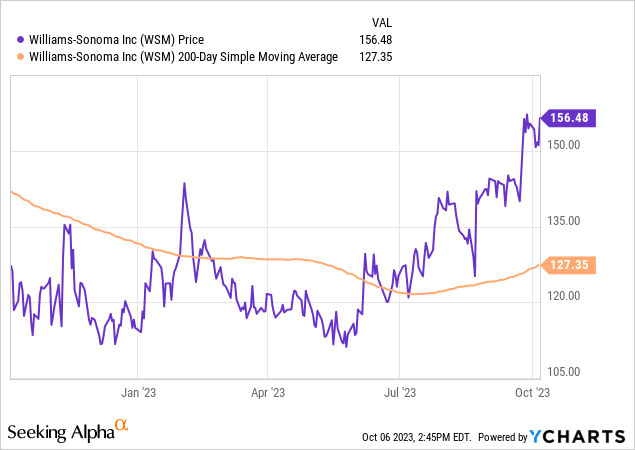

First, let’s check out the share worth and 200-day transferring common “SMA” as of the writing of this text:

The share worth of $156.48 is nearly 23% above the 200-day SMA which stands at $127.35. I believe this transferring common is an efficient long-term pattern indicator which is why I observe it.

In my portfolio purpose, I’m on the lookout for crossover alternatives, the place the value crosses beneath the transferring common after a interval of bullishness, which I take into account a purchase sign so long as different fundamentals are robust. Nevertheless, a purchase alternative might additionally exist if the value is hovering across the transferring common.

This chart exhibits a crossover already occurred in June, adopted by a bullish rebound. So, to check the share worth towards my portfolio targets I created the next simulated commerce state of affairs. I purchase 100 shares on the present worth, maintain 1 12 months, and need to obtain at the least a ten% or higher (unrealized) capital achieve at the moment.

As well as, in anticipation of losses as nicely, I’ve set my most loss tolerance as -20% (unrealized capital loss).

Williams Sonoma – commerce simulation (writer evaluation)

The above simulation exhibits two situations, one the place the longer term share worth rises +15% above the present 200 day SMA, and the opposite the place it drops -15% beneath the SMA.

The end result of each situations is that they aren’t according to my targets for features and losses. Within the first state of affairs, my projected loss is -6.4% and within the second state of affairs I’m projecting a lack of -30.8%.

Based mostly on this simulation, I believe the present share worth is an offsetting issue, and basically too costly right now.

Although your portfolio technique might differ, take into account this part a common and simplified framework with which to consider this inventory in a longer-term sense, through which time one can anticipate potential features in addition to losses, so establishing a most threat tolerance is essential.

Efficiency vs S&P 500

The next is a comparability of the 1-year worth efficiency of this inventory vs the S&P 500 index. I’ve included this metric in my up to date score methodology in order to check this fairness to a significant market index that’s tracked typically, and whether or not it was in a position to outperform it or not.

I take into account this related as a result of it exhibits the market momentum for this inventory. It might be an incredible firm basically, the market actuality is that different traders affect the share worth based mostly on demand for the inventory, so evaluating it to this main index might add some clues as to market sentiment.

William Sonoma – efficiency vs S&P500 (Looking for Alpha)

The information exhibits the inventory outperforming vs this index, which I take into account an power to my score, as I consider it to point a bullish market sentiment for this inventory. In the event you correlate this to the value chart I confirmed earlier, the bullishness is clear.

Danger to my Outlook

A draw back threat to my bullish outlook that I’m involved about is the rising price of debt, because of the elevated fee atmosphere. I already confirmed that the YoY curiosity expense for this firm has gone up rather a lot, and once more it relies on how its debt is structured it might be impacted by the truth that the Fed just isn’t in a rush to decrease its coverage fee but, which can also have an effect on all different rates of interest.

This might have an effect on customers as nicely because it prices extra to purchase issues on bank cards.

Nevertheless, a study earlier this year by JP Morgan pointed to the resilience of the upscale sector:

Throughout the present cost-of-living disaster, customers are slicing again on spending — however demand for luxurious items stays excessive. Within the fourth quarter of 2022, the luxurious market grew 7% organically year-over-year, figures from J.P. Morgan Analysis present.

So, I believe that this retailer will seemingly steer by way of the headwinds, and the Fed seems to be tapering again on fee hikes, regardless that they’re nonetheless elevated.

Like talked about earlier, these are seasonally-driven enterprise fashions so let’s hope for a powerful vacation season arising proper across the nook, and I believe it might take a number of extra quarters of reporting to actually see an influence by the top of January maybe once we ought to revisit this inventory once more.

In closing, my bullish sentiment on this inventory stays and my purchase score stands.