- Chainlink has a bullish market construction at press time.

- The dip would possibly prolong towards $16, bulls can enter at this liquidity cluster.

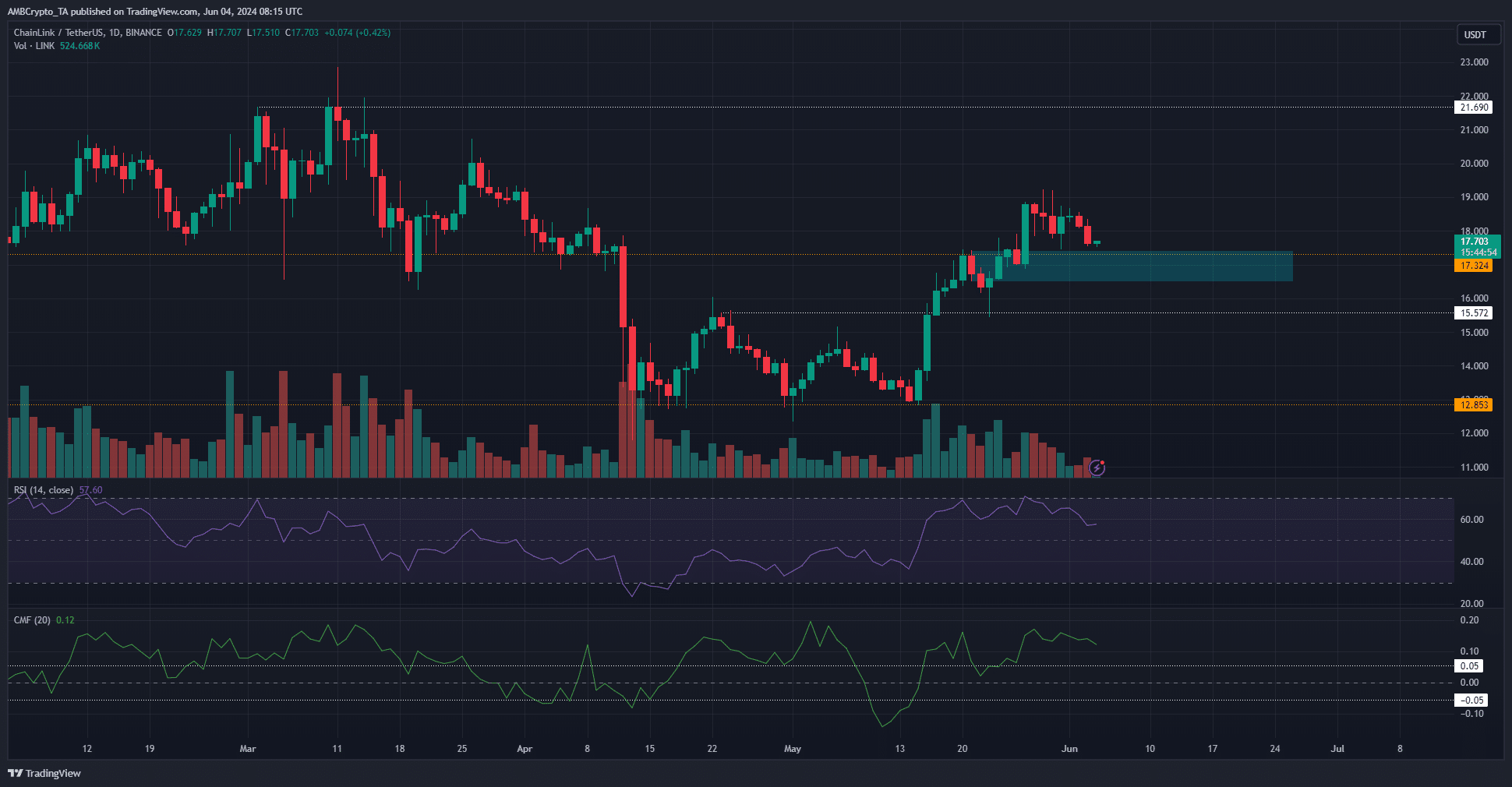

Chainlink [LINK] noticed a get away previous the $17.1 resistance stage final week. The worth approached this stage at press time and is predicted to rebound larger after testing it as assist. The technical indicators had been bullish too.

The Chainlink value prediction is that we’ll doubtless have a double-digit share rally within the subsequent month or two. Nonetheless, the upper timeframe pattern lacked bullishness as LINK ranged between $12 and $21 since November 2023.

The day by day chart confirmed an intense bullishness

Supply: LINK/USDT on TradingView

After climbing above the $16.04 stage in mid-Might, the market construction was bullish as soon as extra. The RSI on the day by day chart confirmed a studying of 57.6 to replicate upward momentum was favored.

The Chaikin Cash Stream’s +0.12 studying signaled sturdy capital move into the market. It emphasised agency shopping for stress. Subsequently, Chainlink is predicted to carry out properly within the coming days.

The previous resistance zone at $17 has now been flipped to assist and the bulls are anticipated to carry the value above the $16.5-$17 area.

The current dip from $19 got here alongside a drop in buying and selling quantity, which bolstered the concept of weak promoting stress and continued beneficial properties.

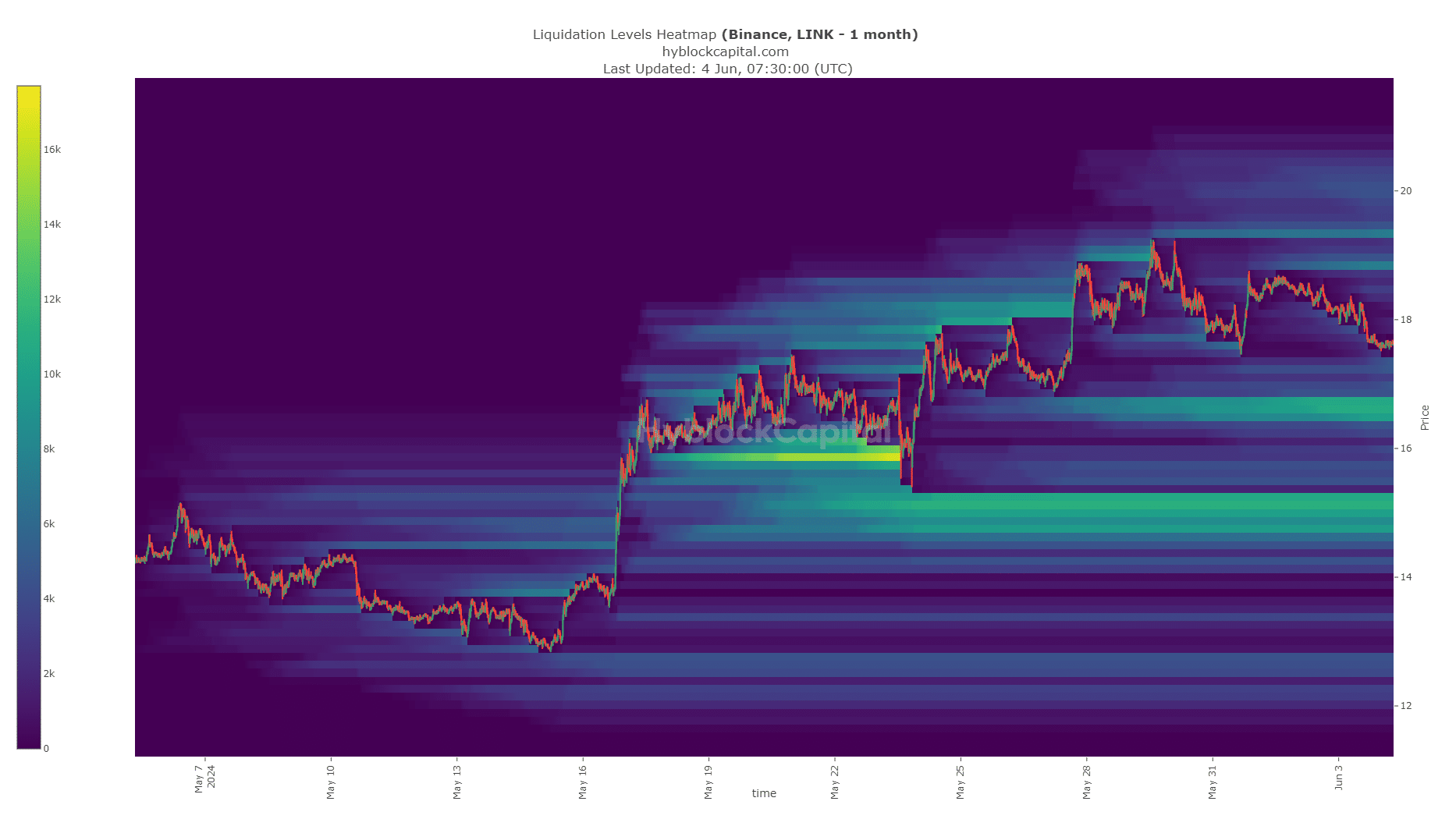

The following magnetic zone for LINK traces up with the technical findings

The liquidation ranges confirmed a cluster of lengthy liquidations on the $16.48-$16.7 space. This lined up with the demand zone highlighted on the 1-day value chart.

Learn Chainlink’s [LINK] Value Prediction 2024-25

Beneath the $16.5 liquidity pocket, the following cluster lies at $14.8-$15.4. The Chainlink value prediction is that we see a powerful bounce from the $16.5 assist zone to $19-$20, and presumably larger if Bitcoin [BTC] begins to pattern upward too.

A drop beneath $16.3 would point out the bulls are weak, and the drop would possibly then stabilize round $15.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different forms of recommendation and is solely the author’s opinion.