Macro strategist Henrik Zeberg thinks the economic system is at present within the midst of an “all the things bubble” that’s primed to get even greater.

The economist tells his 143,400 followers on the social media platform X that the present bubble’s blow-off high isn’t completed.

“Bubble – the place?

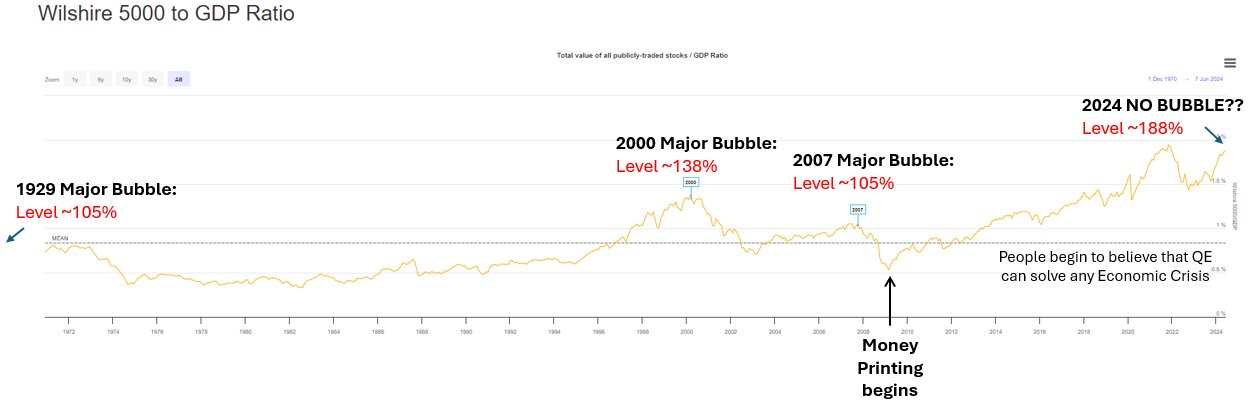

Beneath is Market Capitalization to GDP (gross home product):

1929 was a serious Bubble: 105%

2000 was a serious Bubble: 138%

2007 was a serious Bubble: 105%

What do you suppose the present stage of 188% represents? Then add on Crypto Bubble and Non-public Fairness Bubble. When recession units within the ‘Every thing Bubble’ will pop!”

Non-public markets have witnessed a “outstanding” interval of progress for greater than a decade, surging from $9.7 trillion in belongings below administration (AUM) in 2012 to an estimated $24.4 trillion AUM by the tip of final 12 months, in line with analysis from Huge 4 accounting agency Ernst & Younger (EY).

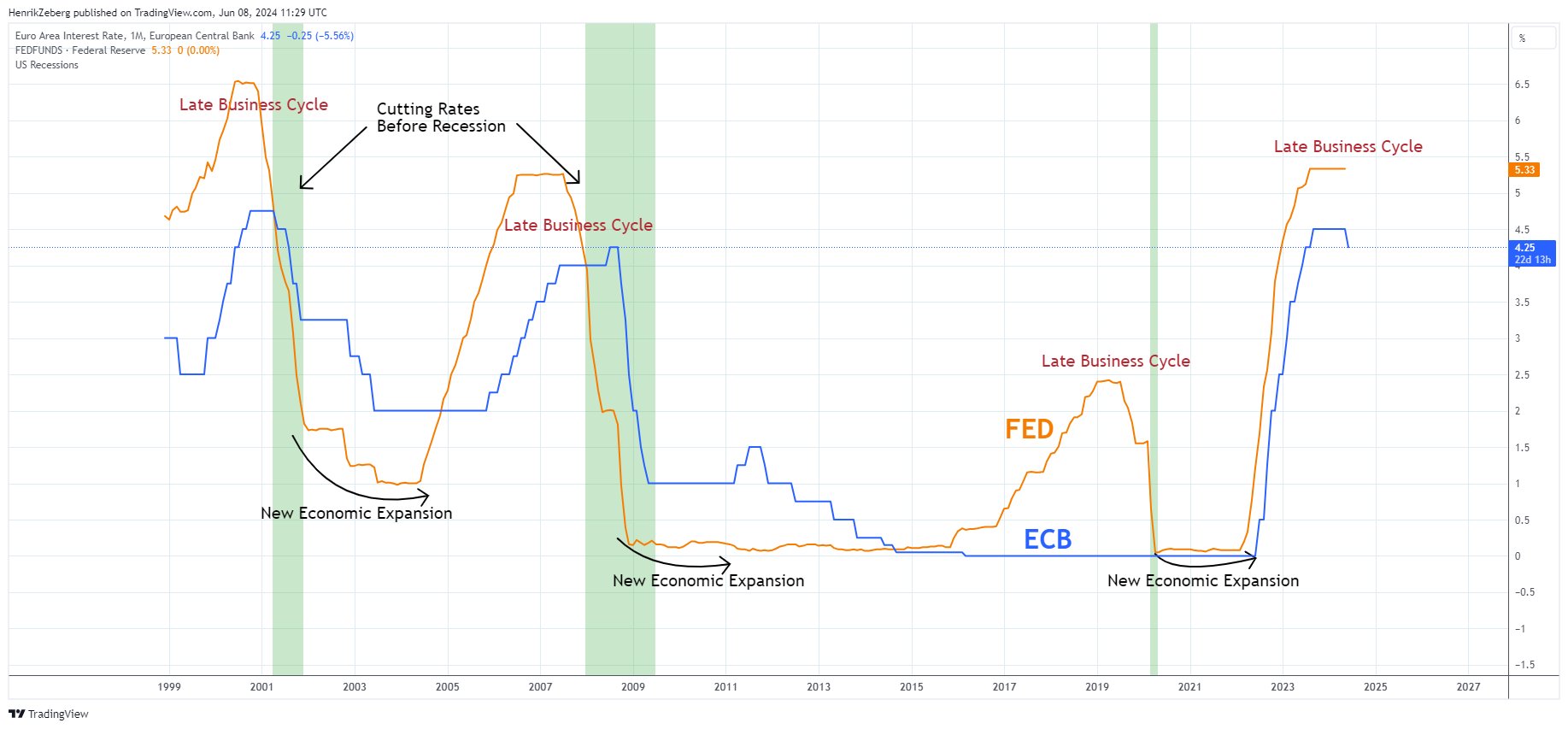

Earlier this week, Zeberg stated central banks just like the Federal Reserve within the US and the European Central Financial institution (ECB) have a tendency to chop charges shortly earlier than a recession.

“Financial Enlargement forward – or Late Cycle and therefore Recession forward?

Let me make it straightforward for individuals who discover it obscure the place we’re within the Enterprise Cycle.

On Thursday, ECB selected to chop its Fund Charges.

ECB and FED at all times will attempt to lower charges late cycle to hinder economic system from falling into recession.

Now have a look at the chart.

Are we ‘Late Cycle’ – or standing in entrance of ‘New Financial Enlargement’?

THINK!”

The Federal Reserve will doubtless concern its subsequent assertion on the Federal Funds Fee on the June twelfth Federal Open Market Committee (FOMC) assembly. The central financial institution is expected to maintain charges the identical.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on X, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: DALLE3