Blast launched its optimistic rollup late Thursday, fulfilling a promise to permit customers to withdraw funds locked in a workforce multisig for greater than three months.

The worth of person deposits rose to virtually $2.3 billion at launch. Now customers have a alternative: withdraw or discover one thing associated to the cash on the newly launched layer-2.

Knowledge from DefiLlama early Friday confirmed the Blast bridge contract stability had plummeted by about 70%, which CoinDesk reported as a “$1.6 billion outflow.”

The precise variety of admissions will not be so clear. Funds depart the deposit contract at a wholesome clip, however the capital – primarily Lido staked ether (stETH) – transfers to Blast’s ETH Yield Supervisor Proxy – and doesn’t depart the community on account of person withdrawals.

learn extra: A blast from the previous: 3 years after the launch of ETH staking

Actually, some drawdowns are to be anticipated, as ether (ETH) is up about 70% since Blast invited customers to tie up their capital for greater than three months in change for a factors debt.

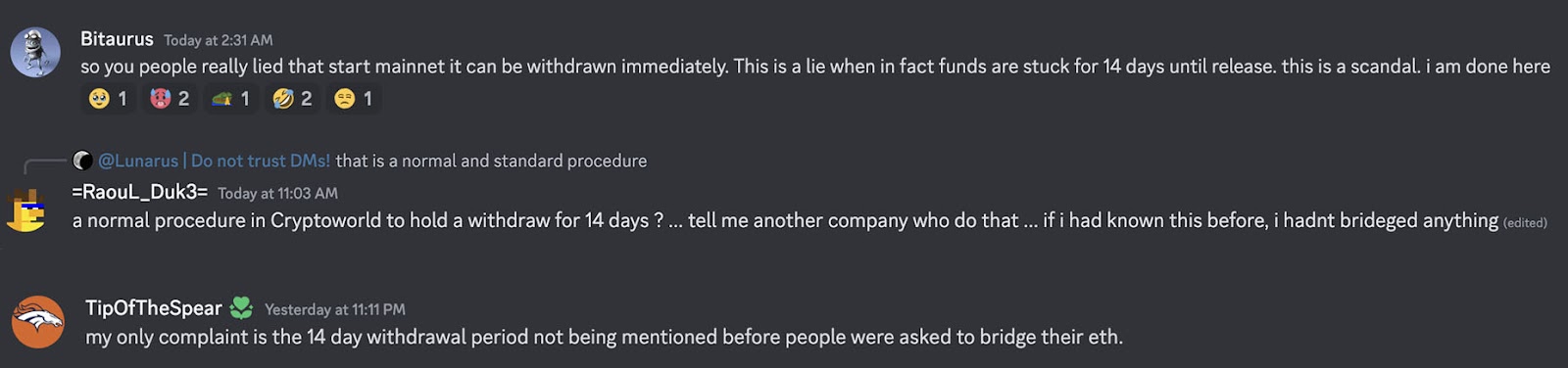

Many depositors look like leaping on the likelihood to get their a reimbursement, based mostly on dozens of discussions on the Blast Discord channel. Nonetheless, some say they weren’t conscious of the delay interval required to make use of Blast’s bridge again to Ethereum.

Such complaints have been discovered within the Blast Discord since launch

Because of the peculiarities of Blast’s optimistic rollups design, depositors should wait 14 days and pay Ethereum fuel charges to maneuver their deposits again to the mainnet. Optimistic rollups, equivalent to OP Mainnet, sometimes have a withdrawal delay of seven days. This delay is called the problem interval and permits fraud proof to be submitted to make sure the integrity of transactions earlier than they’re accomplished.

In line with Blast’s developer documentation, the prolonged interval is a “safety function designed to assist preserve Blast safe.” Blockworks has reached out to Blast representatives for clarification.

Particular third-party bridge dapps might provide quicker transfers, however for a payment. For instance, Orbiter prices 1.5% for the privilege.

Blast has been a advertising phenomenon thus far. Led by NFT dapp Blur founder Tieshun Roquerre, recognized by his on-line nickname “Pacman,” it launched final November to a lot fanfare.

Backed by severe traders and promoted by widespread influencers, any semblance of a working mission took months to materialize.

learn extra: Blast TVL reaches $390 million, with out product

Since then, it has employed builders, forked the OP stack, and continued to draw customers lured by the promise of Blast factors along with ETH staking returns.

85,000 accounts have entry to the Blast Discord, and the workforce has inspired dozens of impartial builders to construct on the platform by way of the Huge Bang marketing campaign.

Knowledge reveals that 57,000 wallets have interacted with the chain since tier 2. About $40 million is now maintained in DeFi dapps by DefiLlama, primarily lending and lending market ZeroLend, an Aave v3 fork.

However it is usually tormented by carpet pulling. At the very least six of the various meme cash launched thus far are scams which have turn out to be nugatory, Dexscreener reveals.

Learn extra: The typical potential crypto again pull yields $2,600 in revenue: Chainalysis

Considered one of them, a playing mission aptly named RiskOnBlast, disappeared with 420 ether, price greater than $1 million raised in a token sale previous to Blast’s launch.

Assuming Blast retains at the very least $1.88 billion of the deposits obtained, it is going to be the third-largest Layer-2 community on Ethereum, a exceptional achievement.

Can Blast carve out its personal area of interest in an more and more crowded Ethereum rollup market?