mphillips007

Introduction

It is time to speak about homebuilders! On this case, the most important homebuilder within the U.S., with a give attention to lower-priced properties, which is the candy spot on this market.

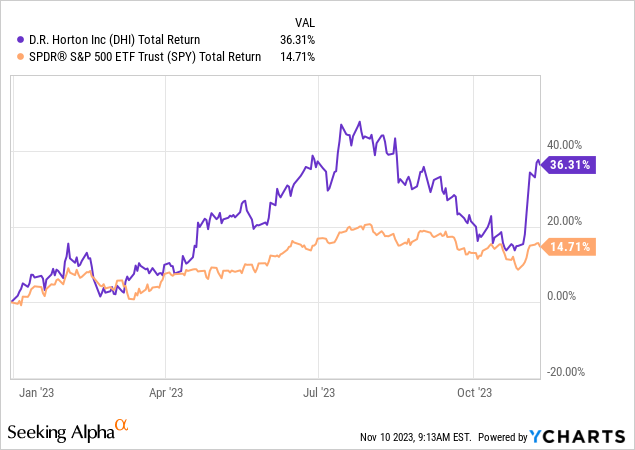

That firm is D.R. Horton (NYSE:DHI), which lately launched its earnings and noticed an enormous bounce in its inventory value as traders began betting on decrease charges once more.

Nonetheless, I have not been a giant fan of the sector, as I merely don’t consider that the large rally in homebuilders is sustainable.

That is what I wrote in an article in August:

As a lot as I like each LEN and DHR, the businesses are in a difficult spot. They’ll solely proceed the present development streak if the housing provide stays low.

I additionally count on that margins will stay below stress as rates of interest have not but come down.

As most homebuilders have nearly doubled from their 52-week lows, I consider the dangers of compelled promoting attributable to potential financial stress make new investments at these ranges unattractive.

After my article was revealed, homebuilders dropped because the market began to cost in a higher-for-longer state of affairs.

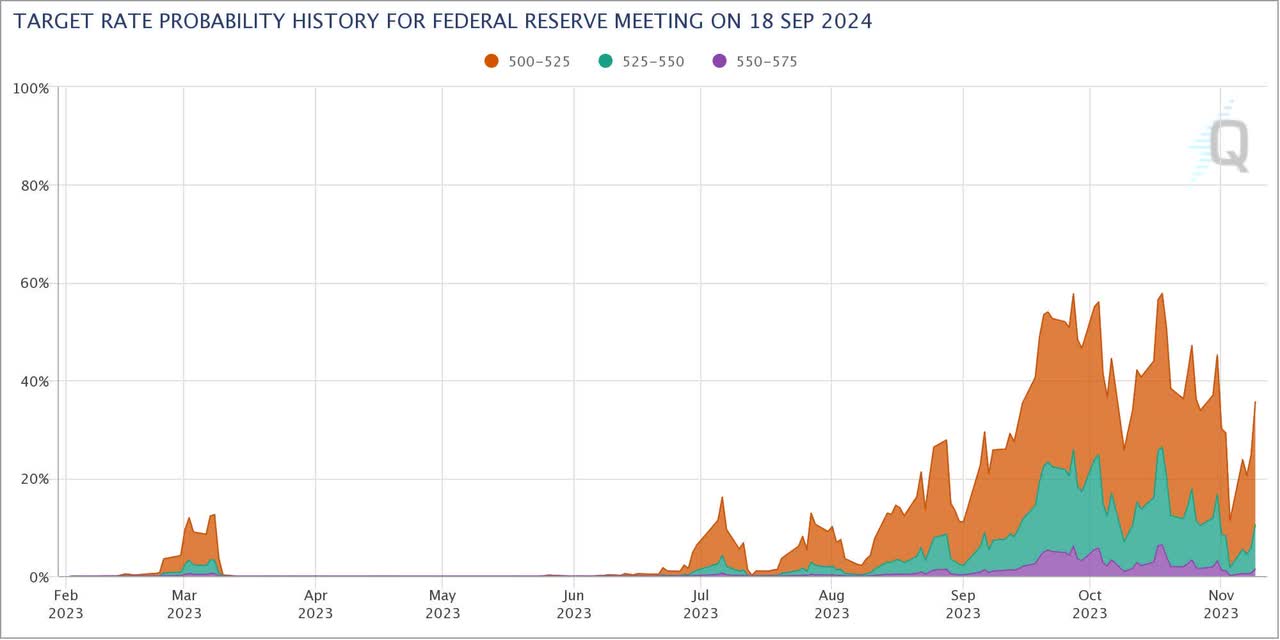

The chart beneath reveals the implied chance of a >5.00% Fed Funds fee on September 18, 2024.

Once I wrote the aforementioned article, that quantity was near zero. It then rose to 60%, pressuring the market and homebuilders.

CME Group

after falling roughly 40 factors, the quantity has risen again to roughly 40% after Powell made clear that not attaining the inflation goal is the largest threat going through the Fed.

Nonetheless, folks aren’t promoting their properties, which fuels homebuilding demand, no matter elevated charges!

Why I am Not Shopping for Homebuilders

This 12 months may be very difficult for the homebuilder thesis. Homebuilders are doing nicely. That is not the difficulty. It is simply that it appears to be a thesis on skinny ice, pushed by uncommon tailwinds.

In any case, house builders are primarily benefitting from elevated charges as a result of individuals are refusing to promote their properties. This will increase the necessity for brand spanking new properties to considerably alleviate the affordability disaster.

The opposite day, Bloomberg wrote an article on the damaged housing market.

Bloomberg

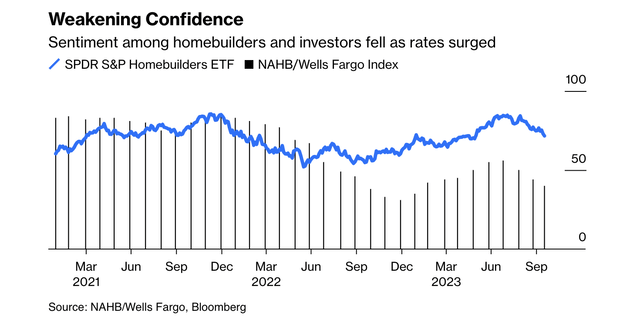

In keeping with the article, the latest surge in mortgage charges, reaching as excessive as 8%, has created a difficult setting for homebuilders. Because of this, revenue margins are below stress, impacting the feasibility of development initiatives.

That is hurting sentiment, as confidence amongst homebuilders is declining, as mirrored within the Nationwide Affiliation of Residence Builders/Wells Fargo sentiment gauge reaching its lowest stage since January. This decline in confidence is more likely to affect future manufacturing plans.

Bloomberg

What’s fascinating is that not like in 2022, when homebuilders had been a shiny spot available in the market, the present state of affairs is characterised by eroding confidence and diminishing revenue margins.

The benefit of shopping for down home-loan charges, a method employed in 2022, is now tougher, with charges round 8%.

Given these developments, I consider that if we see a state of affairs the place individuals are compelled to promote on account of, i.e., elevated unemployment, we may see a rising housing provide, pressuring house builders in a possible stagflation setting.

Nonetheless, D.R. Horton continues to do nicely.

D.R. Horton Is Doing Simply Effective

As I write in most articles, D.R. Horton is not simply the most important homebuilder in the US, with a market share near 14% (up from 6% in 2011), nevertheless it additionally focuses on a market that desperately wants provide.

68% of properties shut with a price ticket of lower than $400 thousand.

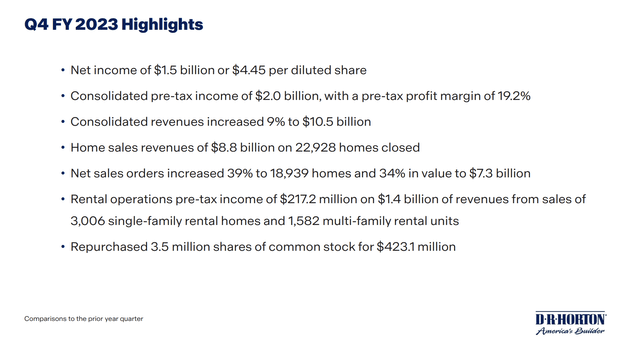

In its just-released quarter, it reported proof that it is certainly benefiting from surprisingly favorable dynamics.

Regardless of excessive mortgage charges and inflationary pressures, web gross sales orders elevated by 39% from the prior 12 months quarter.

D.R. Horton

The demand for brand spanking new and current properties at reasonably priced value factors stays excessive, and favorable demographics help housing demand.

Therefore, the corporate goals to consolidate market share by supplying extra properties at reasonably priced value factors, which has been its technique for greater than a decade.

- The order worth of latest orders elevated by 34% to $7.3 billion.

- The cancellation fee was 21%, up from 18% sequentially however down from 32% within the prior 12 months.

- Energetic promoting communities elevated by 2% sequentially and 10% from the prior 12 months.

Therefore, changes are made to handle altering market circumstances and better mortgage charges, together with elevated use of incentives and diminished house sizes for higher affordability.

Usually talking, that is unhealthy for margins. Nevertheless, the corporate’s margins remained steady.

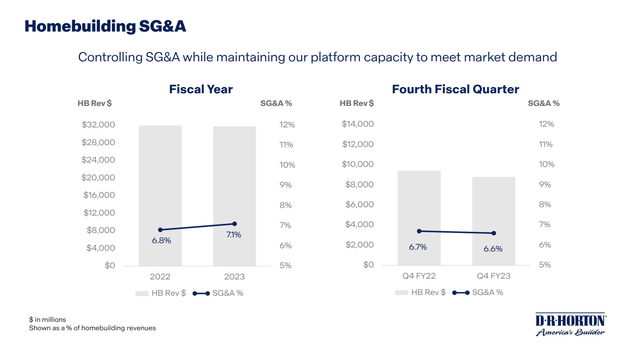

- Within the fourth quarter, homebuilding SG&A bills elevated by 2% from the earlier 12 months. As a share of revenues, it decreased by ten foundation factors in comparison with the identical quarter within the prior 12 months, reaching 6.6%.

- For the total 12 months, homebuilding SG&A was 7.1% of revenues, up by 30 foundation factors from fiscal 2022. The corporate goals to regulate SG&Some time making certain it adequately helps the enterprise.

D.R. Horton

Associated to this, the corporate believes it’s well-positioned with skilled operators, versatile lot provide, and robust capital and liquidity positions.

Lot administration is a giant a part of its monetary flexibility.

As of September 30, the homebuilding lot place consisted of roughly 568,000 tons, with 25% owned and 75% managed by way of buy contracts. Notably, 35% of owned tons are completed, and 54% of managed tons can be completed upon buy.

The corporate’s aim is to generate robust money flows and constant returns.

The method to investing capital will stay disciplined, with a dedication to enhancing long-term worth. Capital can be returned to shareholders by way of dividends and share repurchases.

In the course of the fourth fiscal quarter, the corporate repurchased 3.5 million shares of widespread inventory for $423 million. The complete-year repurchases totaled 11.1 million shares for $1.2 billion, decreasing the excellent share rely by 3%.

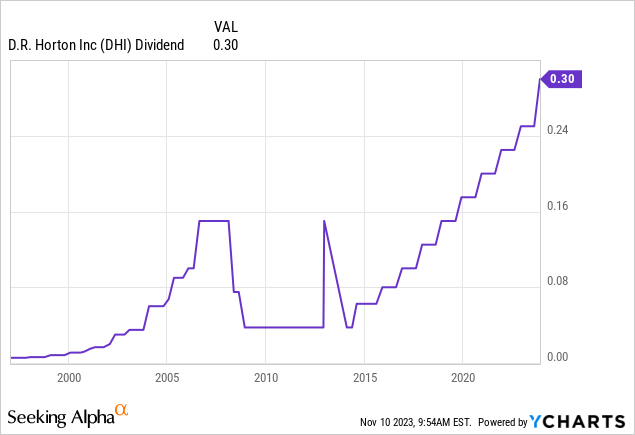

The Board of Administrators licensed the repurchase of as much as $1.5 billion of widespread inventory in October. The quarterly money dividend was elevated by 20% to $0.30 per share.

The dividend yield is 1.0%.

It maintains a BBB+ (one step beneath the A-range) credit standing with consolidated liquidity of $7.5 billion, making DHI probably the most financially steady homebuilders within the U.S.

Threat/Reward

Going into subsequent 12 months, the corporate expects difficult market circumstances within the first quarter of fiscal 2024, with consolidated revenues projected at $7.4 to $7.6 billion.

Anticipated properties closed by homebuilding operations vary from 18,500 to 19,000.

The complete-year outlook contains consolidated revenues of $36 to $37 billion, with properties closed between 86,000 and 89,000. Money stream from homebuilding operations is anticipated to be roughly $3 billion.

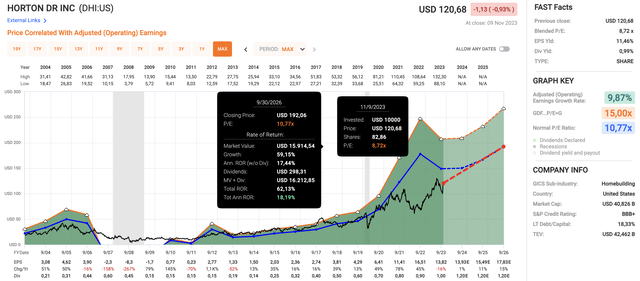

Analysts count on the corporate to develop earnings per share by 1%. Subsequent 12 months, EPS is anticipated to develop by 11%, adopted by a rise of 15% in 2025.

Having stated that, primarily based on these numbers, the inventory may rise to nearly $200 primarily based on a return to its multi-decade normalized P/E ratio of 10.8x. At the moment, DHI trades at a blended P/E ratio of simply 8.7x.

FAST Graphs

The issue is that these numbers depend on a positive macro setting.

Given present tendencies and what I mentioned within the first half of this text, it is not one thing I am keen to wager on.

I do know that many will disagree with me, which is okay, however I simply can not get myself to purchase homebuilders until we get a 20% to 30% sell-off.

The Fed simply made clear that it’ll prioritize combating inflation over financial stability, which doesn’t bode nicely for homebuilders – and the market usually.

Nevertheless, I did put DHI on my watchlist, as it is a homebuilder that might add nice worth to my portfolio.

Takeaway

Regardless of a tricky housing market and inflationary pressures, D.R. Horton reported a 39% improve in web gross sales orders, demonstrating elevated demand for reasonably priced housing.

The corporate strategically addresses altering market circumstances and better mortgage charges, sustaining steady margins.

With a disciplined method to capital, robust monetary stability, and a give attention to shareholder worth, D.R. Horton units itself aside.

Whereas market circumstances pose challenges, the corporate’s outlook stays constructive, supported by analysts’ expectations of future earnings development.

The inventory’s potential, nevertheless, hinges on a positive macro setting, an element that might flip right into a headwind if financial development additional deteriorates earlier than the Fed has reached its inflation goal.

Therefore, I stay on the sidelines to attend for a greater threat/reward.