- Bitcoin’s market construction revealed it was near a re-accumulation zone.

- A bounce to $65,065 could possibly be BTC’s goal as soon as the coin recovers.

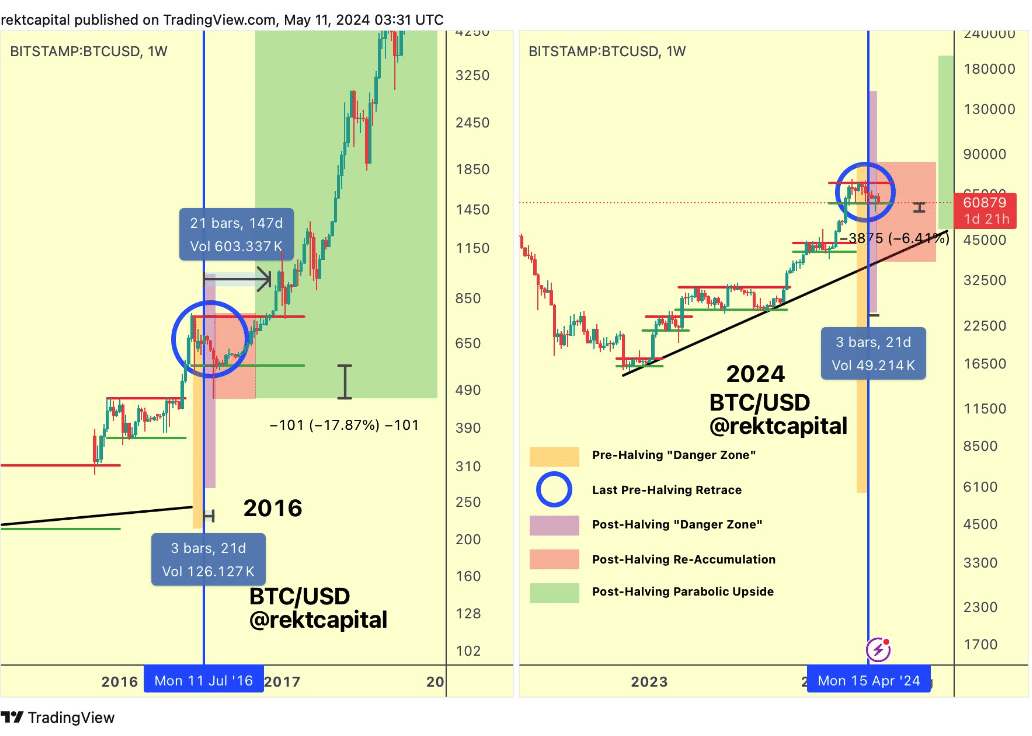

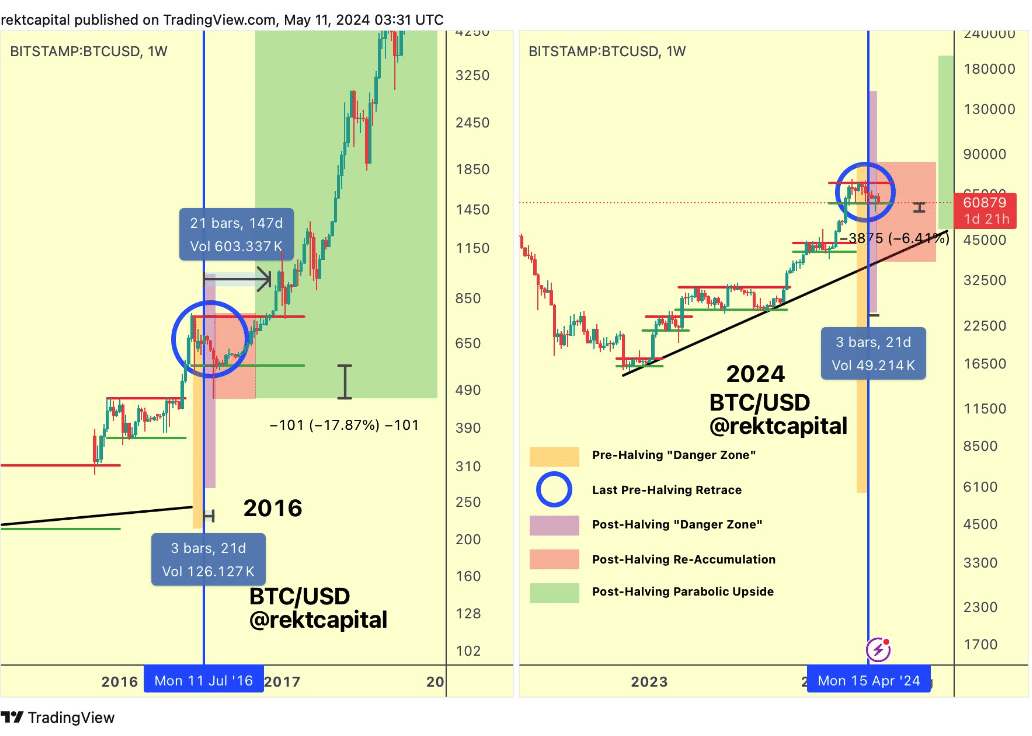

In line with crypto dealer Rekt Capital, Bitcoin [BTC] has left the hazard zone and has reached the re-accumulation space. The analyst talked about this in a put up on X (previously Twitter) on the eleventh of Might.

From the chart Rekt Capital shared, he defined how the coin has glad the post-halving correction, and in two days, Bitcoin may need left the hazard space totally.

The pink days are virtually over

To again up his rationale, he referred to the 2016 post-having cycle. At the moment, three bearish engulfing candlesticks appeared inside 21 days. Afterward, BTC surged previous $4,250 inside some months.

On the 2024 chart, one other set of pink candlesticks appeared, suggesting that Bitcoin’s correction could possibly be near its finish. At press time, Bitcoin’s value was $60,509.

Supply: Rekt Capital/X

This was a 5.61% lower within the final seven days. On account of this plunge, many BTC contracts available in the market have been liquidated.

Utilizing information from Hyblock, AMBCrypto observed that there was a magnetic zone round liquidation ranges. This indicator reveals value ranges the place merchants threat being liquidated.

The magnetic zone (blue) signifies a excessive stage of liquidity and implies that the worth would possibly transfer in that path. For Bitcoin, the worth may transfer towards $65,065 within the brief time period.

This would possibly occur provided that BTC bounces. Failure to reverse upwards would possibly trigger an extra value lower. Additionally, the CLLD, which is the Cumulative Liquidation Degree Delta (CLLD) was damaging.

Unfavourable values of the CLLD point out that brief are beginning to really feel extra of the liquidations. If sustained, this could possibly be bullish for Bitcoin’s value.

Supply: Hyblock

HODLers are in on the exit

We additionally discovered proof of the potential value enhance from one other metric on Glassnode. The metric in query was the Hodler Web Place Change.

Hodler Web Place Change tracks the month-to-month web place of long-term traders. If the worth is damaging, it implies that Bitcoin holders are realizing positive factors, or cashing out on their property.

Nevertheless, a constructive studying of the Hodler Web Place Change implies accumulation. Up till the final week of April, the metric was damaging, indicating that traders have been reserving income.

However because the first week in Might, that has modified. Particularly, long-term holders purchased 26,990 BTC on the tenth of Might. Because it stands, this accumulation would possibly proceed.

Learn Bitcoin’s [BTC] Worth Prediction 2024-2025

Sustaining this momentum would possibly be sure that Bitcoin trades above $60,000 within the coming days. For the long run, this could possibly be instrumental for the parabolic upside.

Supply: Hyblock

Nevertheless, merchants would possibly must be cautious as BTC would possibly drop additional. As Rekt Capital opined, Bitcoin would possibly nonetheless have two extra days of draw back earlier than the worth would possibly start to rise slowly.