- BTC’s value has elevated barely within the final 24 hours.

- Over $17 billion BTC has been accrued in the previous couple of months.

Bitcoin [BTC] has entered a re-accumulation part as long-term holders (LTH) have steadily elevated their holdings of late. The transfer might have an effect on BTC’s value because it struggles to reclaim the $60,000 value vary.

LTHs again Bitcoin

AMBCrypto’s evaluation of the long-term holders’ chart on Glassnode revealed notable developments in Bitcoin possession.

In the beginning of 2024, long-term holders (LTH) managed over 14 million BTC. Nevertheless, this determine considerably dropped within the first quarter, declining to roughly 13.35 million BTC by March 2024.

This decline indicated that long-term holders have been distributing or promoting their Bitcoin, doubtlessly reacting to market situations or seizing profit-taking alternatives.

Supply: Glassnode

By March 2024, the pattern shifted as long-term holders started steadily growing their Bitcoin holdings. Round 300,000 BTC have been added to long-term holdings by August 2024, marking a re-accumulation part.

This advised that traders had renewed confidence in Bitcoin’s long-term worth, as they selected to “HODL” fairly than promote.

The pattern demonstrated a transparent upward motion in long-term holdings, reflecting a powerful perception in Bitcoin’s prospects amongst seasoned traders regardless of short-term market fluctuations.

Attainable implications for future strikes

This upward pattern in long-term Bitcoin holdings might considerably have an effect on Bitcoin’s value.

As seasoned traders accumulate, the elevated confidence in Bitcoin’s future worth will seemingly contribute to higher value stability.

This renewed bullish sentiment, usually seen amongst knowledgeable traders, may precede a possible value surge, reflecting their anticipation of future appreciation.

Additionally, The regular accumulation by long-term holders advised a tightening of provide out there, which might scale back volatility and create a extra steady buying and selling setting.

With fewer BTCs obtainable for short-term buying and selling, there could also be much less dramatic value swings, paving the best way for a extra sustained upward trajectory.

This habits might point out that the market has reached a backside, with long-term holders positioning themselves for a restoration part.

Traditionally, such accumulation phases have led to vital value will increase because the supply-demand dynamics shifts in favor of upper costs.

How BTC has trended

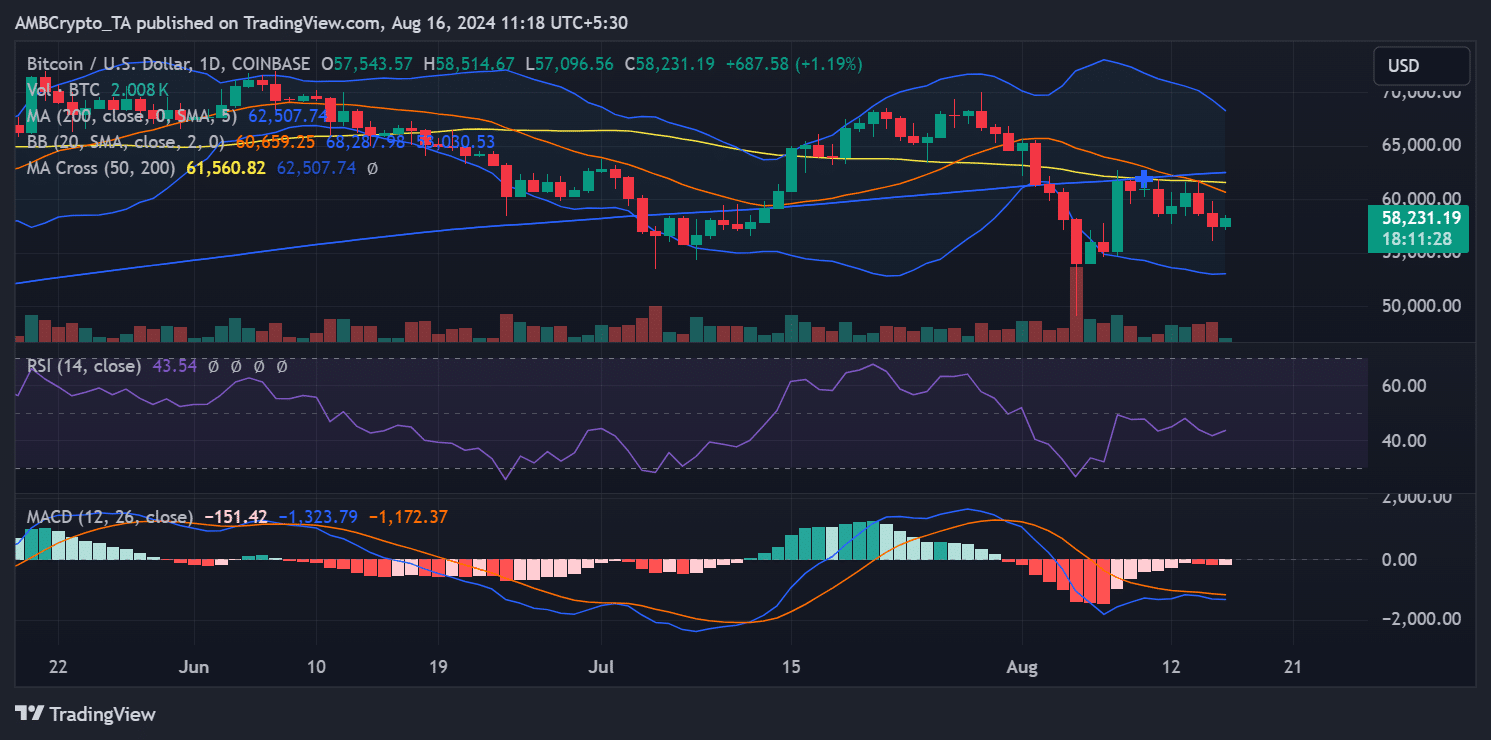

Bitcoin’s press time value was $58,231.19, marking a modest enhance of over 1.19% within the newest buying and selling session. The Bollinger Bands confirmed a contraction, indicating decreased market volatility.

At press time, the worth was trending in the direction of the center band, suggesting the opportunity of sideways motion or consolidation. The higher band was at $68,287.98, whereas the decrease band was close to $50,030.53.

Moreover, the Relative Energy Index (RSI) was round 43.54, inserting it within the impartial zone however edging nearer to the oversold territory.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

This advised that Bitcoin is likely to be undervalued, although there has but to be vital shopping for momentum.

Supply: TradingView

Moreover, the RSI indicated that the promoting strain could also be nearing exhaustion, with a possible value reversal on the horizon if Bitcoin breaks above the center Bollinger Band or an uptick in buying and selling quantity.