- DMM Bitcoin misplaced 4,502.9 BTC to hackers, planning a big buyback to cowl losses.

- AMBCrypto analyzed the doable impression of this buy on the Bitcoin market

On Could thirty first, DMM Bitcoin, a distinguished Japanese cryptocurrency change, encountered a big safety breach ensuing within the lack of roughly 48 billion yen ($305 million) value of Bitcoin [BTC] .

The breach led to 4,502.9 BTC being illicitly transferred out of the change’s reserves, as reported by safety analysts from Blocksec. Analysts famous that stolen funds had been cut up into batches of 500 BTC throughout ten totally different wallets.

DMM Bitcoin’s plan to undo a hacker’s payday

In response to this substantial monetary hit, DMM Bitcoin has initiated a complete restoration technique geared toward compensating affected clients with out disrupting the broader Bitcoin market.

The platform disclosed plans to safe 50 billion yen ($321 million) to buy Bitcoin misplaced. This transfer is a part of a broader initiative to stabilize the change’s operations and restore person belief.

Notably, the hack, ranked because the seventh-largest crypto theft by Chainalysis, prompted fast regulatory motion.

Japan’s Monetary Providers Company has required DMM Bitcoin to totally examine the incident. A report on each the breach’s origins and the corporate’s buyer compensation technique was additionally requested.

In the meantime, Finance Minister Shunichi Suzuki has dedicated to bolstering preventative measures in opposition to future safety breaches within the cryptocurrency sector.

Thus far, the corporate has secured a 5 billion yen mortgage. It’s within the strategy of a big capital increase amounting to 48 billion yen.

Doable impression

Whereas it may appear noteworthy {that a} crypto change is ready to buy thousands and thousands in Bitcoin, the fact is that DMM’s deliberate $320 million funding is unlikely to shake the market considerably.

This buy will solely account for about 4,500 BTC, a mere 0.023% of the present circulating provide of roughly 19.7 million cash, in keeping with Coingecko data.

As compared, U.S. spot Bitcoin ETFs are making purchases over $500 million, which genuinely affect Bitcoin’s worth dynamics.

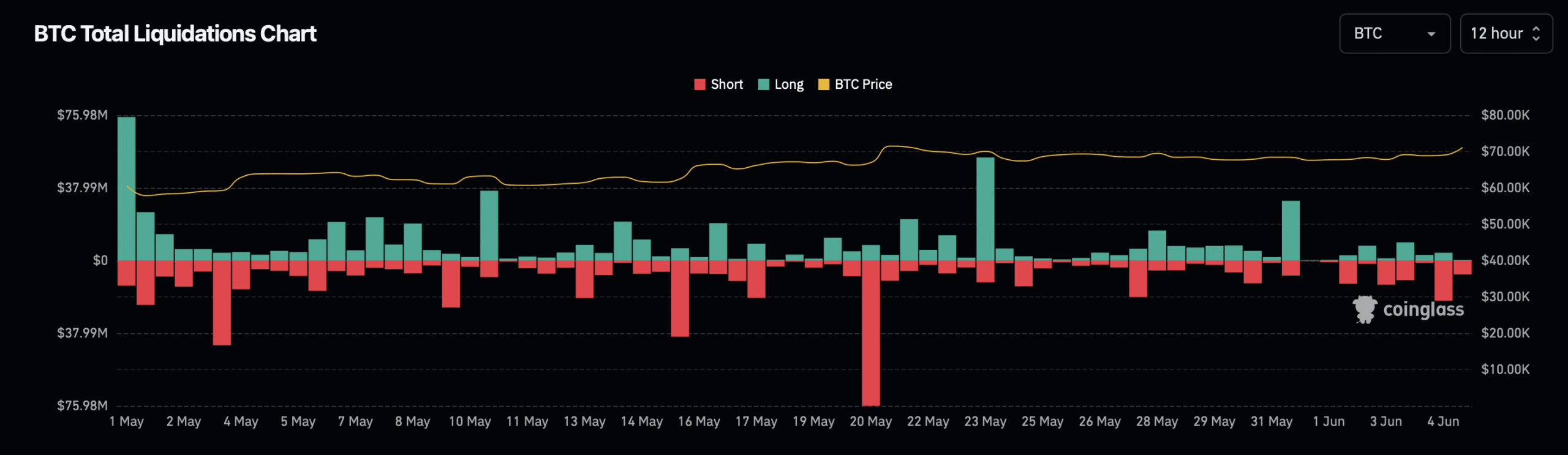

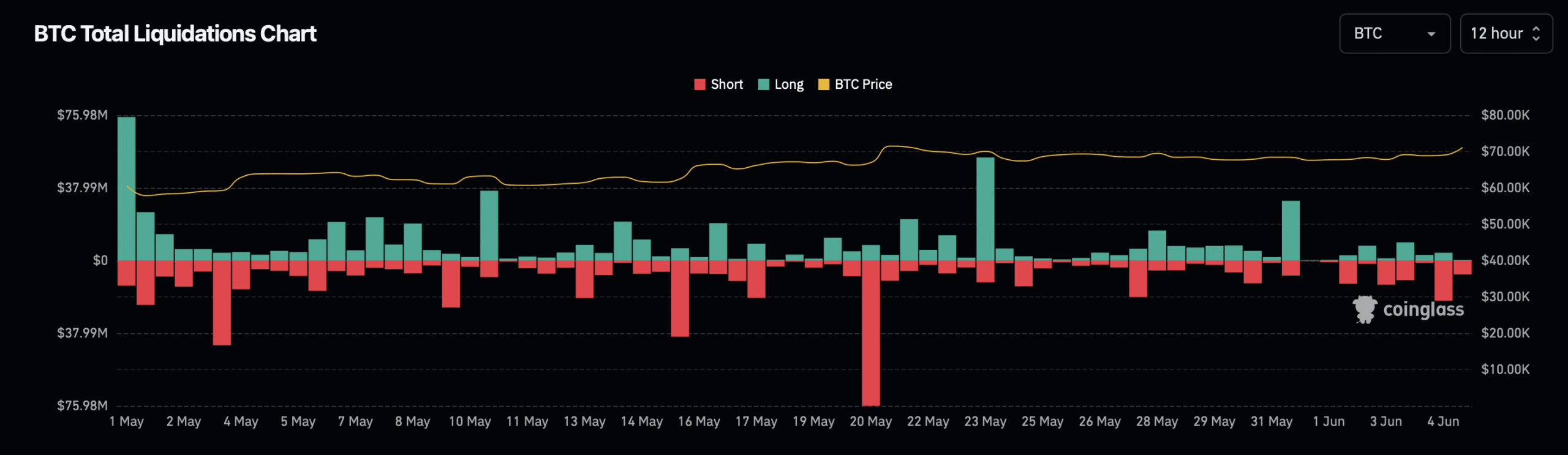

As of now, Bitcoin’s worth is barely above $71,000. BTC rose by 2.9% up to now day and 4.6% over the previous week. Regardless of these positive factors, the rise has led to over $30 million in liquidations out there, per Coinglass.

Supply: Coinglass

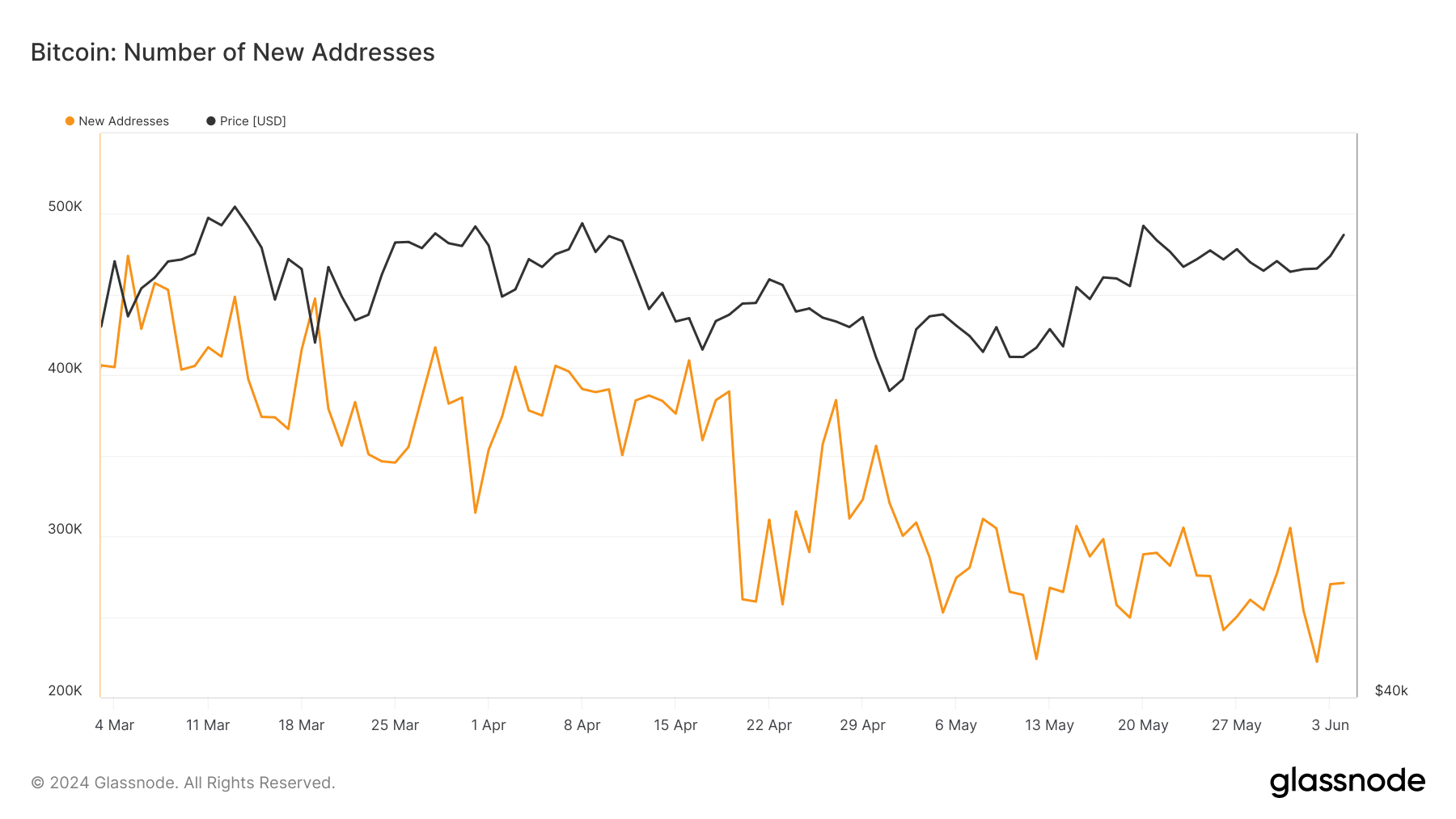

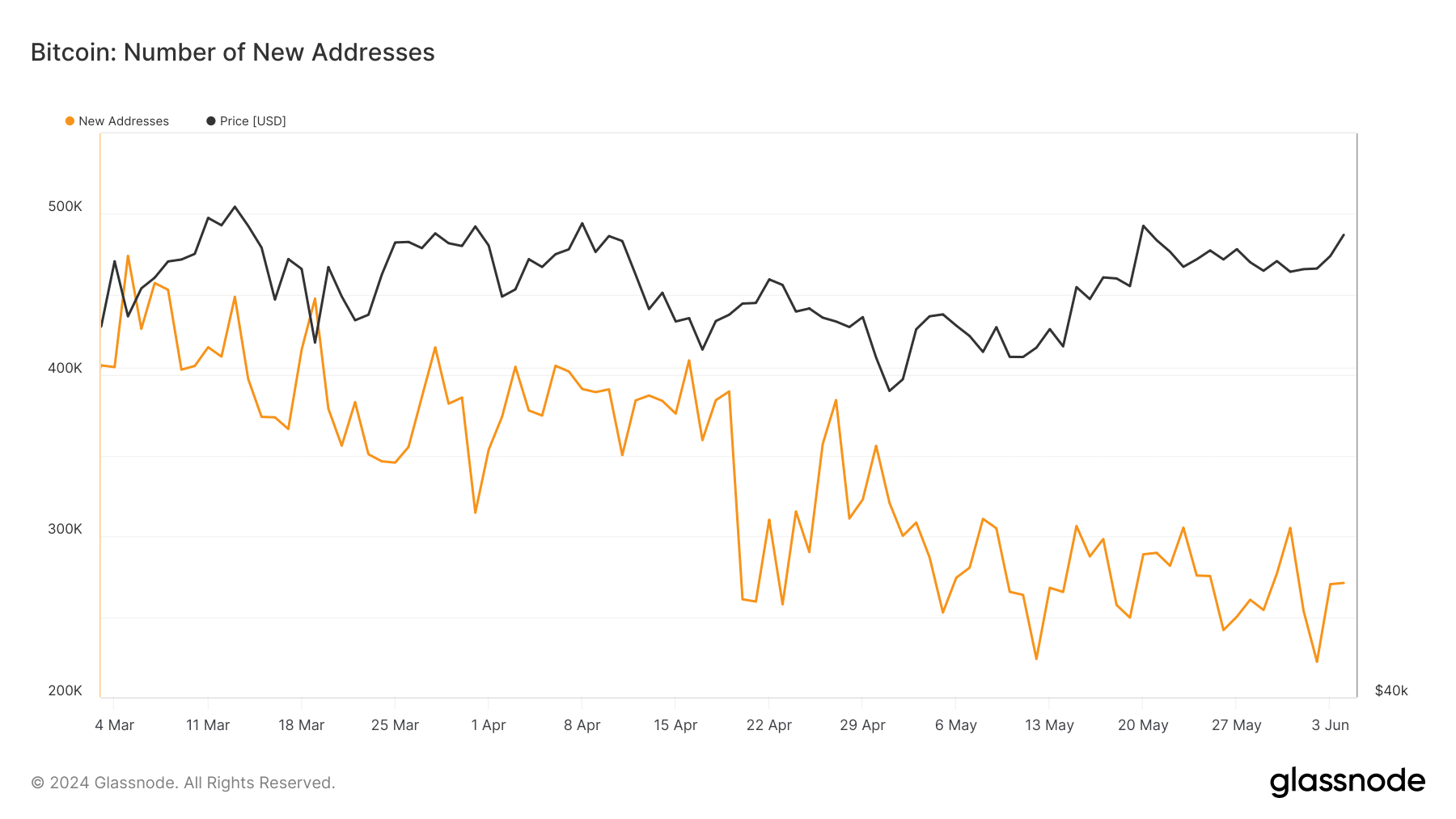

This worth rise correlates with a noticeable uptick within the variety of new Bitcoin addresses proven in data from Glassnode, suggesting a renewed curiosity and doubtlessly increased future valuation.

Supply: Glassnode

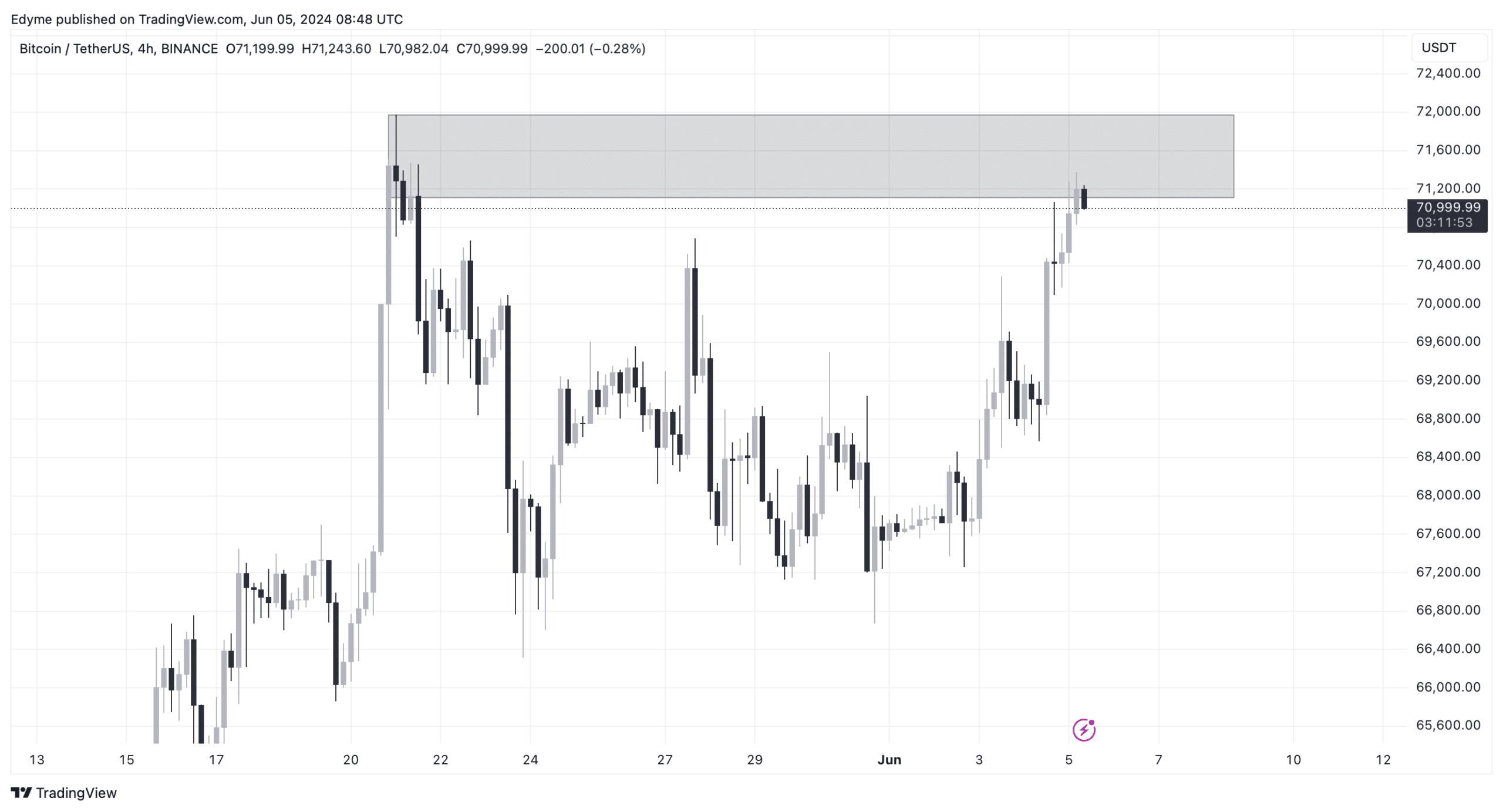

Furthermore, present technical evaluation signifies that Bitcoin is trying to interrupt by means of a big resistance degree on the day by day chart. A profitable breach may doubtlessly provoke a significant rally, catapulting the asset’s worth to new heights.

Supply: TradingView

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

In one other evaluation, AMBCrypto studies that the Community Worth to Transactions ratio, which is the market capitalization divided by the transacted quantity, has been trending increased.

This metric means that BTC would possibly at the moment be overvalued primarily based on its transaction capabilities.