- The FOMC’s fee choice attracts criticism; Peter Schiff and David Solomon predict ‘no cuts’ quickly.

- The crypto market faces a downturn — resilience is noticed, with a give attention to long-term methods.

Amidst considerations in regards to the rising inflation within the U.S., the Federal Reserve has determined to carry rates of interest regular.

Minutes from the Federal Open Market Committee (FOMC) assembly revealed policymakers’ apprehension about easing charges.

The minutes pointed to the truth that regardless of some progress, inflation has remained above the FOMC’s 2% goal, with many client sentiment surveys exhibiting rising worries about future inflation.

FOMC’s choice receives criticism

Criticizing the choice, Peter Schiff, CEO and Chief World Strategist of Euro Pacific Capital, in an X (previously Twitter) put up, famous,

Supply: Peter Schiff/X

Becoming a member of an identical prepare of thought, David Solomon, CEO of Goldman Sachs Group Inc., said at a Boston School occasion that he presently predicted “zero” fee cuts. He mentioned,

“I nonetheless don’t see the information that’s compelling to see we’re going to chop charges right here.”

Damaging influence on the crypto market

Evidently, specialists started questioning the results of the FOMC’s choice on the general market situations.

The influence was notably destructive, as evidenced by its direct impact on main cryptocurrencies.

On the twenty second of Might, Bitcoin [BTC] dropped under the $70K mark, and Ethereum [ETH], which had lately surged from $3,064 to $3,790, turned crimson as effectively.

In reality, on the time of writing, most prime cash confirmed crimson bars on the each day charts.

Constructive sentiments persist

Regardless of the crypto market bleeding, @cryptosanthoshK, a Crypto & DeFi Analyst, famous,

Supply: Crypto King/X

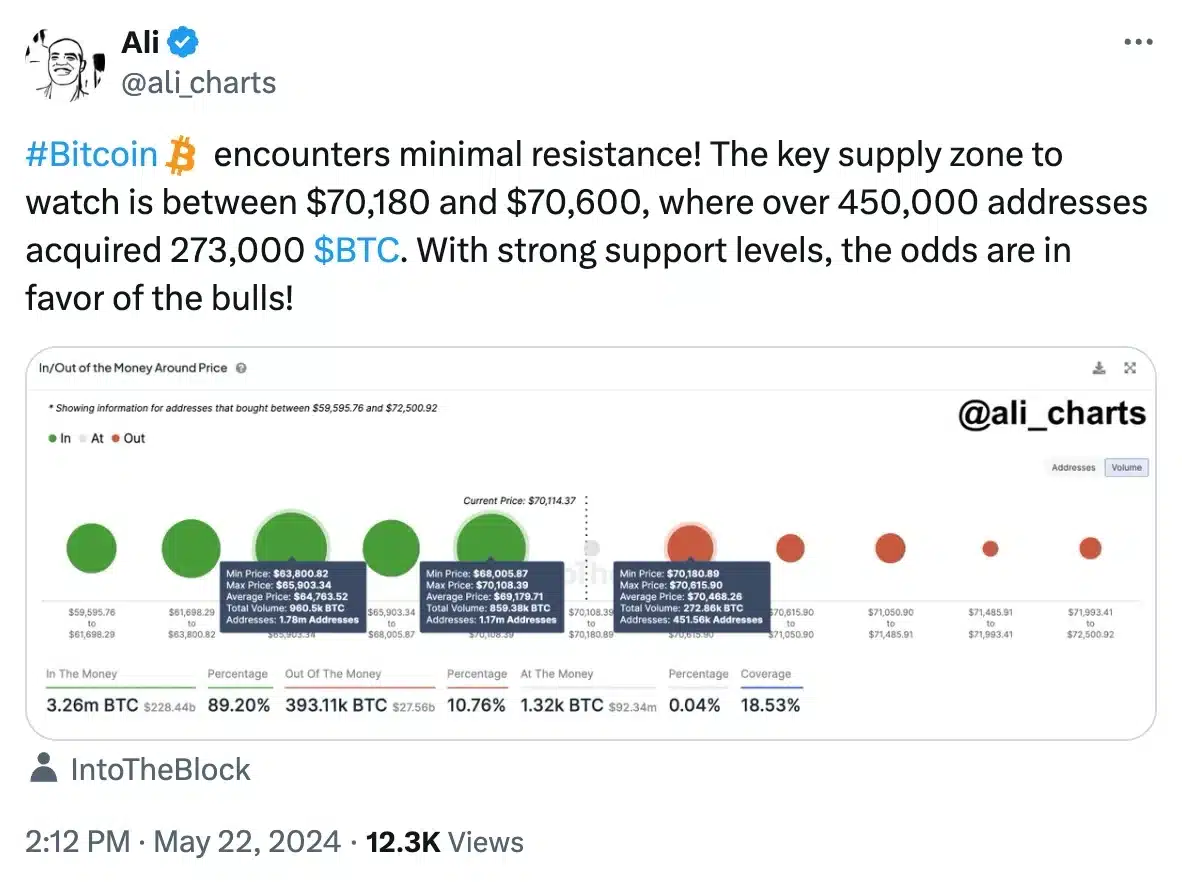

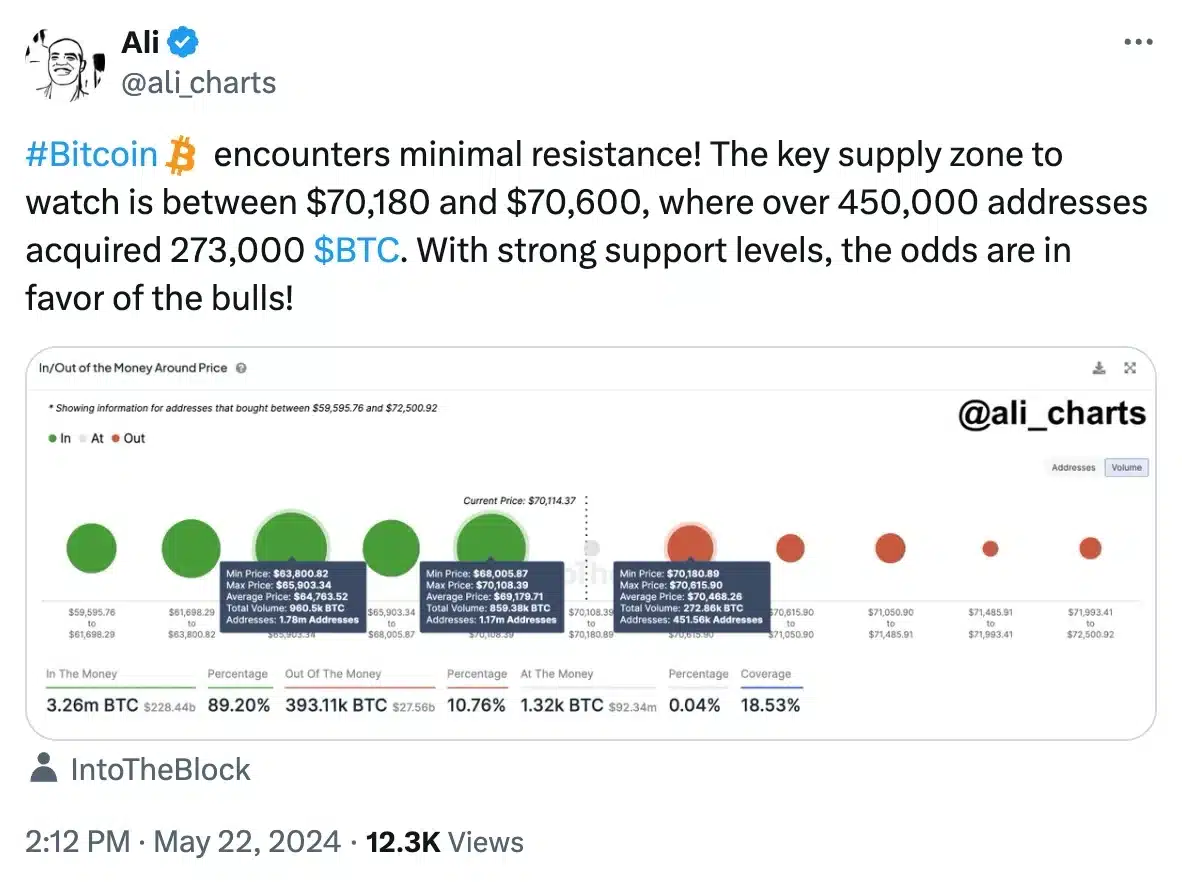

Ali Martinez, the technical and on-chain analyst, echoed an identical sentiment and mentioned,

Supply: Ali/X

Glassnode’s Bitcoin liveliness metric additional confirmed this, by exhibiting an increase in coinday creation versus destruction, indicating a shift in the direction of long-term holding over profit-taking.

Supply: Glassnode

Anticipating ETH to expertise a major value improve as a result of anticipation of an exchange-traded fund (ETF) approval, Satoshi Flipper, an investor/dealer added,

“$ETH will ship an epic ETF pump this week. Market costs can’t keep irrational perpetually.”

Inventory market declined

Regardless of the prevailing optimistic sentiment surrounding cryptocurrencies, consideration also needs to be paid to the efficiency of the inventory market, which skilled a decline on the twenty second of Might.

The Dow Jones Industrial Common dropped by 201.95 factors, or 0.51%, closing at 39,671.04, marking its worst session of the month.

Equally, the S&P 500 fell by 0.27% to succeed in 5,307.01, whereas the Nasdaq Composite, specializing in tech shares, recorded a lack of 0.18%, ending at 16,801.54.