New knowledge reveals that asset administration titan BlackRock has introduced in over $10 billion into its spot market Bitcoin (BTC) exchange-traded fund (ETF) because it launched in January.

In accordance with the analysis workforce of crypto change BitMEX, on March eleventh, BlackRock hauled over $500 million into its spot market BTC ETF.

Spot market ETFs give traders publicity to an asset with out them having to straight buy it. ETFs centered across the prime digital asset by market cap have been permitted by the U.S. Securities and Change Fee (SEC) on January eleventh.

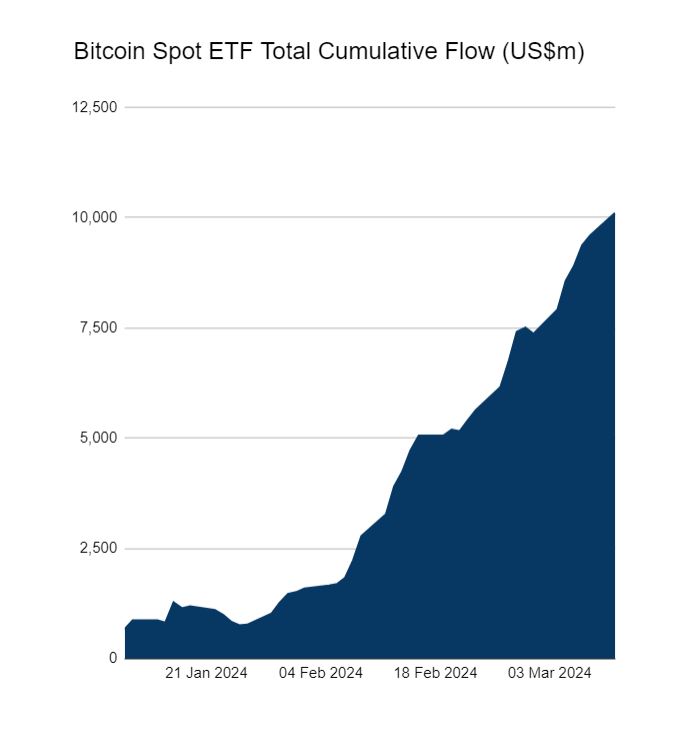

BitMEX’s knowledge shows that the sum of money flowing into Bitcoin ETFs has persistently risen because the SEC’s approval, reaching over $10 billion.

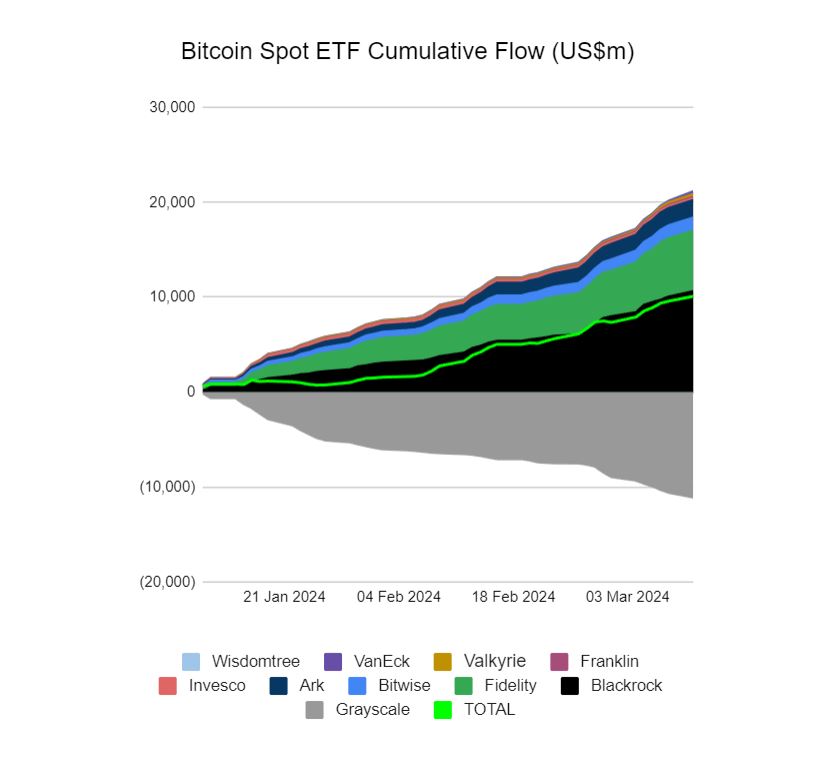

Lastly, the crypto change lays out knowledge displaying the cumulative circulate of funds into BTC ETFs since they went reside, which exhibits that BlackRock leads the pack by far, adopted by Constancy, Wisdomtree and ARK.

On February twenty eighth, BlackRock’s ETF noticed a file $612 million price of inflows.

“Bitcoin ETF Circulation – twenty eighth Feb 2024. All knowledge in. At this time was a file influx day, with $673.4 million of internet influx. This was pushed by BlackRock, which additionally had a file day, with $612.1 million of influx.”

Bitcoin is buying and selling for $72,654 at time of writing.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Generated Picture: Midjourney