Since peaking on March 17, Solana has maintained a singular person depend constantly above 800,000, signaling a robust neighborhood engagement that displays positively on the Solana (SOL) value. Every day DEX trades on the blockchain stay excessive, underscoring sustained energetic participation.

Whereas the outlook for Solana stays bullish, it’s anticipated that the present consolidation section could persist a bit longer earlier than the token experiences a big uptick as soon as once more.

Solana Whole Worth Locked Stays Above $4 Billion

Lately, the Solana ecosystem has achieved a noteworthy achievement by surpassing the $4 billion mark in Whole Worth Locked (TVL) for the primary time since April 2022. This mark was reached on March 15, and since March 22, Solana TLV has remained above $4 billion.

This vital metric, which tallies the combination worth of property deposited throughout decentralized finance (DeFi) platforms inside Solana, serves as a crucial indicator of the ecosystem’s general well being, the effectiveness of its DeFi functions, and the diploma of person engagement. The current uptick in TVL reveals a revival of investor confidence and an escalating curiosity within the DeFi choices obtainable on Solana.

Traditionally, Solana’s TVL reached its peak in 2021, with figures hovering above $10 billion. This era of exponential development was adopted by a marked lower, resulting in a substantial contraction in TVL. The span from November 2022 to November 2023 noticed the TVL fluctuating inside the vary of $250 million to $350 million, indicating a section of stabilization and consolidation for the Solana ecosystem.

This section was essential in laying the muse for the following revival, because it mirrored a interval of equilibrium that in the end paved the way in which for the present surge in DeFi exercise on Solana.

Learn Extra: Solana vs. Ethereum: An Final Comparability

Solana Customers and DEX Trades Stay Sturdy

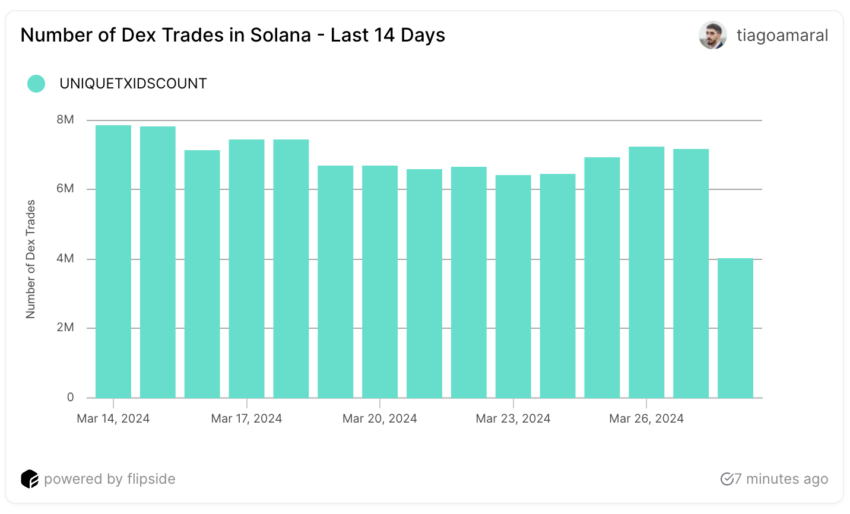

A notable occasion was the unprecedented each day quantity of Decentralized Change (DEX) transactions, reaching a file 7.86 million on March 14, setting a brand new excessive. From March 14 onwards, Solana’s DEX buying and selling quantity constantly exceeded 6 million transactions each day, a stark distinction to the interval earlier than December 2023 when each day transaction volumes peaked at 2.2 million on Solana DEXs.

Between March 19 and 24, distinctive each day DEX trades have been all the time across the 6 million zone. Then, it began to develop once more, reaching greater than 7 million from March 25 to March 27.

One other metric drawing consideration from Solana’s on-chain analytics is the Every day Distinctive Transaction Signers, which gauges the variety of distinctive customers transacting on the community every day.

Beginning in January 2024, there’s been a constant rise on this metric. It reached 823,000 customers by March 14 and soared above 2,000,000 by March 17. That represents a rise of 143% in simply three days. But, after surpassing 2,000,000 each day distinctive customers, the depend of each day signers started to decrease, dropping to 936,000 by March 21. After some consolidation, that quantity began to rise once more.

Solana registered 873,000 distinctive customers on March 23, and that quantity grew to 1.1 million on March 27.

SOL Value Prediction: EMA Strains Are Drawing a Consolidation

The SOL 4-hour value chart clearly signifies the 20 EMA line nearing a dip beneath the 50 EMA line. EMAs, extra responsive than SMAs, adeptly replicate market traits by weighting current value actions, essential for figuring out development instructions and reversals.

When the shorter-term 20 EMA crosses underneath the longer-term 50 EMA, it sometimes alerts a shift in direction of bearish momentum. This motion typically ushers in a consolidation section, the place costs stabilize because the market reaches equilibrium between consumers and sellers.

Observing the SOL value chart, it’s evident that whereas short-term EMAs stand nicely above the longer-term ones, they’re aligning with present value ranges. That signifies that SOL is certainly present process a consolidation section.

Learn Extra: High 6 Tasks on Solana With Large Potential

Ought to Solana bear a correction, it could take a look at the $167 help degree. If SOL fails to carry, the following potential help is at $137. Nonetheless, ought to the bullish momentum resume, this consolidation might function a springboard. This might doubtlessly propel SOL again to its journey to a brand new all-time excessive. Its earlier file is $259.97, reached in November 2021.

Disclaimer

In step with the Belief Undertaking tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.