- Rising cash stream into AI corporations may set off a bounce for these tokens

- Wholesome social dominance may be key to bringing the rally to life

AI-themed tokens together with Fetch.ai [FET] and Render [RNDR] may be set to regain a few of their erased positive factors if the correlation with NVDA is one to think about. For these unfamiliar, NVDA is the inventory of NVIDIA Corp, an Synthetic Intelligence agency. Based on knowledge from Google Finance, NVDA’s worth appreciated by 12.26% within the final 5 days alone.

Actually, AMBCrypto’s findings from a recent Bloomberg report revealed that a rise in capital deployed to AI tasks this week propelled the stated hike.

Round two weeks in the past, NVDA’s value plummeted because of the geopolitical unrest within the Center East. On the similar time, the costs of FET and RNDR recorded extreme drawdowns on the charts too.

Supply: Google Finance

Consideration to shift to those tokens if…

Nonetheless, this was simply one in all a number of intervals the place the costs of those cryptocurrencies moved in the identical route because the inventory. Actually, the potential rise may be past dependence on the normal asset.

On this article, AMBCrypto seems to be at totally different on-chain metrics to see in the event that they align with the aforementioned prediction. To start out with, we thought of the query of social dominance.

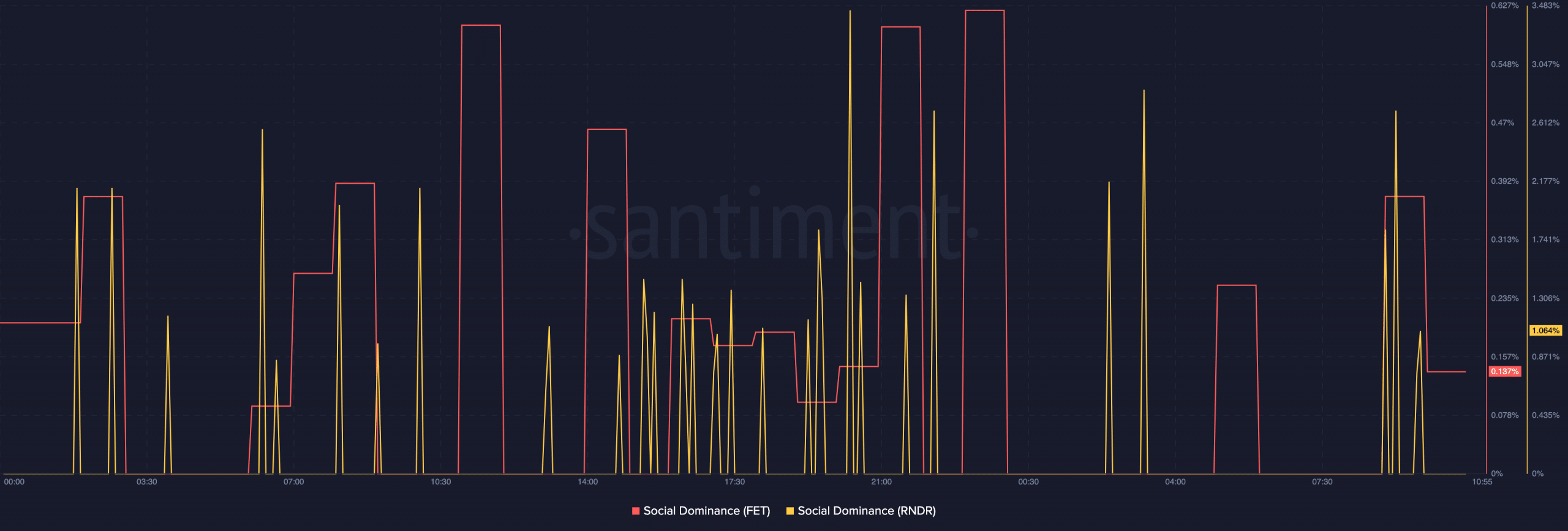

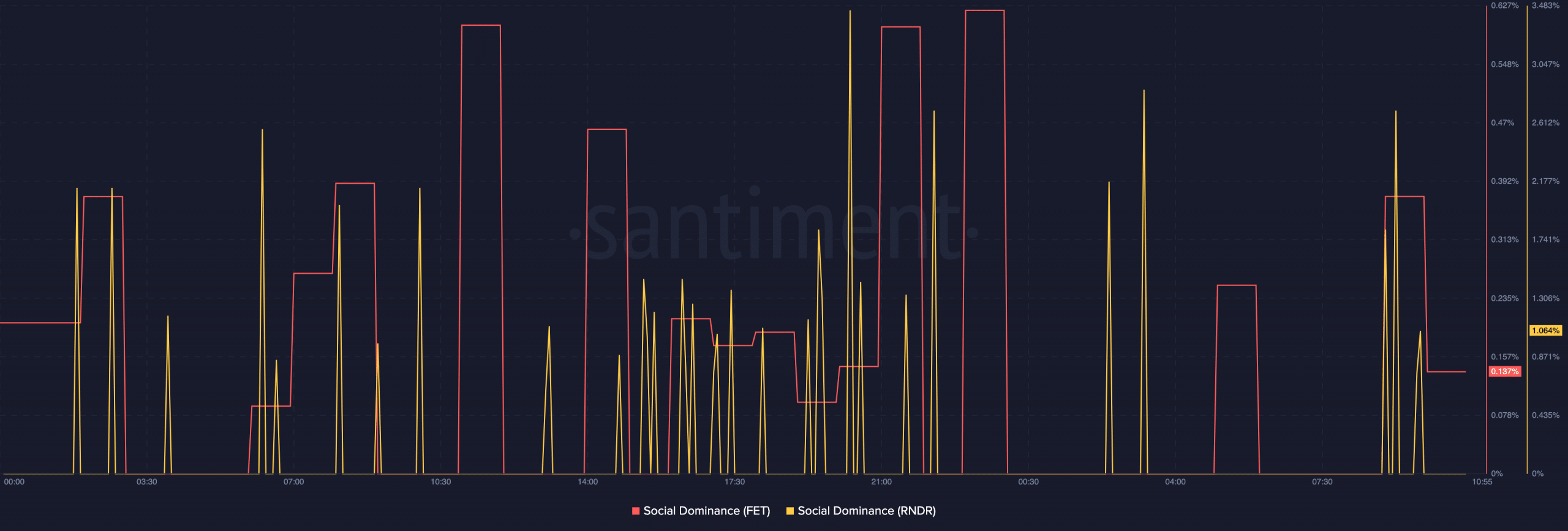

Based on Santiment, Render’s social dominance spiked to 2.69% on 27 April, earlier than the studying dropped on the charts. FET additionally registered a hike to 0.37% earlier than falling to 0.13% at press time.

In principle, the state of the metric means that discussions across the token have been okay relative to different belongings. For the worth, this may very well be excellent news contemplating the truth that the studying has remained in a wholesome place.

Supply: Santiment

If the metric was above 3.45%, historic knowledge revealed that the tokens would have been overheated. On this case, as a substitute of the potential to climb, the costs may tumble on the chart.

Subsequently, if slight demand is available in for these tokens, FET may go previous its weekly peak of $2.62. RNDR, however, may additionally be capable of revisit $9.53.

Is nobody there to assist?

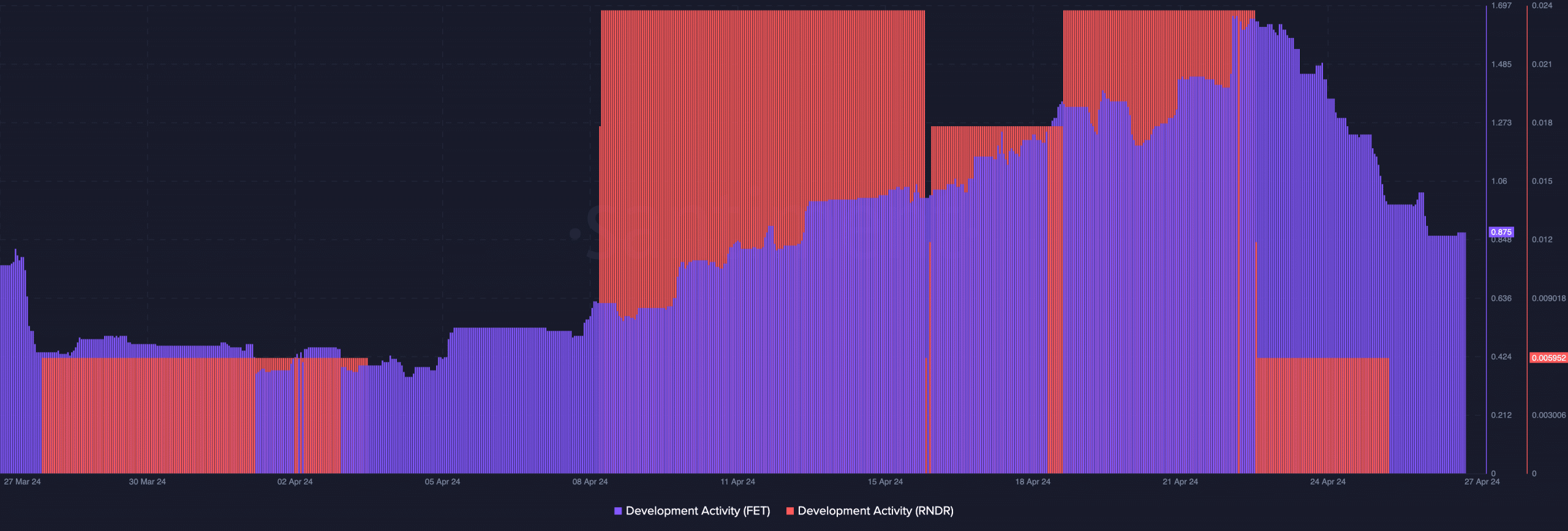

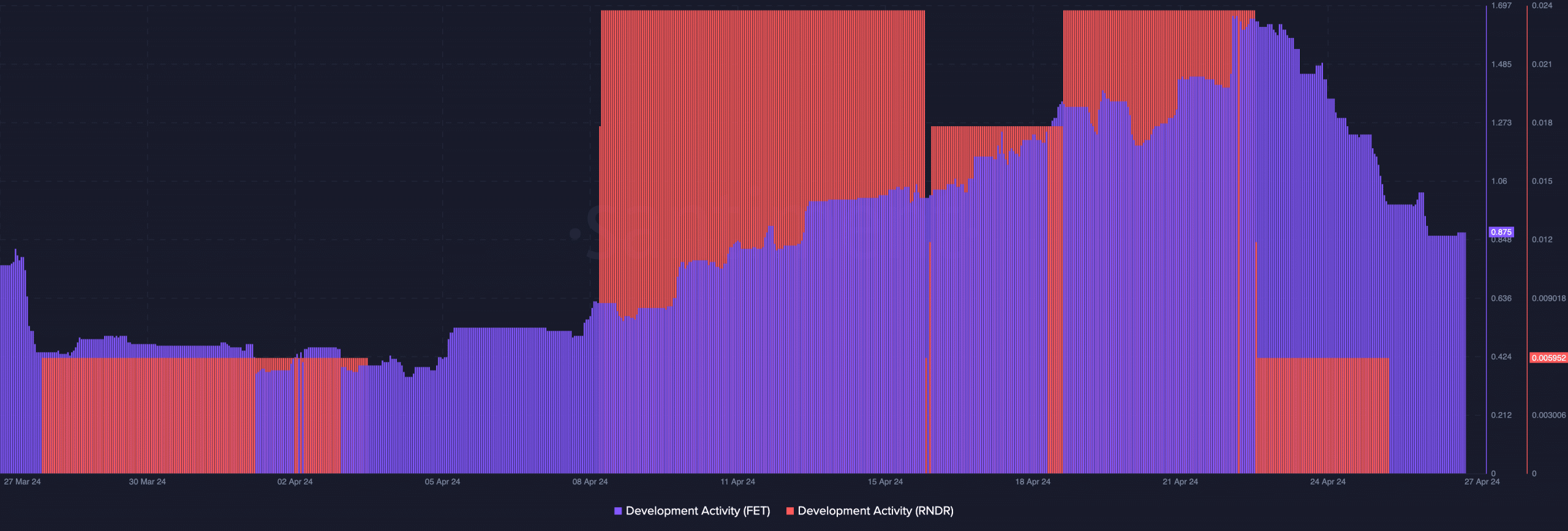

In addition to the social metrics, one other indicator to think about is growth exercise. This indicator is necessary as a result of the AI crypto financial system plans to boost the use instances provided by these tasks. A glance again on the plan to merge FET with AGIX and OCEAN was a testomony to this resolve. As such, if utility has to set off demand, growth shouldn’t decelerate.

Sadly, Fetch’s growth exercise dropped after rising to a brand new month-to-month cliff on 22 April. It was across the similar interval that the metric in Render’s phrases additionally began to fall.

Supply: Santiment

A decline within the metric signifies that builders slowed down on pushing out codes dedicated to delivery options on the community. Nonetheless, market members may have to control these metrics, in addition to NVDA.

Reasonable to not, right here’s FET’s market cap in RNDR’s phrases

Ought to social dominance rise alongside NVDA’s value, then RNDR and FET may swing north. If this occurs with rising growth exercise, a double-digit hike may be potential within the brief time period. As well as, a decline within the elements talked about above may invalidate the bullish thesis.