- A cohort of BTC whales have continued to fill their baggage.

- This has occurred regardless of the coin’s latest worth motion.

Bitcoin [BTC] whales have intensified accumulation regardless of the coin’s latest decline beneath $62,000.

In line with on-chain information supplier Santiment, BTC whales holding between 1000 and 10,000 cash gathered 15,121 BTC valued at $930 million between the seventh and the eighth of Might.

This pushed the cohort’s complete BTC holding to its highest degree in 14 days.

🐳 As #Bitcoin ranges tightly between $61K and $64K, massive whales have made some accumulation strikes over the previous 24 hours. Wallets with 1K-10K $BTC have collectively gathered ~$941M price of cash, rebounding to their highest holding degree in 2 weeks. https://t.co/NkYwRsc8Pd pic.twitter.com/LWAt03TgUP

— Santiment (@santimentfeed) May 8, 2024

At press time, this group of BTC buyers held 38% of the coin’s circulating provide of 20 million BTC.

BTC has the bears to cope with

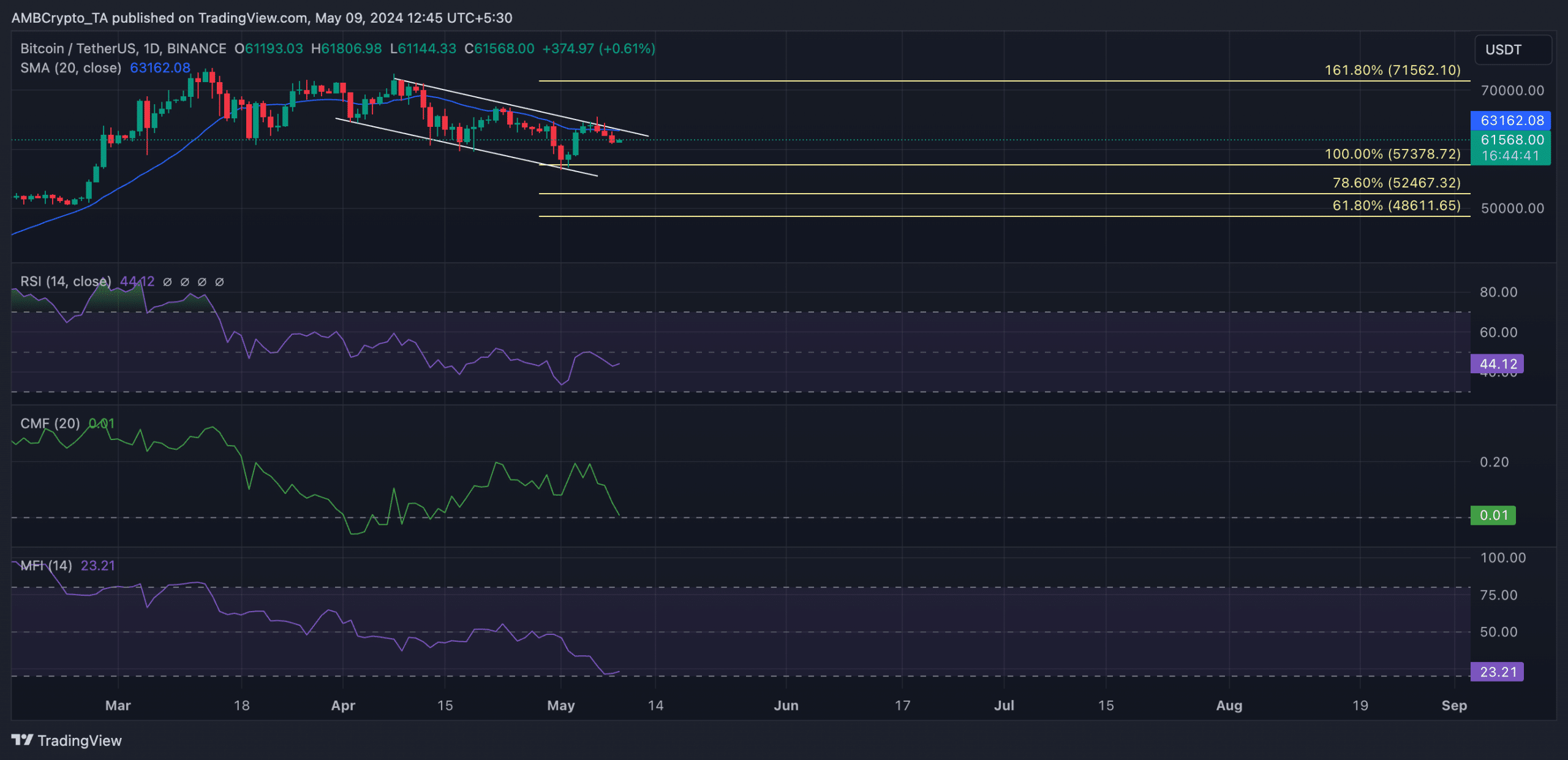

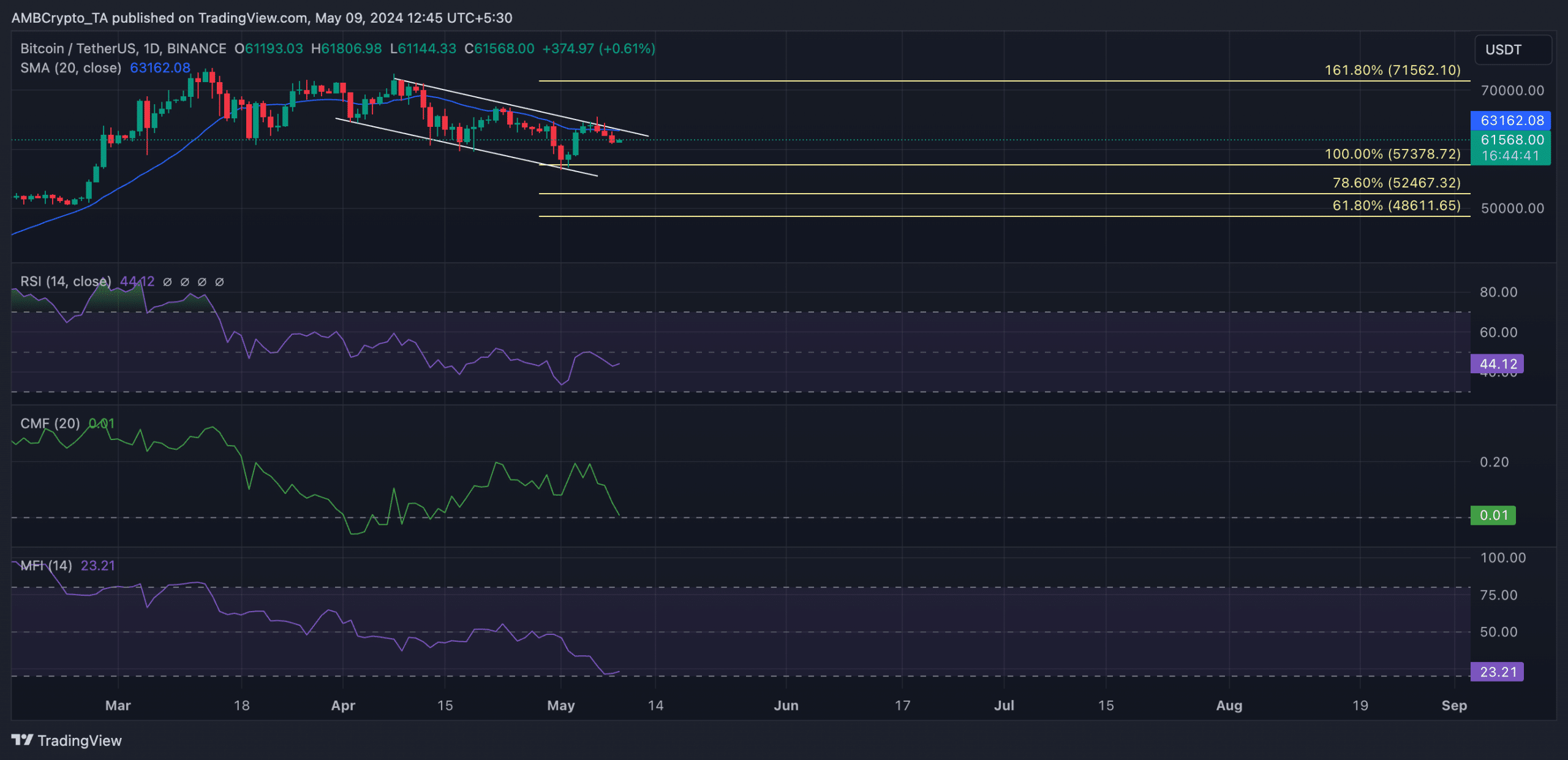

At press time, BTC exchanged fingers at $61,621. The coin just lately crossed beneath its 20-day easy transferring common (SMA), placing it liable to an extra decline within the quick time period.

When an asset’s worth falls beneath its 20-day SMA, it means that the short-term pattern for the asset is downward.

Market members typically view this as an indication that sellers are in management and that the asset’s worth will possible proceed declining.

Readings from BTC’s worth motion on a 1-day chart confirmed that its worth fell beneath its 20-day SMA on the seventh of Might and has since witnessed a 3% decline in its worth.

Additional, the coin has seen a decline in demand amongst basic market members. An evaluation of its key momentum indicators confirmed them beneath their respective middle strains at press time.

For instance, the coin’s Relative Energy Index (RSI) was 44.12, whereas its Cash Move Index (MFI) was 23.21. At these values, the symptoms confirmed vital bearish stress out there.

Likewise, as of this writing, the coin’s Chaikin Cash Move (CMF) was poised to cross beneath the zero line. This indicator measures the cash stream into and out of the coin’s market.

A CMF worth beneath zero signifies market weak point, suggesting elevated liquidity exit.

Supply: BTC/USDT on TradingView

If the bears strengthen their place, they might pull the coin’s worth right down to the assist line of BTC’s descending channel sample.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

If this occurs, the main cryptocurrency asset will alternate fingers on the $57,000 worth area.

Nonetheless, if this bearish projection is invalidated as bullish exercise positive factors momentum, BTC’s worth might rally towards the sample’s resistance line and try a crossover.