Kateryna Kolesnyk/iStock by way of Getty Photographs

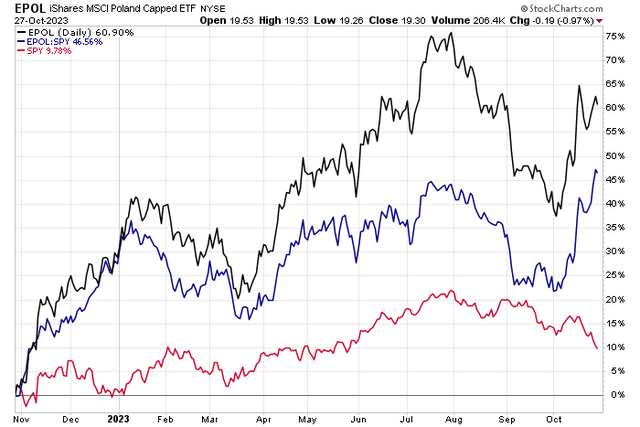

On the lookout for relative energy into year-end? Take a look at Poland. Ranked 1 out of 400 in its Asset Class, the iShares MSCI Poland ETF (NYSEARCA:EPOL) has outperformed the S&P 500 over a number of timeframes recently, after present process extreme underperformance for years since its 2010 inception.

I’ve a purchase ranking on the fund. Its valuation is compelling, and I like how robust the nation ETF has been within the final month and since October 2022, although it’s uncovered to at least one dangerous sector.

EPOL: +61% Whole Return YoY, Sharply Optimistic This Month

Stockcharts.com

In keeping with the issuer, EPOL seeks to trace the funding outcomes of a broad-based index composed of Polish equities. The ETF presents publicity to a broad vary of corporations in Poland and can be utilized to specific a bullish nation view.

EPOL is a small ETF with simply $209 million in belongings below administration as of October 27, 2023. Looking for Alpha doesn’t present a dividend yield, however iShares notes that its trailing 12-month distribution fee is 1.6% – about on par with the S&P 500’s yield. EPOL will not be an excessively low cost fund given its 0.58% annual expense ratio, however share-price momentum has been spectacular over latest timeframes – notably simply this month with its 13% MTD advance in comparison with a cloth decline within the SPX.

An vital issue to contemplate with this nation ETF is the foreign money impression. The EURUSD pair has been considerably regular recently close to $1.06 – on the whole, any drop within the euro is bearish, so the greenback’s rise since July makes EPOL’s alpha all of the extra spectacular. By way of liquidity, quantity is modest at simply 206,000 every day within the final three months whereas its 30-day median bid/ask unfold is often slender, averaging six foundation factors.

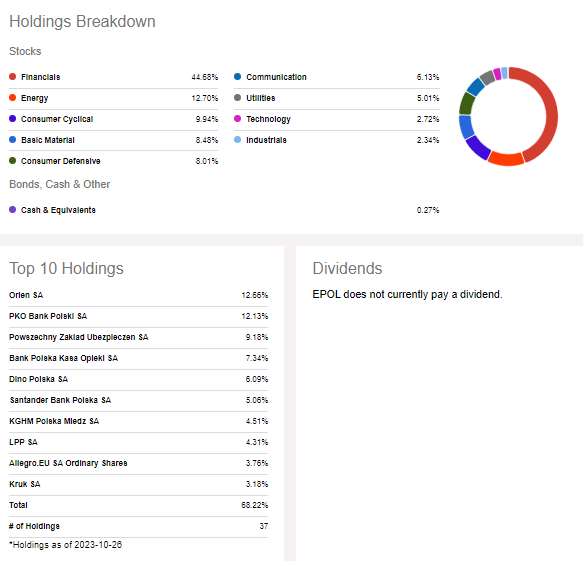

Digging into the portfolio, its 37 holdings are closely weighted into the Financials sector. So, monitoring macro rate of interest traits and micro steadiness sheet adjustments are keys for potential traders. You’ll not discover a lot expertise publicity in EPOL, so don’t count on the fund to trace intently with the S&P 500. General, 68% of the allocation is discovered within the prime 10 holdings, including to potential danger. The highest 3 positions comprise greater than one-third of the ETF.

EPOL: Sector Breakdown & High Holdings

Looking for Alpha

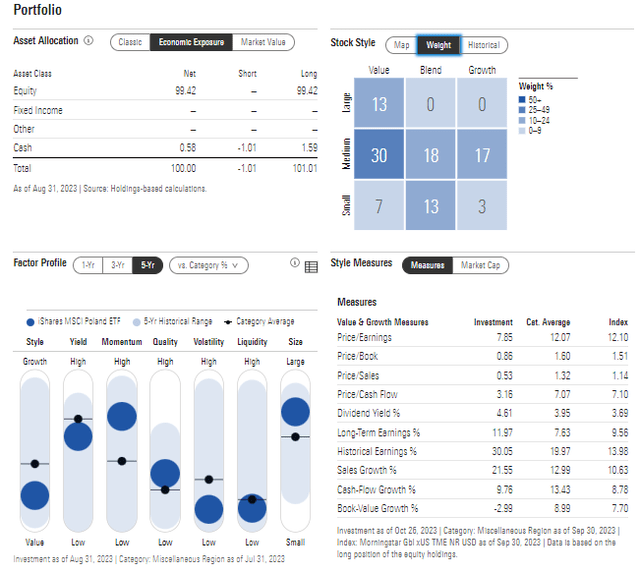

General, there’s heavy mid-cap publicity and nil weight in large-cap progress. Thus, I’d think about it a extremely cyclical allocation given the worth bent and 87% weight in SMIDs. Whereas it’s thought of a low-volatility fund on the issue view, there have traditionally been quick strikes decrease in EPOL and liquidity will be weak at instances regardless of the at present respectable Looking for Alpha grade.

With a price-to-earnings ratio below 8 and a excessive historic yield, there’s a case for a worth play right here. Furthermore, the bank-heavy portfolio sells at lower than 0.9 instances guide worth. I like these valuation circumstances.

EPOL: Portfolio & Issue Profiles

Morningstar

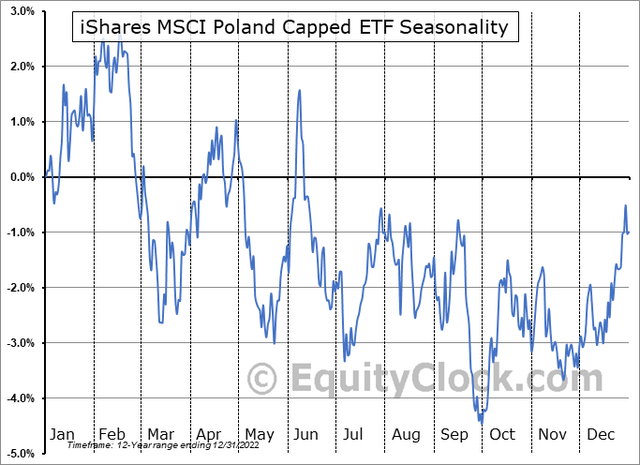

Seasonally, EPOL tends to wrestle in November, in response to knowledge from Equity Clock. Nonetheless, shopping for round Thanksgiving (for US traders) and holding by Valentine’s Day has traditionally been a successful play. Lengthy-term returns are lackluster with this nation fund, nevertheless.

EPOL: Bullish Traits December-January

Fairness Clock

The Technical Take

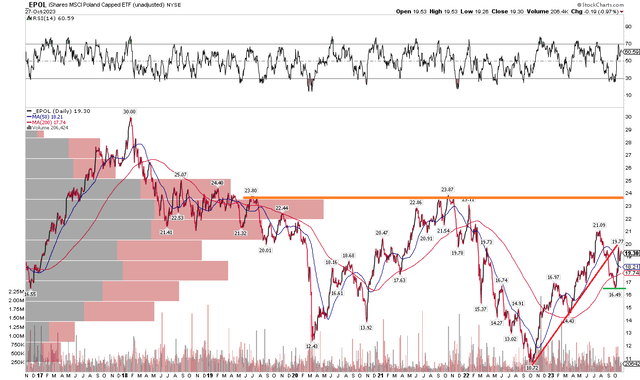

As talked about earlier, Poland equities have been a long-term loser within the ETF’s greater than 12-year historical past. Discover within the price-only chart beneath that the fund is below its highs from a few years in the past. Only in the near past, EPOL did not rally above its late 2021 peak close to $24. The $21 mark was met with promoting stress earlier than a check of the mid-$20s may very well be made. Shares plunged by greater than 20% from late July to a low earlier this month.

Curiously, there was sharp relative energy within the final handful of weeks, in order that bears watching heading into year-end. For now, the shorter-term 50-day shifting common stays above the long-term 200-day shifting common, which is a optimistic signal. With a excessive quantity of quantity by worth as much as the $24 stage, nevertheless, the bulls have their work reduce out for them.

Additionally check out how EPOL broke beneath a key uptrend help line off the October 2022 low – that tells me bearish absolute dangers stay in play regardless of relative outperformance since earlier this month. I see near-term help on the latest inflection spot of $16.50. General, there’s not an entire lot to be tremendous enthusiastic about technically.

EPOL: Massive Relative Power, Lackluster Absolute Power

Stockcharts.com

The Backside Line

I’ve a purchase ranking on EPOL. The nation ETF encompasses a very low valuation with robust share-price momentum. Forex dangers and the Polish banking sector are key dangers to watch.