The co-founder and CEO of market intelligence agency CryptoQuant thinks that Bitcoin exchange-traded funds (ETF) inflows might propel BTC to a brand new all-time excessive within the coming months.

Ki Younger Ju tells his 332,900 followers on the social media platform X that in a bullish situation, he sees Bitcoin surging above $100,000 by the tip of 2024.

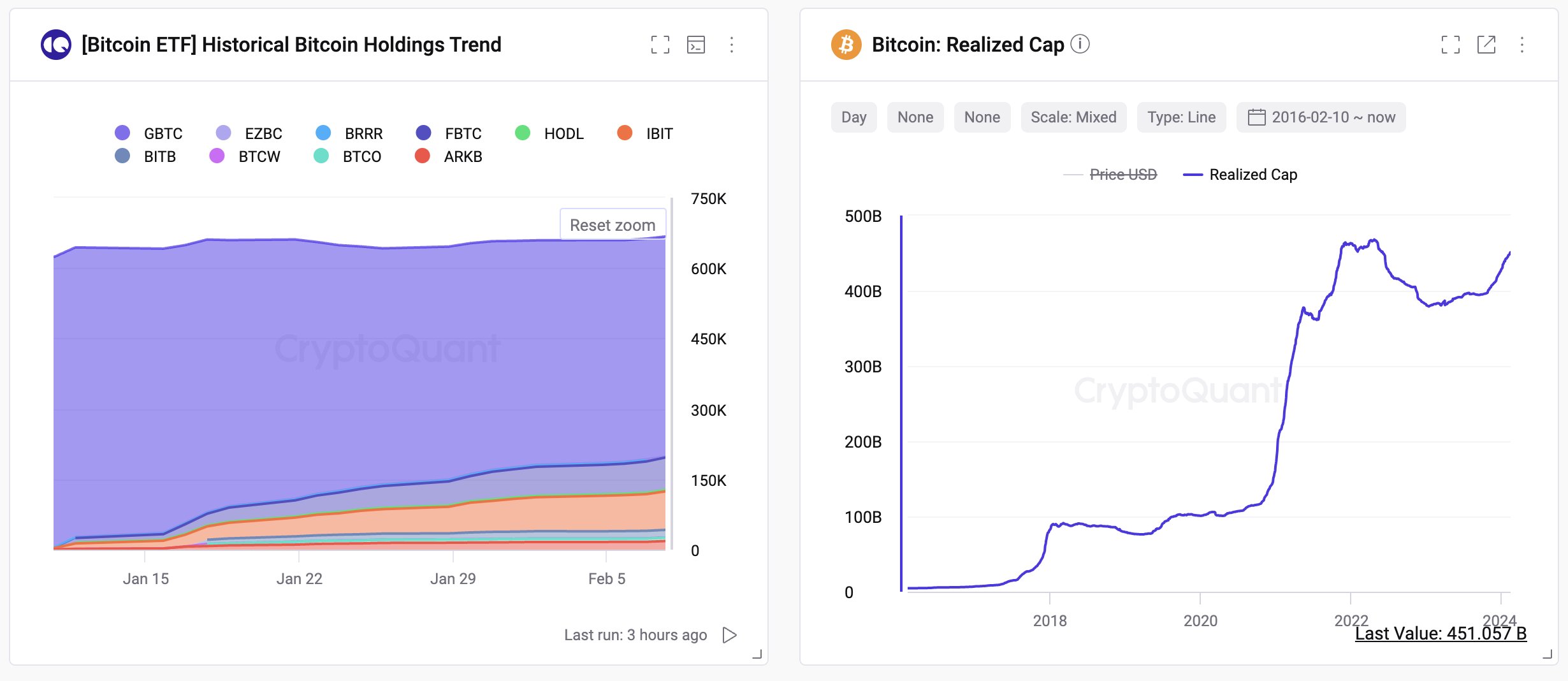

The analyst bases his prediction on two metrics: BTC ETF inflows and Bitcoin’s realized cap, an on-chain metric that makes an attempt to supply a greater estimate of the crypto king’s market capitalization by eliminating long-lost and unclaimed cash within the calculation.

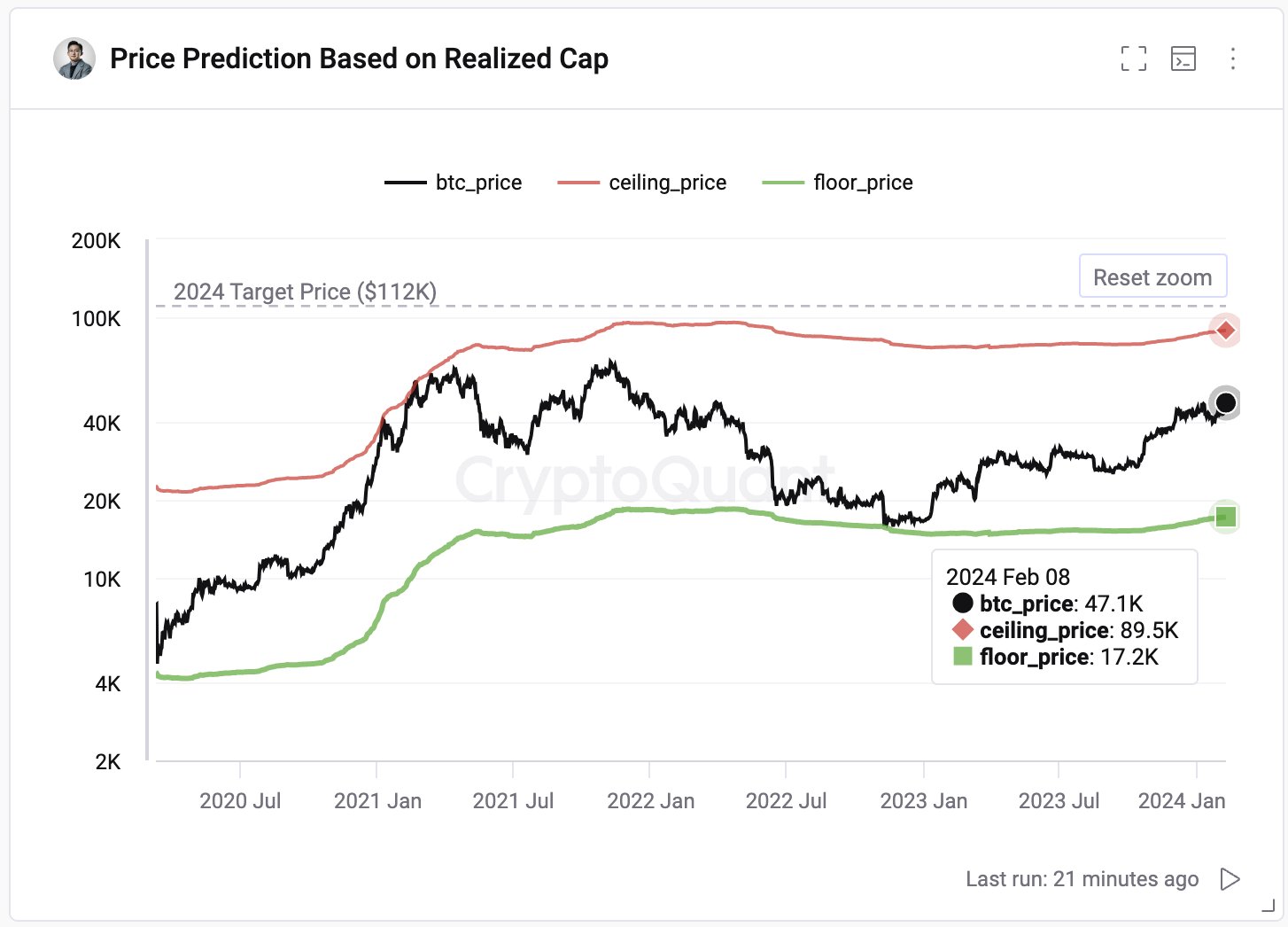

Utilizing BTC’s realized cap, the CryptoQuant CEO identifies the potential ceiling and flooring costs for Bitcoin this 12 months.

“Bitcoin might attain $112,000 this 12 months pushed by ETF inflows, worst-case $55,000.”

Wanting nearer on the on-chain metric, Ki Younger Ju says Bitcoin’s realized cap presently sits at $451 billion. However he says ETF inflows might push BTC’s realized cap to greater than half a trillion {dollars}.

“[The] Bitcoin market has seen $9.5 billion in spot ETF inflows monthly, probably boosting the realized cap by $114 billion yearly.

Even with GBTC (Grayscale Bitcoin Belief) outflows, a $76 billion rise might elevate the realized cap from $451 billion to $527-$565 billion…

With present spot ETF influx tendencies, the highest worth might attain $104,000-$112,000.”

At time of writing, Bitcoin is buying and selling for $48,378, up practically 2% within the final 24 hours.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Generated Picture: Midjourney