da-kuk

Funding thesis

My first bullish thesis about C3.ai (NYSE:AI) inventory didn’t age nicely for the reason that inventory has underperformed the broader U.S. market by far since August. Nevertheless, I don’t anticipate AI to be a fast win for the reason that firm is on the nascent phases of its enterprise life cycle, and substantial volatility is inherent to aggressive development firms. Really, current optimistic developments, together with optimistic earnings surprises, a strategic give attention to a recurring income buildup, and a powerful steadiness sheet, present a agency basis to construct long-term worth for shareholders. Furthermore, my valuation evaluation suggests the inventory is greater than 40% undervalued. To conclude, I reiterate my “Purchase” score for AI.

Latest developments

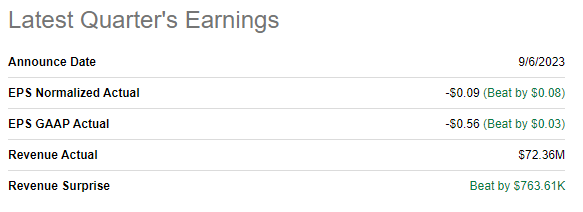

The most recent quarterly earnings had been launched on September 6, when the corporate topped consensus estimates. Income demonstrated a ten% YoY development., which is a stable enchancment in comparison with the earlier three quarters.

Looking for Alpha

As an investor who’s searching for a powerful potential long-term guess in C3.ai, consistency in delivering optimistic earnings surprises is essential. Due to this fact, it is very important underline that the corporate has by no means missed EPS consensus estimates because it went public, and there was just one slight income miss. Which means the administration is practical and truthful with development projections, which is kind of necessary for a development firm as a result of it showcases consistency in development trajectory. For a software program firm, securing recurring income from subscriptions is essential; I like that in Q1 FY 2024, subscription income constituted 85% of the entire. Increasing recurring income builds a secure basis for long-term income development.

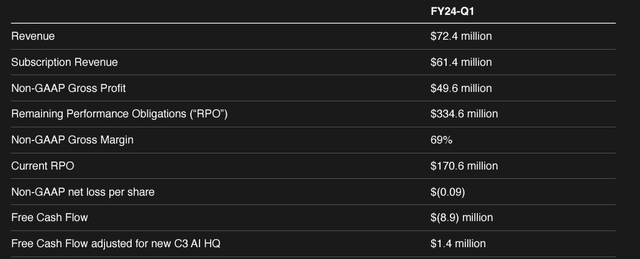

AI’s newest earnings presentation

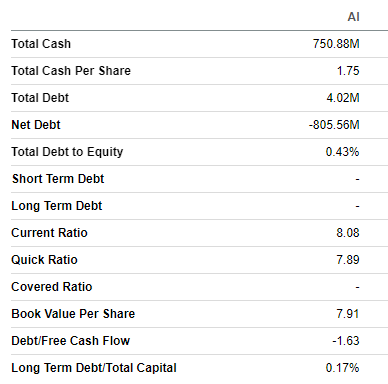

The corporate continues to be unprofitable, and its detrimental internet change in money in Q2 was virtually $80 million, which could appear a notable quantity. But when we evaluate it to AI’s large $800 million internet money place as of the final reporting date, the money burn charge doesn’t appear like an enormous downside. The steadiness sheet is a fortress with virtually no leverage and powerful liquidity, which provides the corporate a pair extra years to proceed growing its choices and investing closely in advertising and marketing.

Looking for Alpha

I like the corporate’s technique to construct a accomplice ecosystem to strengthen its market place. Based on the newest earnings name, 60% of agreements in Q1 had been closed by companions like Google Cloud, AWS, Microsoft, and Booz Allen Hamilton. By leveraging the strengths and capabilities of companions, C3.ai can simply faucet right into a broader vary of experience, which might doubtlessly unlock extra development alternatives. Having partnerships with huge names additionally makes the corporate extra serious about new collaborations, which may additional speed up market penetration, in the end providing extra income streams.

AI’s newest earnings presentation

Regardless of synthetic intelligence’s appearances in scorching headlines changing into uncommon, the business is booming, and it’s anticipated to compound at 19% CAGR over the subsequent decade, which is a large tailwind for C3.ai. As companies acknowledge the worth of synthetic intelligence options in streamlining inner processes and making data-driven selections, C3.ai, with its suite of purposes, is well-positioned to fulfill the elevated demand. The corporate’s expanding customer relationships with the U.S. Division of Protection [DOD] are a significant high quality signal for me as a result of authorities contracts, particularly associated to the nation’s security, normally have stringent necessities for know-how, safety, and compliance. The truth that C3.ai meets these excessive requirements provides me stable validation that the corporate’s know-how is powerful and safe. Having contracts with the DOD additionally provides numerous recognition and credibility to AI, which makes the corporate well-positioned to soak up secular business tailwinds.

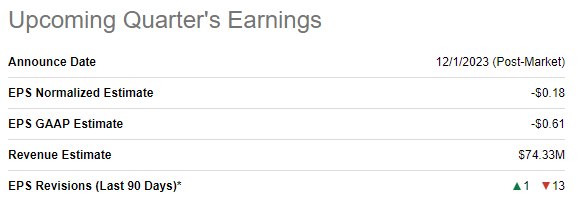

The upcoming quarter’s earnings launch is scheduled for December 1. Consensus estimates forecast quarterly income at $74.3 million, which signifies that the topline is anticipated to extend YoY by a formidable 19%. Income development acceleration is an efficient signal for traders, particularly amid the present extremely unsure macro atmosphere.

Looking for Alpha

Valuation replace

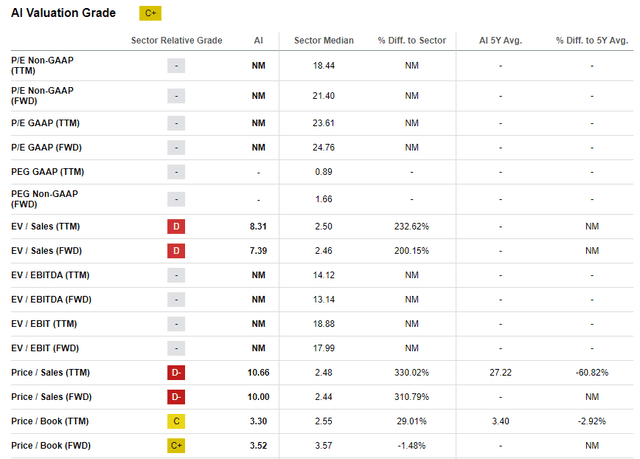

The inventory delivered a large year-to-date 140% rally, considerably outperforming the broader U.S. market. AI’s valuation ratios are considerably increased than the sector median. Nevertheless, contemplating the corporate’s stellar income development profile, excessive multiples don’t essentially imply overvaluation.

Looking for Alpha

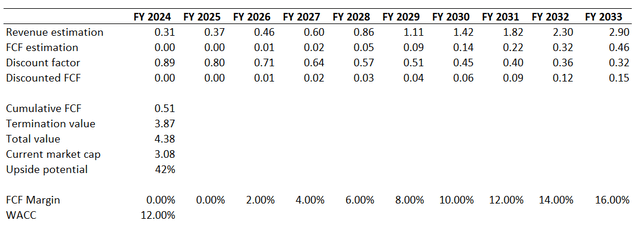

Due to this fact, let me proceed with the discounted money stream [DCF] simulation. I exploit an elevated 12% WACC on account of the truth that the corporate nonetheless doesn’t generate optimistic FCF, and there’s a excessive stage of uncertainty about when AI will really begin producing optimistic internet money flows. I exploit income consensus estimates projecting a staggering 28% CAGR for the subsequent decade, however I take into account this truthful given the corporate’s comparatively small scale and huge potential for the business. For the FCF margin, I’m conservative and anticipate the corporate to start out producing optimistic numbers solely in FY 2026 with an extra two proportion factors yearly enlargement.

Writer’s calculations

Based on my DCF evaluation, the enterprise’s truthful worth is about $4.4 billion, which means the inventory worth has a 42% upside potential. That mentioned, my goal worth for AI inventory is $37. Please additionally listen that I’m not including up the present substantial over $800 million internet money place to the truthful worth calculations to be conservative.

Dangers replace

AI is an aggressive development firm, and it nonetheless doesn’t generate working earnings, which suggests excessive dangers and a excessive stage of uncertainty for traders. In case the corporate doesn’t show the flexibility to enhance profitability because the enterprise scales up, traders may get thinking about the enterprise mannequin not economically viable. This may lead to an enormous inventory sell-off because of the traders’ disappointment. It would take a number of quarters of profitable earnings dynamics for the corporate to regain traders’ confidence within the inventory. That mentioned, potential traders ought to be able to tolerate substantial short-term volatility and maintain the inventory over the long run.

Synthetic intelligence is a scorching subject in the present day, and not one of the know-how giants plans to overlook this megatrend. Established gamers acknowledge huge synthetic intelligence potential and actively make investments substantial assets to dominate this area. AI’s spare capital represents a tiny portion of the hyper-scaler firms’ deep pockets, which means that bigger firms are free to pursue extra aggressive improvement methods, making it an enormous problem for smaller gamers like C3.ai to compete.

Backside line

To conclude, regardless of current market underperformance, AI continues to be a great funding alternative and continues to be a “Purchase”. The corporate is well-positioned to soak up business tailwinds with the administration’s strategic give attention to recurring income and practical planning, which I see in constant optimistic earnings surprises. Whereas dangers for potential traders exist, I consider that the huge upside potential outweighs all of the dangers and uncertainties if traders are able to tolerate short-term volatility.