MakerDAO, creator of the DAI stablecoin, has a very good downside: demand for its product is excessive.

SparkLend, a lending and borrowing platform organized as a sub-DAO inside Maker, has spent a lot DAI in latest weeks that it wants permission to lend extra.

In a board vote authorized at midday ET on Thursday, Maker voted unanimously to double D3M’s most debt ceiling to 2.5 billion DAI.

“D3M” stands for Decentralized Debt Markets Module, a mechanism designed to optimize DAI liquidity throughout varied DeFi platforms. The module mechanically adjusts DAI mortgage charges on exterior platforms (corresponding to Aave) to align with the Dai Stability Payment throughout the MakerDAO system.

Learn extra: The MakerDAO stability sheet now consists principally of crypto-backed loans

The explanation for this modification is the quickly rising demand for loans at SparkLend previously week, which diminished the accessible DAI to 250 million. Maker’s danger consultants lobbied in favor of the rise, arguing there isn’t any have to hold it so restricted.

“With latest bull market situations, it’s turning into more and more tough to maintain up with mortgage demand,” Block Analitica analyst Monet-Provide wrote on the Maker discussion board, noting that the protocol blew by the newest debt ceiling improve and rising at a tempo. common fee of about 20 million DAI per day.

“This poses the chance of inadvertently reaching D3M’s most debt ceiling and artificially limiting Spark’s progress,” he wrote.

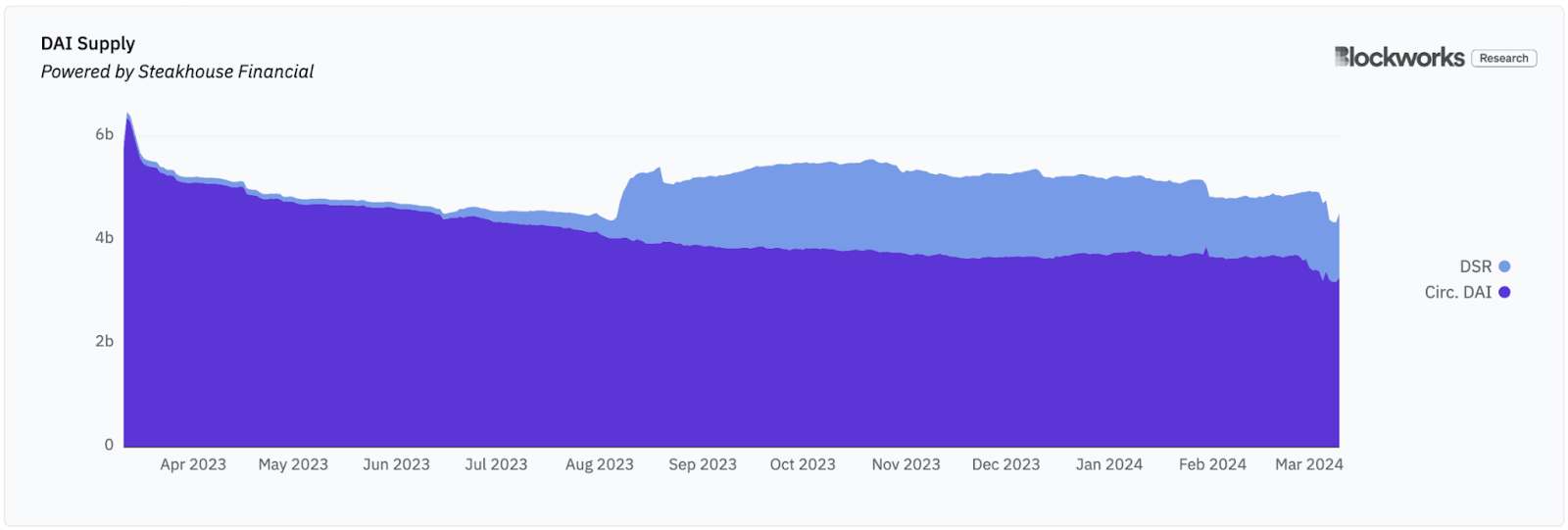

MakerDAO not too long ago greater than doubled stability charges throughout the board on March 10 following a vote by its board. The Dai Financial savings Charge (DSR) elevated from 5% to fifteen%.

Return alternatives for stablecoins have elevated, prompting merchants to change DAI borrowed at low charges for higher-yielding USDC or different stablecoins utilized in DeFi.

For instance, along with promising excessive returns, a newcomer to the stablecoin market (Ethena’s USDe) is incentivized by a points-like system referred to as “shards.”

Learn extra: Stablecoins ought to give attention to liquidity, not decentralization – founding father of Ethena Labs

These dynamics put downward stress on DAI’s greenback peg and pushed Maker’s PSM module, which permits swaps between DAI and USDC, to file lows.

Learn Blockworks analysis: MakerDAO: The natural demand doesn’t develop on bushes

Ethena co-founder often known as Leptokurtic argued at an ) in DeFi.

“I truly suppose that the marginal influence that Ethena has had on these adjustments might be lower than what folks have been fascinated about in latest weeks,” Leptokurtic stated. “These fee adjustments would occur with or with out Ethena’s presence – it is now that individuals are making that connection somewhat simpler between charges in [centralized finance] and DeFi.”

Spark developer Sam MacPherson, CEO of Phoenix Labs, stated throughout the identical dialogue that present rate of interest ranges are “nearly actually not sustainable” in the long run.

Learn extra: Spark Protocol rethinks stablecoin stability mechanisms

“Ethena performs a fantastic position right here in bridging this inconsistent rate of interest conduct,” stated MacPherson. “Maker is as a lot on the mercy of the market as anybody else, it is simply that there isn’t any sensible contract that does this, there’s extra of a slower human course of the place folks attribute option to the pricing inside Maker – however that is actually not the case.”

Instances are good proper now for stablecoin holders, with many choices to obtain comparatively secure double-digit returns.

The query is: how lengthy can this final?

“You may’t have sustainable charges of 30, 40, 50% on USD,” MacPherson stated. “Presumably [traditional finance] will improve in measurement,” pushing rates of interest again down.