halbergman

Mortgage charges formally hit 8% right now. It’s wonderful contemplating mortgage charges had been as little as 2.5% again in simply 2020. Nevertheless it isn’t the excessive charge that’s so alarming – it’s the speed of change. And that is what separates this era from any interval up to now.

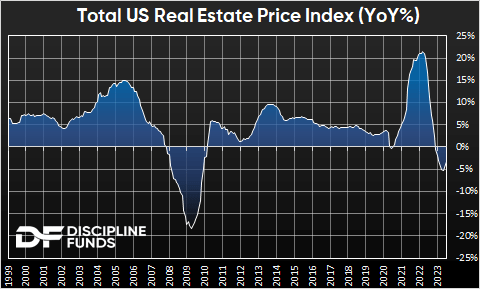

The Fed has made an unprecedented change within the tempo of charge hikes. However the enjoyable half concerning the Everybody Will get a Narrative Financial system is that relying on the place you look, the true property market is or isn’t damaged.

As an illustration, let’s have a look at simply how bifurcated the true property market has develop into. The industrial aspect is in a demise spiral.

Industrial costs are down 16% and financing for industrial offers has evaporated. Make money working from home has created enormous extra stock, and there’s $2T+ of debt that’s going to be rolling within the coming few years.

In the meantime, residential has additionally frozen, however earn a living from home made our properties extra useful and rising rates of interest locked most present residence house owners of their “Golden Handcuffs”. So there’s no compelled promoting, low inventories and excessive unaffordability. And costs at the moment are… up 1% from a 12 months in the past.

While you dig into the information, it’s a catastrophe. Present residence gross sales are down 40%+. The NAHB Residence Builder Sentiment Index is plumbing its current lows.

Mortgage functions are at a 25-year low. And the purchase:hire index is simply sitting at ranges that we final noticed earlier than the Housing Bubble. It’s exhausting to border actual property information as something apart from unhealthy.

It’s additionally wonderful as a result of you may each argue that the true property market is completely damaged, however you too can argue that the housing market is holding up remarkably properly within the face of some very robust headwinds.

What’s Coming Subsequent?

We’ve lengthy been saying that this challenge can not resolve itself with out one or two issues taking place:

- The Fed wants to chop charges again to about 2-3% to convey mortgage charges under 5%.

- Actual property costs have to expertise much more ache.

Given the bifurcation in industrial and residential, it’s exhausting to see the tremendous bearish case for residential until the employment scenario will get rather a lot worse. That’s the lynchpin holding a variety of this collectively. And if it worsens, then we’d all have to buckle up.

However to date that hasn’t been the case. Industrial stays a ticking time bomb, however is vastly smaller than residential, so it performs a much less vital position within the broader economic system. And because the Fed is holding up the Golden Guillotine of bond losses in financial institution steadiness sheets, that hasn’t been as worrisome as anticipated earlier this 12 months.

So it’s all holding collectively, even when it feels just like the “that is nice” meme. However as I’ve been saying for the previous couple of years, this ain’t over. Not by a protracted shot. One or each of the above circumstances will occur with absolute certainty within the coming years. The query is whether or not we get there in a panicky method or if we get there in a managed method.

Editor’s Be aware: The abstract bullets for this text had been chosen by Looking for Alpha editors.