vovan13

Pricey readers/subscribers,

I like water firms. I invested in a number of of them, and I had a major portfolio stake in water-adjacent enterprise Uponor earlier than it was clear this Finnish outperformer was going to be taken personal. Water firms are enticing companies as a result of, like most utilities, they’re regulated to a excessive diploma. It means much less explosive progress and potential, for probably the most half, but it surely additionally means earnings security and stability.

Throughout ZIRP, this mix is what precipitated these firms to considerably outperform and commerce at near-ridiculous multiples. It made it onerous to estimate simply how “low” issues have been certain to go outdoors of such an surroundings. Now we’re seeing what occurs to these companies and the way we may worth them to see an upside right here.

On this case, we’re taking a look at a pure-play water/wastewater participant, the SJW Group (NYSE:SJW).

I am going to undergo the corporate with you and present what would make me considering investing within the enterprise. To be clear, I don’t take into account this firm to be a “BUY” at this time.

I might need a greater value.

Right here is why.

SJW Group – I like water, however I need a good valuation.

So, what precisely is SJW Group?

This.

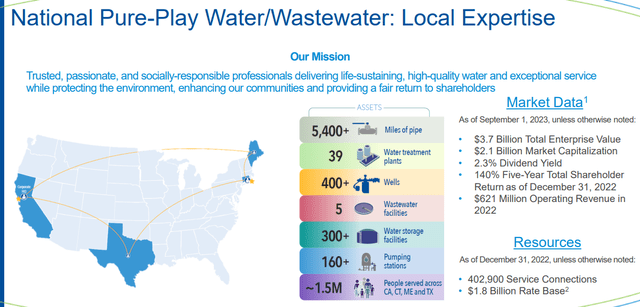

SJW Group IR (SJW Group IR)

The corporate has an interesting set of property in what are literally very strong general geographies. With its near-$2B price base encompassing over 400 000 connections, this can be a vital participant, with as low a yield as we have grown accustomed to from these types of companies.

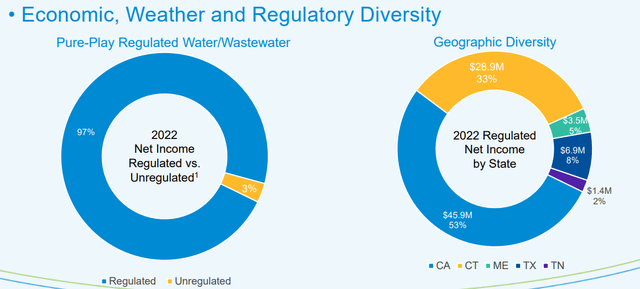

The primary danger, to start with, with the a part of the corporate’s thesis, is diversification, or quite the shortage of it.

Over 50% of the corporate is in California – and I am none too eager on overexposure to California and the best way issues are going there right now. There are good firms there, that is for certain – however I would like a special combine right here, reversing Texas with the California publicity.

SJW Group IR (SJW Group IR)

However that’s not how issues are – and I can stay with that, on the proper value. SJW, like different firms, depends on delivering strong efficiency and customer support with what are restricted returns – however with the upside that nothing can actually occur to these returns, so long as society continues to operate. The corporate is a comparatively small participant – although not as small as some others within the area that I’ve checked out.

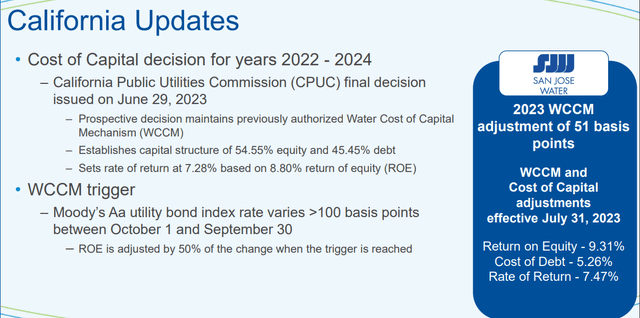

And never desirous to be too unfavourable, I’ve truly been via the final regulatory consequence in California, and the outcomes weren’t too unhealthy. Including to this, system enchancment fees in Texas are accredited, and basic price case and infrastructure funding surcharges in CT and Maine.

As with different water firms, SJW is not any slouch in terms of delivering dividends extra time. 80 years is the time the corporate could have paid an unbroken dividend custom in the course of the subsequent 12 months, with will increase 55 years working, making SJW a dividend king.

Not a nasty factor.

In relation to continued progress, SJW is hanging its hat on a $1.6B five-year plan for funding in water and wastewater infrastructure in addition to PFAS remediation (nonetheless to be accredited by regulators). The corporate does promote its constructive and principally constructive relationship with state commissions, however having some expertise on this subject, I might argue that these ties have but to be really examined and could also be throughout the subsequent 5 years.

Except for this, SJW additionally focuses on opportunistic M&A, which is one other constructive, as a result of, not like different water firms, SJW seems to be at nationwide views and footprints for potential progress.

Traditionally, the corporate has been fairly conservative investing within the infrastructure, however that is ratcheting up, and rapidly.

SJW IR (SJW IR)

A lot of the firm’s anticipated progress is predicted to come back from inorganic progress from small, very small, and medium-sized neighborhood water programs that are being added to the corporate’s portfolio, such because the latest set of additives in Texas. Particularly in Texas, the corporate has seen vital connection progress within the final 15-20 years, with greater than 27,000 wastewater and water connections.

However alternatives for extra additions nonetheless exist, with greater than 8,400 neighborhood water programs within the 4 states the place the corporate is most energetic, and one other 16,000 publicly owned wastewater programs ripe for inclusion in firms akin to this.

Extra benefits exist. The corporate has sturdy entry to the capital markets with its A-rating by way of credit score, a $350M line of credit score with lower than 30% of that presently utilized, and a market cap of $2.1B, which is 3x+ the dimensions of the water firms I in any other case take a look at and put money into, akin to York Water (YORW).

The corporate’s debt/market cap is not class-leading, particularly when you think about it was at sub-33% in 2018, and now carries at 57.3%. It is utterly the unsuitable time, as I see it, to go debt-heavy right here, however on the identical time, credit score markets do not appear fearful for the corporate right here.

In brief, SJW’s benefit performs to its native data relationships and expertise with regulators, having 232,000+ connections in San Jose, 100,000+ in Connecticut, 34,000+ in Maine, 26,000+ in Texas, and are rising even now. The latest price choices hail out of California, they usually appear to be this.

SJW IR (SJW IR)

Not the most effective, however actually not the worst – and admittedly, a couple of bps higher than I had it in my expectations based mostly on macro and different water firms in the identical space or in California general.

Total, SJW is a strong enterprise with an excellent portfolio of wastewater and water-based property. What challenges the corporate does, and is presently dealing with, are challenges confronted by most water firms, with the exception maybe of the PFAS cleanup, which offers not less than a small complication to traders right here.

The opposite problem for an SJW funding is primarily how this firm is valued outdoors of ZIRP – as a result of we have been in ZIRP for therefore lengthy. It has been over a decade since we have been at these price ranges, and it will seemingly be a number of years earlier than we see them meaningfully decline once more.

This begs the query of how we should always worth the corporate, and that is what the first problem is right here. Some analysts argue that the PFAS problem is the first danger to have a look at right here – I say this is not irrelevant, however valuation in addition to keeping track of escalating prices is among the core points right here.

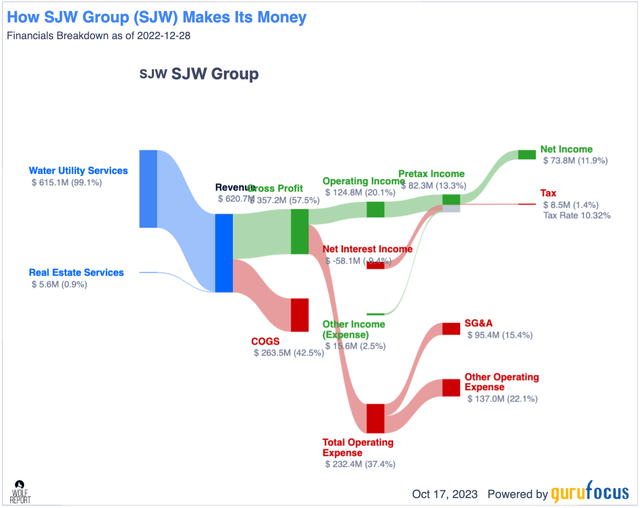

SJW is a well-run enterprise. The corporate has among the many higher gross margins in its business, even when this turns into comparatively common margins as we transfer all the way down to EBIT and internet margins. The corporate, whereas having above-average debt for an organization on this sector and to its friends, has a well-working enterprise mannequin with the next specifics.

SJW Income/internet (GuruFocus)

Nobody can accuse SJW of not being worthwhile or not making an excellent sum of money from its revenues.

Nevertheless, on the coronary heart of the matter lies the corporate valuation, and that is the place we run into challenges with this firm.

SJW – Why the valuation presents an issue

The issue is that the corporate has offered an 18x+ P/E for so long as we have had favorable rates of interest. The final time the corporate was at any type of respectable valuation was again in 2015. After that, not solely do we have now uncharacteristic EPS volatility, however we even have a 25-30x+ P/E valuation for an organization that whereas being a dividend king, yields not more than 2.5% and solely presents an upside if we permit a premium.

Even at this time, when you check out the numbers except you forecast at 25-31x P/E on a normalized foundation, that is an funding that provides you lower than 15% annualized RoR for the following few years. At something sub-25x P/E, this turns beneath 12% annualized, and beneath 23x, it is single digits. That is a tall order, even when the corporate is presently forecasted to develop at a excessive price attributable to growth – 8% EPS progress per 12 months.

However earlier than you cheer for this, I wish to level out that the corporate in reality misses estimates 1 / 4 of the time on a 1-year foundation with a ten% margin of error. That is very uncommon for a water firm or an excellent utility, as a result of their complete enterprise mannequin, a part of their complete funding case relies on being forecastable and resilient – one thing which SJW is barely so-so if we take a look at these earnings and forecast accuracy numbers (Supply: FactSet).

I don’t view this firm as presently, on this market or for the medium to long term, as deserving of this type of premium. I would be considering shopping for it at a long-term 24-25x P/E, which to me implies a PT of $54/share. That is the bottom PT for the corporate that I can discover any analyst holding. The present S&P International analysts following the corporate, 5 of them, give the corporate a spread beginning at $58/share and going to $82/share, with a mean of $72. So my low cost right here is appreciable. Nevertheless, regardless of this PT common, just one out of these analysts is at a “BUY”, with 3 at a “HOLD” and one at “SELL”. So the conviction that these analysts present is on the missing aspect and leaves one thing to be desired.

So whereas I can see myself at a value the place I might be considering investing in SJW, it is nowhere close to the place the corporate Is at this time.

Due to that, I give it a “HOLD”.

Thesis

- SJW is a strong dividend king, a water firm utility enterprise with over $1.8B in market cap even after the drop. The corporate has a well-covered dividend yield and operates in enticing markets, delivering services that individuals can’t be with out, which makes it an excellent funding on the proper value.

- Nevertheless, SJW has the identical points as most water firms we discover at this time in the marketplace – most of them are nonetheless overvalued relative to what they need to be price in a declining market. SJW additionally provides to this by having some points by way of value will increase and environmental cleanup, which provides to what I consider to be an overvaluation.

- At this explicit time, I don’t consider the corporate to be a “BUY” – I give the corporate a PT of $54/share, which is among the lowest accessible value targets for this firm – however there are too many good choices accessible in the marketplace at this time.

Bear in mind, I am all about:

1. Shopping for undervalued – even when that undervaluation is slight, and never mind-numbingly huge – firms at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

2. If the corporate goes nicely past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

3. If the corporate would not go into overvaluation, however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

4. I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

- This firm is general qualitative.

- This firm is essentially protected/conservative & well-run.

- This firm pays a well-covered dividend.

- This firm is presently low-cost.

- This firm has a practical upside based mostly on earnings progress or a number of expansions/reversions.

Which means the corporate fulfills each single one in all my standards, making it comparatively clear why I view it as a “BUY” right here.

Thanks for studying.