- Merchants misplaced thousands and thousands of {dollars} to the widespread correction.

- The volumes of ADA, SHIB, and DOT elevated however which may not be excellent news.

Triggered by Bitcoin’s [BTC] precipitous drop to $67,640, the costs of Shiba Inu [SHIB], Polkadot [DOT], and Cardano [ADA] skilled steep corrections within the final 24 hours.

At press time, SHIB had declined by a whopping 11.87%. This pegged again its value because it modified palms at $0.000029. Nonetheless, the memecoin’s value was not the one affected metric. On account of the worth lower, Shiba Inu’s market cap fell out of the highest 10.

DOT, alternatively, registered a 4.27% lower inside the identical interval because it worth fell to $10.64. ADA, which was beforehand on its technique to $0.80, decreased by 5.95% whereas buying and selling at $0.71.

The storm cracks down on the thrill

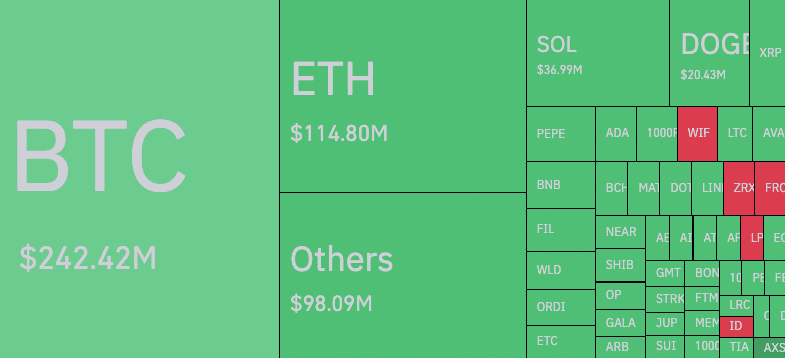

Based on AMBCrypto’s analysis, the turbulence brought about huge liquidations out there. Within the context of the crypto market, liquidation is normally attributable to unfavorable market actions.

Supply: Coinglass

It happens when an change forcefully closes a dealer’s place because of inadequate funds to maintain it open. Throughout the final 24 hours, SHIB longs skilled a wipeout price $1.19 million.

Nonetheless, the Liquidation Heatmap gotten from Coinglass confirmed that shorts liquidation was price $316,410

For ADA and DOT, it was an identical scenario as there was extra lengthy liquidations than shorts. Past merchants’ lack of fund, AMBCrypto additionally noticed that the quantity of those cryptocurrencies jumped.

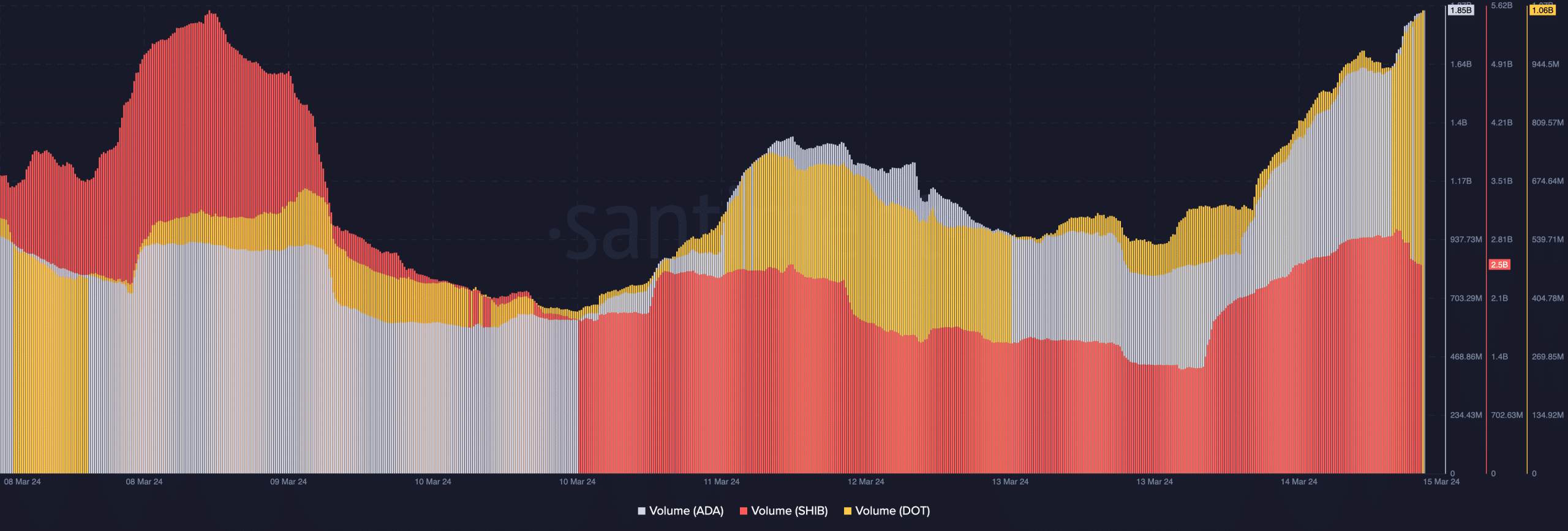

As of this writing, Cardano’s quantity had elevated to 1.85 billion. Polkadot’s jumped to 1.06 billion whereas Shiba Inu’s quantity initially rose to 2.81 billion earlier than declining to 2.50 billion.

Usually, rising costs on surging volumes point out an wholesome uptrend. However within the case of SHIB, DOT, and ADA, the falling costs on growing quantity point out the values is likely to be gathering energy to the south.

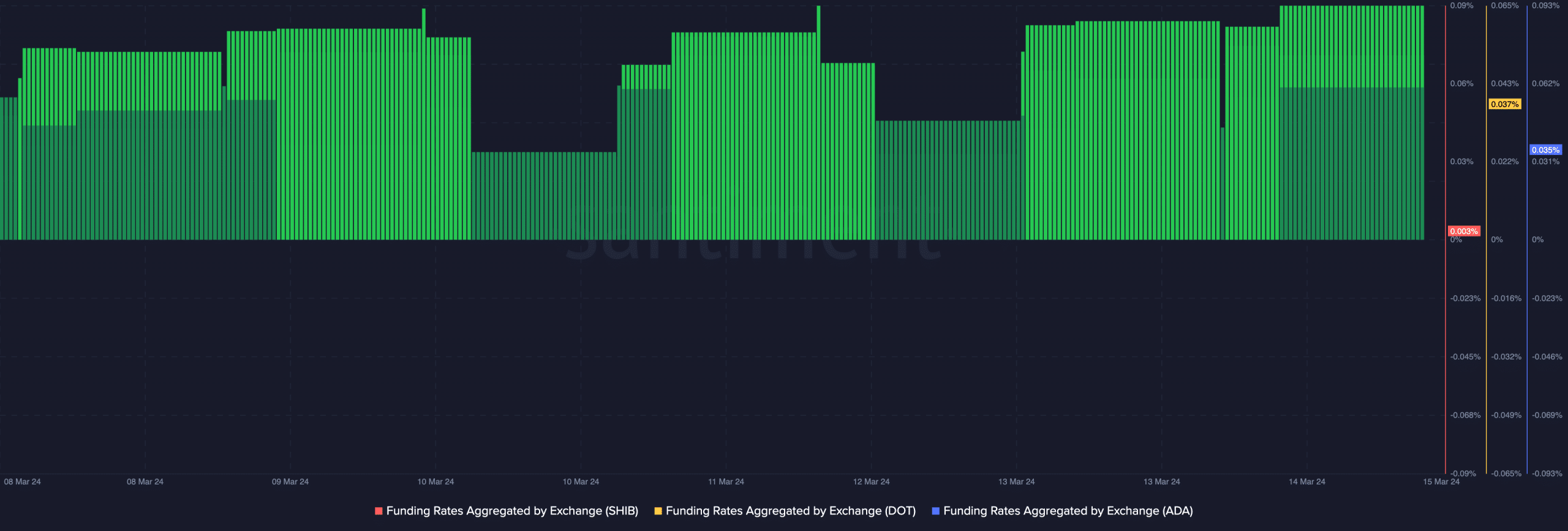

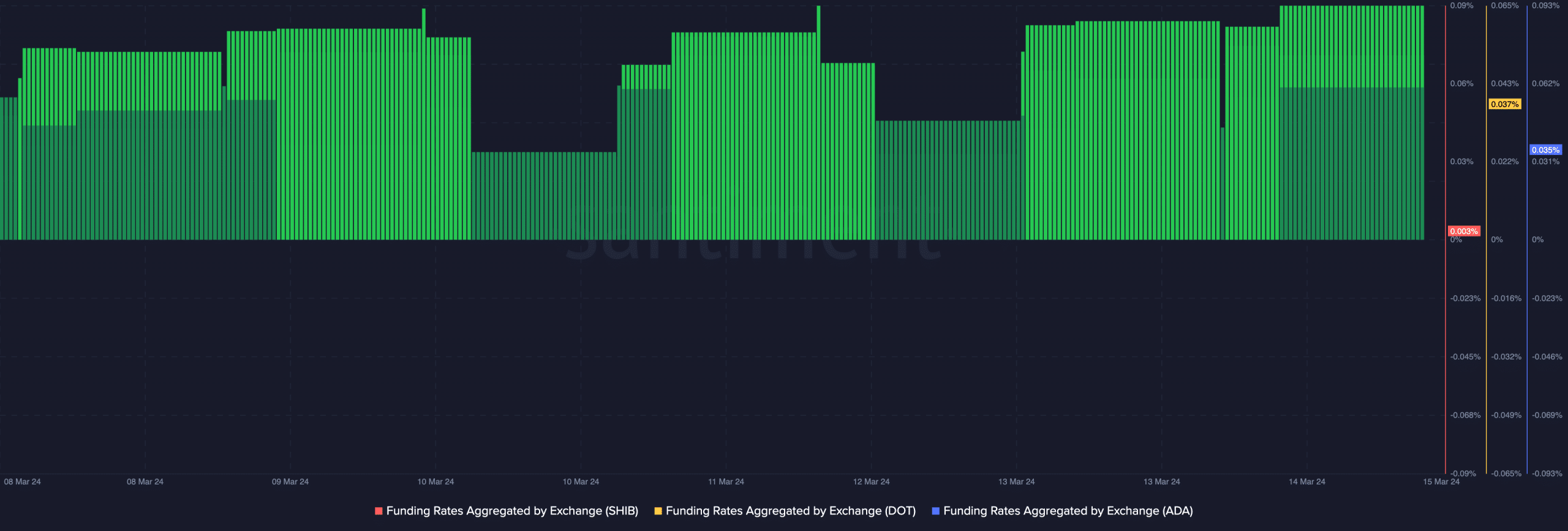

Supply: Santiment

Are these dips for purchasing?

If the quantity continues to rise whereas the costs decreases, then the worth would possibly decline additional. Nonetheless, a falling quantity may make the downtrend weak and possibly foster a rebound.

When it comes to the Funding Charge, on-chain information showed that it was constructive on all three ends. A constructive Funding Charge implies that the perp value was buying and selling above the spot worth.

Every time this occurs, it turns into costlier for merchants to maintain their positions open. To keep away from doable liquidation, merchants can promote the perp, purchase the spot, and take the Funding Charge as an incentive.

Supply: Santiment

Reasonable or not, right here’s SHIB’s market cap in ADA phrases

From a price-based angle, the constructive Funding Charge whereas value transfer decrease could possibly be bearish for ADA, SHIB, and DOT. In a scenario like this, longs’ aggression is intense however rewards don’t appear to be forthcoming.

Subsequently, this might causes the respective costs to key into resistance moderately than pump into assist. Nonetheless, an extra decline may not be totally dangerous as contributors may have an opportunity at shopping for the dip earlier than the following leg up.