Hispanolistic/E+ by way of Getty Pictures

Introduction

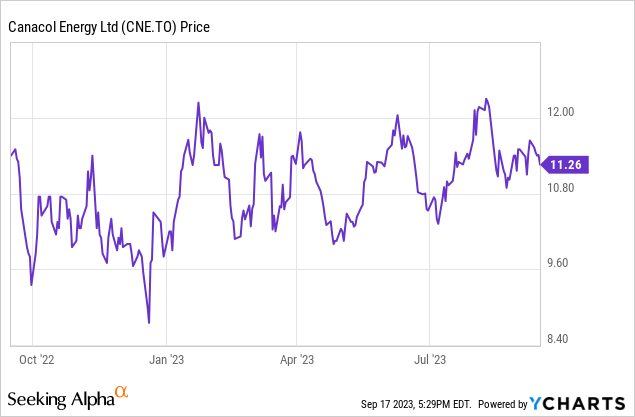

I’ve been following Canacol Power (TSX:CNE:CA) (OTCQX:CNNEF) for a number of years now, however I haven’t actually been too proud of the share value evolution. Regardless of having the ability to promote its pure gasoline at very flat costs (which might maybe clarify why buyers deserted the Canacol ship to pursue an funding in different pure gasoline producers that truly do provide higher publicity to the North American pure gasoline costs) and regardless of a robust (and coated) dividend, the share value stays too low.

I’ll proceed to regulate Canacol Power because it stays a sizeable place in my portfolio. The beneficiant dividends are useful, however I nonetheless hope to generate capital positive factors as effectively.

The money stream stays fairly sturdy because of the steady pure gasoline value

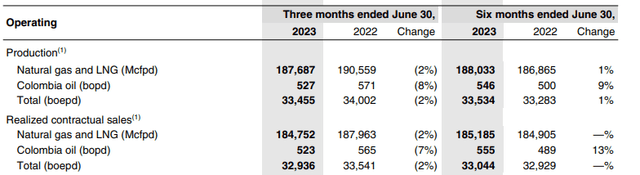

Canacol’s manufacturing fee has been fairly steady currently, as it is geared towards overlaying the demand quite than pushing the manufacturing considerably larger. In the course of the second quarter of the 12 months, the output remained nearly unchanged at 33,500 boe/day, of which 98.5% got here from pure gasoline. The overall gross sales quantity was about 185,000 MMcf per day after taking the native area consumption into consideration.

Canacol Power Investor Relations

The pure gasoline was offered at an average price of US$5.13 per mcf and whereas Canacol was “punished” for its comparatively mounted value round US$5/mcf when the North American pure gasoline costs have been trending larger, it’s totally clear Canacol is now making the most of the steady Colombian costs because the realized value is considerably larger than the costs in North America.

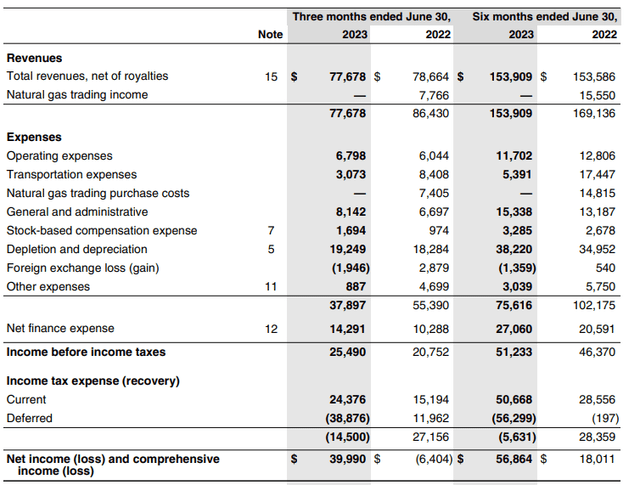

Because the output is steady and the realized value is fairly steady as effectively, it in all probability doesn’t come as a shock to see a fairly flat whole reported income, which came in at US$77.7M. That’s virtually precisely the outcome generated within the first quarter of the 12 months, so there undoubtedly aren’t any unfavourable surprises.

Canacol Power Investor Relations

That being mentioned, the working bills and transportation bills elevated considerably. Because of the very low price nature of each, the rise sounds fairly dangerous when expressed in a proportion (the manufacturing price elevated by 30% however this represented simply $1.8M, or lower than 3% of the income).

And naturally the corporate remained worthwhile: The pre-tax earnings was $25.5M and there was a tax good thing about $14.5M leading to a internet earnings of $40M or $1.17 per share.

As defined in earlier articles, the tax invoice varies tremendously in Colombia because the quarterly tax invoice takes the FX adjustments on the obtainable tax swimming pools into consideration. The normalized company tax fee in Colombia is 35% with a small surcharge based mostly on the oil manufacturing (however Canacol barely produces any oil, in order that surcharge is negligible).

Primarily based on a normalized 35% tax fee, the underlying internet earnings would have been US$16.6M for an EPS of US$0.49. That’s roughly C$0.65 based mostly on the present alternate fee.

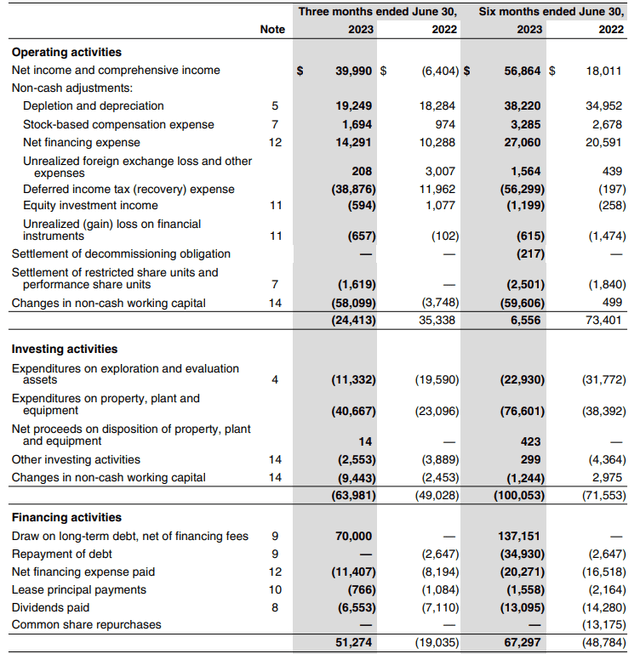

The money stream assertion is also a little bit bit distorted by these tax adjustments. The overall reported working money stream was a unfavourable 24.4M USD and even after including again the $58.1M in working capital adjustments, the $33.7M implied outcome was fairly low. This was brought on by an efficient excessive money tax cost associated to a restructuring on the finish of the earlier monetary 12 months. The normalized tax cost would have been round $9M for Q2, however Canacol needed to fork over in extra of $24M. The tax funds ought to normalize within the subsequent few quarters.

Canacol Power Investor Relations

This additionally implies that if we actually need to determine the corporate’s normalized money stream, we must always work with the normalized tax funds, indicating we must always add about $15M in taxes paid that weren’t owed. That being mentioned, we also needs to deduct $12M in lease and curiosity funds as these weren’t included but.

The normalized working money stream outcome was roughly $36.7M throughout the second quarter.

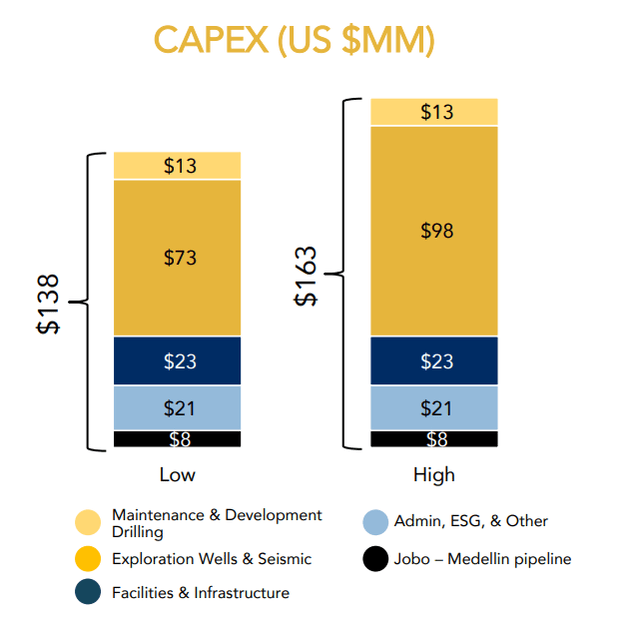

As anticipated, the capex remained very excessive as Canacol spent about $52M throughout the second quarter. This implies the corporate was primarily free money stream unfavourable however I already defined within the earlier articles Canacol is at the moment quickly “overspending” on capex to extend its reserves. It is aiming for a reserves alternative ratio of in extra of 200% and you may’t make an omelette with out breaking eggs: The budget includes $73-98M to be spent on exploration wells.

Canacol Power Investor Relations

As proven above, the whole capex excluding the brand new pipeline and excluding the exploration drilling could be round $57M. And that’s lower than $15M per quarter.

Am I thrilled the corporate is spending this a lot on capex? Not likely. However it’s a “mandatory evil” because the completion of the Jobo-Medellin pipeline will increase the demand for Canacol’s pure gasoline and it’ll stay essential to maintain the 2P reserves at an attractively excessive stage.

In the meantime, Canacol continues to pay a dividend of C$0.26 per share on a quarterly foundation. That is costing the corporate roughly US$6.5M per quarter (and if it wasn’t for the aggressive drill marketing campaign, this dividend could be very effectively coated). With Canacol’s share value buying and selling at simply C$11.26, the dividend yield is roughly 9.2% (topic to the Canadian dividend tax fee).

Funding thesis

I’ve an extended place in Canacol, and regardless of the beneficiant dividend funds, I am not a really pleased shareholder as the corporate’s share value has been fairly disappointing and at this second my whole return is just about zero.

That being mentioned, the corporate continues to ship on its guarantees and the only real level of criticism I had up to now few years (reserve growth) is now being handled. I’ve been including a little bit bit to my current place up to now few days.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. alternate. Please concentrate on the dangers related to these shares.