By Michael Each of Rabobank

As anticipated, the RBA left charges on maintain at 4.35%, however offered succor in changing a tightening bias with “not ruling something in or out.” That leaves rather a lot to the creativeness of those that have mortgages, and/or would love home costs to proceed to make them multi-millionaires with out having to do any work. Nonetheless, as our Ben Picton famous, the RBA added charges are solely “barely” restrictive, which suggests a impartial fee solely barely decrease than 4.35%. Furthermore, it thinks unemployment, now 4.1%, must rise to 4.5% earlier than the labor market is again in stability, and Ben thinks the re-regulation seen there of late means it might need to be as excessive as 5%: with out that, it’s laborious to see how the RBA’s assumption that sluggish productiveness progress picks up once more, and torrid wages progress slows down could be concurrently achieved. General, Ben nonetheless thinks charges are on maintain till November, and we solely get two 25bp cuts in whole.

The BOJ’s tiny fee hike and finish to unfavorable charges, yield curve management, and shopping for ETFs didn’t go fairly as deliberate. Bond shopping for will proceed (sure, “Charge hikes and QE”), and no timeline for any additional BOJ motion noticed JPY drop previous the 150 degree. That underlines all of the Fed has to do now’s to be much less dovish than everybody else, and the greenback will stay nicely bid (vs. different fiat a minimum of). But on the similar time, Bloomberg quotes two Japanese analysis homes who suspect the BOJ will really have to do way more: they discuss of an end-point coverage fee of two% and a couple of.5%.

The final time we noticed that was September 1993, shut sufficient to the top of the primary Chilly Warfare to have symmetry with the popularity that we are actually deep right into a second one – with nasty sizzling flushes. On which be aware, Russia’s TASS news service was yesterday claiming France is ready to send 2,000 soldiers to Ukraine, which Paris has denied.

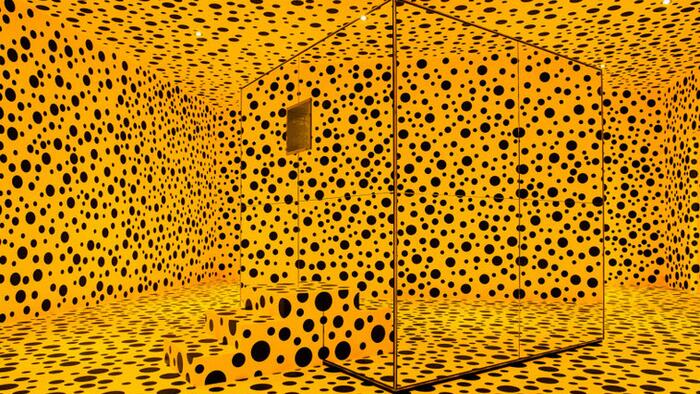

However in the present day is all concerning the Fed’s dot-plot, the place we’re not taking a look at US shopper, however Kusuma sentiment. (Yayoi Kusuma being the doyenne of dot-based artwork who seems to be like Janet Yellen on the magic mushrooms she tried in China.)

RBA-style, no one expects the Fed to do something on charges; however all people will search for what they could do later of their up to date dots. BOJ-style, we might even see some pockets of hypothesis about decades-long precedent-breaking situations, resembling the next impartial fee – though I count on there shall be very sharp disagreement throughout the Fed over that.

Headline US CPI says it might be foolish to chop charges forward; so does core CPI; and core companies CPI; and PPI; and month-to-month payrolls; and weekly preliminary jobless claims; and home costs, in case you don’t need them to rise additional; and the development in power costs, the place our crew have simply revised their projections for Brent greater once more; and the development in copper (and cocoa!); and US shares, or a minimum of something AI associated; and monetary circumstances; and gold; and Bitcoin, now bigger than silver when it comes to market capitalisation, which was traditionally lengthy day-to-day cash for a lot of. Alternatively, we have now questions over knowledge high quality; weak ISM surveys, particularly the employment indices; weak industrial manufacturing; ‘meh’ retail gross sales; indicators of shopper stress; worries over industrial actual property; and recognition that the US practice solely retains rolling attributable to fiscal stimulus that may ultimately go off the rails. That already makes for a tough Fed debate and forward-looking decision-making course of. On stability, it factors to some reasonable tweaks decrease in Fed Funds later this yr, as our Fed strategist Philip Marey has been saying since final yr.

Nonetheless, the true complexity comes additional down the monitor. How does the above dynamic play out?

- What if Joe Biden wins re-election, retains the fiscal faucets open, and embraces extra populist commerce insurance policies?

- What if Donald Trump wins re-election, retains the fiscal faucets open, and imposes 10-100% tariffs on varied merchandise?

- How do different central banks reply to both?

- How does geopolitics reply?

- After which how does the Fed reply?

No Fed economist can compute all the above binaries, and uncertainties, and sure uncomfortable certainties, to offer an correct studying on future US and international progress and inflation.

The reality is the potential map of future dot plots seems to be like Kusuma’s ‘Infinite Polka-dots Instillation’, and the typical of that –which the market will attempt to look to today– goes to be basically meaningless.

Nonetheless, as famous, Philip is plotting his personal course, making clear that if we get extra US protectionism after November 2024, the Fed shall be pressured to pause in 2025. In different phrases, doubtlessly the Fed path may not be that far off the RBA; through which case, what’s the stress then like on the BOJ and others, just like the ECB?

Following the Fed, we additionally get a coverage choice in Brazil, the place the Selic Charge is seen coming down 50bp from 11.25% to 10.75%. That’s forward of a fee choice in Mexico tomorrow, the place they’re prone to lower charges 25bp to 11.0%, and as Bloomberg notes that some EM curves are beginning to diverge from that of the US. You don’t want to affix too many dots to understand how that may typically find yourself, traditionally. Dot. Dot. Dot.

As we look forward to that Fed choice, let me shut with one other hyperlink between Kusuma and institutional financial pondering. Each take easy concepts (‘dots’; or ‘tax cuts’, and so on.) and stretch them advert nauseum, advert ridiculum to turn out to be their total careers. But they make hundreds of thousands by doing so, even all of it bears no resemblance to the true world. How dotty is that?

Loading…