Joe Raedle

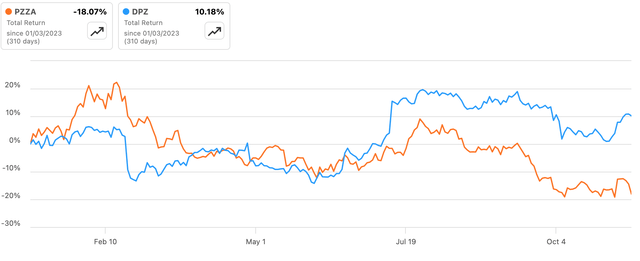

Papa John’s (NASDAQ:PZZA) has had a tricky yr, falling round 18% together with dividends and considerably underperforming shut rival Domino’s (DPZ). Driving that poor efficiency is softness in its underlying enterprise, with margins below stress and unit progress targets being walked down. Though the inventory’s decline makes Papa John’s affordable worth proper now, I might be in search of a reduction to extra worthwhile Domino’s earlier than being a purchaser right here.

Supply: Searching for Alpha

Papa John’s has a beautiful enterprise mannequin in that it makes a number of its revenue from franchise & royalty charges in addition to commissary gross sales to franchised shops. North America franchised retailers account for round half of its 5,825 whole system dimension, with worldwide franchised shops an extra 40% of the overall. That solely leaves round 10% as company-owned, principally in North America however with a smattering within the UK too.

Royalty income is principally a straight reduce of franchised retailer gross sales. As a portion of retailer gross sales, royalty income landed at round 4.6% in North America final yr. On a worldwide common foundation, the royalty fee was slightly over 3% of whole system gross sales. This income could be very excessive margin for the agency because it attracts nearly no price of gross sales and comparatively little by the use of working bills. Commissary gross sales are low margin however the money flows are pretty reliable as Papa John’s operates a quite simple markup pricing mannequin. In North America, which means it targets a 4% working margin on gross sales of components to its shops. Since meals gross sales are clearly integral to every outlet’s enterprise, this gives a gradual stream of earnings to the top firm.

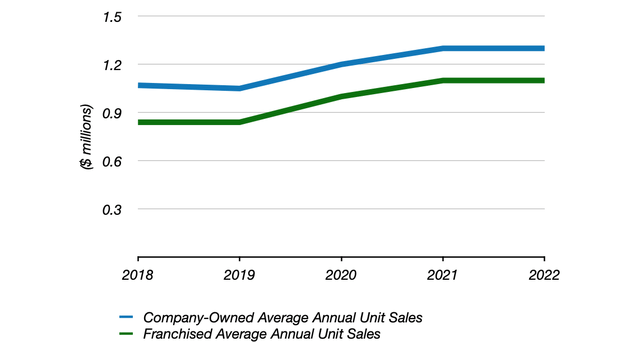

Retailer-level economics are nonetheless essential for a quantity causes. Most clearly, engaging unit economics present the most effective incentive for franchisees to develop. If you’re making nice returns in your current retailers, it is solely pure that you’d be completely satisfied to open extra. That is the place Papa John’s has been displaying good enchancment lately. Again in 2018, the typical company-owned outlet generated $840k in annual gross sales. That had risen to $1.1 million as of final yr.

Papa John’s Common Annual Unit Gross sales

Information Supply: Papa John’s Annual Reviews

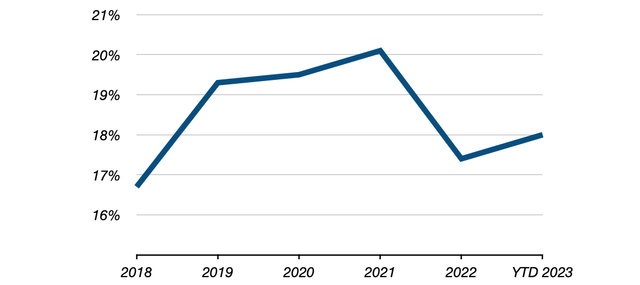

Eating places sometimes show an excellent quantity of mounted price leverage, so it is extremely probably that this gross sales improve has additionally led to improved store-level earnings. As a tough information, we will take a look at how the pattern has performed out at its company-owned shops. Now, final yr was clearly marked by extreme enter price inflation as meals costs rose sharply; because of this, EBITDA margin in its North America company-owned section was solely round 60bps larger than in 2018. 2021 margin was round 350bps larger than 2018, which may be a greater information than the depressed 2022 determine.

Papa John’s Firm-Owned Retailer EBITDA Margin

Information Supply: Papa John’s Kinds 10-Ok & 10-Q

These numbers will not translate precisely over to franchised shops as unit gross sales are round $200k each year under company-owned ones. Nonetheless, if we assume a circa 10% margin after annual royalty charges, then annual store-level common EBITDA can be across the $100k mark. Papa John’s shops are comparatively low-cost to open up as there may be sometimes no dine-in space and so floor space is comparatively small. In 2018, it price round $350k per new outlet on common as per its 10-K. Adjusted for inflation that’s someplace within the $430k space at the moment. Meaning franchisees are making unlevered cash-on-cash returns of round 20-25%, which is not dangerous. It helps clarify why administration was initially concentrating on 6-8% internet annual outlet progress over the 2023-2025 interval.

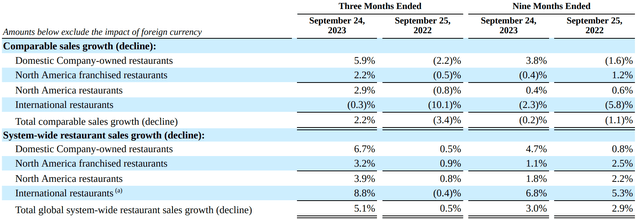

As talked about within the opening paragraph, Papa John’s has underperformed Domino’s by round 28ppt year-to-date. A few of that is associated to softness in its personal enterprise. For example, in Q2 it shifted round 90 franchised shops within the UK over to company-owned, and that’s contributing to larger D&A bills and placing downward stress on EBIT and margins. Preliminary comps steering was additionally walked down earlier within the yr, with North America same-store progress now anticipated within the 0-2% vary versus 2-4% beforehand. Though North America comps improved to 2.9% in Q3, year-to-date international comparable gross sales progress remains to be barely detrimental. That appears significantly delicate in mild of present ranges of inflation.

Supply: Papa John’s Q3 2023 10-Q

Lastly, administration additionally downgraded its 2023 internet unit progress outlook to 245-260 versus 270-310 beforehand. On the mid-point that may work out to round 4.5% annual internet unit progress, which as you may see is under the 6-8% medium-term goal outlined again in 2022. Now, this purpose had already been marked down a degree to 5-7% in Q2, however administration has guided that it’s going to miss even this decrease goal subsequent yr:

We’re targeted on thoughtfully increasing in our most vital markets and getting into new markets. With that stated, we do anticipate that our 2024 growth shall be decrease than our long-term information of 5% to 7% system-wide annual progress. This assumes the identical challenges we anticipate getting into the fourth quarter, proceed into 2024.

Ravi Thanawala, Papa John’s CFO, Q3 Earnings Name

The above signifies that total system gross sales progress shall be slightly decrease than anticipated. Since that’s what actually drives earnings, it is not shocking the market has marked these shares down. There has most likely been a macro response as effectively provided that larger Treasury yields have made equites much less engaging on the whole. For example, when the shares traded above $130 two years again, they had been on a 40x adjusted EPS a number of. With the shares at $63.82 proper now, the a number of has fallen to round 25x the consensus 2023 EPS estimate.

Confronted with barely weaker system gross sales progress, administration has determined to step by step increase North American commissary margins to eight% from 4%, which shall be finished in annual increments of 100bps. This may weigh on store-level profitability for franchisees, so the primary concern can be additional slippage in internet unit progress, particularly given squeezing client funds would possibly put stress on identical retailer comps on the identical time. Commissary bills signify round 30% of an outlet’s gross sales, so which means franchisees are a circa 30bps hit to annual store-level margins over the subsequent 4 years. There are rebates in place for shops that hit sure progress targets and so forth, however the threat stays that franchisees shall be barely much less incentivized to open up new retailers.

With that every one that stated, the present valuation is not unattractive in my opinion. Papa John’s enterprise mannequin of counting on royalty charges and sticky commissary gross sales is worthy of a premium a number of. Regardless of being considerably diminished, progress prospects are nonetheless sound. As a result of royalty charges are so excessive margin, a given degree of underlying system gross sales progress ought to drive a sooner fee of EPS progress attributable to total revenue margin growth. A circa 4% fee of annual internet unit progress, 2% each year for same-store gross sales progress, plus larger commissary EBIT from margin growth and gross sales progress can be sufficient to drive double-digit progress in annual EPS. A 25x current-year EPS a number of for that isn’t costly.

What drives my Maintain score is that you may get the identical funding profile with Domino’s, which additionally trades on a circa 25x consensus EPS a number of. With Papa John’s marking its unit progress outlook down, its system gross sales progress outlook is now across the 6-7% mark. Domino’s targets a wider 4-8% annual gross sales progress fee – which on the mid-point is about the identical as Papa John’s. The place you come out on prime with Domino’s is that it has superior store-level economics, with administration pointing to round $150k in annual EBITDA for franchisees. That means each larger store-level margins and circa 35% cash-on-cash returns for Domino’s franchisees, so I might have barely extra confidence of their long-term unit progress prospects. As such, I do not actually see a compelling cause to plump for Papa John’s inventory till it trades at a reduction to Domino’s.