- Current information prompt a decline in promoting stress, indicating potential for a market aid rally.

- Optimistic shifts have been seen in Bitcoin’s MVRV ratio and lively addresses, signaling an optimistic market pattern.

The worldwide crypto market briefly surpassed a market capitalization of $2.35 trillion earlier on the 2nd of July earlier than experiencing a slight contraction, dropping about $10 billion in market cap worth.

This downturn was partly attributed to Bitcoin [BTC], which noticed a lower from its 24-hour peak of $63,790 to its press time worth of $62,461, marking a 1.2% discount throughout this era.

Indicators of a aid rally

Because the mud settles from a tumultuous June, market analysts are hinting on the onset of a “aid rally.” In keeping with insights from the crypto intelligence platform Santiment, the market may very well be at a turning level.

Earlier, Santiment shared insights on X (previously Twitter), suggesting a shift in market dynamics as a consequence of decreased promoting stress on exchanges. The platform famous,

“After a lot small dealer capitulation, the gang’s negativity and common dealer losses signifies that a aid rally could be starting.”

Minkyu Woo, an analyst and verified creator at CryptoQuant, echoed this sentiment in a latest evaluation.

He noticed that the exhaustion of sellers was changing into obvious as the common measurement of high Tether [USDT] outflows from exchanges decreased, following a major surge in June.

Woo said,

“This discount in outflows means that buyers are extra inclined to carry their property quite than withdrawing money from the market. This might suggest that investor sentiment has turned extra optimistic following the Bitcoin halving occasion.”

Bitcoin: Are there indicators of bullishness?

To gauge the bullish sentiment additional, analyzing Bitcoin’s key metrics is important.

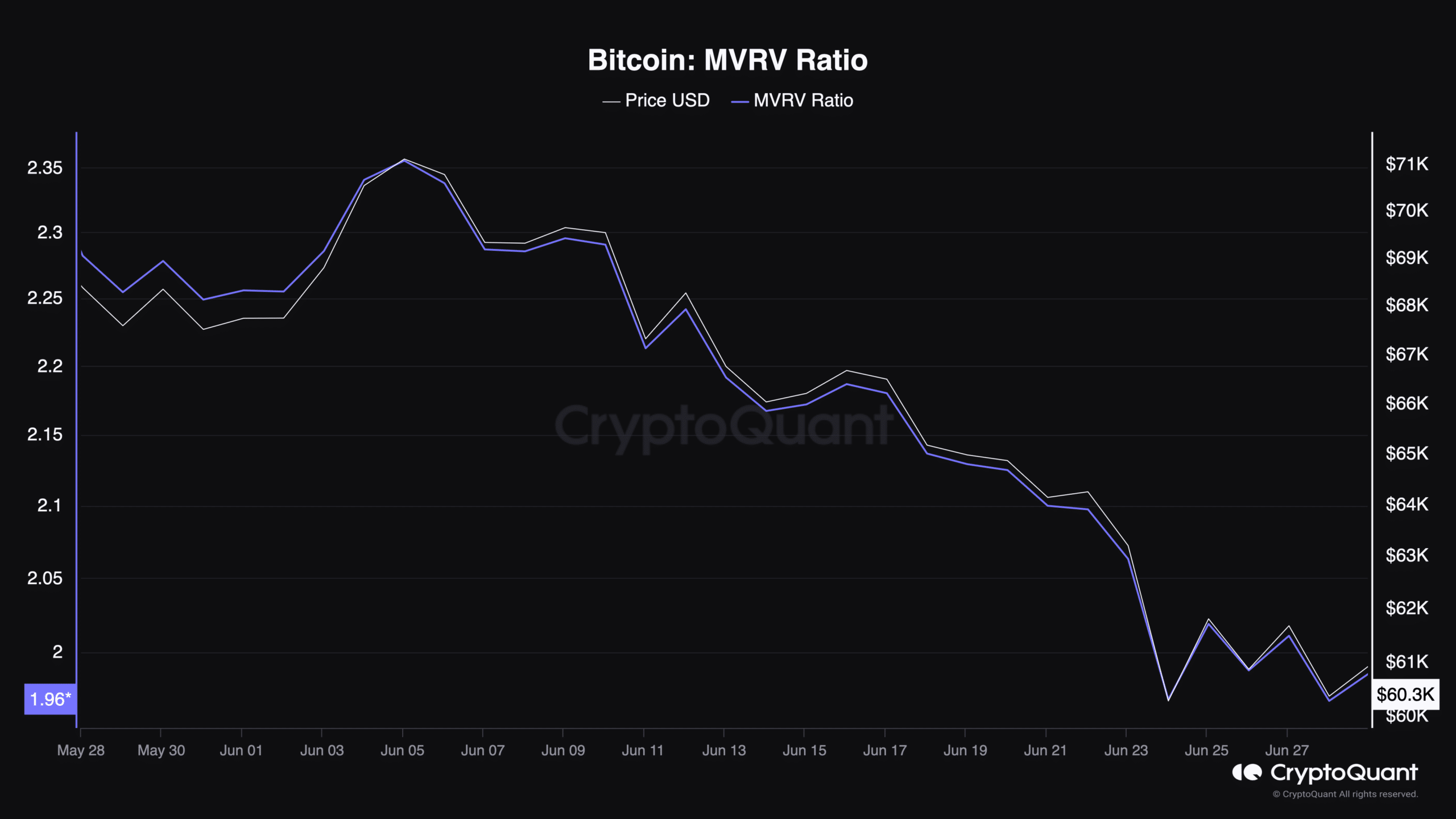

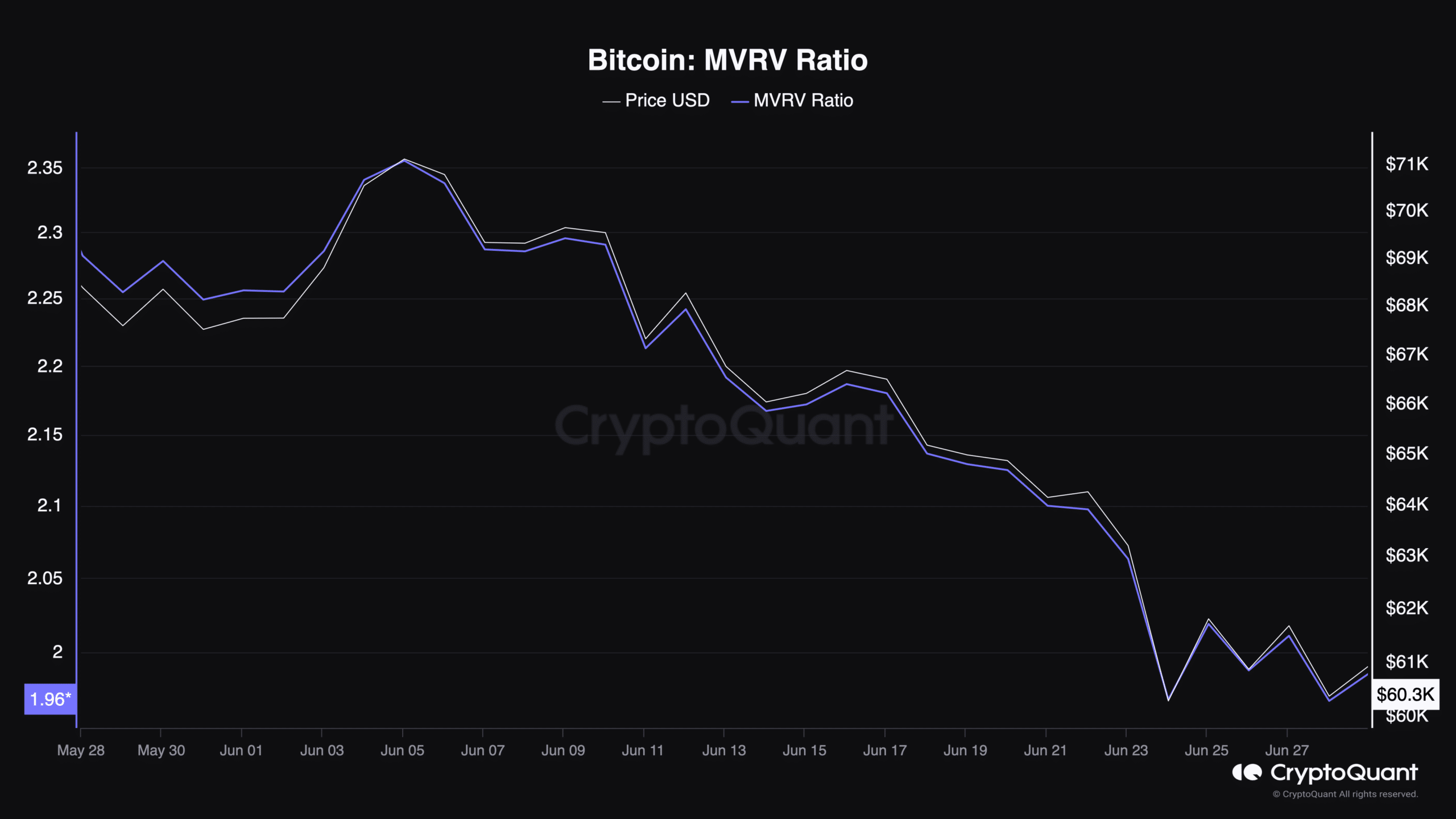

So, AMBCrypto famous that the Market Worth to Realized Worth (MVRV) ratio, a major indicator of market sentiment, has not too long ago proven a decline of practically 1%. At press time, the MVRV ratio was 1.96.

Supply: CryptoQuant

This metric measures the disparity between the market worth and the realized worth of Bitcoin, with a decrease ratio usually indicating undervaluation, doubtlessly signaling shopping for alternative or a bottoming market.

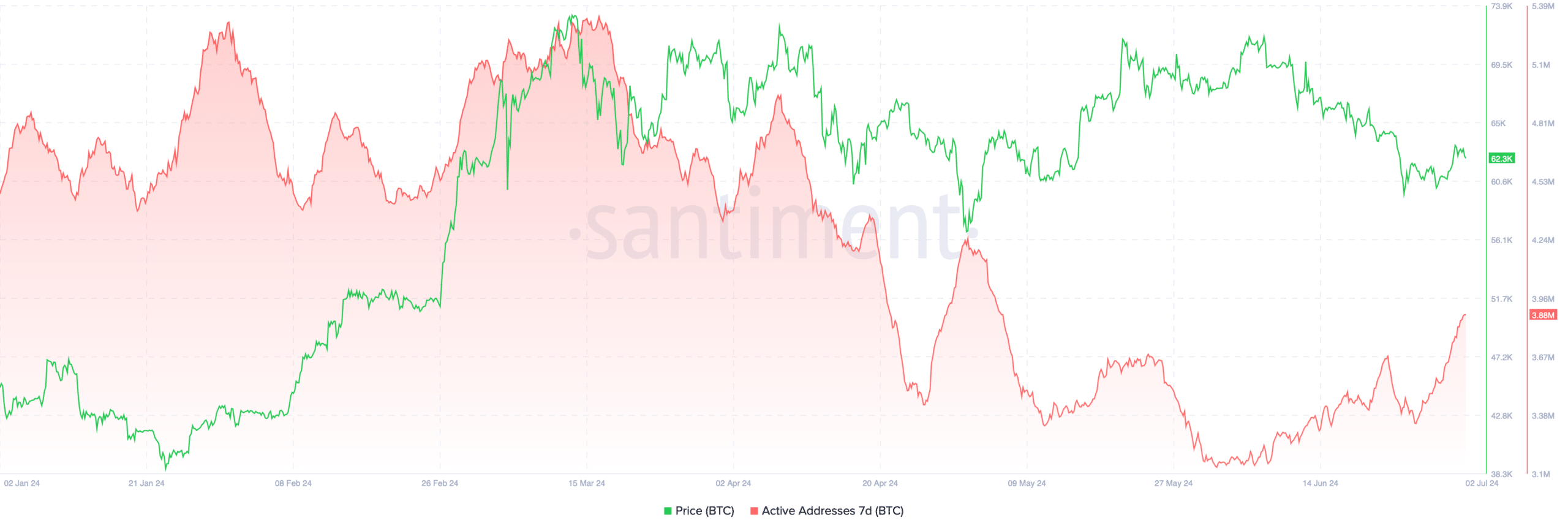

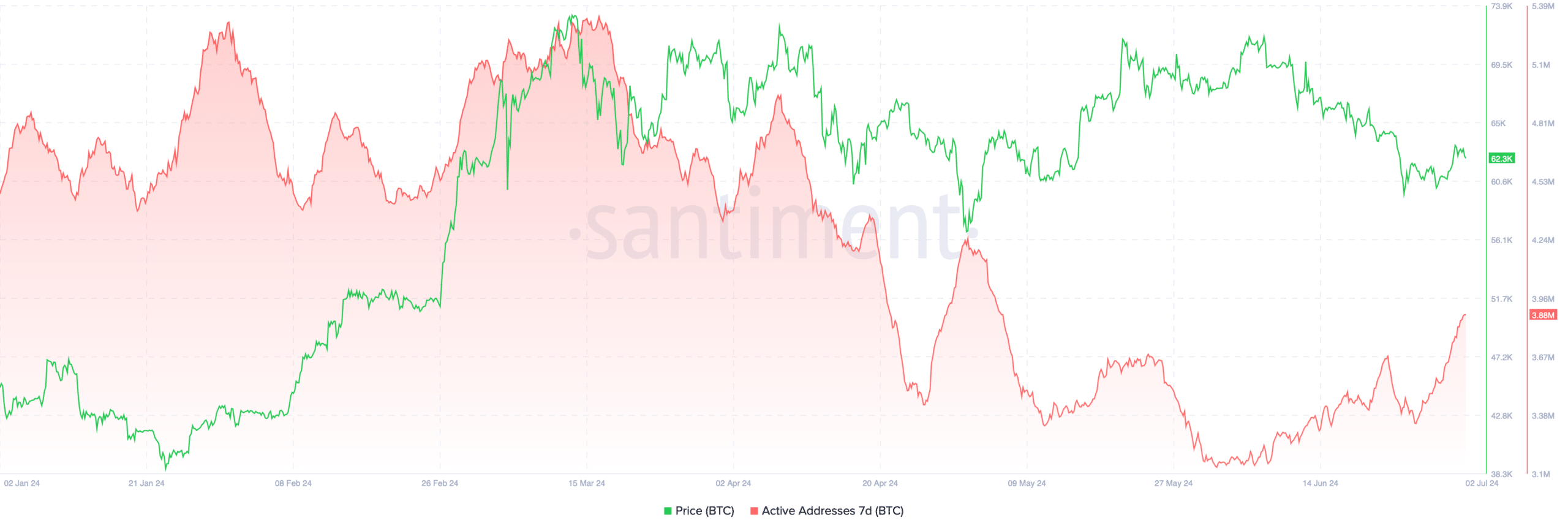

Moreover, Bitcoin’s community exercise has seen an uptick, with the variety of active addresses rising from 3.14 million in early June to roughly 3.88 million at press time.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

A rise in lively addresses sometimes suggests a rising person engagement and could be a optimistic signal for the market’s well being and bullish potential.

Supply: Santiment

This bullish outlook coincided with AMBCrypto’s latest report on BTC that the asset’s miner reserves have shot up, which could point out that the promoting from the miners could be cooling off.