On this evaluation, we are going to determine assist and resistance ranges inside the Chainlink (LINK) market, drawing insights from latest worth actions, Exponential Shifting Averages (EMAs), and quantity profile evaluation.

By deeply inspecting these key indicators, we purpose to offer actionable insights and strategic suggestions for merchants trying to improve their buying and selling strategy and capitalize on the dynamics of the LINK market.

Chainlink 4H Worth Evaluation

Throughout the four-hour timeframe, the value of LINK has reverted beneath the 50 EMA (in Violet), a beforehand essential resistance line. In contrast to different cryptocurrencies like Bitcoin, LINK has proven no bullish indicators.

Since reaching its June excessive of almost $19, LINK’s worth has been present process a correction.

The worth is at present positioned between the 50 EMA and the 100 EMA (in Blue), with the latter probably serving as a major assist stage within the mid-term. Moreover, the value stays properly above the 200 EMA (Inexperienced Space) on this timeframe, indicating a continued bullish outlook for the long run.

The amount profile signifies that the $16.7 assist line might be a major assist stage if LINK breaches the 100 EMA at $17.4.

Learn Extra: How To Purchase Chainlink (LINK) and Every little thing You Want To Know

Chainlink 1H Worth Evaluation

Within the one-hour timeframe, Chainlink has confronted notable challenges in its try and ascend past the 200 EMA space. Regardless of a number of makes an attempt to breach this essential threshold, the value has constantly retraced, indicating sturdy promoting strain on this area.

Presently, the value finds itself positioned beneath all three EMAs—the 50, 100, and 200. This configuration not solely underscores the present bearish sentiment but additionally suggests formidable hurdles for any potential upward motion.

Trying forward, these EMAs will probably function important resistance ranges within the mid-term, exerting additional downward strain on the value of Chainlink. Furthermore, the amount profile resistance vary, particularly at $18.2, provides one other layer of resistance, reinforcing the significance of this worth stage in limiting upward momentum.

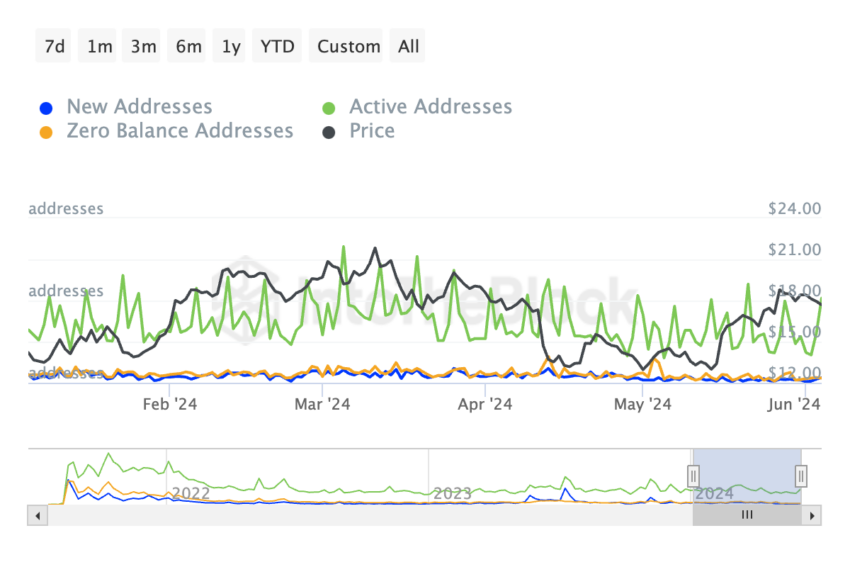

Chainlink’s Lively Addresses Are on the Rise

Trying on the fundamentals, the rise in lively addresses exhibits sturdy community exercise.

Heightened engagement, similar to an uptick within the utilization of lively addresses or transactions inside a community like Chainlink, could also be construed as a bullish indication for a number of causes:

Community Growth: Elevated exercise usually hints at a burgeoning consumer group or heightened acceptance of the platform’s choices. This suggests a broader consumer base, probably driving up demand for the related cryptocurrency (particularly, LINK).

Service Demand: Chainlink primarily offers decentralized Oracle providers, facilitating the mixing of real-world knowledge into good contracts throughout numerous blockchain platforms. Heightened exercise would possibly signify an elevated want for these providers, bolstering the utility and attractiveness of the Chainlink community.

Market Sentiment: Escalating engagement has the potential to sway market sentiment, indicating religion within the venture and its prospects for future growth. Buyers and merchants would possibly interpret the surge in exercise as a constructive sign relating to the community’s viability and progress potential, prompting heightened funding and upward worth actions.

This means that the latest dip from $19 to the place it’s now’s primarily as a consequence of market dynamics.

So, it’s probably LINK will drop beneath $18 earlier than selecting up steam once more. If Bitcoin retains breaking information, LINK might even climb to $20 or $22.

Strategic Suggestions

Make the most of Help and Resistance Evaluation: Incorporate assist and resistance ranges recognized from technical evaluation into buying and selling methods. Make the most of assist ranges, such because the 100 EMA (4H) and the assist line at $16.7 (4H), as reference factors for establishing stop-loss orders and figuring out potential entry alternatives throughout worth retracements.

Equally, acknowledge resistance ranges, such because the 50/ 100/ 200 EMAs (4H) and the amount profile resistance vary at $18.2 (1H), to gauge potential areas of bullish worth reversal and regulate buying and selling positions accordingly.

Learn Extra: Chainlink (LINK) Worth Prediction 2024/2025/2030

Dynamic Place Administration: Implement dynamic place administration strategies based mostly on assist and resistance ranges to optimize risk-reward ratios. Take into account scaling into positions close to assist ranges to capitalize on potential worth rebounds whereas scaling out of positions close to resistance ranges to safe earnings and decrease publicity to draw back threat.

Repeatedly monitor worth motion round these key ranges to adapt buying and selling methods in response to altering market circumstances.

Threat Mitigation Methods: Make the most of assist and resistance evaluation to boost threat mitigation methods and shield buying and selling capital. Set stop-loss orders beneath important assist ranges to restrict potential losses within the occasion of a breakdown, whereas trailing cease orders will be employed to lock in earnings as costs strategy resistance ranges.

By incorporating these threat administration strategies, merchants can successfully handle draw back threat and protect capital in unstable market environments.

Disclaimer

In step with the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.