- Challenge may have put person funds at vital threat

- OP token fell by 4.57% in 24 hours following the disclosure

L2s are within the information right this moment after main safety vulnerabilities had been unearthed in Optimism’s [OP] stack, the software program underpinning prime layer-2 (L2) chains just like the OP Mainnet and Base. Apparently, the problems had been delivered to mild by Offchain Labs, the unique developer of one other main Ethereum scaling resolution – Arbitrum [ARB].

Optimism avoids main threat

In a blog post shared on 26 April, Offchain Labs highlighted the safety flaws detected within the recently-released OP Stack fraud proofs within the check surroundings. The proof related to these loopholes had been shared with OP Labs, the event workforce behind Optimism, who later conceded to it.

The failings reportedly allowed an attacker to tamper with the chain’s safety, both by getting a fraudulent declare accepted by the protocol, or by getting an accurate declare rejected. These points might need put person funds at a “very excessive threat” if the model had reached the mainnet.

In keeping with Offchain Labs, on the time of writing, OP Labs had mounted these points, with the testnet up to date as nicely.

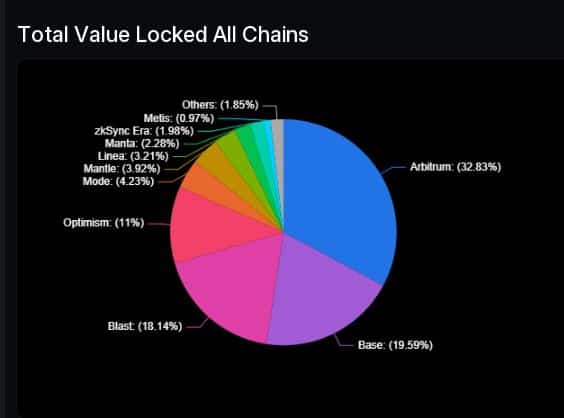

For these unfamiliar with the venture, OP Labs has been testing fault proofs in latest months, a key safety function that’s on the core of optimistic rollup expertise. L2 chains constructed on the OP Stack are a few of the largest within the ecosystem, with Base, Blast, and OP Mainnet accounting for over 48% of the whole deposits on rollups, AMBCrypto discovered utilizing DeFiLlama knowledge.

Supply: DeFiLlama

Lifelike or not, right here’s OP’s market cap in BTC’s phrases

FUD harms Optimism’s OP token

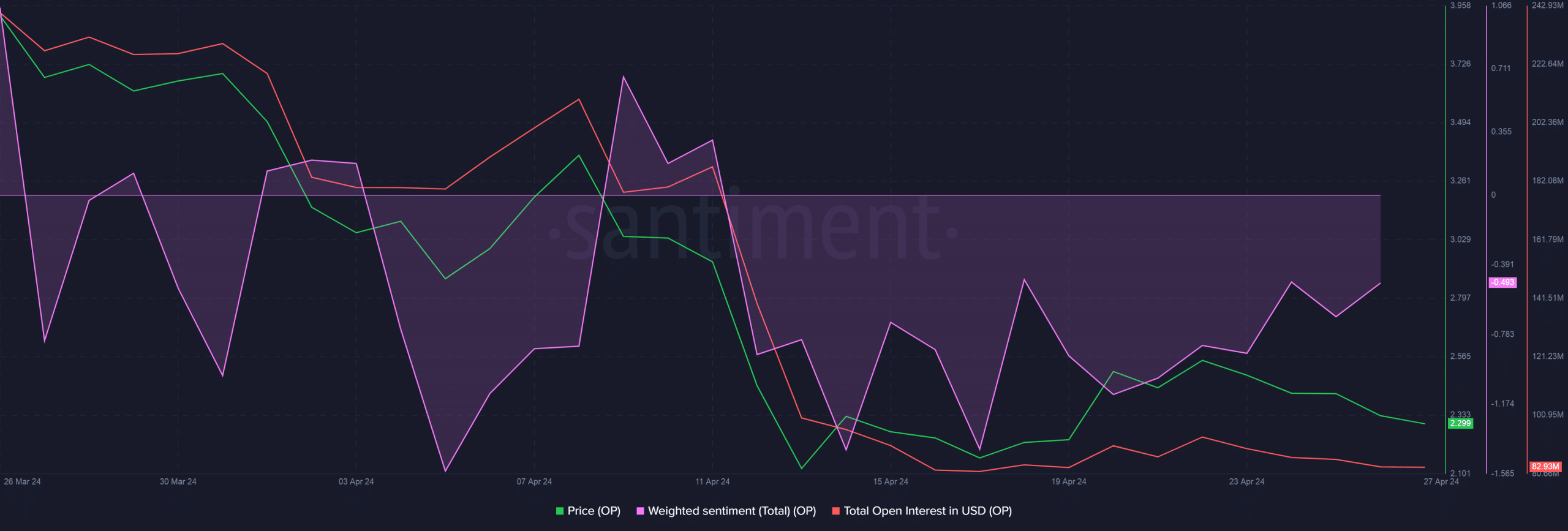

Though the problem stands resolved, the disclosure generated vital FUD amongst OP token holders. The crypto fell by 4.57% within the final 24 hours, based on CoinMarketCap.

Market sentiment for the coin continued to stay damaging too, as seen by AMBCrypto utilizing Santiment’s knowledge. Furthermore, the Open Curiosity (OI) in Futures market dropped, suggesting low curiosity from speculative merchants.

Supply: Santiment