Navigating the complexities of the cryptocurrency market and seizing alternatives require a mix of innovation, moral practices, and a deep understanding of distributed ledger know-how (DLT).

As blockchain know-how reshapes the normal finance sector and pioneers the growth of decentralized finance (DeFi), staying knowledgeable and adaptable is essential to success. Therefore, the transformative potential of DLT highlights the affect on monetary inclusion, cost effectivity, and the broader financial ecosystem.

The Transfer In the direction of Tokenization

President of Hedera, Charles Adkins, advised BeInCrypto that blockchain know-how has emerged as a basic power in reworking transactions, lending, and investments. He attributed the success to the inherent capabilities that allow simultaneous entry, validation, and document updating.

This innovation is especially impactful in cross-border funds, commerce financing, and end-to-end cost transfers.

It permits banking establishments to conduct close to “atomic” worldwide settlements with diminished handbook interventions and decrease prices. Certainly, such developments improve cost fashions’ effectivity and prolong monetary companies to beforehand unbanked populations, fostering higher monetary inclusion.

“Blockchain know-how units out to allow particular person collaboration and permit societies to play an element in figuring out the way forward for technological innovation. DLT, as an illustration, has created new belief layers that allow people, enterprises, and governments to generate collective social affect with out the chance of dangerous actors buying affect,” Adkins stated.

Learn extra: Deploying Blockchain Infrastructure: Challenges and Options

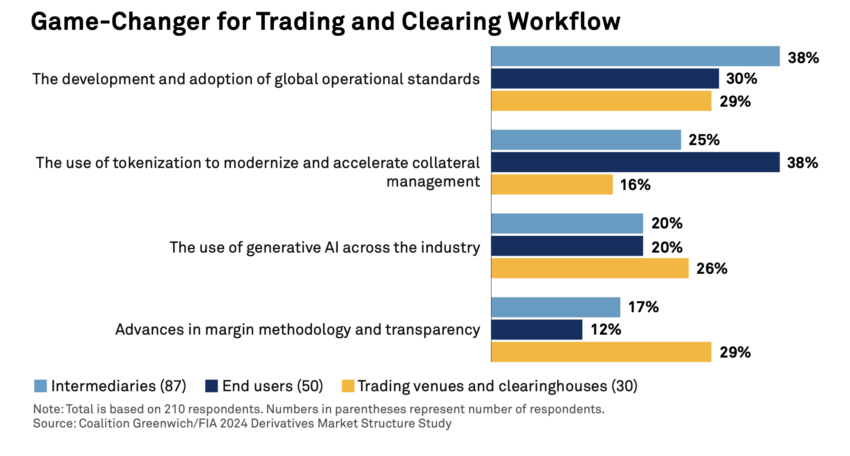

Distributed Ledger Know-how in Buying and selling. Supply: Coalition Greenwich

DLT is on the forefront of monetary improvements like fractional tokenization, promising to democratize entry to wealth alternatives. Certainly, a current research performed by Coalition Greenwich revealed that stakeholders within the derivatives sector prioritize the adoption of tokenization. It helps improve collateral administration over implementing generative synthetic intelligence (AI).

Actually, for finish customers, tokenization emerged as essentially the most vital potential innovation in buying and selling and clearing workflows.

“Many giant asset managers are engaged on initiatives to check the potential for utilizing [tokenization] to maneuver money and securities extra effectively. From their perspective, the transformation of monetary belongings into tokens and using distributed ledgers to handle transfers may result in a considerable discount in time and expense,” analyst on the Coalition Greenwich wrote.

Because of this, Adkins envisions a future the place DeFi and conventional finance applied sciences converge, enhancing the monetary system for establishments and people.

Blockchain Past Monetary Markets

DLT’s potential extends past monetary markets to handle urgent points like local weather change and greenwashing. By enabling correct monitoring and reporting of carbon emissions, DLT empowers organizations to optimize their processes, align with environmental requirements, and provide transparency to shoppers and policymakers.

Nonetheless, constructing belief and understanding between builders, policymakers, and the general public is essential to attain this. Dedication to training, crypto advocacy, and collaboration amongst Web3 initiatives exemplify the efforts to make sure safety and transparency throughout private and non-private sectors.

“DLT performs an important position in stopping greenwashing makes an attempt by organizations, a problem that has grown in relevance as a result of difficulties in verifying if corporations are adhering to sustainability targets. As a result of knowledge is publicly out there on the distributed ledger, organizations can’t falsify their carbon footprint or make unbacked claims about their sustainability efforts,” Adkins emphasised.

One notable challenge, as mentioned in a research by the College of Copenhagen, entails using blockchain know-how to create an in depth and clear document of corporations’ carbon footprints. This challenge, named REALISTIC, permits for the exact documentation of products’ CO2 emissions all through their manufacturing and provide chain processes.

The implementation of such know-how aids corporations in complying with new EU laws that mandates the reporting of carbon footprints. It additionally paves the best way for shoppers to confirm the environmental affect of their purchases by QR codes.

“[With a pen, for instance] we don’t know the equal carbon affiliation which every of its elements… So whenever you’re trying to procure the assorted elements of the pen you’ll know precisely learn how to weigh which half comes from the place, and perceive the affect by way of carbon [footprint],” Chief Income Officer at SAP Sustainability Deb Kaplan stated.

Learn extra: High 9 Eco-Pleasant Cryptocurrencies To Make investments In

The Local weather Ledger Initiative (CLI) is one other key participant. It focuses on the mixing of digital improvements like blockchain, the Web of Issues (IoT), and synthetic intelligence for local weather change mitigation and adaptation. The CLI helps varied use circumstances and offers a platform for testing digital improvements in real-life eventualities. Subsequently, it emphasizes the position of DLT in scaling carbon markets and enhancing their environmental integrity.

Adkins believes the mixing of DLT with AI is poised to sort out misinformation and knowledge integrity challenges. As blockchain know-how matures, He anticipates its mainstream adoption, unlocking societal and financial advantages, particularly in asset administration and past.

“DLT will enable builders to handle challenges with low-quality, biased, and unverified knowledge, offering data-sharing infrastructures which might be open to all researchers and builders, and making certain transparency at each level of the AI knowledge enter course of,” Adkins concluded.

Staying forward within the markets requires an unwavering dedication to innovation, moral governance, and neighborhood engagement. By embracing the rules of DLT, people and establishments can guarantee a confidence and integrity within the digital age.