- NEAR, RNDR and TAO costs have climbed previously 24 hours.

- Nonetheless, these tokens could also be unable to keep up this pattern.

The factitious intelligence (AI) token market has rallied following Bitcoin’s [BTC] current surge above $71,000.

Over the previous 24 hours, the AI token market capitalization has climbed by 5%, whereas buying and selling quantity has elevated by 20%, in keeping with CoinMarketCap.

The values of main AI and large data-based cryptocurrency property, resembling Close to [NEAR], Render [RNDR], and Bittensor [TAO], have climbed by 8%, 5%, and seven%, respectively, previously 24 hours.

No clear signal of a continued rally

An evaluation of the tokens’ key momentum indicators, which monitor shopping for and promoting exercise, revealed that their worth enhance has not been backed by any actual demand from market contributors.

It merely mirrors the uptick within the basic cryptocurrency market previously 24 hours.

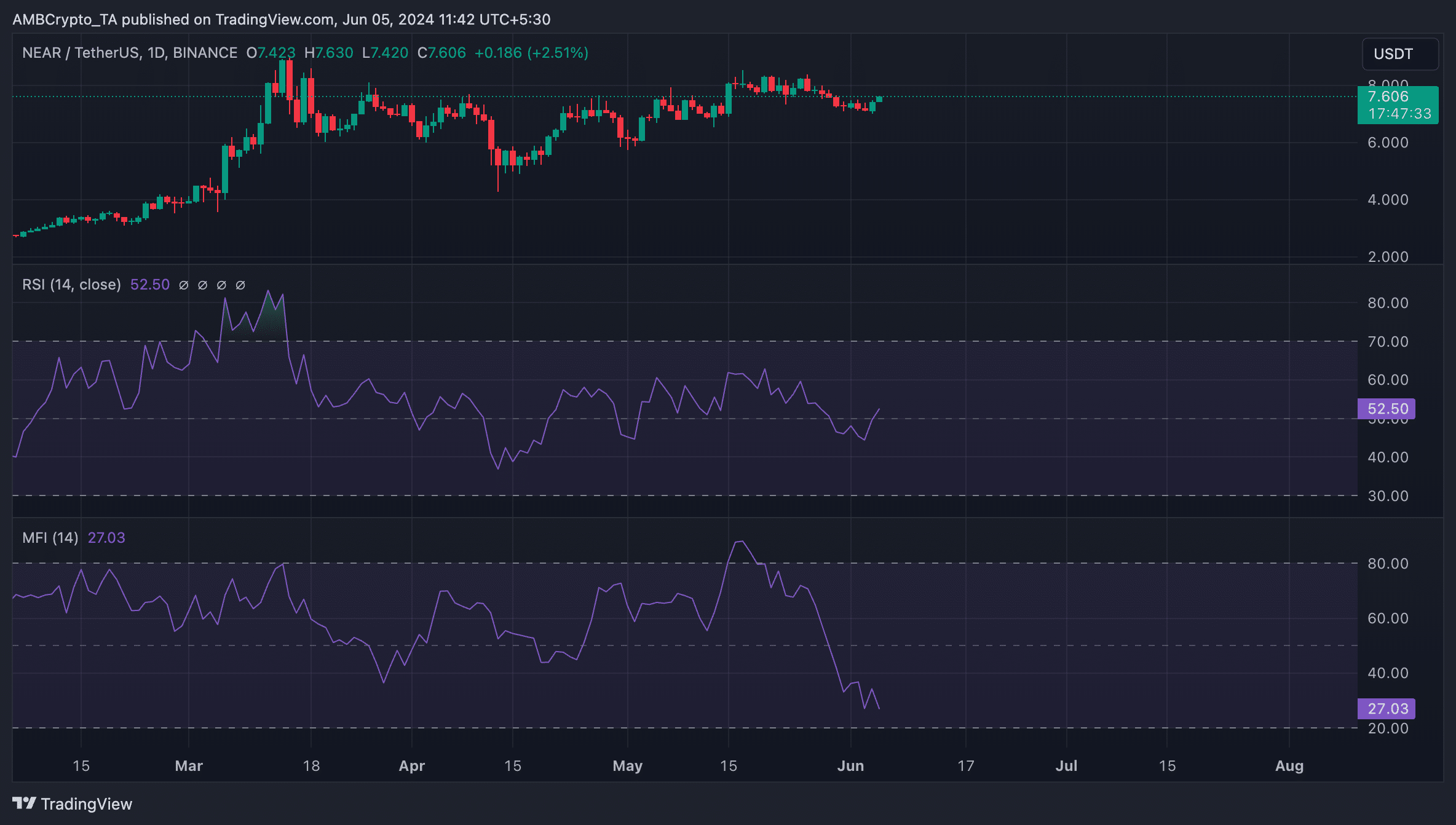

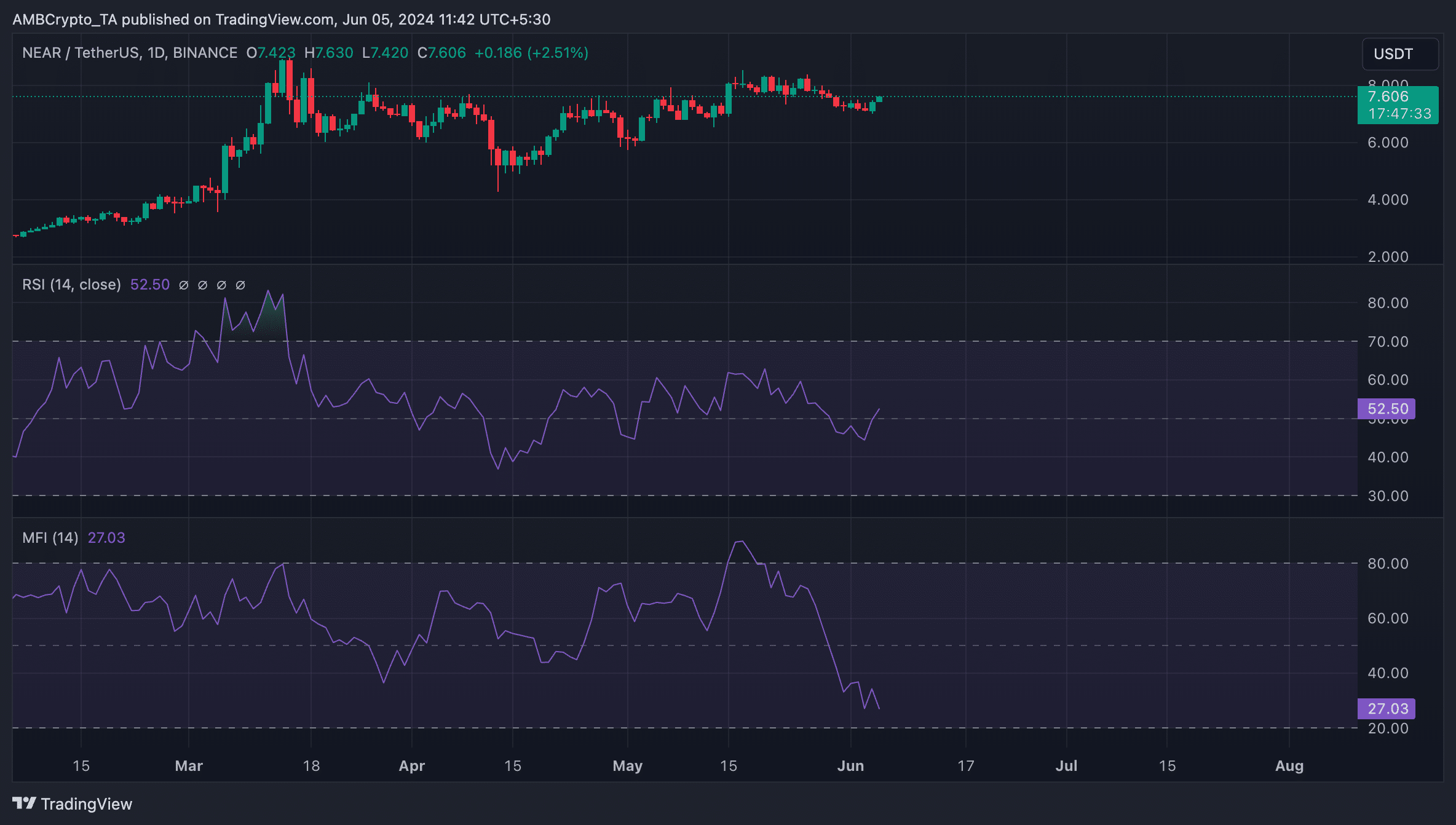

For instance, NEAR’s Relative Power Index (RSI) was 52.29, whereas its Cash Movement Index (MFI) was 26.96.

A mixed studying of the values of the 2 momentum indicators confirmed that whereas market sentiment stays predominantly impartial, there was a substantial outflow of cash from the NEAR market.

This hints at the potential for the altcoin shedding its most up-to-date good points as promoting stress good points traction.

Supply: NEAR/USDT on TRadingView

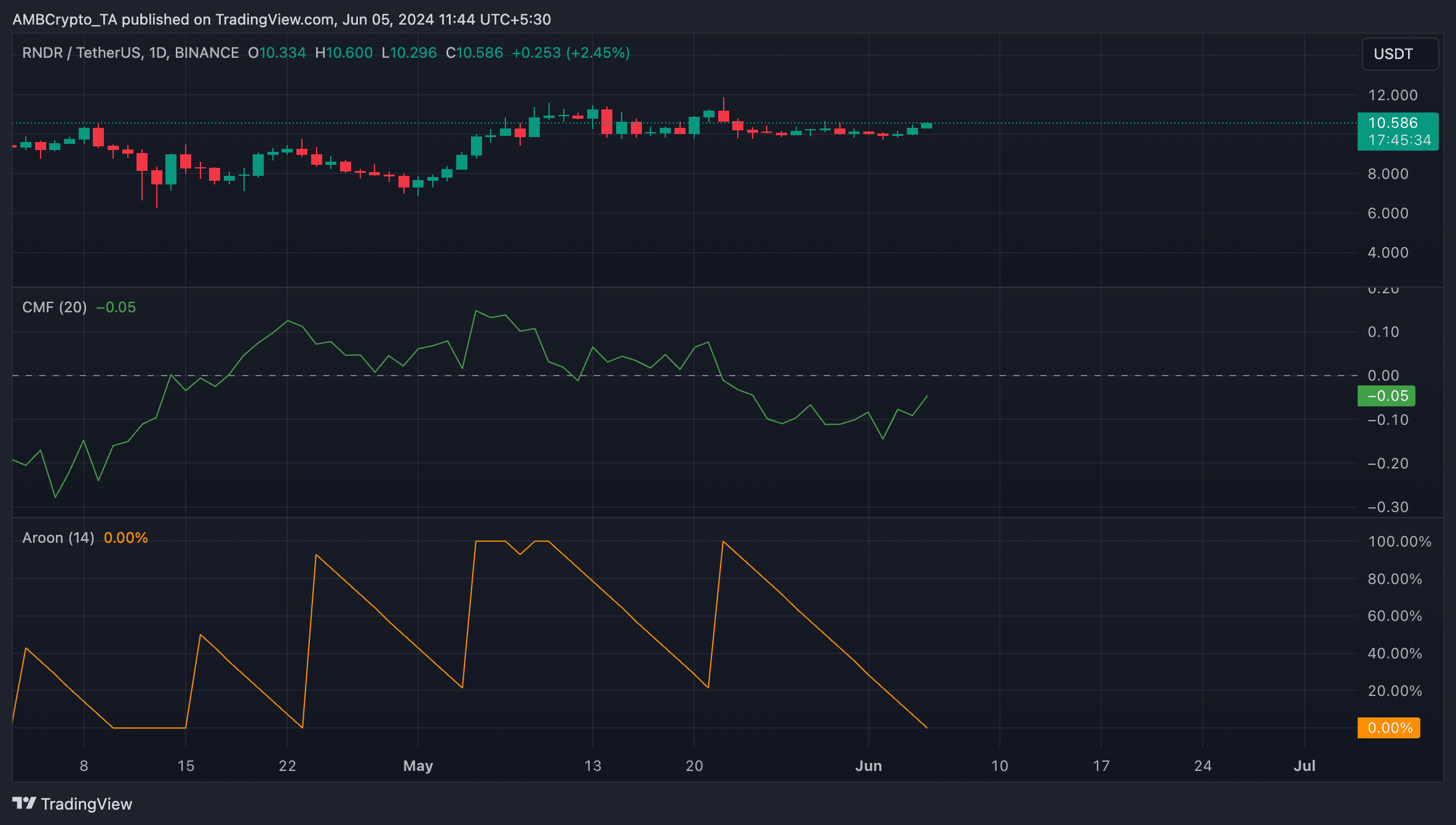

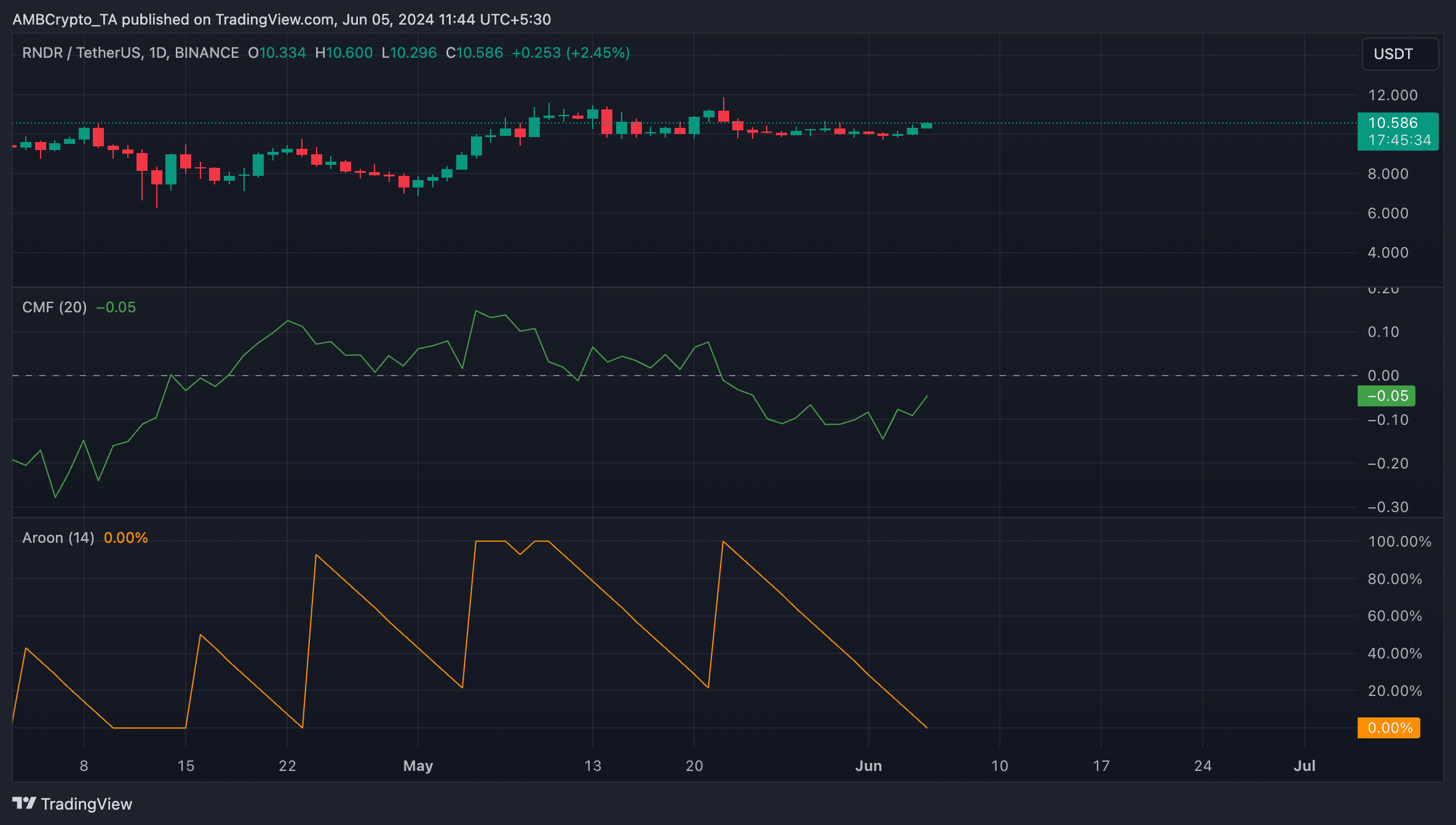

Relating to RNDR, its Chaikin Cash Movement (CMF) was noticed under the zero line on the time of writing. This indicator gauges the stream of cash into and out of an asset’s market.

When it returns a price under zero, it alerts market weak spot. It suggests a spike in promoting stress, marked by capital flight, and a sign of a possible worth decline. As of this writing, RNDR’s CMF was -0.05.

RNDR’s Aroon Up Line (orange) was 0%, confirming the present uptrend’s weak spot. An asset’s Aroon Indicator measures its pattern power and potential worth reversal factors.

When the Aroon Up Line is near zero, any market uptrend is deemed weak, and the latest excessive was reached a very long time in the past.

Supply: RNDR/USDT on TRadingView

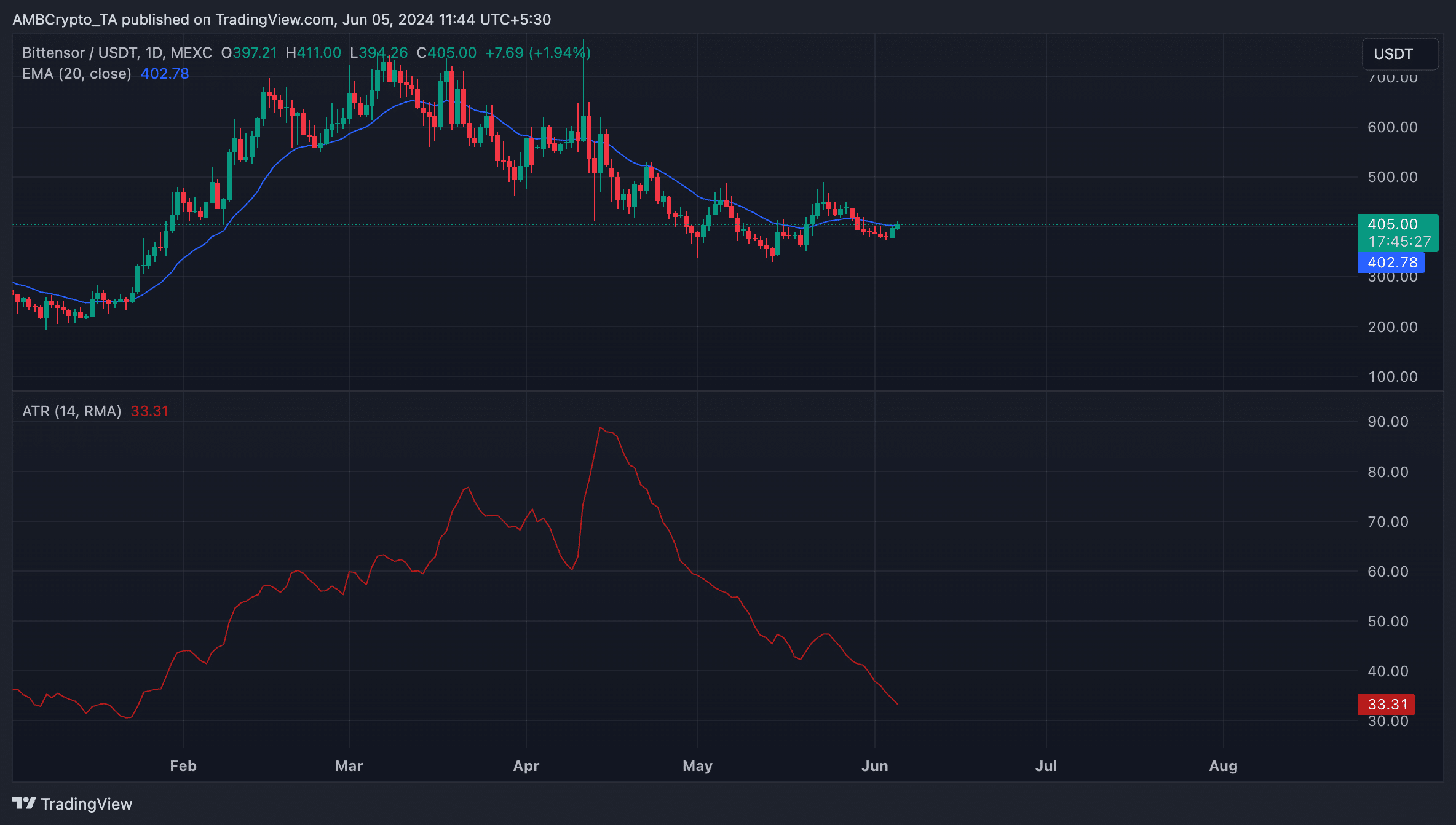

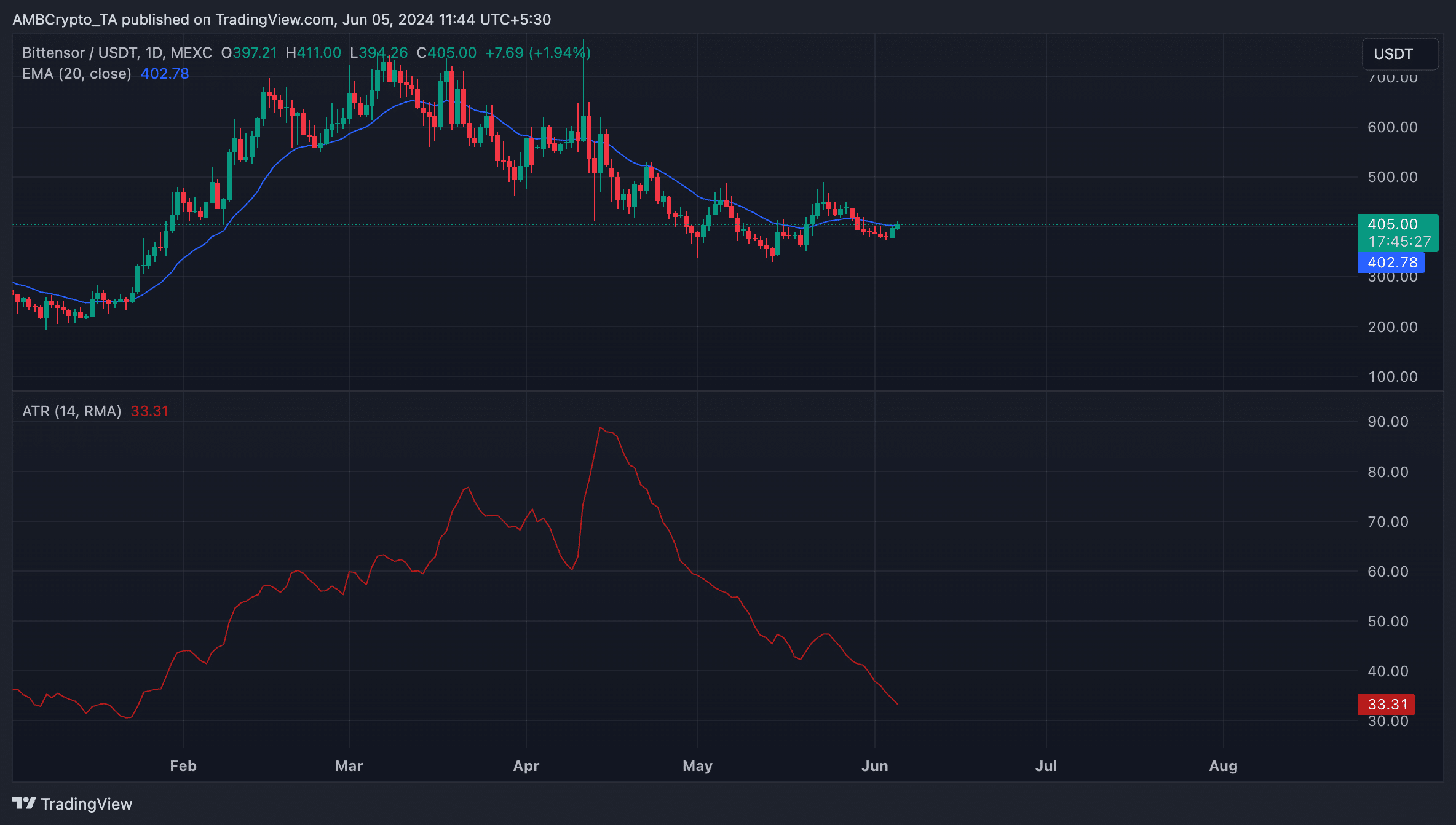

TAO’s efficiency isn’t any totally different, as its worth at present trades near its 20-day exponential shifting common (EMA).

When an asset’s worth trades near this key shifting common, the market consolidates as the value lingers inside a variety.

This was confirmed by TAO’s declining Common True Vary (ATR). This indicator measures market volatility.

Supply: TAO/USDT on TRadingView

When it declines this manner, it suggests a interval of indecision or consolidation out there.