- Solana’s value appreciated by greater than 11% within the final 7 days

- Most market indicators had been bullish, however the CMF flashed bearish indicators

Solana’s [SOL] value motion remained influenced by the market bulls because it continued to rise over the previous couple of days. If the market scenario stays the identical, then the possibilities of SOL reclaiming $200 in Could could be excessive. Nevertheless, there stay a couple of issues for SOL’s value on the charts.

What’s happening with Solana?

Solana bulls dominated bears final week because the token’s value surged by greater than 11%. In reality, in response to CoinMarketCap, SOL’s value elevated by 7% within the final 24 hours alone. On the time of writing, SOL was buying and selling at $155.10 with a market capitalization of over $69.5 billion.

Crypto Tony, a well-liked crypto-analyst, lately posted a tweet highlighting SOL’s attainable value motion, declaring that issues may get even higher. As per the tweet, SOL’s value may retain its bullish momentum and may go larger on the charts.

SOL’s value appears to be quick approaching a key resistance at $160. A profitable breakout above that stage might end in SOL touching $200 in Could.

To raised perceive whether or not that’s attainable, AMBCrypto analyzed Santiment’s information. As per our evaluation, optimistic sentiment round SOL spiked sharply on 9 Could – An indication that buyers are assured in SOL.

Its open curiosity hiked together with its value too. An increase on this metric normally signifies that the possibilities of the continued value development persevering with are excessive.

Additionally, SOL’s funding fee dropped barely on the charts. Typically, costs have a tendency to maneuver the opposite manner than the funding fee – One other signal of a attainable value hike.

Supply: Santiment

Considerations galore?

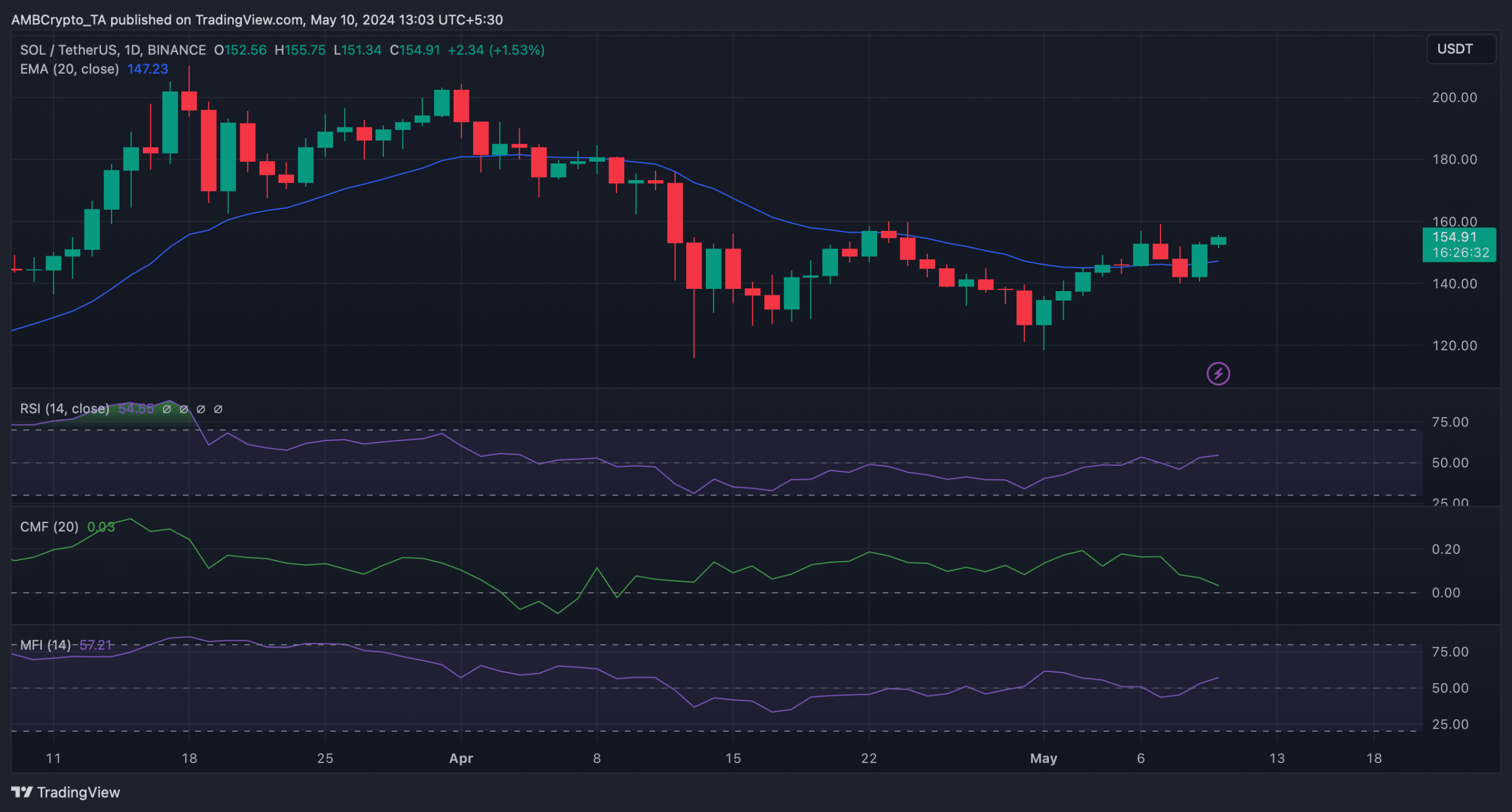

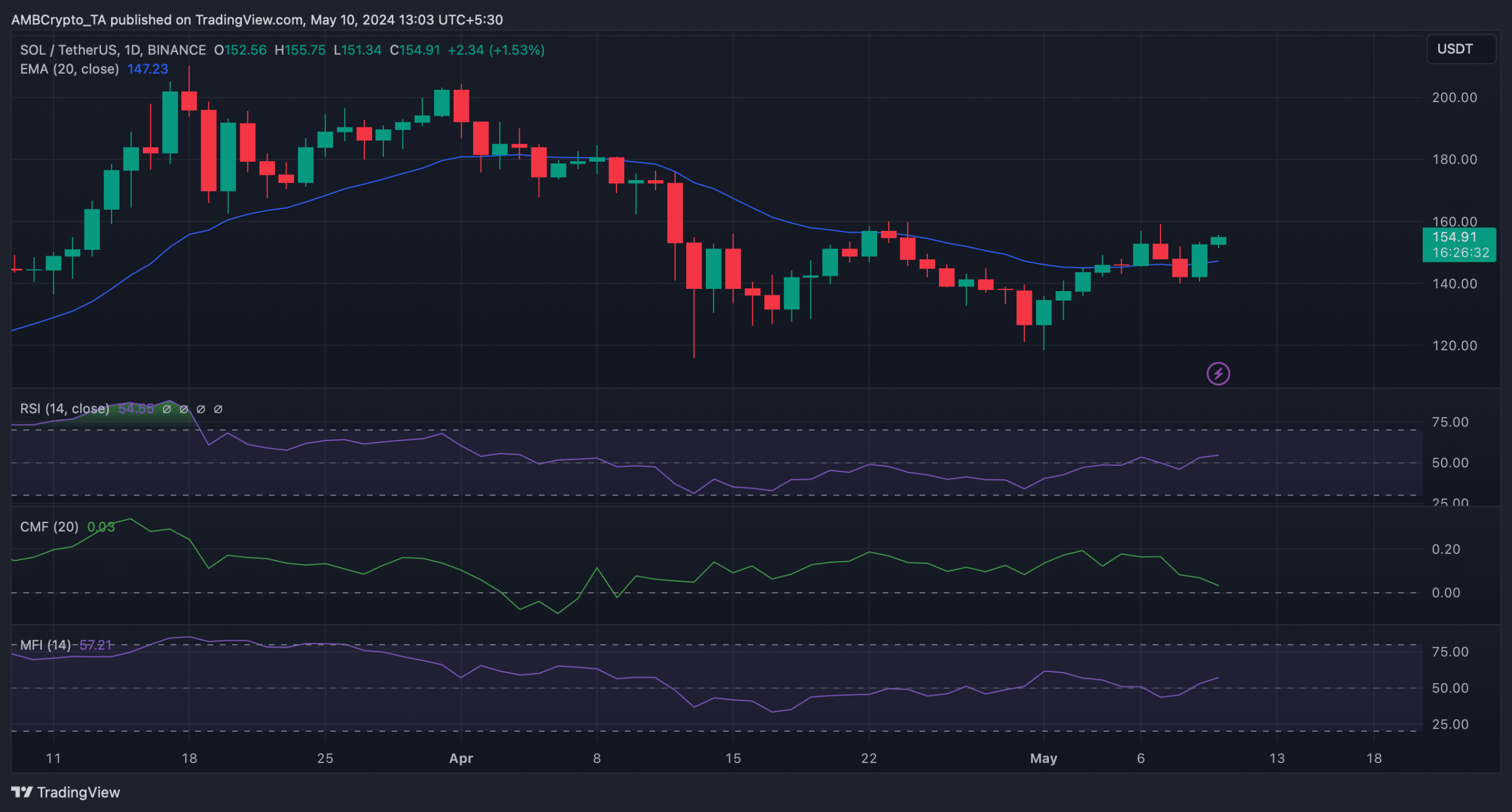

AMBCrypto then analyzed SOL’s day by day chart to see whether or not technical indicators supported the opportunity of SOL going above $160. In response to our evaluation, SOL’s value was resting above its 20-day Exponential Shifting Common (EMA).

The Relative Energy Index (RSI) registered a pointy uptick too. At press time, it had a worth of 54.6. Solana’s Cash Circulation Index (MFI) additionally adopted an identical growing development. These indicators recommended that SOL’s bull rally may proceed.

Supply: TradingView

Nevertheless, the Chaikin Cash Circulation (CMF) aligned with bears’ curiosity because it dropped over the previous couple of days.

AMBCrypto had beforehand reported that SOL was pressured to retreat from its $160-level on 7 Could.

Real looking or not, right here’s SOL’s market cap in BTC’s phrases

If the Chaikin Cash Circulation’s (CMF) indication comes true, then SOL won’t be capable of breach that stage this time both. A rejection from the resistance zone might trigger a development reversal, which might push the token’s value to $120 within the coming days.