JHVEPhoto

Expensive readers/followers,

I have been a frequent analyst of Telenor (OTCPK:TELNY) right here on Searching for Alpha. The truth is, in the event you take a look at the 2 tickers, you will notice that my articles are among the most represented for each tickers. Whereas I can not declare that Telenor has been the best-performing funding in my portfolio since I staked out and elevated a stable place, it is nonetheless been a suitable return.

Extra importantly, I’ve put myself able the place I can see important returns in an surroundings the place Telcos would begin to see a premium as soon as once more. I don’t think about this to be possible for the close to time period, however then once more I don’t make investments for the close to time period – I make investments for the medium or long run.

Even when all my investments have trim targets, I am completely superb with investments not reaching these trim targets for a very long time. I just lately coated Maersk (OTCPK:AMKBY), a superb instance of an organization the place I am lengthy, however I don’t anticipate to get better materially within the close to time period. Telia (OTCPK:TLSNF) is one other instance, extra related to this context of telco firms.

On this particular article, I will cowl 3Q23 for Telenor attempt to see the place we’re going from right here, and supply an goal and impassionate replace on this enterprise.

Telenor – 3Q23 confirms what upside there may be to the long-term

So what’s so nice concerning the firm hereafter 3Q23? Effectively, the corporate noticed a considerable 4% enhance in top-line development (gross sales income) and good EPS/profitability. To remind you, Telenor is a stable telco out of Norway with a secondary concentrate on development markets in Asia.

Not like its friends comparable to Telia, which has tried related development methods and verticals, Telenor has really succeeded in these, seeing an ongoing transformation of the corporate to even larger ranges of profitability. (Supply: Telenor 3Q23)

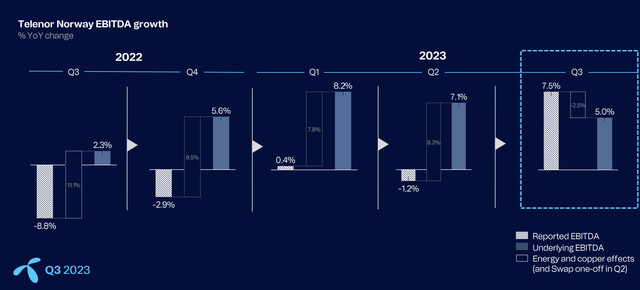

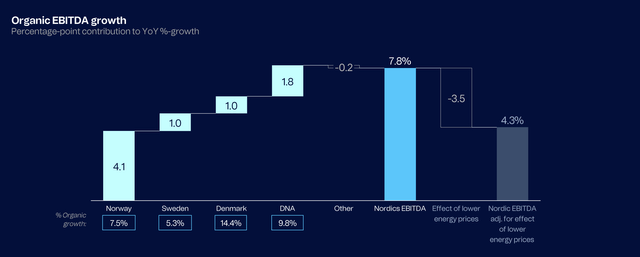

This profitability will be confirmed with a company-wide FCF of 4.3B NOK for the quarter, and this newest quarter marks the fourth consecutive quarter of 5%+ cellular service income development, with an EBITDA development of just about 8%. Norway particularly, as a phase for Telenor, has closed the hole to underlying EBITDA right here.

Telenor iR (Telenor iR)

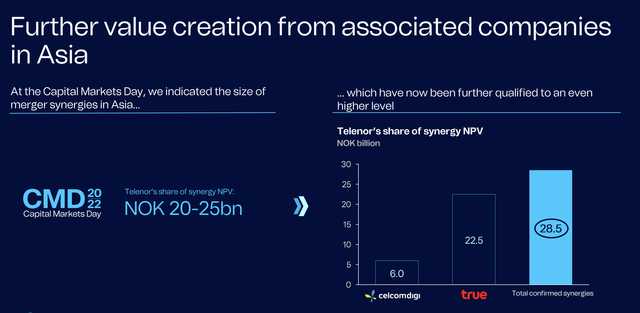

Telenor has Sweden as a phase too, after all, however I consider the main target right here ought to be Asia. The corporate, as of 3Q23, is the no 1. telco in 3 out of 4 markets right here. These numerous constructions, together with CelcomDigi, ship substantial dividends and income to Telenor, which allow amongst different issues the continued excessive yield and has resulted within the firm elevating synergy targets even additional. (Supply: Telenor 3Q23).

For the corporate’s Asian phase, the corporate is planning a strategic overview within the Pakistan phase and is working actively to drive dividends from each CelcomDigi (Profitable) and True (ongoing), additionally driving continued development in Bangladesh.

Telenor IR (Telenor IR)

Turning to strictly monetary targets and highlights, we’re seeing important service income development as talked about, with a CapEx to gross sales share that at 13.3% is without doubt one of the lowest within the phase. Even decrease than Orange (ORAN), and that firm is a little bit of a pacesetter on this. This doesn’t imply that the corporate doesn’t see value will increase. OpEx is up 5.9% for the YoY interval, pushed throughout the board by wage value will increase, operational and upkeep bills, gross sales and advertising and marketing prices, vitality prices, and different prices. This involves a complete of over 350M NOK – however on a share foundation or relational foundation, this isn’t considerably greater than another telco within the sector (Supply: GuruFocus).

Nordics noticed a big general EBITDA enhance.

Telenor IR (Telenor IR)

FCF was an general spotlight this yr. FCF drivers right here had been improved EBITDA, improved internet working capital, decrease curiosity prices, licensing prices, tax funds, and different elements. The corporate leverage is again throughout the goal vary at 2.2x, in comparison with 2-2.5x. Like different Nordic firms, Telenor stays impacted by important FX volatility and vitality worth volatility, with further stress from inflation and growing rates of interest.

The corporate has, nonetheless, elevated its general outlook for the complete yr, now anticipating above 3% natural service income development, a 3-4% full-year YoY EBITDA development on the natural aspect, and a full-year CapEx/gross sales of 17% – not the 13.3% for the quarter, not record-high, however as excessive as one may anticipate for a corporation that is nonetheless within the midst of funding cycle. (Supply: Telenor 3Q23)

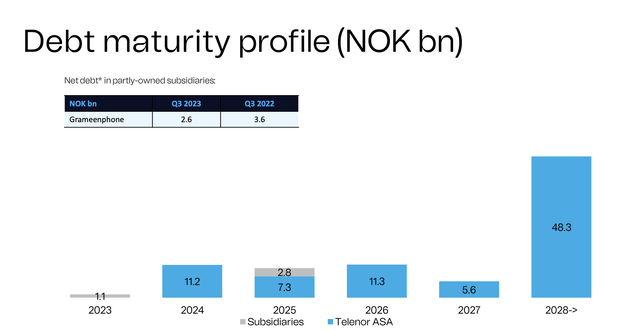

Debt maturities and different considerations on the basic aspect?

These are extraordinarily low general. A lot of the firm’s debt is not maturing till late 2028 or past.

Telenor IR (Telenor IR)

Different considerations or issues right here that transcend what we have been by means of for Telenor in earlier articles?

There’s some lack of readability for these Asia dividends going ahead. As a result of the corporate has a 5B NOK upstream FCF goal, the query is that if that is nonetheless potential with the Pakistan sale. The corporate says it’s – however we’ll should see. The corporate’s primary argument right here is that Pakistan was not the motive force for that 5B NOK goal, however this after all raises the bar for the corporate’s different Asia segments by way of efficiency. Whereas CelcomDigi dividends appear to be working properly and on observe to ship good outcomes even sooner or later, there’s at all times some danger right here.

Secondly, regulatory points. The regulator has mentioned that it desires to interrupt the nationwide regulation of Telcos in Norway into regional rules of twenty-two areas. Prior to now, Telenor was the one mounted operator that was regulated – this new construction implies that sooner or later, different gamers may even turn out to be regulated, and it will outcome, in the long run, in a further 400,000 households for Telenor. This regulation is not as a lot a unfavourable difficulty as one thing to regulate for the long run, and the present Telenor expectation is for it to enter play in the long run of 2024E – but it surely might flip into 2025E as properly.

Other than this, there aren’t many new points or considerations which have arisen over the previous few months.

Danger & Upside for Telenor

As all investments I do have, Telenor has each an upside and a draw back. We start with the dangers to the funding, as at all times. The danger to Telenor as an funding is that the market views the yield and return that Telenor affords on the present valuation to be too unfavorable, and the inventory trades down. This has occurred up to now. It isn’t unusual if the market affords 4-5% risk-free {that a} 7-8% yield is not as nice or as extremely valued, even when it is secure, because it was a number of years again. There are additionally the dangers of points within the Asian geographies, that are geopolitically extra unstable than the corporate’s core areas.

The upside, nonetheless, is the other of this, and it occurs to be the state of affairs I view because the extra possible in the long run. That is why I’ve important investments in Telenor. I consider the mix of excellent yield, stable fundamentals, and a non-optional societal service (telecommunications), will lead to a big long-term upside of at the very least 10-15% CAGR.

Let us take a look at the valuation for this firm and what it affords at present ranges.

Valuation for Telenor

That is going to be my final Telenor article for 2023, except one thing very materials occurs. Which means it is possible that my subsequent article on the corporate will coincide with the dividend choice, the affect of which might be materials.

I’m not altering my goal for Telenor presently, and whereas Telenor is on no account as enticing because it was within the double digits – once I added to my place – the corporate remains to be a superb “BUY” right here.

Why is it a superb “BUY” after 3Q?

As a result of it is barely down from its 120 NOK stage, and presently trades nearer to 115 NOK, which even solely to a normalized a number of of 17-18x P/E provides it an upside of 20% per yr – and that features primarily flat development over the subsequent few years. You may ask why a Telco may warrant an 18-19x P/E – that is as a result of that is the place the corporate has traded on a 5-year common. 20-year common P/E for this firm is sort of 17x – so this buying and selling vary is well-established, and that is the rationale why I think about it to be “legitimate”.

This 20% annual upside is partly as a result of 7-8% from yield, and is predicated on the basics that I’ve talked about above – and in addition, reminding you, of the corporate’s lower than 51% long-term debt to capital, and the truth that the corporate is A-rated from S&P International, one of many only a few telecommunications firms that manages this, due to extraordinarily conservative debt metrics and dealing with.

So, the upside right here is, as I see it, stable. I do not view it possible that the reversal right here goes to be fast, however I additionally do not see it as all that possible that we’ll see important downturns once more to an 80-90 NOK stage, at the very least not with out some exterior catalyst or inner outcome. On condition that rate of interest will increase appear principally “performed” in the interim in Scandinavia, and I do not see the macro situations for telcos in Scandinavia worsening considerably, I am pretty optimistic concerning the firm’s general prospects right here.

When valuing Telenor, 17 analysts observe the corporate as of the twenty ninth of November 2023. They offer the corporate a worth goal vary beginning at 92 NOK and going to 170 NOK, with a median of 128 NOK. Clearly, as you possibly can see from my worth goal, I consider the corporate to be price greater than this for the long run. We’re more likely to see some near-term earnings stress from non-recurring objects, however 2024E is predicted to normalize internet earnings and developments right here. (Supply: FactSet).

All in all, I consider the prospects for Telenor to nonetheless be adequate to warrant a stable, optimistic thesis right here – and the basic variables and forecasts in addition to the historic prospects suggest to me that this firm warrants a “BUY” right here.

Thesis

My thesis for Telenor is as follows:

- I view Telenor as top-of-the-line telcos in all of Europe, primarily based on its fundamentals and markets. Safer than Orange, and safer than Tele2/Telia. Maybe Deutsche Telekom (OTCQX:DTEGY) is likely to be as secure, however lower than half the present yield.

- Based mostly on this security and this yield in addition to this upside, I am marking this firm as a “BUY” and contemplating it with a PT of 150 NOK/share. I’m nonetheless not decreasing my PT right here as of November/December of 2023.

- I consider the suitable solution to spend money on the enterprise is native shares solely, not ADRs. The native share trades on the Oslo Share trade underneath the image TEL, and I might not spend money on any Norwegian firm besides by shopping for the native share.

Keep in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital positive aspects and dividends within the meantime.

2. If the corporate goes properly past normalization and goes into overvaluation, I harvest positive aspects and rotate my place into different undervalued shares, repeating #1.

3. If the corporate does not go into overvaluation, however hovers inside a good worth, or goes again right down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is essentially secure/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low cost.

- This firm has a sensible upside primarily based on earnings development or a number of expansions/reversions.

I name the corporate “low cost” right here, and it fulfills each single one among my funding standards.

This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please pay attention to the dangers related to these shares.