Ethereum (ETH) flew off centralized exchanges this week, doubtlessly lowering promoting stress on the ETH market, based on the crypto analytics agency IntoTheBlock.

In a brand new analysis, Lucas Outumuro, IntoTheBlock’s head of analysis, tracked Ethereum’s netflows, which measure the ETH shifting out and in of centralized crypto exchanges by subtracting the quantity of ETH’s withdrawals from its deposits.

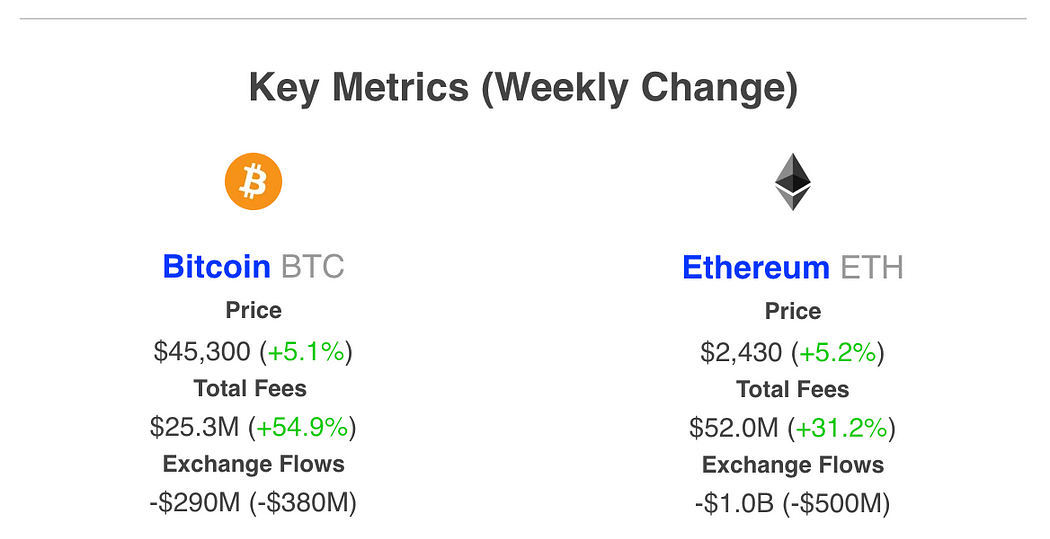

Outumuro notes that greater than $1 billion price of Ethereum netflows left centralized exchanges this week. ETH’s community charges, which point out the willingness to spend and demand to make use of the asset, elevated by greater than 30% over the identical time interval.

Bitcoin (BTC) additionally flowed off centralized exchanges, clocking $300 million price of internet outflows and breaking an eight-week pattern of inflows onto exchanges. Bitcoin’s community charges spiked by greater than 50% this week as properly.

Massive upticks in change inflows are inclined to result in a mean value drop of 5% for crypto property, based on a 2021 research printed by fellow crypto analytics agency Santiment.

ETH is buying and selling at $2,512 at time of writing. The second-ranked crypto asset by market cap is up 2.64% up to now 24 hours.

BTC is buying and selling at $47,478 at time of writing. The highest-ranked crypto asset by market cap is up practically 3% up to now 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Worth Motion

Observe us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney