Overview

Auric Mining Restricted (ASX:AWJ) is a gold exploration and mining firm primarily based in Western Australia. In three-and-a-half years since its ASX itemizing, Auric has grow to be a gold producer on this premier jurisdiction.

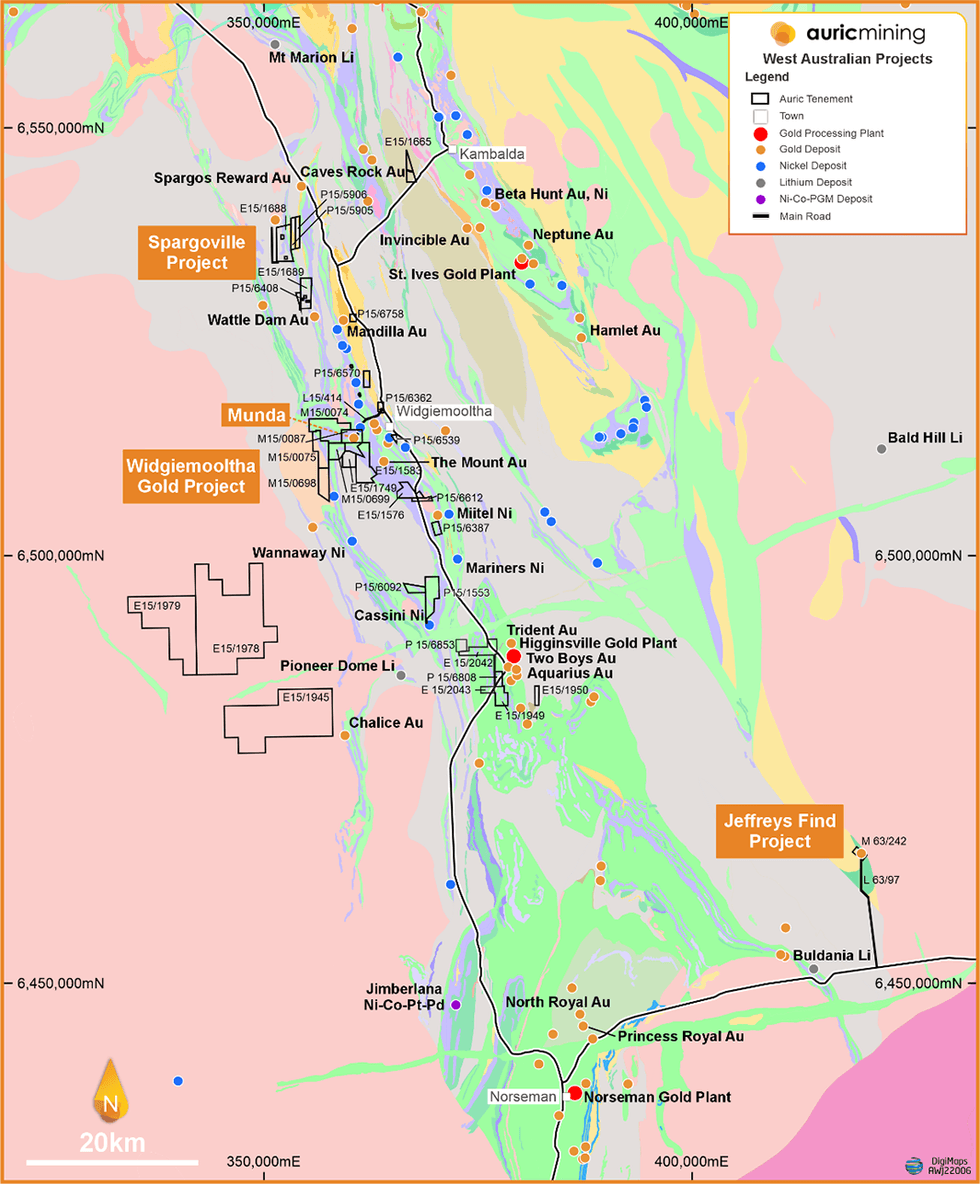

Since incorporation, it has moved from zero to 250,000 ounces of gold assets and 0 to 282 sq. kilometers of tenements. Auric Mining is within the firm of a few of the greatest gold initiatives within the Goldfields, together with the St Ives Gold Mine, Karora Assets’ Higginsville Operations & Beta Hunt Mine, all multi-million-ounce mines.

Apart from gold, there are quite a few treasured metals being mined within the space with world-class deposits of nickel, lithium and uncommon earths. Auric is gold-focused and has the potential to grow to be a big producer within the area.

First blasting at Jeffreys Discover passed off in Could 2023. Over the following six months, 9,741 ounces of gold had been produced.

Partnering with Auric in its Jeffreys Discover Mission is BML Ventures of Kalgoorlie (BML), a well known and adept Kalgoorlie contractor. BML is a specialist mining contractor. It has explicit experience in shallow, open-pit mining with brief length initiatives in The Goldfields.

The Jeffreys Discover Mission commenced in Could 2023 and is due for completion within the first quarter of 2025. The three way partnership is partially exploiting 47,000 ounces of gold assets.

Gold ore on the ROM Pad at Jeffreys Discover, Norseman. Ore was hauled to Coolgardie for milling in 2023.

Stage One is now full with Stage Two mining to begin in March 2024.

Success for Auric at Jeffreys Discover means the corporate is self-funding for 2024 and capable of maintain its exploration and improvement exercise with out want for extra capital elevating. Auric now has a highway map for 5 years of steady mining and income.

Grade management drilling at Munda was accomplished in January 2024

Auric’s main focus continues to be on the corporate’s flagship asset – The Munda Gold Mission.

To this point nearly 200,000 ounces of gold assets have been recognized at Munda, the asset being a part of the broader Widgiemooltha Gold Mission, encompassing 22 tenements.

Munda is among the largest deposits within the Widgiemooltha space having the potential to grow to be a big gold undertaking.

In mid-year 2023 the Firm launched to the ASX a third-party scoping examine on the economics and potential of open-pit mining at Munda.

The scoping examine estimates the mining of as much as 120,000 ounces of gold over a three-year mine life. It’s envisaged gold ore could be toll-processed at a close-by Coolgardie Mill. The examine initiatives free money income of between $50 million and $100 million, primarily based on numerous gold costs.

Manufacturing from Munda may begin within the fourth quarter of 2024.

Auric can also be planning to progress its Spargoville Mission, the place it has tenements ideally positioned alongside strike from the Wattle Dam gold mine, a prolific mine which produced 268,000 ounces of gold at 10 g/t, between 2006 and 2013.

An skilled and savvy administration staff leads Auric Mining in direction of its imaginative and prescient of turning into a big gold producer in Western Australia. With the three administrators proudly owning roughly 17 % of the corporate, they’re centered and motivated for achievement.

Auric Mining’s board of administrators: Mark English, Managing Director; Steve Morris, Chair; and John Utley, Technical Director

Steve Morris, non-executive chairman, has greater than 25 years of expertise in monetary and pure assets markets.

Mark English, managing director, has a 40-year profession as a chartered accountant and is relaxed with all sides of working a public firm on the ASX together with main fairness and debt raisings.

John Utley, technical director, has 35 years of expertise in gold exploration and improvement.

This vary of experience gives a excessive stage of confidence that the corporate will obtain its targets.

Firm Highlights

- Auric Mining is a publicly listed firm with a market cap of round $13m.

- Its flagship asset is the 200,000-ounce Munda Gold Mission at Widgiemooltha, simply 100 kms from Kalgoorlie. It has an intention to start manufacturing in 2024 earlier than extra intensive mining from 2025 onwards.

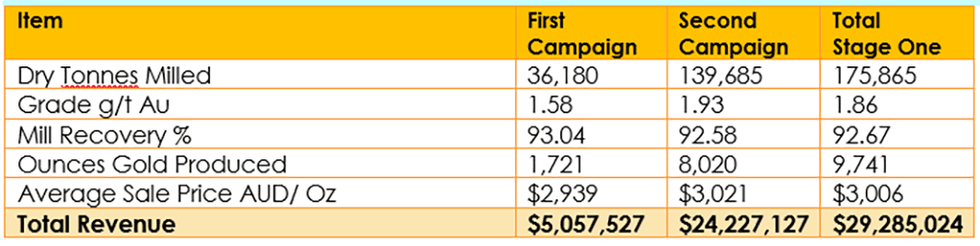

- Throughout 2023 the main focus was on mining at its Jeffreys Discover Gold Mine, close to Norseman. Stage One mining between Could and November 2023 produced 9,741 ounces of gold, creating nearly $30 million in gross income.

- A last reconciliation noticed surplus money of $9.5 million generated. Auric banked $4.78 million, being 50% of the excess money as agreed with its JV associate, BML Ventures of Kalgoorlie.

- Mining at Jeffreys Discover will recommence in March 2024 with expectations of expanded mining exercise and considerably higher tonnage to be processed in comparison with 2023.

- As an explorer, Auric has amassed 282 sq. kilometers of tenure because it seems to search out and mine one million ounces of gold between Kalgoorlie and Norseman.

- The realm hosts a few of the richest mineral deposits and mines on the planet. Along with gold, Auric additionally has alternatives for discovery of lithium, uncommon earths and nickel.

- Auric has three predominant initiatives: The Munda Gold Mission which is a part of the Widgiemooltha Gold Mission; Jeffreys Discover Gold Mine; The Spargoville Mission.

- The corporate has a board and management staff with a observe document of delivering success for shareholders, notably in discovering and bringing to manufacturing gold initiatives.

Auric’s tenements are between Norseman and Kambalda in Western Australia.

Key Initiatives

Widgiemooltha Gold Mission & Munda Gold Mission

Development to open-pit mining is gathering momentum with a plan to begin gold manufacturing by way of a starter pit within the final quarter of 2024 on the Munda Gold Mission.

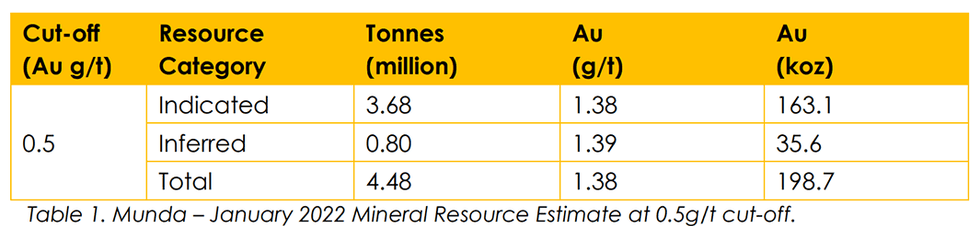

The Widgiemooltha Gold Mission combines 22 tenements of extremely potential gold nation close to Widgiemooltha and contains the Munda Gold Mission. Since buying the Munda tenements, drilling outcomes verify indicated and inferred gold assets of virtually 200,000 ounces (4.48 mt @ 1.38 g/t with 0.5 g lower off).

The Widgiemooltha tenements have substantial protection on the north finish of the Widgiemooltha Dome.

Even with the intensive mining historical past within the space, appreciable exploration prospectivity stays. A number of important gold initiatives found or developed prior to now ten years, together with:

- Karora Assets (TSX:KRR); Higginsville Gold Operations (assets of 38.08 Mt @ 1.7 g/t for two,015,000oz Au);

- Karora Assets; Beta Hunt (assets of 29.32Mt at 2.5g/t for two,403,000oz Au); and

- Astral Assets (ASX:AAR); Mandilla Mission (assets of 30.0Mt @ 1.1g/t for 1,030,000oz Au).

Auric Mining is now fast-tracking improvement at Munda. With quite a lot of gold processing mills within the neighborhood, the transfer to manufacturing is now gathering momentum.

In mid-2023 a Scoping Examine on Munda produced a optimistic outcome. The examine proposed a shallow open gold mine. At gold costs from $2,400/oz to $2,800/oz, the Manufacturing Goal for the Mission ranges from roughly:

- 1.67Mt at 2.2g/t producing 112.0koz gold, to

- 2.18Mt at 1.9g/t producing 129.1koz gold.

The Manufacturing Goal generates an undiscounted amassed money surplus after cost of all working capital prices, however excluding pre-mining capital necessities, of between roughly $54.7m to $101.4m.

Mining is contemplated over an roughly 3-year interval (13 calendar quarters).

Pre-mining capital and start-up prices are estimated to be roughly $0.8m to $1.7m.

Working capital necessities of roughly $3.9m to $8.1m had been estimated primarily based on a Stage 1 starter pit design.

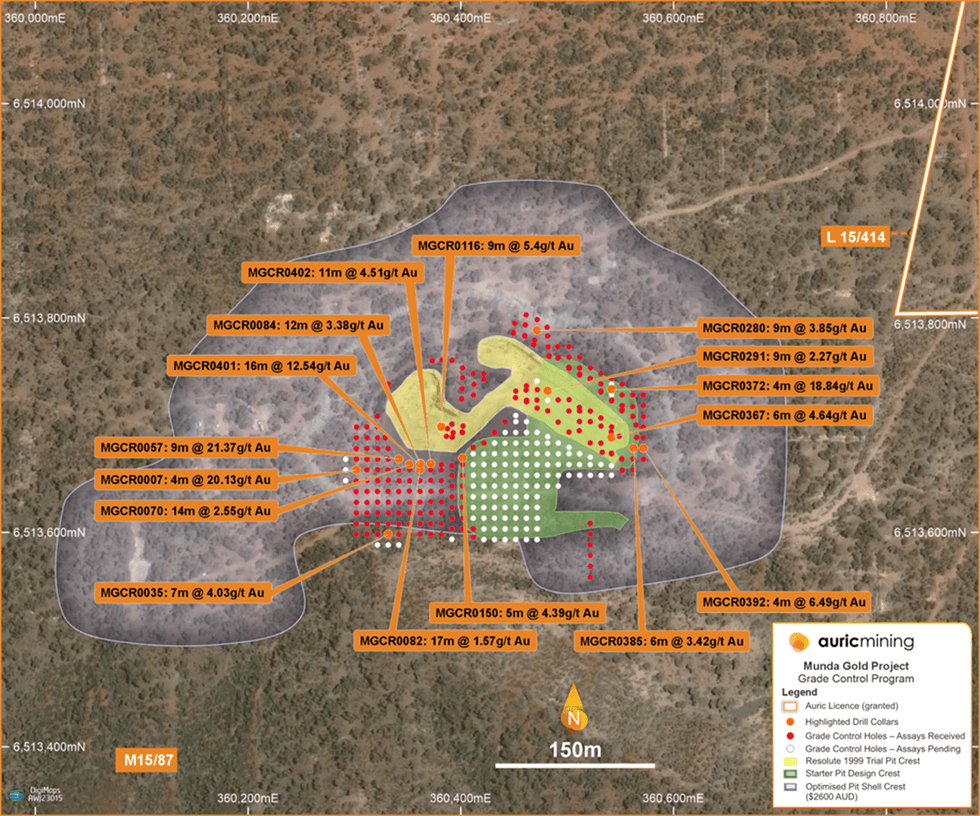

Grade Management Program outcomes at Munda.

To additional advance the Mission Auric accomplished a grade management drilling program at Munda in January 2024. In whole 351 holes had been sunk on a 10m x 10m grid over a possible starter pit.

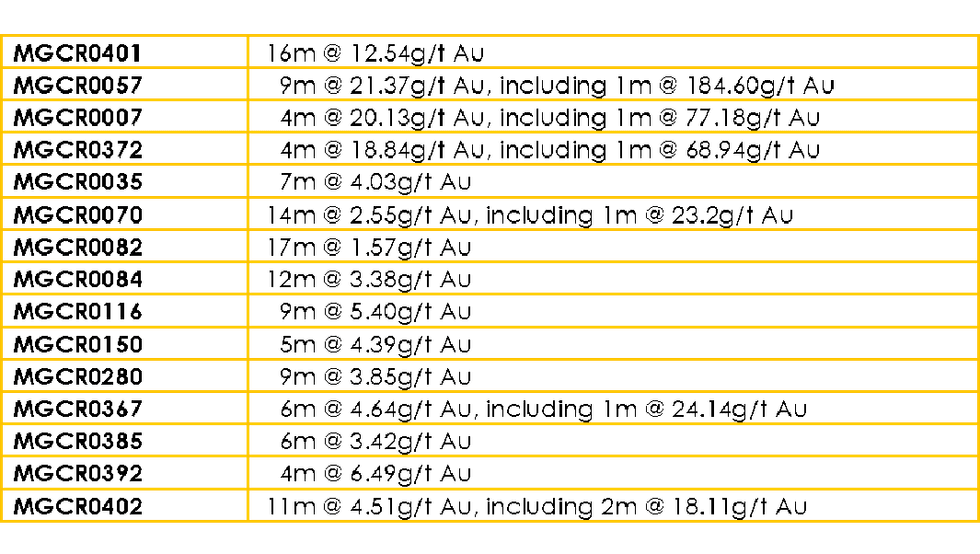

Assay outcomes embrace quite a few important intercepts at a 0.5g/t cut-off with excessive grade or broad intercepts corresponding to:

Evaluation of samples shall be full by the top of the primary quarter 2024.

Additional grade management drilling is envisaged as the corporate hones in on this excessive grade deposit.

A starter pit lasting about three months is envisaged within the final quarter of 2024. Extra intensive mining would comply with within the interval 2025-2027.

In all, Munda is projected to be a short-life undertaking, capable of produce distinctive money income with a gold value persevering with at above $3000 an oz.

Jeffreys Discover Gold Mine

Recent from mining nearly 10,000 ounces of gold in 2023, Jeffreys Discover’s Stage Two is definite to be considerably higher in scope.

The Jeffreys Discover Gold Mine is positioned roughly 45 kilometers northeast of the city of Norseman and 12 kilometers off the principle Eyre Freeway by way of a haul highway.

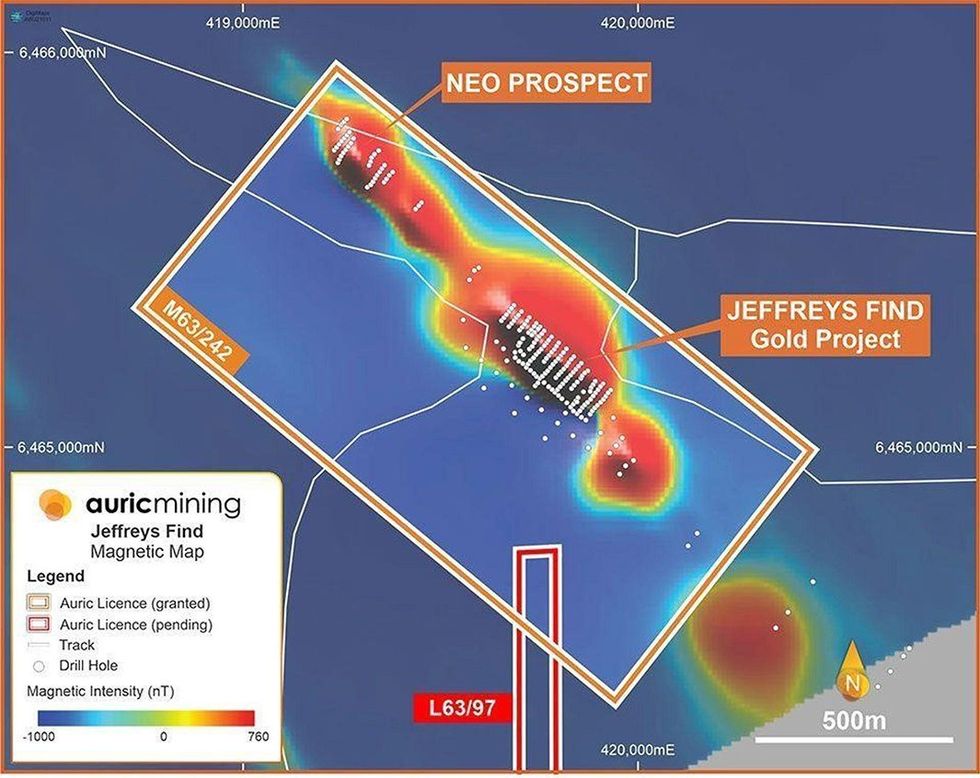

Jeffreys Discover is a short-life mine with a complete gold-resources estimate of almost 50,000 ounces.

Magnetic picture of the gold useful resource at Jeffreys Discover

The corporate has carried out remarkably nicely with this mine, having acquired the tenements simply 3.5 years in the past.

Stage One mining passed off over six months, from Could to November 2023 with about 175,000 tonnes of gold ore hauled to the Greenfelds Mill at Coolgardie the place it was processed. Remaining refining and sale of gold bullion produced passed off on the Perth Mint.

Stage One – Manufacturing & Income Statistics

The undertaking is a three way partnership endeavor between Auric and well-known Kalgoorlie contractor BML Ventures Pty Ltd (BML).

Auric’s danger is mitigated by BML who assume all working prices together with mining and haulage. Gold processing prices are recovered from the sale of gold bullion. In spite of everything prices have been deducted surplus money is break up equally between the companions.

For last mining in 2024 Auric has contributed $1 million in money in direction of working capital which shall be repaid in direction of the top of the ultimate section of mining.

The ultimate pit shell at Jeffreys Discover Gold Mine shall be premised on a gold value of $2,900 an oz, in comparison with the Stage One pit which was designed on the idea of gold at $2,600 an oz. In consequence the tonnage of ore being hauled to the mill shall be considerably increased in 2024.

Gear is being mobilised to the mine website in February and mining will recommence in March 2024. A seamless increased gold value has positioned the three way partnership in a strong place to throw off surplus money nicely in extra of what was achieved in 2023.

Auric’s MD Mark English, Chairman Steve Morris and Technical Director John Utley on the Perth Mint with Auric gold bars from its Jeffreys Discover Gold Mine.

Spargoville Mission

Extremely potential tenements as firm seems for gold on strike to Wattle Dam

Situated roughly 35 kilometers southwest of the mining city Kambalda, the Spargoville Mission is an underexplored asset with partially examined or fully untested gold, nickel and lithium anomalies.

The asset sits north of the Wattle Dam gold mine. The Wattle Dam gold mine produced 268,000 oz of gold at a median grade of 10 g/t between 2006 and 2013.

Whereas solely partially drilled, preliminary exploration outcomes from the Fugitive Prospect embrace an intercept at 14 meters with a grade of two.51 g/t gold, indicating the asset’s promising potential.

Auric’s tenements at The Spargoville Mission.

Administration Staff

Auric Mining’s Administration and Board of Administrators have a wealth of expertise in gold discovery, in mine operations and throughout the total spectrum of finance and administration. That have stretches to all elements of the globe.

Board of Administrators

Steven Morris – Non-executive Chairman

Steve Morris is a well known monetary markets government with greater than twenty years expertise at a senior stage. He garnered business respect as head of personal purchasers for Patersons Securities, now Canaccord Genuity, and has additionally been managing director of Intersuisse. Mr. Morris has served as a senior government of the Little Group. From 2014 to 2019, Morris was a non-executive director of De Gray Mining (ASX:DEG), a gold firm now with a $2.4 billion market capitalization. Mr. Morris is nicely linked in finance circles and was a board member of The Melbourne Soccer Membership for 9 years together with three years because the vice chairman.

Mark English – Managing Director

Mark English is a Chartered Accountant with greater than 40 years’ expertise in enterprise. English was the founding director of Bullion Minerals Ltd, now DevEX Assets (ASX:DEV) an organization he managed for seven years earlier than taking it to an IPO. Mr. English has appreciable expertise with main fairness and debt raisings. He at the moment sits on the Board of WA built-in agricultural firm Moora Citrus Group, one of many nation’s largest citrus producers and processors.

John Utley – Technical Director

John Utley has a 35-year profession in mining and exploration with a dominant give attention to gold property. He holds a grasp’s diploma in Earth sciences from the College of Waikato in New Zealand. Mr Utley has labored in Australia, South America, Papua New Guinea and most not too long ago in Canada the place he was the Chief Geologist for Atlantic Gold Company, an organization now owned by St Barbara (ASX:SBM). He spearheaded exploration and improvement of the Touquoy Gold Mine in Nova Scotia, Canada, previous to being acquired by St Barbara. Mr Utley beforehand labored with Plutonic Assets (ASX:PLU) and was head of the exploration staff on the Darlot Gold Mine in the course of the discovery and improvement of the two.3-million-ounce Centenary gold deposit.