- Bitcoin’s value went slightly below the $70k mark.

- Metrics recommend that BTC will witness an additional value correction.

Bitcoin’s [BTC] worth has been considerably in a consolidation section close to the $70k mark for fairly a number of days. If the newest evaluation is to be believed, then buyers may not witness an unprecedented value rise within the close to time period.

Due to this fact, AMBCrypto deliberate to test BTC’s metrics to see what to anticipate from it within the coming week.

Bitcoin has issues forward

Based on CoinMarketCap, BTC’s worth simply dropped beneath the $70k mark. The token’s worth went down marginally within the final 24 hours. At press time, it was buying and selling at $69,973.35 with a market capitalization of over $1.38 billion.

Nevertheless, it was attention-grabbing to notice that, regardless of the latest drop, over 97% of BTC holders have been in revenue. Moreover, as per IntoTheBlock’s data, the marketplace for BTC was nonetheless bullish.

Within the meantime, Michael van de Poppe, a well-liked crypto analyst, posted a tweet highlighting Bitcoin’s present state. As per the tweet, the probabilities of BTC reaching $100k anytime quickly have been low, as we have been nonetheless following the trail of the 4-year cycle.

Moreover, the tweet talked about that BTC consolidating in between $60k and its ATH appeared more likely to occur.

Will BTC’s value fall additional subsequent week?

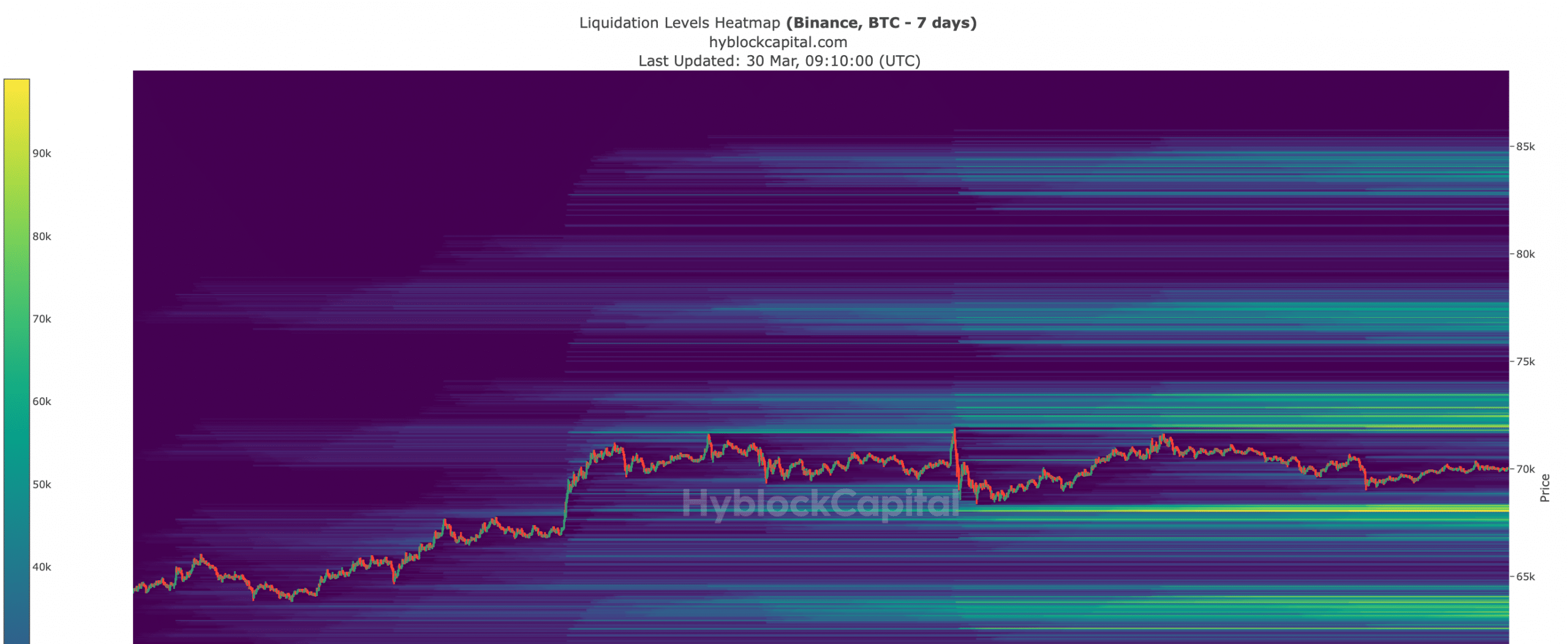

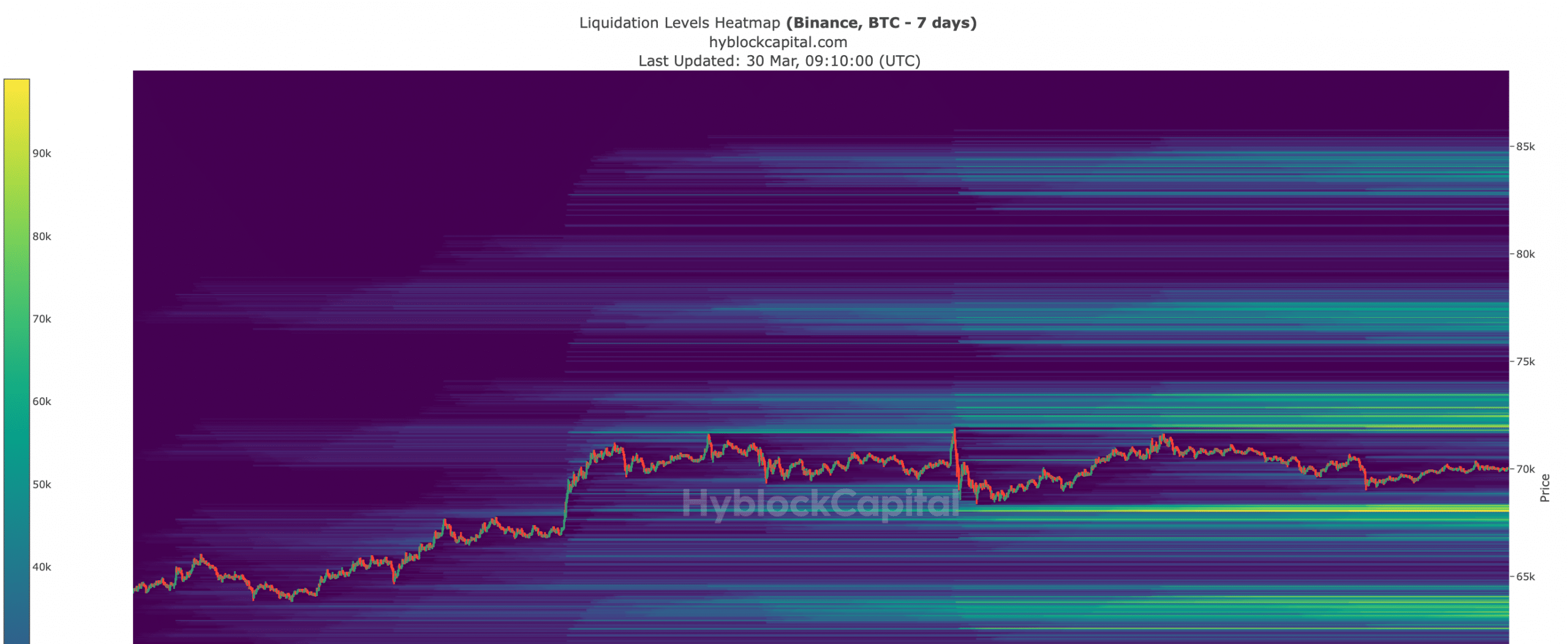

AMBCrypto checked BTC’s metrics to search out out whether or not BTC will proceed to stay much less unstable within the upcoming week. Our evaluation of Hyblock Capital’s information additionally revealed the same situation to the aforementioned evaluation.

We discovered that northward BTC’s liquidation will improve sharply to $72k. Excessive liquidity would possibly act as robust resistance for the king of cryptos and prohibit its value from transferring up.

Equally, southward BTC’s assist lies close to $69k. If it fails to check that assist, then BTC’s value would possibly as effectively attain $63k.

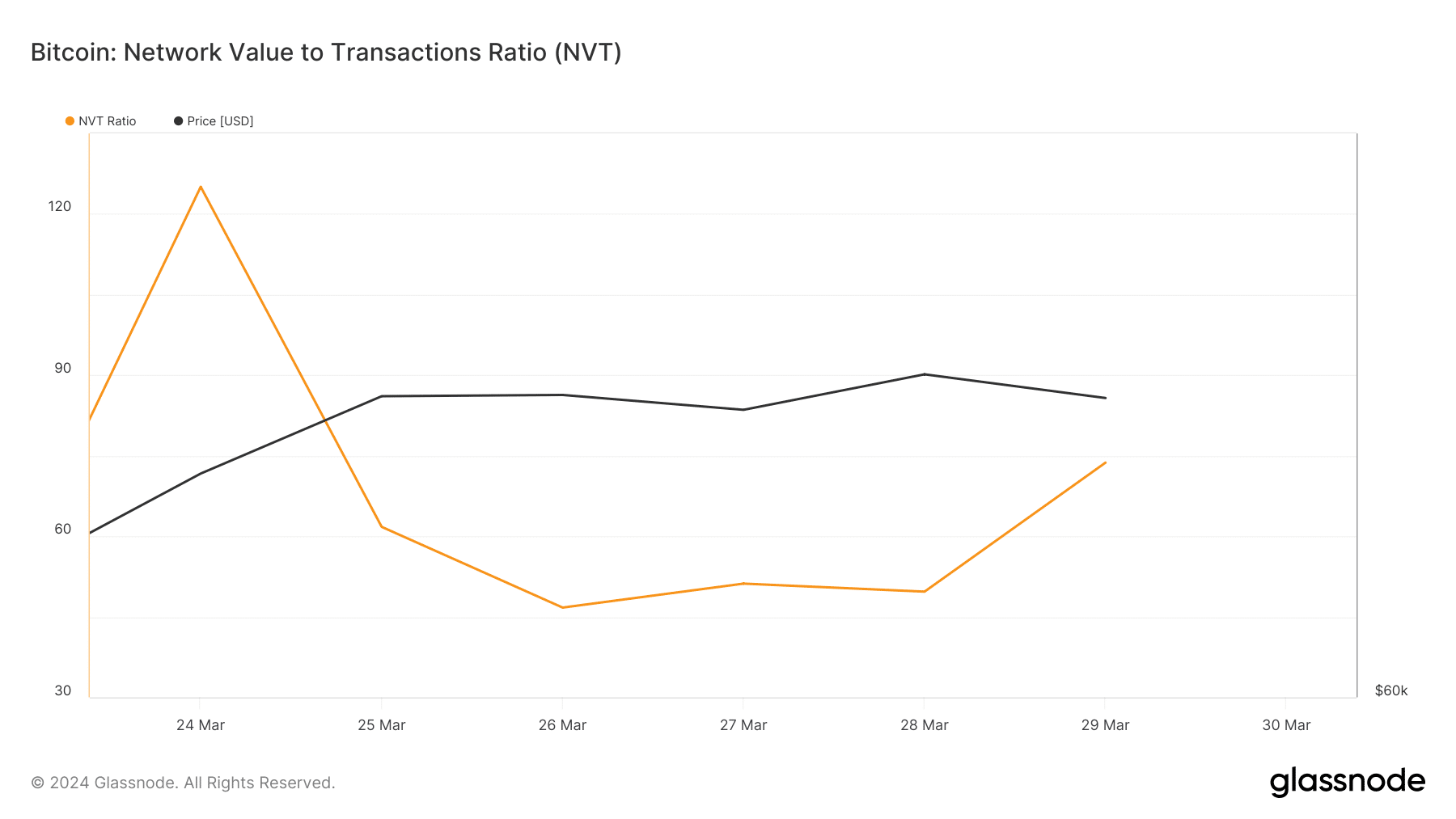

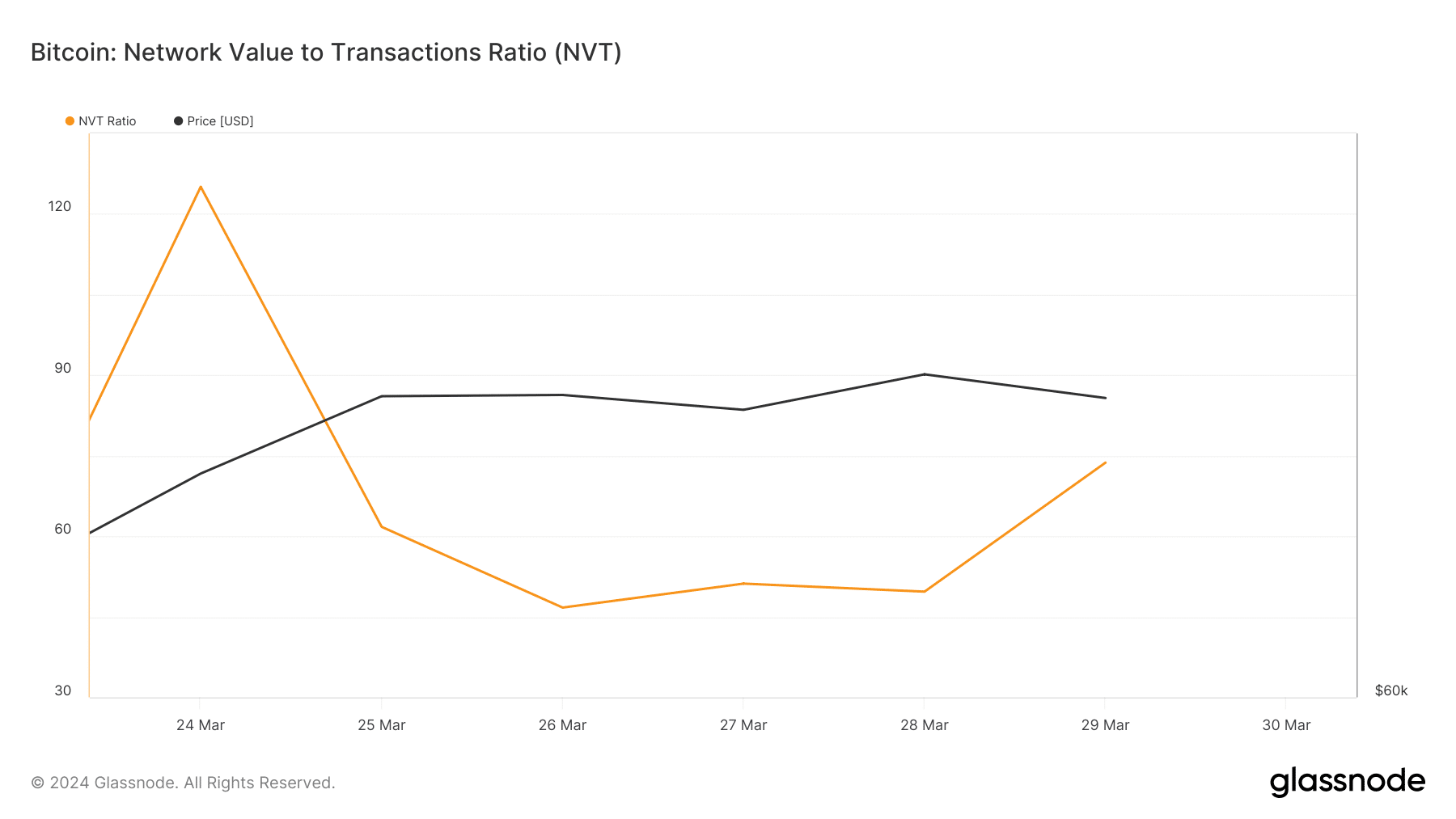

Supply: Glassnode

An evaluation of Glassnode’s information revealed that BTC’s network-to-value (NVT) ratio elevated in the previous few days. Every time the metric rises, it signifies that an asset is overvalued, suggesting that the probabilities of a value correction are excessive.

Supply: Glassnode

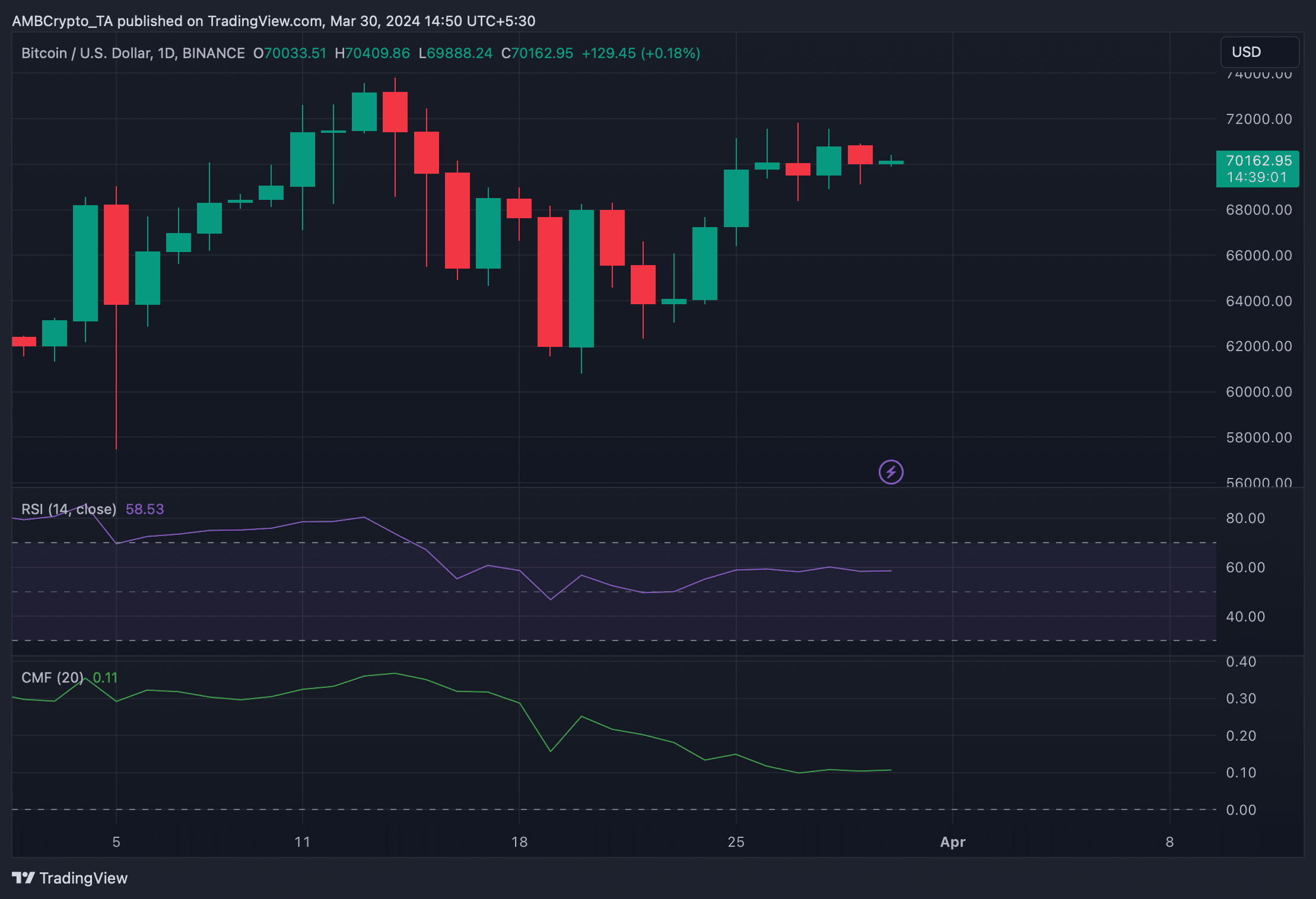

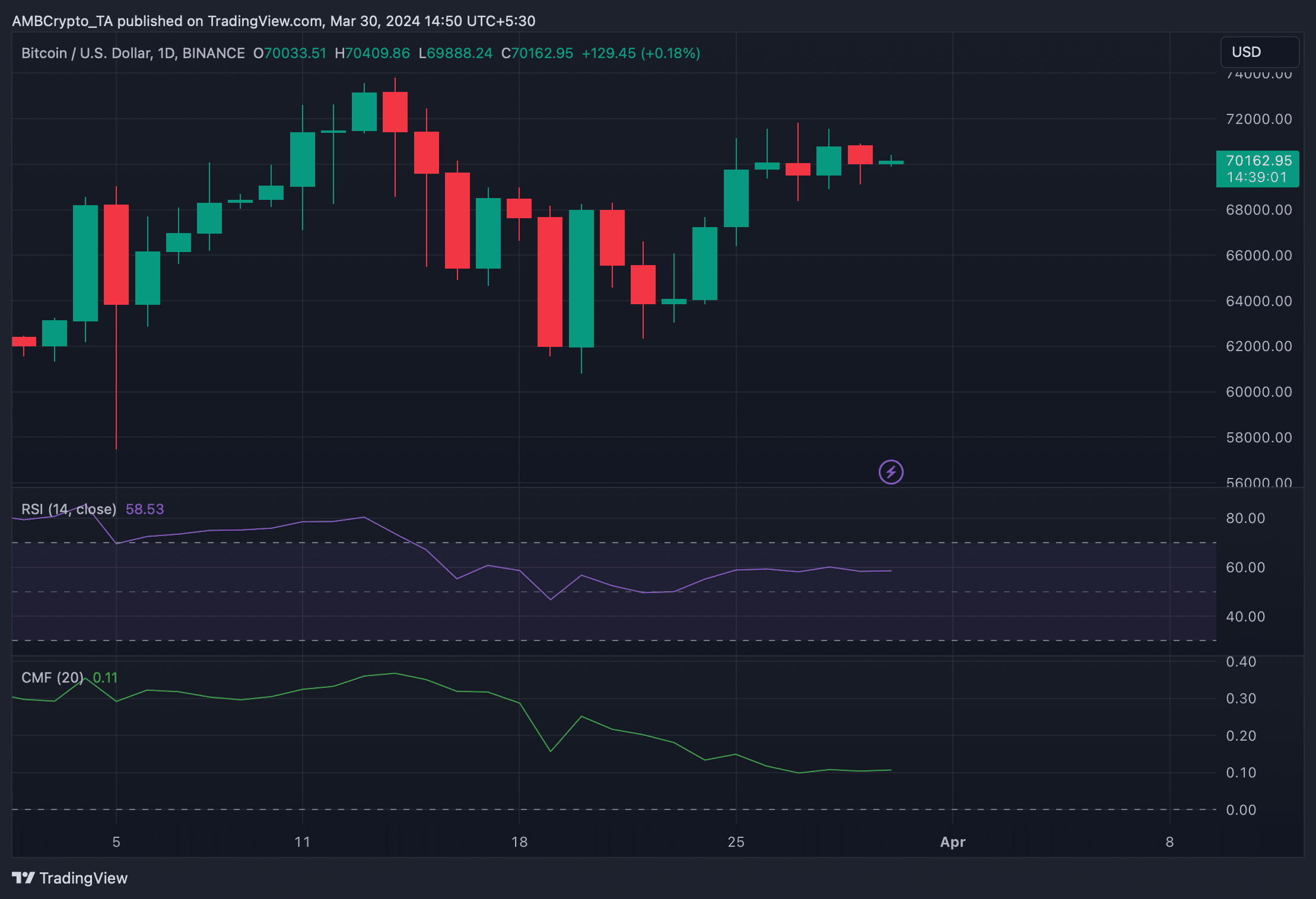

To double-check whether or not a value correction subsequent week is inevitable, AMBCrypto took a have a look at its each day chart. We discovered that BTC’s Relative Power Index (RSI) took a sideways path.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

On high of that, its Chaikin Cash Circulation (CMF) additionally adopted the same route. The symptoms, mixed with different metrics, gave a bearish notion.

Due to this fact, the probabilities of BTC reaching its assist stage have been excessive. Nevertheless, contemplating the unpredictability of the crypto market, nothing could be mentioned with the utmost certainty.

Supply: TradingView