- Legendary dealer Peter Brandt believes Ethereum’s value chart is ‘intriguing’

- Ethereum’s value confirmed indicators of restoration, with a rise in new addresses

Ethereum has up to now exhibited a unstable mixture of value actions, initially dipping under the $3,000-threshold in latest days earlier than rallying above it as soon as once more.

This value habits has caught the eye of merchants and buyers alike, with the asset appreciating by a 1.4% within the early hours of Friday. This restoration signifies a pivotal second for Ethereum because it strives to take care of its momentum above this key value stage.

Analyzing Ethereum’s chart patterns and broader market sentiment

Amidst these fluctuations, Peter Brandt, a seasoned dealer with a long time of expertise within the monetary markets, took to the social media platform X to express his views on Ethereum’s present value chart, which he described as “intriguing.” His evaluation has sparked a wide selection of discussions among the many buying and selling group.

Brandt’s examination of Ethereum’s value chart revealed two potential patterns – A flag and a channel. Initially, he interpreted the formation as a flag, which is usually seen as a continuation sample that seems throughout transient pauses in dynamic market developments.

Nonetheless, upon additional evaluation, Brandt steered that the sample may higher resemble a channel.

Supply: X

This construction is outlined by two parallel, sloping traces, with the value testing every boundary a minimum of twice. Regardless of the paradox in defining the precise sample, Brandt highlighted the potential for a breakout in both path, indicating a impartial place in the direction of the quick way forward for Ethereum’s value actions.

This neutrality is mirrored within the broader market sentiment.

As an illustration, data from Santiment indicated that the sentiment in the direction of prime cryptocurrency belongings stays “adverse,” a pattern that has been persistent for the reason that Bitcoin halving passed off on 19 April. This episode did not catalyze a major enhance in market caps throughout the sector.

Supply: Santiment

This overarching temper means that whereas quick features are attainable, the market stays cautious concerning the longer-term prospects.

Indicators of restoration and technical outlook

Regardless of the prevailing bearish sentiment, nevertheless, there are indicators of potential restoration on the horizon.

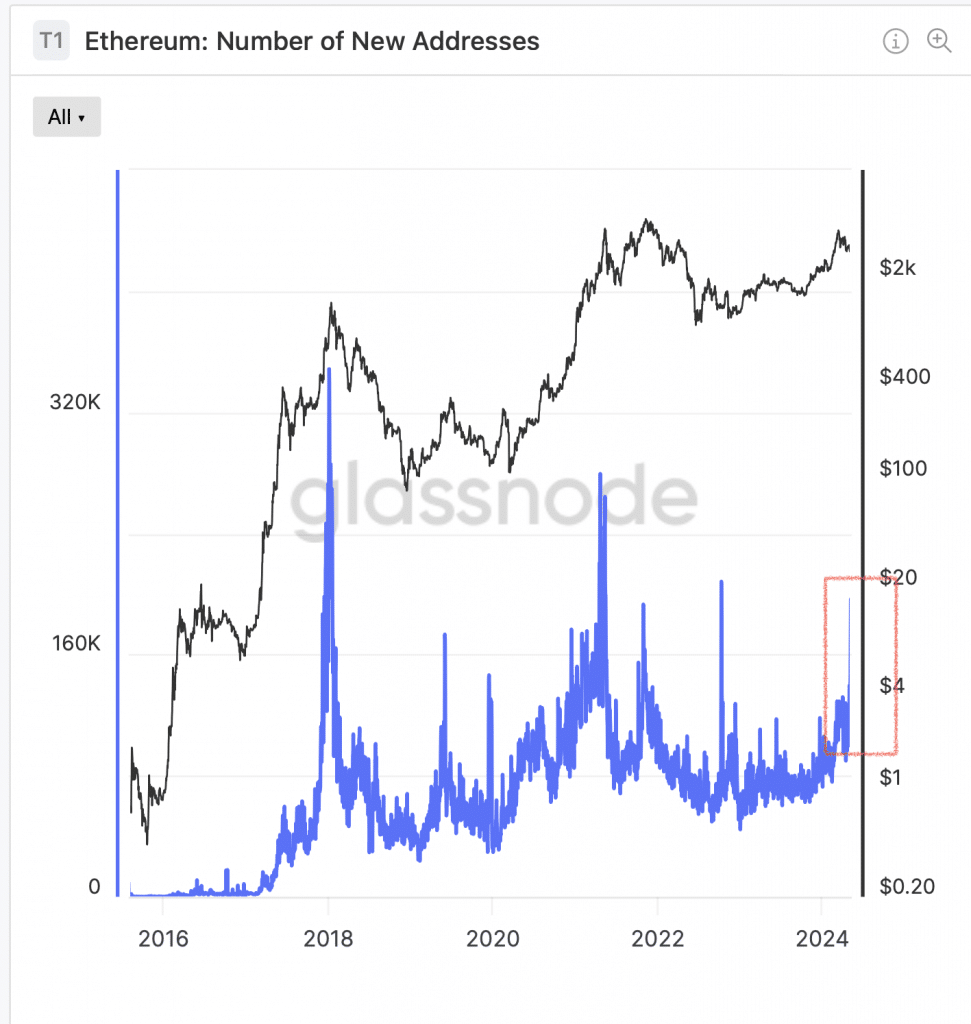

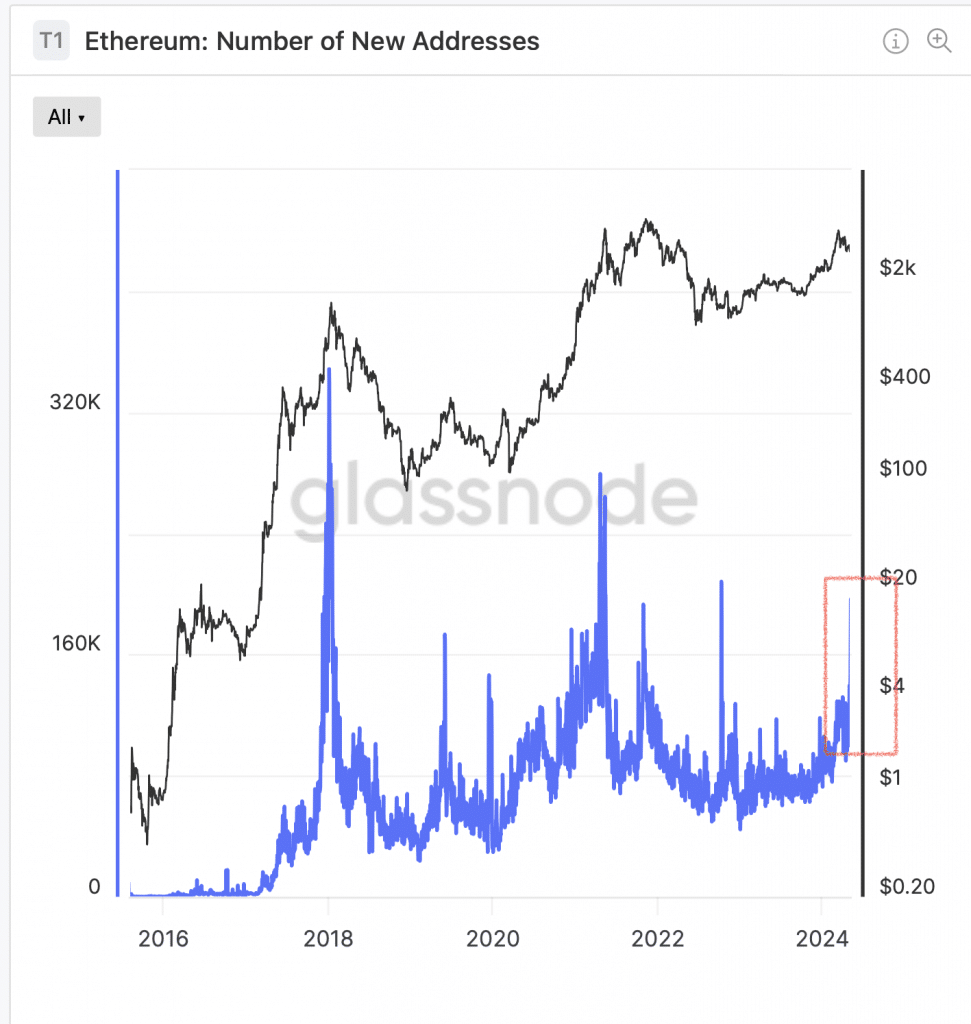

In accordance with Glassnode data, the variety of new Ethereum addresses has surged, climbing above 160,000 from its lows under 100,000 earlier in January.

Supply: Glassnode

This uptick in new addresses may very well be a bullish sign for Ethereum, indicating better curiosity and potential funding within the asset, regardless of its latest struggles.

From a technical perspective, the each day chart for Ethereum nonetheless highlighted a bearish pattern at press time, with sustained breaks of construction to the draw back. Nonetheless, a more in-depth have a look at the 4-hour chart revealed that Ethereum may see short-term upward motion. This potential hike may very well be a strategic transfer by the market to take out liquidity at greater ranges, earlier than persevering with the prevailing downtrend.

Supply: ETH/USDT, TradingView

Further evaluation from AMBCrypto supported this view, noting elevated volatility in Ethereum’s value actions, as indicated by the Bollinger Bands.

Lastly, the Relative Energy Index (RSI) had a studying of 40, reinforcing the sturdy bearish sentiments out there.