- The BNB market has not trended previously two months, however merchants nonetheless have alternatives.

- Traders can take coronary heart from the similarities between the early 2024 consolidation and the present one.

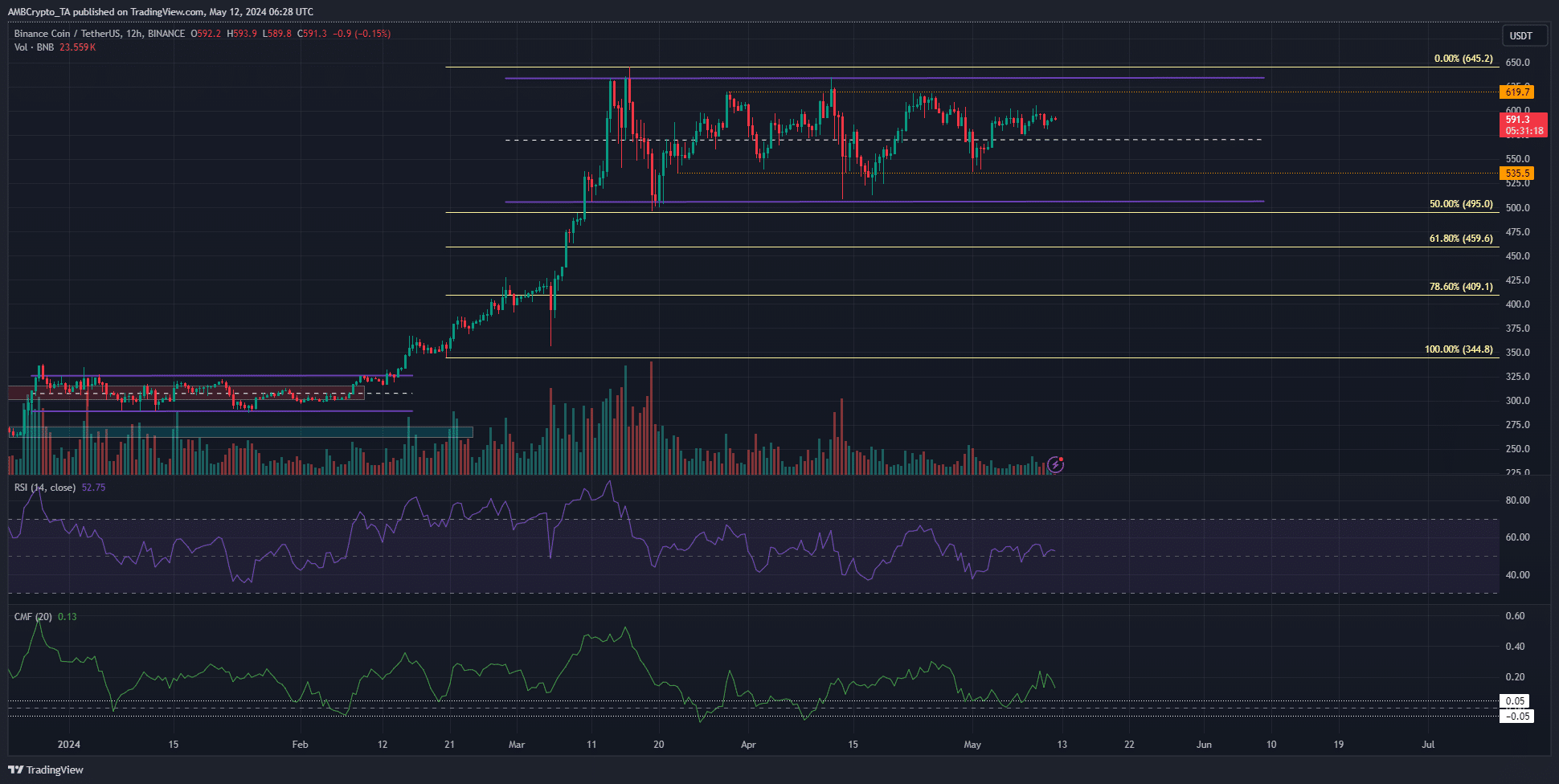

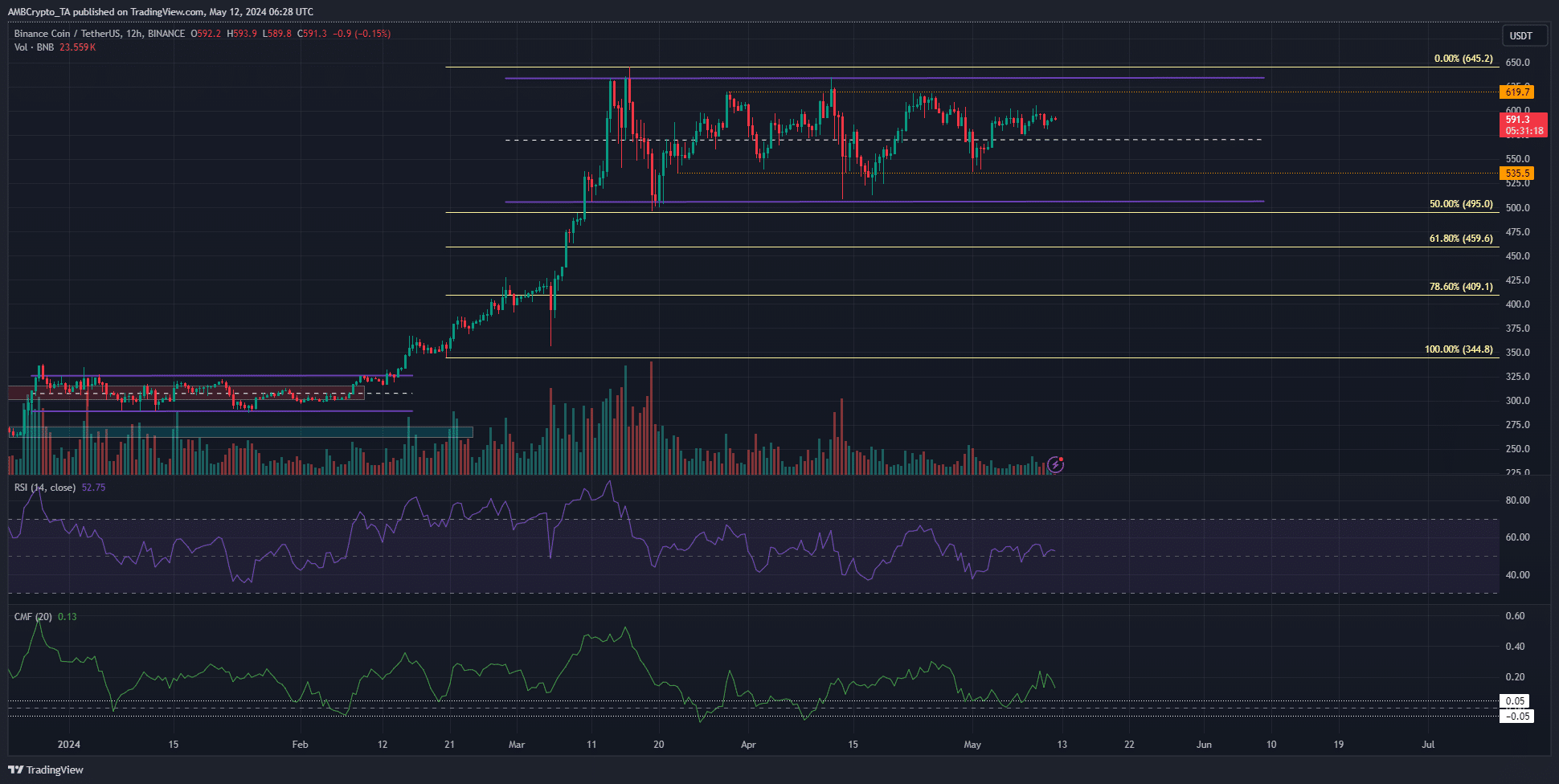

Binance Coin [BNB] traded inside a variety previously two months. Two ranges inside the vary have been of explicit curiosity to swing merchants.

In an earlier report, AMBCrypto highlighted these ranges, noting that the BNB market was in a consolidation section.

The Weighted Sentiment behind the change token was damaging, which steered market members won’t be eager to purchase it.

But, the technical indicators and the value motion steered that an upward breakout was extra possible than a downward transfer within the coming weeks.

A have a look at the January consolidation exhibits the place BNB may head subsequent

Supply: BNB/USDT on TradingView

The vary formation of the previous two months was highlighted in purple. It prolonged from $506 to $633. Over the previous six weeks, BNB has traded inside the $619-$535 space, marking these as necessary ranges as properly.

Evaluating the present consolidation section to the one earlier in 2024, we see similarities within the quantity traded. Towards the top of the consolidation, quantity was minimal.

A breakout previous the $310 resistance zone and the $327 vary excessive boosted the amount.

At press time, the amount was small in comparison with March. Nonetheless, the value was above the mid-range stage at $571. The 12-hour RSI confirmed momentum was impartial with a studying of 52.75, however the CMF was constructive.

This indicated capital inflows to the market have been important and outlined shopping for stress. If Bitcoin [BTC] may get well its uptrend, it would give BNB the house to rally greater too.

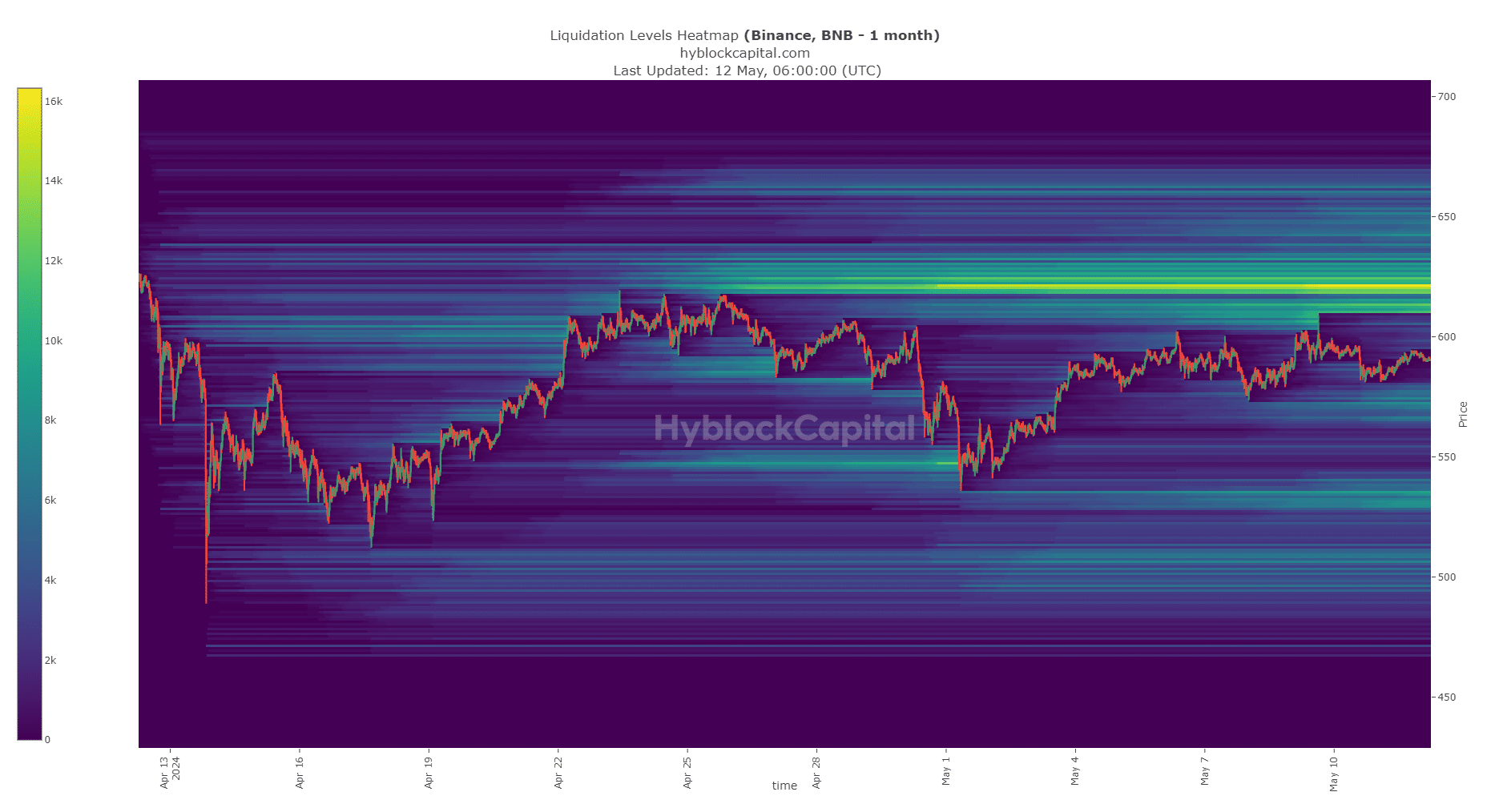

Marking the liquidity pockets

The $619 and $535 ranges have been key from a value motion perspective. The liquidation heatmap of the previous month additionally indicated that the $615-$625 area was a magnetic zone for the value.

Is your portfolio inexperienced? Take a look at the BNB Revenue Calculator

Therefore, BNB may go to this area and fall decrease.

To the south, the smaller pockets of liquidity at $570 and $535 have been those to look at, the place BNB may drop earlier than a bullish reversal.

Disclaimer: The data introduced doesn’t represent monetary, funding, buying and selling, or different varieties of recommendation and is solely the author’s opinion.