alexsl

The online unrealized losses in most financial institution’s securities portfolios elevated in 3Q as rates of interest rose as a result of the Federal Reserve continued to lift their Fed funds goal. Some banks, such because the Financial institution of America (BAC), had very vital elevated losses of their HTM portfolio. Whereas some buyers nonetheless assert that these unrealized losses do not actually imply a lot, financial institution regulators assume they do in accordance with Federal Reserve Financial institution research and in accordance with statements of their new proposed capital necessities. It is a quarterly replace for the third quarter to my prior articles on financial institution unrealized losses within the securities portfolios.

As Curiosity Charges Enhance So Do Unrealized Losses

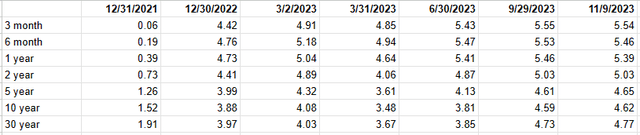

Lengthy-term rates of interest elevated considerably this previous quarter. Charges rose sharply after the top of the quarter then dropped again right down to be about the identical as the top of 3Q. The shorter finish of yield didn’t actually have vital modifications. These banks that maintain long-dated securities, akin to MBS, noticed essentially the most influence from rising charges.

U.S. Treasury Yields

house.treasury.gov

(Word: 3/2/2023 was the beginning of the financial institution disaster)

Charges on Deposits Larger Than Quantity Earned on Securities

An attention-grabbing subject that I noticed for a couple of banks is that they paid the next common rate of interest on interest-bearing deposits than they obtained on their securities portfolio. Capital One Monetary (COF), for instance, paid a median 3.30% on interest-bearing deposits and obtained a median of two.86% on their securities portfolio. Capital One holds all their securities in an AFS portfolio so I don’t perceive why they maintain securities which might be successfully being financed by money that’s dearer than what they’re getting on the securities – on common. It even appears worse contemplating in 3Q 2022, they paid a median 1.00% on interest-bearing deposits and obtained a median 2.25% on their securities portfolio. The identical with the Financial institution of New York Mellon (BK) that paid a median 3.62% and obtained a median 3.24% in 3Q in comparison with a median paid in 3Q 2022 of 0.95% and obtained a median 1.87% on their funding securities.

Unrealized Losses Are Necessary

As I lined in my promote Citigroup (C) article, the study by the Kansas Federal Reserve Financial institution concluded that unrealized securities losses do have a big influence on banks and the proposed new banking rules contains intensive point out of unrealized securities losses as one of many causes that the brand new rules are wanted. (Word: use this link to learn the proposed rules as a result of the unique hyperlink within the Citi article not exists.)

Some have asserted that due to hedging these unrealized losses usually are not actually that important. I strongly disagree. The truth is that if a financial institution is compelled to instantly promote these securities due to liquidity points to lift money they can not unwind the hedges in tandem with the securities gross sales. As well as, there are dangers that the celebration to the opposite facet of the hedge is in monetary hassle, which was a significant issue in 2008. These rate of interest hedges usually are not simply particular to their debt securities portfolios – they’re often hedges towards all of the property, together with loans held on their stability sheet. (That is an attention-grabbing study from final April on rate of interest hedging by banks.)

As I lined in my prior 2Q loss article, the one “certified” securities can be utilized underneath BTFP to borrow cash from the Fed. Many banks maintain numerous securities that aren’t certified and, due to this fact, could possibly be compelled to promote these securities at a loss if they should increase money instantly.

Others have additionally asserted that as a result of the market worth of the long-term debt the financial institution issued has declined as rates of interest rose this offsets their unrealized securities losses. That could be a typical principle asserted by a professor in some graduate faculty Econ class. Good in principle however ignores actuality. Financial institution rules take a look at the face worth – the precise quantity of their authorized legal responsibility – not the market worth of that legal responsibility.

AFS and HTM Unrealized Losses on Debt Securities

This a quarterly replace to my prior articles on unrealized securities losses. The small print behind the tables under of prior interval losses are included in my 2Q article. Most banks maintain their debt securities in two totally different portfolio accounts. The available-for-sale – AFS securities are those who may be bought and are reported at truthful worth on the stability sheets. Any unrealized losses/features are reported through amassed different complete revenue -AOCI – within the shareholder fairness space of the stability sheet. Held-to-maturity – HTM securities are debt securities which might be anticipated to be held till their maturity and are reported on the stability sheet at price. HTM unrealized losses/features usually are not straight reported on the stability sheet. Some banks, akin to Capital One, maintain all their debt securities in AFS accounts and do not have HTM accounts. Any precise features/losses on safety gross sales are reported on the revenue assertion. I used the top of the quarter numbers and never the typical numbers for the quarter. I additionally used the most recent reported variety of shares excellent.

3Q Quarter Outcomes

Citigroup (C)

September 30, 2023

Loss per share $16.42

Loss as proportion of present inventory worth 40%

AFS $246,763 million price – $241,783million truthful worth = $4,980 million loss

HTM $259,456 million price – $231,002 million truthful worth = $28,454 million loss

Complete unrealized loss $31,434 million

10-Q (sec.gov)

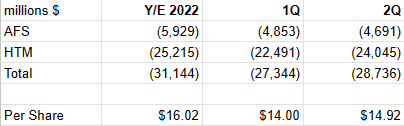

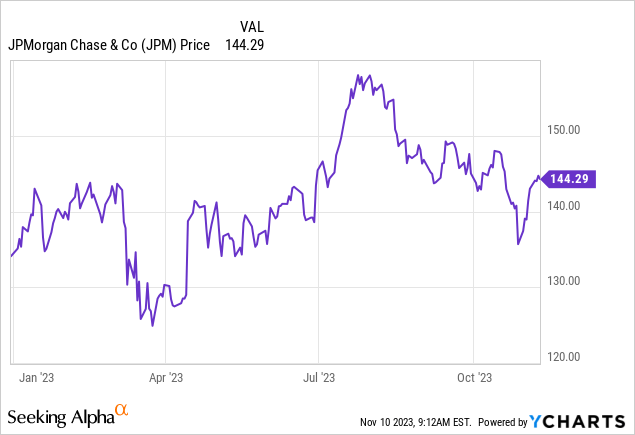

JPMorgan Chase (JPM)

Loss per share $20.17

Loss as proportion of present inventory worth 14%

AFS $206,500 million price – $197,119 million truthful worth = $9,381 million loss

HTM $594,761 million price – $545,820 million truthful worth = $48,941 million loss

Complete unrealized loss $58,322 million

10-Q (sec.gov)

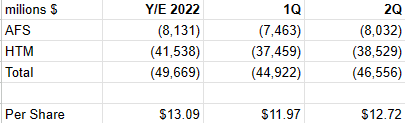

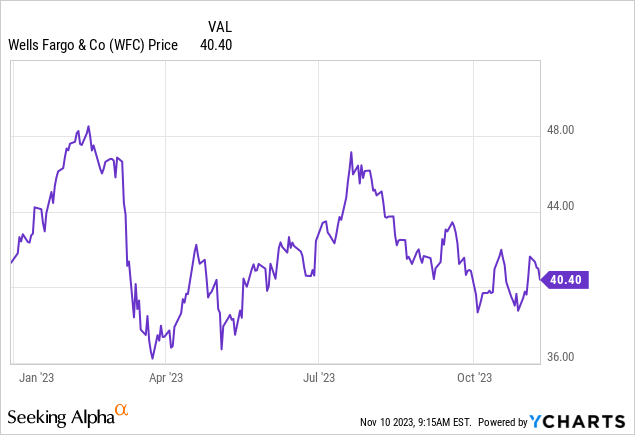

Wells Fargo (WFC)

September 30, 2023

Loss per share $16.82

Loss as proportion of present inventory worth 42%

AFS $137,265 million price – $126,437 million truthful worth = $10,828 million loss

HTM $267,214 million price – $216,927 million truthful worth = $50,287 million loss

Complete unrealized loss $61,115 million

10-Q (sec.gov)

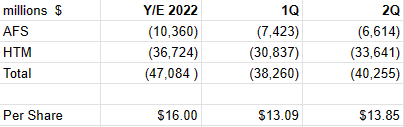

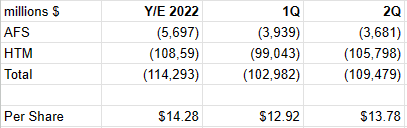

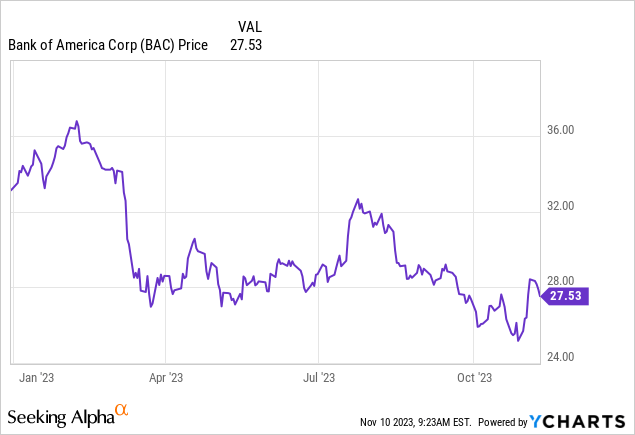

Financial institution of America (BAC)

September 30, 2023

Loss per share $17.20

Loss as proportion of present inventory worth 62%

AFS $170,125 million price – $165,610 million truthful worth = $4,515 million loss

HTM $603,365 million price – $471,761 million truthful worth = $131,604 million loss

Complete unrealized loss $136,119 million

10-Q (sec.gov)

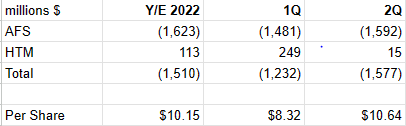

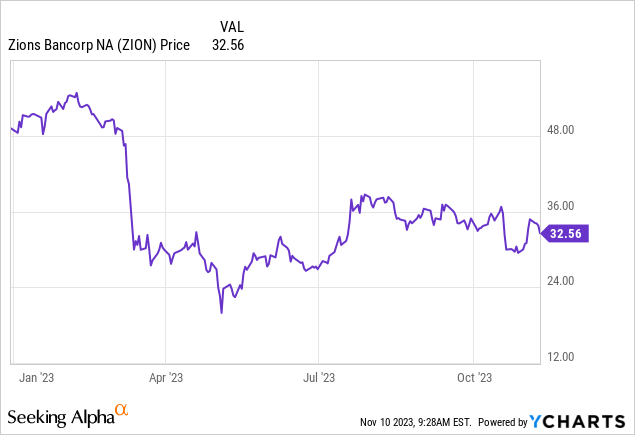

Zions Bancorporation (ZION)

September 30, 2023

Loss per share $16.48

Loss as proportion of present inventory worth 51%

AFS $12,078 million price – $10,148 million truthful worth = $1,930 million loss

HTM $10,559 million price – $10,049 million truthful worth = $510 million loss

Complete unrealized loss $2,440 million

10-Q (sec.gov)

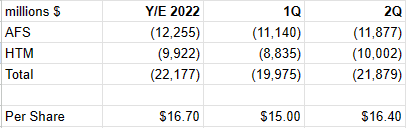

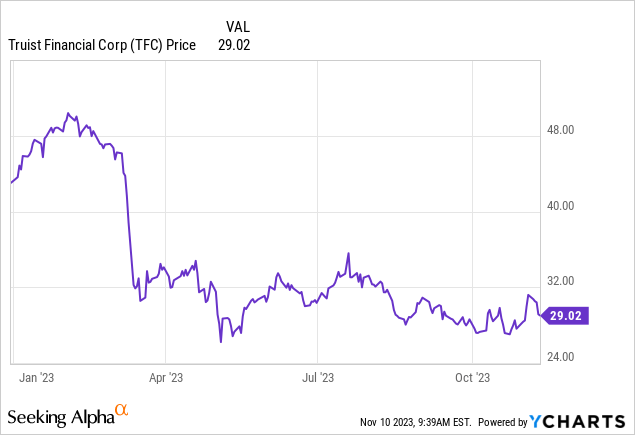

Truist Monetary (TFC)

September 30, 2023

Loss per share $20.21

Loss as proportion of present inventory worth 70%

AFS $79,627 million price – $65,117 million truthful worth = $14,517 million loss

HTM $54,942 million price – $42,501 million truthful worth = $12,441 million loss

Complete unrealized loss $26,958 million

10-Q (sec.gov)

Financial institution of New York Mellon (BK)

September 30, 2023

Loss per share $16.45

Loss as proportion of present inventory worth 36%

AFS $83,074 million price – $77,218 million truthful worth = $5,856 million loss

HTM $51,007 million price – $44,211 million truthful worth = $6,796 million loss

Complete unrealized loss $12,652 million

10-Q (sec.gov)

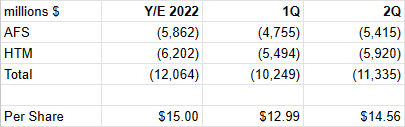

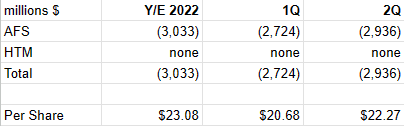

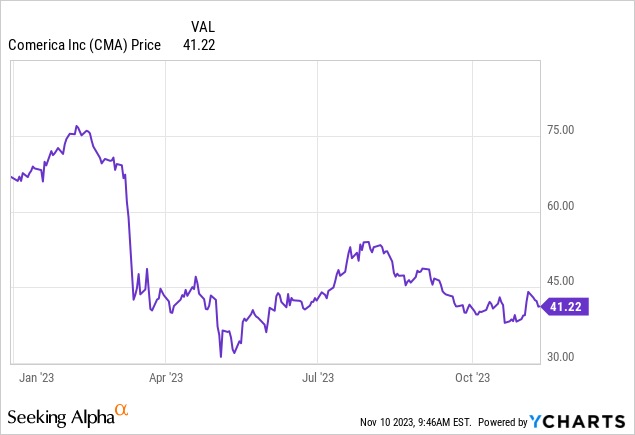

Comerica (CMA)

September 30, 2023

Loss per share $27.64

Loss as proportion of present inventory worth 67%

AFS $19,969 million price – $16,323 million truthful worth = $3,646 million loss

HTM None

Complete unrealized loss $3,646 million

10-Q (sec.gov)

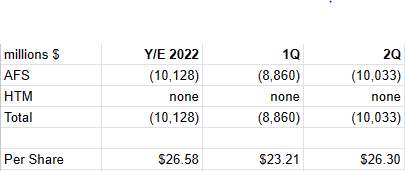

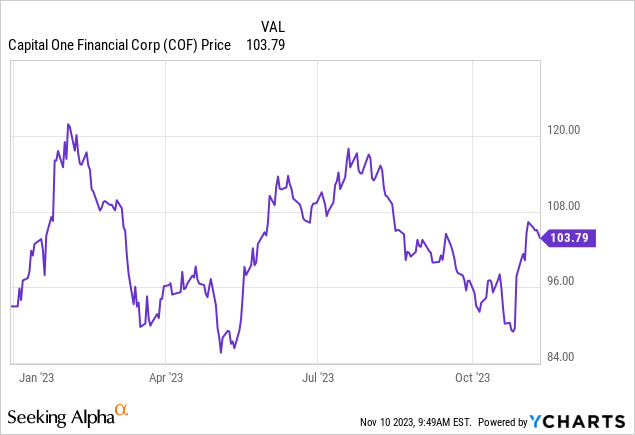

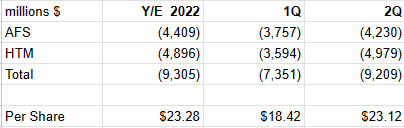

Capital One Monetary Group (COF)

September 30, 2023

Loss per share $33.64

Loss as proportion of present inventory worth 32%

AFS $87,650 million price – $74,837 million truthful worth = $12,813 million loss

HTM none

Complete unrealized loss $12,813 million

10-Q (sec.gov)

PNC Monetary Companies Group (PNC)

September 30, 2023

Loss per share $32.01

Loss as proportion of present inventory worth 27%

AFS $45,990 million price – $40,590 million truthful worth = $5,400 million loss

HTM $91,797 million price – $84,447 million truthful worth = $7,350 million loss

Complete unrealized loss $12,750 million

10-Q (sec.gov)

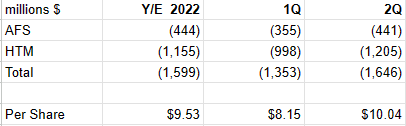

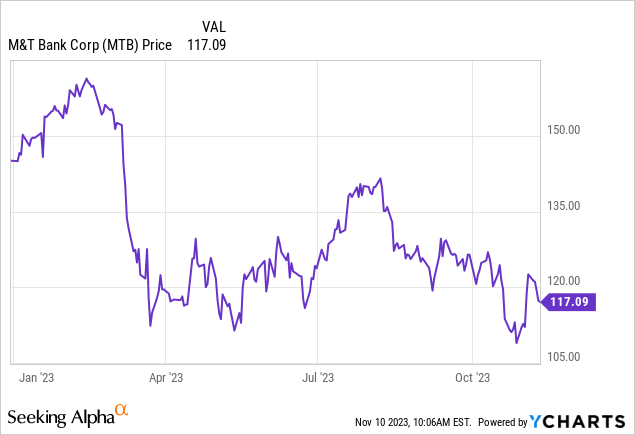

M&T Financial institution Corp. (MTB)

September 30, 2023

Loss per share $21.89

Loss as proportion of present inventory worth 19%

AFS $11,039 million price – $10,592 million truthful worth = $437 million loss

HTM $15,571 million price – $12,375 million truthful worth = $3,196 million loss

Complete unrealized loss $3,633 million

10-Q (sec.gov)

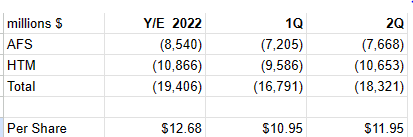

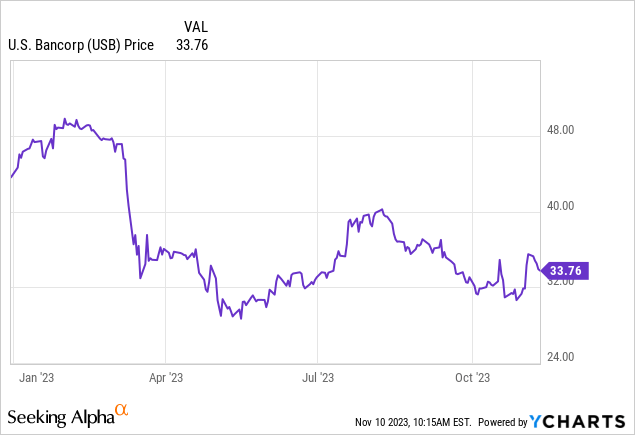

U.S. Bancorp (USB)

September 30, 2023

Loss per share $15.82

Loss as proportion of present inventory worth 47%

AFS $76,850 million price – $67,207 million truthful worth = $9,643 million loss

HTM $85,342 million price – $70,359 million truthful worth = $14,983 million loss

Complete unrealized loss $24,626 million

10-Q (sec.gov)

Conclusion

Rates of interest are at the moment at about the identical stage as the top of 3Q after dropping from two weeks in the past. It’s debatable if charges have already peaked, which might imply that the unrealized losses on securities have additionally peaked. The subsequent main subject could possibly be large losses on industrial actual property loans. The mixture of continued very massive losses on unrealized losses on securities and these growing large losses on loans might put some banks in very severe hassle. A few of these banks have already got stability sheet points from these unrealized losses on securities, which received a lot worse in 3Q.

The numbers within the report needs to be used solely as a part of a dealer’s determination to put money into a selected financial institution. If one thinks that long-term rates of interest are headed sharply decrease, a number of the banks with the most important losses may be value a re-evaluation as a result of the losses can be lowered as charges decline. I, nevertheless, really feel that charges will stay comparatively excessive and that there could possibly be some severe troubles within the close to future with industrial actual property loans. Mixed with the potential for stricter capital necessities, financial institution shares might stay within the doldrums for a while.