- Analysts challenge a potential BTC rise after a document uptick in US cash provide.

- Nonetheless, quick positions in opposition to BTC have spiked, elevating fears of a worth correction.

Bitcoin [BTC] has been in a worth consolidation vary between $60K and $70K for weeks, a boring set-up for speculators who thrive on volatility.

This sideways motion prolonged after the April halving occasion and the seemingly ‘stagnant’ demand from US spot BTC ETFs.

However there’s a brand new growing narrative for the King coin—an uptick within the US cash provide.

Bitcoin’s path ahead

In response to X consumer (previously Twitter) TechDev_52, an entrepreneur and crypto analyst, BTC may very well be tipped for a ‘blowoff’ after BTC vs. M1 liquidity hit a document excessive.

‘$BTC had no enterprise setting new highs in 2021. M1 soared to document heights, however #bitcoin couldn’t set one in opposition to it. Now that it’s damaged above its 2M supertrend, we’re doubtless in for that blowoff transfer it’s all the time signaled.’

Supply: X/TechDev_52

The analyst blamed the ‘COVID panic M1 liquidity’ for the dearth of ‘blowoff’ in 2021 when BTC printed the same breakout in opposition to the cash provide.

For the unfamiliar, M1 liquidity tracks essentially the most liquid chunk of the cash provide. It contains foreign money and any property that may swiftly be transformed to money. For M2, the scope goes additional to some ‘not so liquid elements’ of the cash provide, like financial savings deposits.

Apparently, M2 has additionally expanded by 0.7%, per one other analyst, Willy Woo. In earlier cycles, the surge within the cash provide led to an uptick in BTC’s worth in USD phrases.

It stays to be seen whether or not the BTC’s breakout in opposition to the M1 liquidity and M2 growth will push it above the vary.

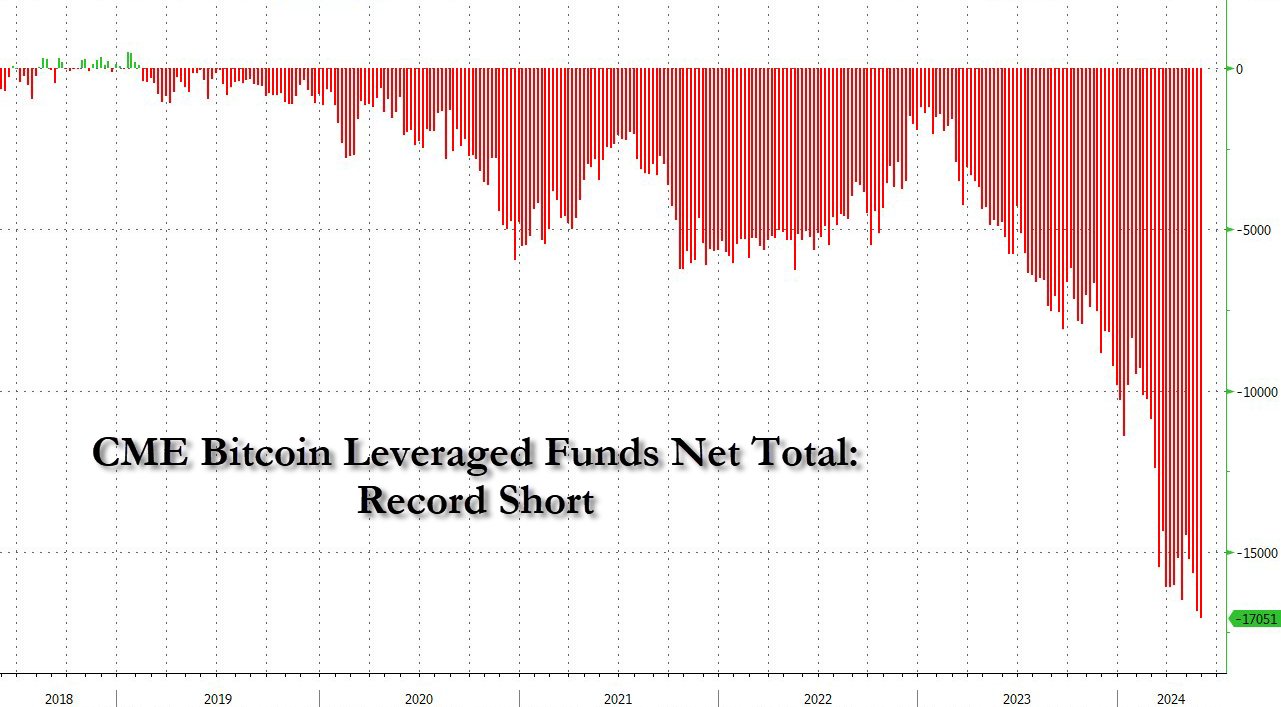

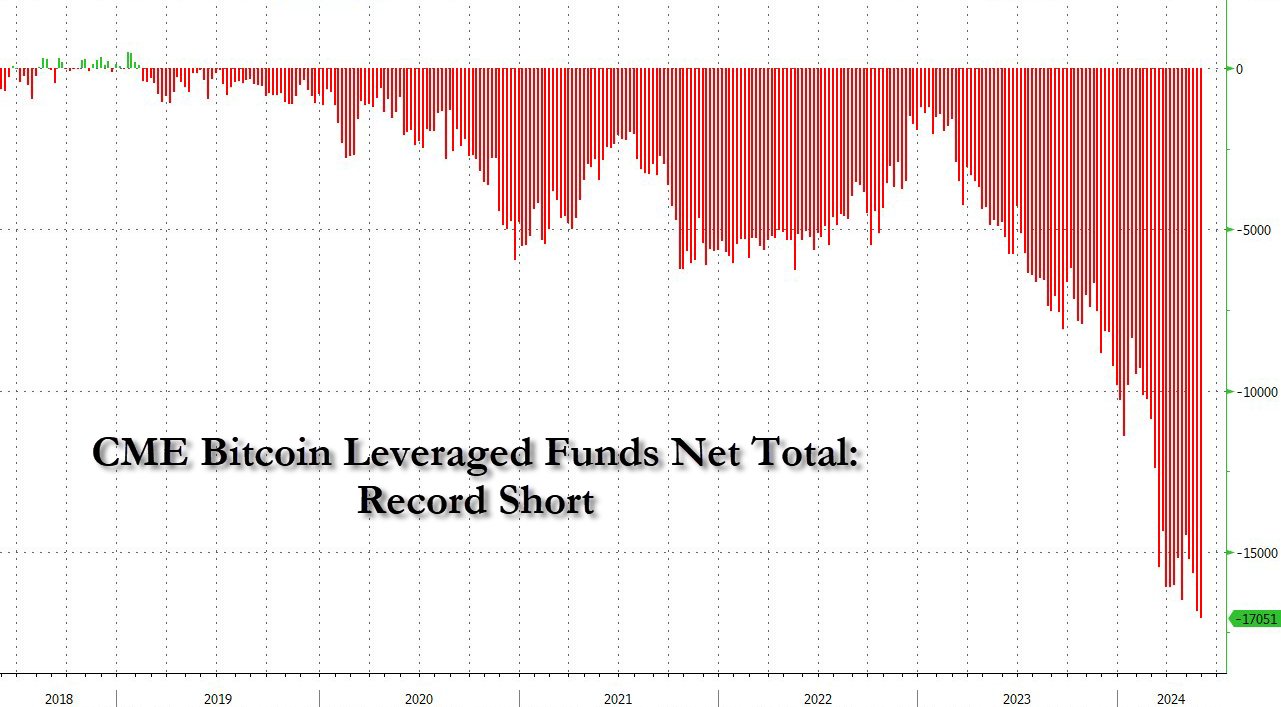

Nonetheless, latest knowledge confirmed that leveraged funds hit document BTC short positions. This may very well be a hedge in opposition to any potential drop in BTC or bets on worth correction.

Supply: X/ZeroHedge

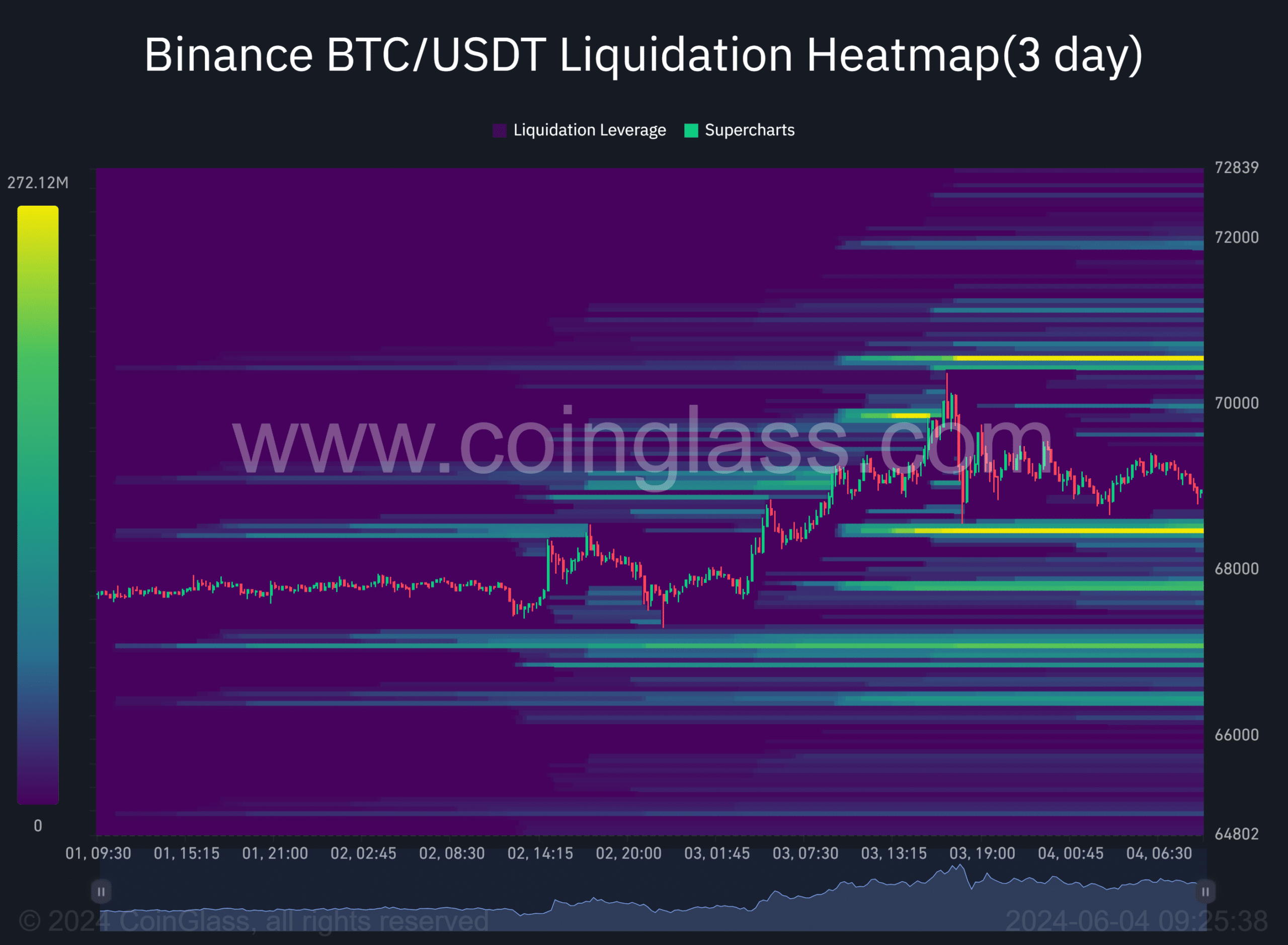

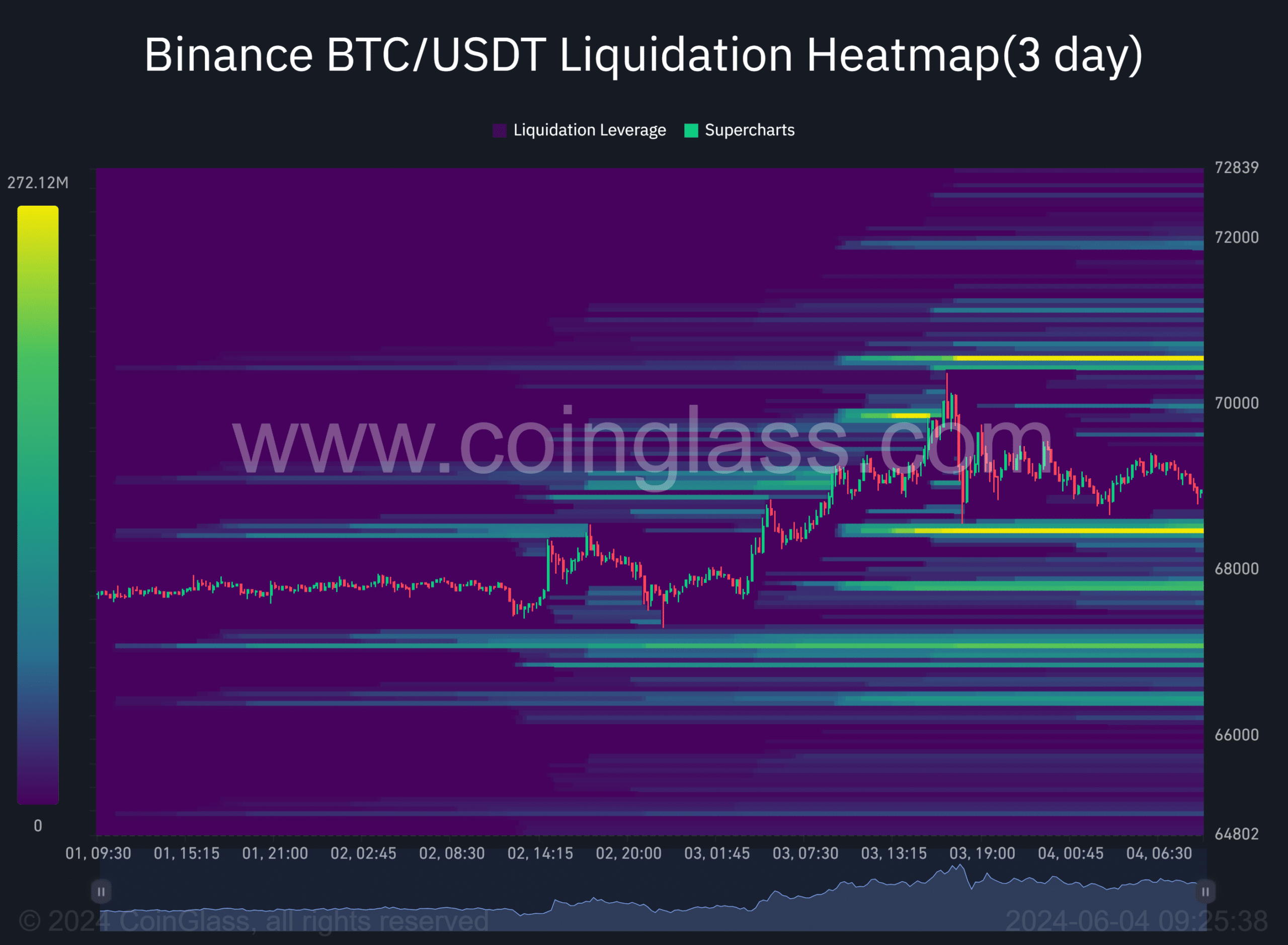

Within the meantime, a short-term transfer in direction of $70.5K was extra doubtless after sweeping the liquidity at $68.4K.

In response to Coinglass knowledge, each ranges, marked orange, had been key liquidity cluster factors that might act as magnets for worth motion.

Supply: Coinglass