Overview

The encouraging development of electrical automobiles (EVs) is having constructive results on the demand for battery metals comparable to lithium. World lithium consumption is predicted to succeed in 1,427 kt of lithium carbon equal (LCE) in 2025, up from 797 kt of manufacturing in 2022, based on a Q2 2023 report from Australia’s Workplace of the Chief Economist. Latest decrease pricing of lithium within the spot market has not modified the underlying international development of EV’s and the geopolitical provide dangers within the provide chain.

EVs are driving the rising demand for lithium-ion batteries ensuing within the development of the market globally. This places the concentrate on junior mining corporations which are busy creating vital mineral initiatives around the globe particularly with probably decrease working prices long run. With lithium costs experiencing a downward pattern, now might be an opportune time for buyers to get into the lithium area because it stays a vital component for batteries and electrical automobiles. With lithium belongings in Tier 1 mining jurisdictions, Australia-based QX Sources (ASX:QXR) presents buyers publicity to this quickly increasing market.

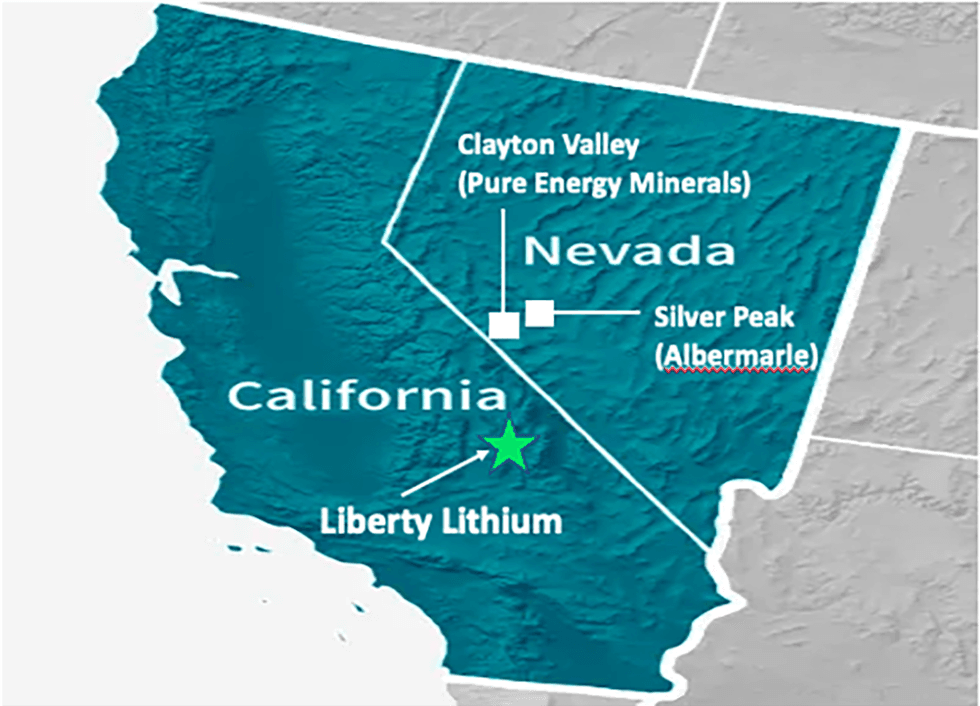

QXR’s lithium technique is centered across the growth of its Liberty Lithium Brine Challenge in California and a portfolio of lithium initiatives throughout the Pilbara area of Western Australia. Liberty Lithium is among the largest single lithium brine initiatives within the US with contiguous claims over 102 sq. kilometres (equal to twice the realm of Sydney Harbour). The geological setting of the challenge mirrors Albemarle’s Silver Peak lithium brine deposit in Clayton Valley, Nevada, and main Argentina brine initiatives. Like Silver Peak, QXR’s Liberty might be a large-scale, producing lithium brine asset.

Downstream producers within the US, together with automakers, are in want of securing lithium provide, particularly if home provide is accessible. As such, automakers within the US have been making important investments in lithium initiatives. The latest was a $100-million investment by Stellantis into Managed Thermal Sources, which owns a lithium challenge in California. It’s encouraging to notice rising curiosity from end-users investing straight into initiatives making Liberty Lithium a pretty alternative.

The corporate has an indicative growth plan involving drilling, sampling and testwork beginning with two permitted drill holes over the principle a part of the floor lithium anomaly, deliberate for November-December 2023. The goal is to determine lithium-bearing brine aquifers at depth, which is anticipated to result in detailed drilling towards an preliminary useful resource by mid-2024. QXR has adequate monetary muscle to hold out the drilling and different work, particularly with the current AU$3 million raise through a personal placement and entry to a further AU$3 million beneath an at-the-market (ATM) facility.

QXR intends to gather giant volumes of lithium brines and submit them for testwork with numerous direct lithium extraction (DLE) suppliers. DLE applied sciences has the potential to considerably enhance the availability of lithium from brine initiatives given increased recoveries, together with the bonus of sustainability and ESG advantages. Quite a few confirmed DLE applied sciences are rising and being examined at scale, presenting a possibility for QXR to seek out strategic companions.

The corporate is headed by managing director Steve Promnitz, who has a confirmed observe file within the lithium sector. He efficiently reworked Lake Sources, a lithium brine developer, from a $1-million market worth personal firm to an ASX-listed firm with an AU$2.1-billion market capitalization upon his departure in 2022. His geology and chemistry background together with expertise of working in main mining corporations, comparable to CRA and Rio Tinto, ought to show useful for QXR.

Firm Highlights

- QX Sources is an Australia-based firm targeted on the exploration and growth of battery minerals, with an enormous lithium brine challenge within the US, exhausting rock lithium belongings in a main location in Western Australia (WA), copper-molybdenum-gold belongings in Queensland and a strategic funding in nickel sulphides in Sweden.

- Liberty Lithium Brine Challenge, situated in California, is taken into account analogous to Albemarle’s Silver Peak deposit and is among the largest single lithium brine initiatives within the USA with contiguous claims over 102 sq. kilometres.

- The possibly large-scale lithium brine challenge situated within the US is of serious significance, as individuals within the electrical automobile worth chain are aggressively searching for to safe home battery minerals provide to steadiness potential supply-side geopolitical dangers to the vitality transition.

- QXR has commenced drilling of the Liberty Lithium Challenge and secured AU$3 million in funding in late 2023 together with entry to a further AU$3 million beneath an at-the-market facility. The goal is to publish an preliminary useful resource on the challenge by mid-2024.

- Moreover, the fundraise additionally presents flexibility to ramp up exploration actions throughout its Pilbara lithium exhausting rock challenge that are additionally very thrilling prospects. It has 4 lithium exhausting rock initiatives within the Pilbara Province spanning 350 sq. kilometres and in proximity to a few of Australia’s largest lithium deposits and mines.

- The corporate’s different belongings embrace the copper-gold-molybdenum challenge in Queensland and a 39-percent stake in Bayrock Sources, which owns a portfolio of battery metals initiatives in Sweden.

Key Tasks

Liberty Lithium Brine Challenge

QXR has entered right into a binding settlement with vendor IG Lithium LLC (IGL) to accumulate a 75 % curiosity within the Liberty Lithium Brine Challenge in California. Individually, QXR agreed to buy a small package deal of leases adjoining to Liberty Lithium to consolidate the realm, requiring cost of US$100,000 money and QXR shares of the identical worth to the third-party leaseholder.

The Liberty Lithium Brine Challenge, situated in SaltFire Flat, California, is made up of 1,269 contiguous claims over 102 sq. kilometres (10,230 hectares). It is among the largest single lithium brine initiatives within the US. The challenge is situated close to long-life evaporation operations and is well-serviced by roads and energy in a area eager to be a part of the vitality transition.

Challenge Highlights:

- Promising Geology. The challenge has an identical look to well-known lithium brine initiatives in Argentina/Chile, growing confidence within the potential for large-scale lithium discovery. QXR has indicated it’s seeing important native county and regulatory curiosity in creating Liberty Lithium in the direction of manufacturing, pushed by the help for battery minerals manufacturing on this a part of California.

- Sturdy Sampling Outcomes. Sampling on the challenge has returned as much as 215 mg/L lithium in brine at floor. These elevated lithium outcomes prolong over a formidable distance of 10 kilometres, demonstrating the sturdy potential of the Liberty Lithium Challenge. Comparable close by brine initiatives, comparable to Pure Vitality Minerals’ Clayton Valley challenge simply throughout the California/Nevada border, are advancing to potential financial growth on decrease grades downhole of 110 to 160 mg/L lithium. Geophysical evaluation exhibits a big basin over 1,000 metres deep and indicating brine aquifer targets at depth.

- Drill Program Underway. QXR has undertaken a diamond drill program with two permitted drill holes totaling 1,000 metres, together with downhole sampling and geophysics, focused on the centre of the floor lithium anomaly. Drilling started in November-December 2023 and is continuous in early 2024. Bulk volumes of lithium brines can be submitted for testwork with numerous DLE suppliers. The goal is to determine lithium-bearing brine aquifers at depth, which is anticipated to result in an preliminary useful resource by mid-2024.

- Future Partnerships. Finish-users, DLE know-how suppliers, challenge builders, and battery makers have already intimated curiosity in collaborating with QXR as soon as lithium brines are recognized in drill holes.

Hardrock Lithium – Pilbara

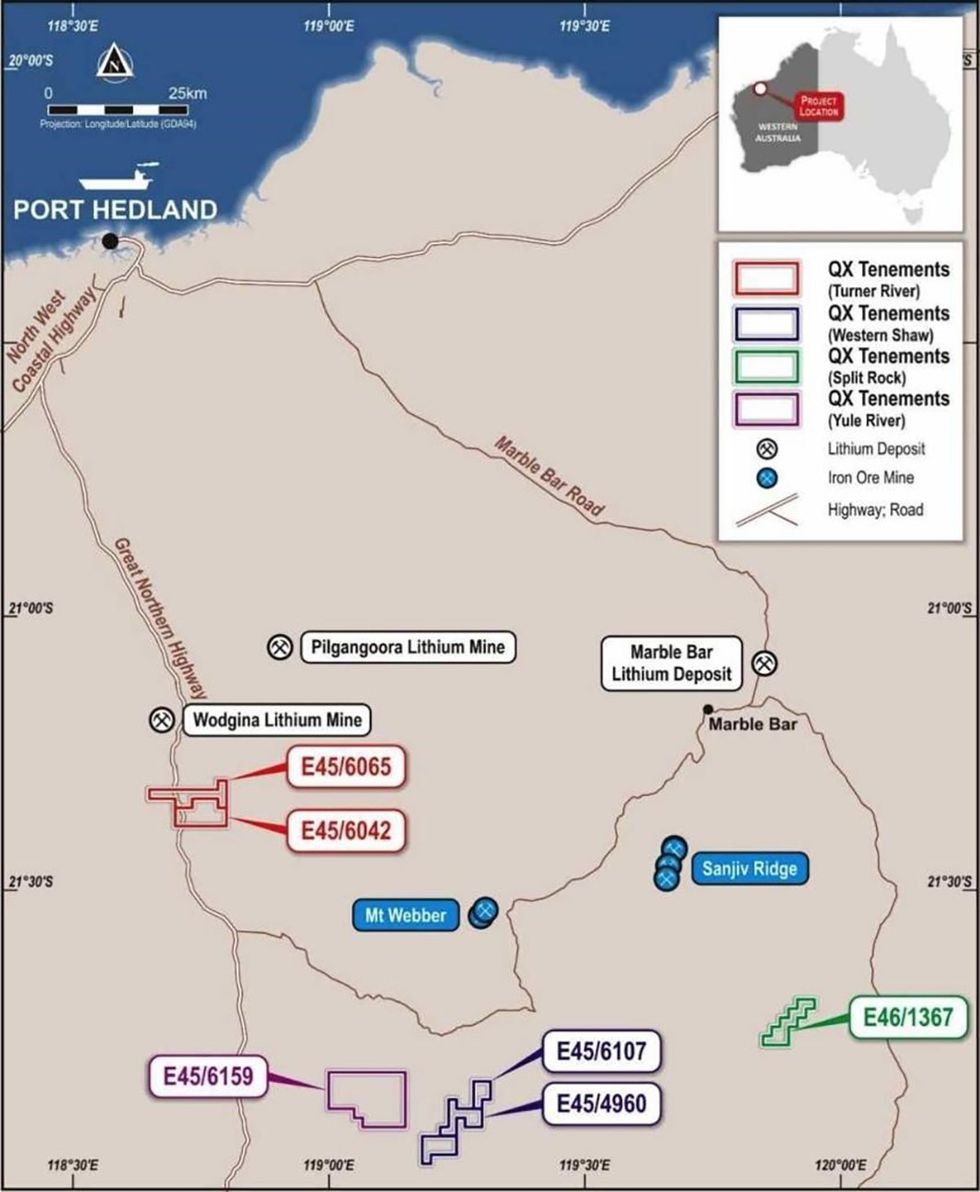

Along with its California asset, QXR has a extremely potential portfolio of lithium initiatives throughout the Pilbara area of Western Australia, masking a mixed space of 355 sq. kilometres. The portfolio contains 4 exhausting rock lithium initiatives – Turner River, Western Shaw, Cut up Rock and Yuletide River.

Turner River Challenge

The Turner River lithium challenge is situated about 120 kilometres south of Port Headland and is accessible through the Nice Northern Freeway. It’s situated about 12 kilometres south of the Woodgina lithium mine web site, one of many world’s largest hardrock lithium deposits.

Rock chip sampling on the Turner River Lithium challenge returned grades of as much as 4.90 % lithium oxide in samples of lepidolite. Assay outcomes from extra rock chip sampling returned 1.6 % and 1.1 % lithium oxide. Pegmatites have been noticed in different areas at Turner River, which can be drilled in future drilling campaigns.

Western Shaw Lithium Challenge

The challenge spanning 96 sq. kilometres is situated 220 kilometres southeast of Port Hedland in Western Australia with entry through the Nice Northern Freeway. A number of pegmatites have been recognized and sampled within the west and south of QXR’s Western Shaw leases. Pegmatites appeared bigger and extra plentiful within the southern part. Quite a few pegmatites returned encouraging lithium outcomes from cellular XRF evaluation. Eighteen samples returned between 300 and 600 elements per million (ppm) lithium in pegmatites at Western Shaw.

Cut up Rock Challenge

The challenge covers an space of 35 sq. kilometres and is roughly 200 kilometres southeast of Port Hedland and 180 kilometres north of Newman. It’s situated alongside the southeast margin of the Cut up-Rock Supersuite, which is taken into account regionally potential for lithium-bearing pegmatites. The challenge is definitely accessible through a longtime street community. The proximity to Thor Mining’s (ASX: THR) Ragged Vary challenge, which has reported various targets potential for lithium inside its tenement space, is encouraging. The challenge is prone to even be potential for base metals together with copper, lead, zinc, silver and gold, given the quite a few base metals prospects that happen alongside the north and south margins of its tenement.

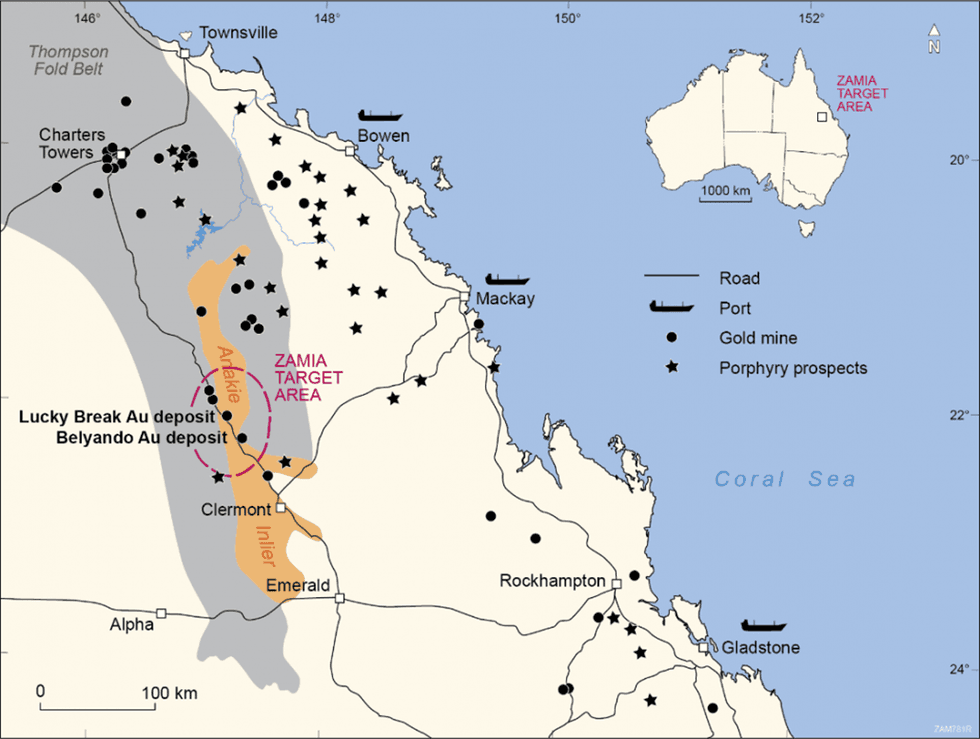

Central Queensland Gold Tasks

QXR is creating two Central Queensland gold initiatives (the Belyando and Fortunate Break Mines) by an earn-in settlement with Zamia Sources. QXR at the moment owns 70 % of Zamia Sources and has the power to earn as much as 90-percent curiosity by spending an additional $1 million on exploration and challenge growth works. Each gold initiatives are strategically situated throughout the Drummond Basin, a area that has a greater than 6.5-Moz gold endowment.

Map of Places of Zamia’s Exploration Tenements in Australia

Along with the 2 gold initiatives, Zamia owns an advanced-stage pure Molybdenum (Mo) deposit in Central Queensland, the Anthony Molybdenum Challenge. The challenge is adjoining to main sealed roads and close to rail and vitality help. The Anthony Challenge has a JORC-2012 compliant indicated and inferred mineral useful resource estimate of 24,700 tonnes (53.7 million kilos) of contained molybdenum in sulphide, transition (partial oxide), and oxide zones from floor.

Bayrock Sources

QXR holds 39 % of Bayrock Sources, an unlisted public Australian firm, which has a portfolio of battery minerals exploration and growth belongings in Sweden, primarily in nickel, cobalt and copper. The 2 principal initiatives embrace the Lainejaur Challenge and the Vuostok Challenge throughout the Northern Nickel Line. Bayrock is totally funded to hold out its deliberate exploration actions on the Lainejaur Ni-Cu-Co challenge and the Vuostok challenge.

The Lainejaur challenge is an advanced-stage nickel-dominated battery metals asset, the place current drilling (July 2023) has returned 4.7 metres at 2 % nickel, 1.6 % copper and 0.1 % cobalt from 283 metres downhole. The challenge has an present JORC 2012 inferred mineral useful resource estimate of 460,000 tonnes @ 2.2 % nickel, 0.15 % cobalt, 0.70 % copper, 0.68 g/t palladium, 0.20 g/t platinum and 0.6 5g/t gold.

The Northern Nickel Line covers almost 340 sq. kilometres comprising 5 exploration permits over areas beneficial for nickel-copper-cobalt in Northern Sweden. The first focus throughout the Northern Nickel Line is the Vuostok Challenge, the place a diamond drill program has returned encouraging outcomes, thus far. Excessive-grade nickel-copper has been intersected together with 6.9 metres at 1.2 % nickel, 2.2 % copper from 5 metres downhole, and in one other drillhole with 6.2 metres at 1.2 % nickel, from 11 metres downhole.

Administration Crew

Maurice Feilich – Govt Chairman

Maurice Feilich has been concerned in funding markets for almost 30 years, commencing his profession as an institutional spinoff dealer at McIntosh Securities in 1998. He joined Tricom Equities in 2000 as head of equities, and in 2010, grew to become a founding accomplice of Sanlam Non-public Wealth. Feilich has a observe file of success and stable networks within the small assets sector.

Steve Promnitz – Managing Director

Steve Promnitz has important expertise within the assets sector, having labored within the gold sector with main and mid-tier producers in addition to throughout the battery minerals of copper, nickel and uncommon earths. Beforehand, he was CEO of small/mid-tier corporations and has held senior administration roles with international useful resource corporations (Rio Tinto, WMC) and senior company finance roles with main banks (Westpac, Citigroup). Promnitz efficiently reworked Lake Sources, a lithium brine developer, from a $1-million market worth personal firm to an ASX-listed firm with an AU$2.1-billion market capitalization on the time of his departure. He holds a BSc (Hons) from Monash College.

Ben Jarvis – Non-executive Director

Ben Jarvis has in depth expertise within the small assets sector as each a public firm director and strategic advisor. Since 2011, he has been a non-executive director of South American-focused gold and silver mining firm, Austral Gold (ASX:AGD) which is dual-listed on the Australian Securities Trade and the Toronto Enterprise Trade (TSX-V: AGLD). Jarvis is the managing director and co-founder of Six Levels Investor Relations, an Australian advisory agency he fashioned in 2006 that gives investor relations companies to a broad vary of corporations listed on the Australian Securities Trade.

Roger Jackson – Non-executive Director

A certified geologist with a profession spanning greater than 25 years, Roger Jackson has appreciable expertise in mineral exploration, mine administration, mining companies and the advertising of mineral concentrates. Jackson is the founding director of various corporations together with Central Gold Mines, Bracken Sources, and Hellyer Gold Mines. He’s a long-standing member of the Australian Institute of Firm Administrators, member of the Australian Institute of Geoscientists, fellow of the Geological Society of London and a fellow of the Australasian Institute of Mining and Metallurgists.

Dan Smith – Non-executive Director & Firm Secretary

Dan Smith holds a Bachelor of Arts and is a fellow of the Governance Institute of Australia. He has 14 years of major and secondary capital markets experience and has suggested on and been concerned in various IPOs, RTOs and capital raisings on the ASX and NSX. Smith serves as non-executive director and firm secretary of various corporations on ASX and AIM.

This text was written in collaboration with Couloir Capital Ltd.