Rost-9D/iStock through Getty Pictures

Abstract

Gol Linhas Aéreas Inteligentes (NYSE:GOL) newest monetary outcomes had been good, however not nice. The primary unfavorable was that the yield was decrease than anticipated, however the airline did have a greater load issue. GOL has downgraded its steerage on account of decrease pricing and larger non-fuel prices, however it’s nonetheless pointing to a strong consequence. Probably the most important spotlight, in my opinion, is the results of the latest warrant difficulty, which I analyzed on this article GOL: Worst Priced In? Sadly, the end result was disappointing and highlighted GOL’s poor remedy of minority shareholders. My new year-end 2024 value goal of US$4.9 affords an upside however has been reduce from US$5.6.

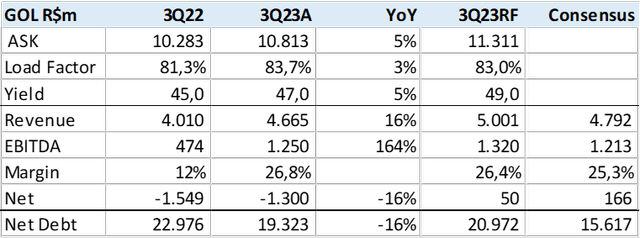

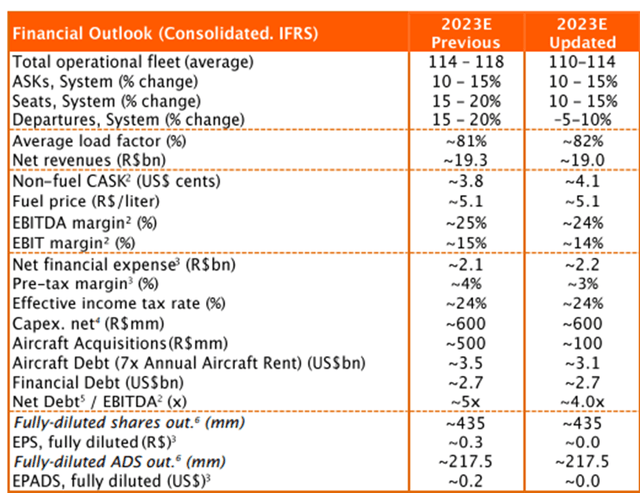

Outcomes and Steering

The airline is constant to publish a strong margin recuperation pushed by pricing or yields and plane utilization or load issue. EBITDA margins have now returned to pre-pandemic ranges, which ought to assist constructive free money circulate era from which GOL can scale back debt. Up to date steerage suggests a good consequence, however demand and pricing appear to be waning whereas prices enhance. The first constructive surprises may come from gas prices, with oil falling from latest highs, in addition to the Brazilian foreign money appreciation. It’s value noting that there’s a decrease leverage indicator post-warrant difficulty and the creation of a US$1.2bn bond conversion.

GOL 3Q23 Outcomes Abstract (Created by creator with information from GOL)

GOL Steering (Picture by GOL)

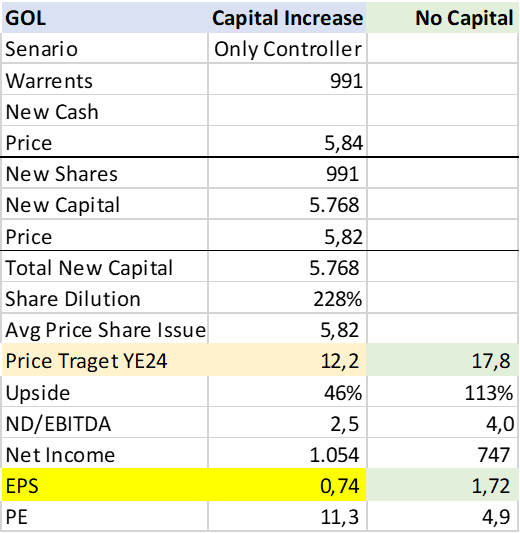

Share Dilution

When GOL introduced its warrant difficulty value as much as 1.8 billion, it was anticipated that just a few, if any, minority shareholders would take part as a result of steep value construction. Based on the corporate’s press launch, the controller was supposed to accumulate their share. Sadly, the end result was not as I had anticipated. The controllers didn’t buy the warrants for R$5.82 as initially acknowledged, however as an alternative obtained them totally free. Moreover, they transformed a US$1.2bn Senior Notes into Convertible Notes with a strike value of R$5.84, which is effectively within the cash. This implies the controllers can swap US$1.2bn for 990 million new shares, leading to a rise of their stake within the firm from 57% to 87%.

Though this debt swap is constructive for credit score high quality and bond values, it cuts into GOL’s fairness appreciation potential. Nevertheless, the truth that GOL didn’t enter Chapter 11 and wipe out minorities altogether is a saving grace.

GOL Warrant Challenge (Created by creator with information from GOL)

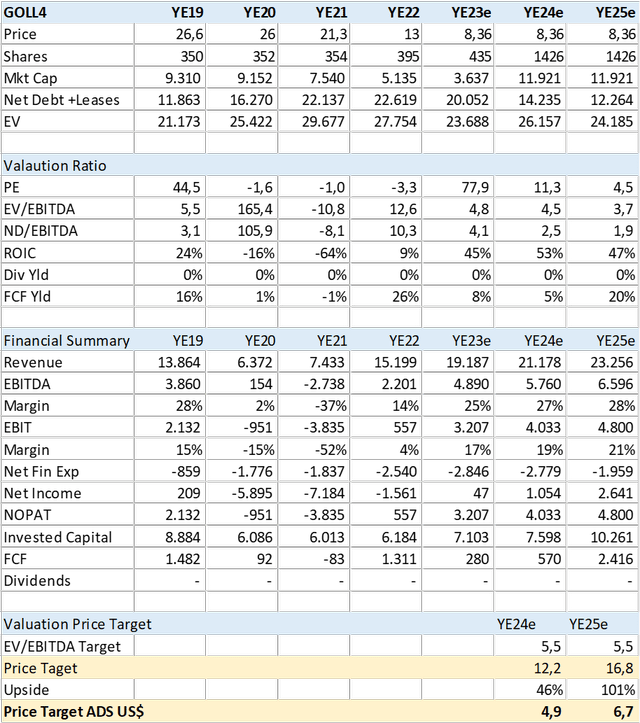

Valuation

Based mostly on my evaluation, I imagine that GOL’s worth will be greatest measured utilizing a goal EV/EBITDA of 5.5x, which is decrease than the valuation given to Azul (AZUL), LATAM (OTCPK:LTMAY), Copa (CPA), and Volaris (VLRS). This is because of GOL’s weak stability sheet, inconsistent execution, and subpar monitor file in company governance. Different valuation metrics have been tough to use as a result of lack of earnings volatility, notably due to international change positive aspects and losses ensuing from USD debt and gas hedges.

In gentle of latest occasions, I’m adjusting the value goal for YE24 to R$12.2 or US$4.9 per ADR from the earlier goal of US$5.6. This is because of a rise in share rely, with decrease debt discount ensuing from the warrant and convertible bond occasion.

GOL Monetary Abstract & Valuation (Created by creator with information from GOL)

Conclusion

GOL is an airline that continues to work its well beyond the affect of the pandemic. They’re engaged on enhancing plane utilization, margins, and decreasing their debt. The latest warrant difficulty and debt for fairness swap are anticipated to be the ultimate main company restructuring occasions that may have an effect on their fairness.