- BTC ETFs attracted inflows from Gold ETFs, per a VanEck government.

- BTC could possibly be nearer to a parabolic run following a key replace on the US cash provide.

Market watchers have lengthy speculated that US spot Bitcoin [BTC] ETFs may draw flows from Gold ETFs. In accordance with VanEck’s CEO, Jan Van Eck, this has turn out to be a actuality.

On the sidelines of Paris Blockchain Week 2024, the VanEck government underscored that Gold ETFs have seen outflows regardless of hitting report highs and rallying 14% in 2024.

“There are outflows out of Gold bullion ETFs within the US this 12 months even because it (gold) hits all-time highs and is up 14% this 12 months.”

Van Eck added that, based mostly on a Google search evaluation, buyers’ curiosity in ‘Bitcoin dominated gold.’

Regardless of the above fascinating developments, US Bitcoin ETFs added about 30K BTC in Could, however demand stagnated.

Bitcoin ETF demand stagnates, however …

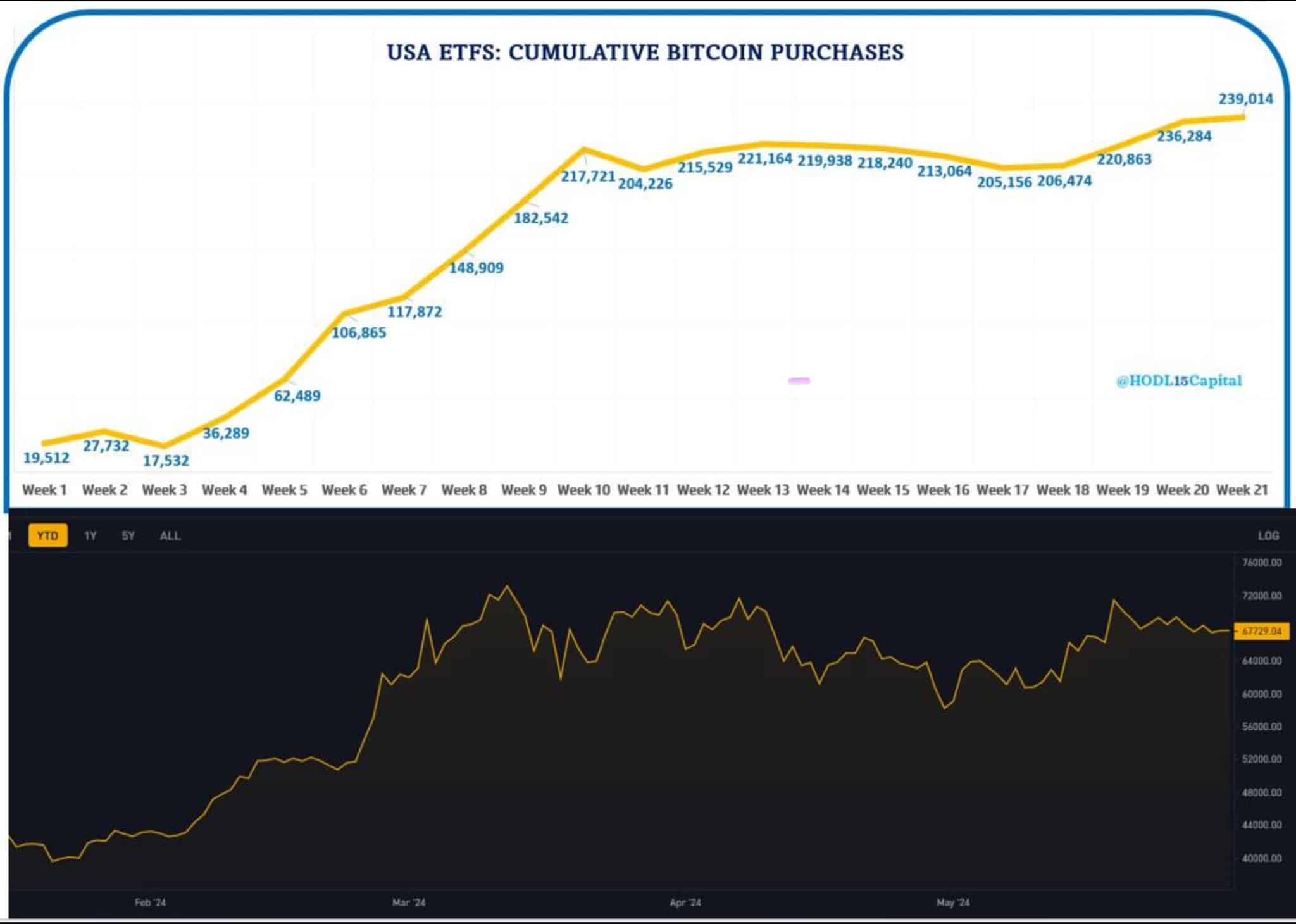

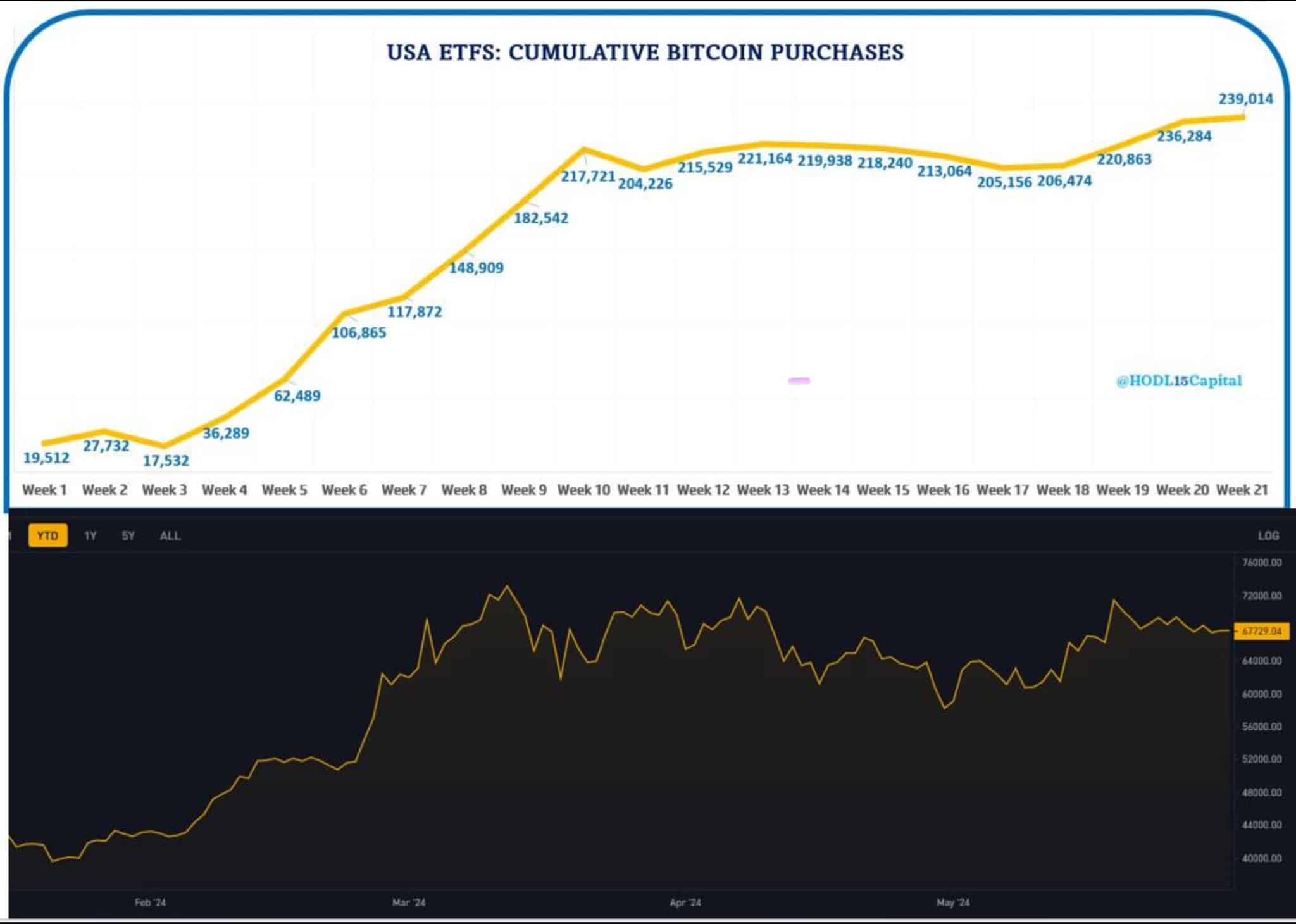

In Could, the US spot BTC ETFs recorded web constructive flows and added 29.5K BTC, factoring GBTC promoting.

On thirty first Could, the ETFs logged a web constructive influx of $48.7 million per Soso Worth data. BlackRock’s IBIT led the inflows with $169 million, adopted by Constancy’s FBTC’s $5.9 million.

Nevertheless, Grayscale’s GBTC dented the above inflows after recording $124.3 million in outflows final Friday, per Farside Traders data.

When the cumulative spot BTC ETF demand was plotted towards the BTC worth, the chart confirmed that the demand stagnated together with the worth.

Supply: X/HODL15Capital

Nevertheless, BTC may quickly hit a parabolic run. The king coin has hit an important and comparable milestone final seen earlier than the 2017 parabolic run – breaking above the US cash provide. In accordance with crypto analyst TechDev,

‘In 2021 $BTC was carried to new USD highs by elevated cash provide. In 2024 it’s gotten there by itself demand (and thus broke out towards M1). Add the anticipated M1 progress this time and we doubtless see $BTC outpace expectations based mostly partly on 2021.”

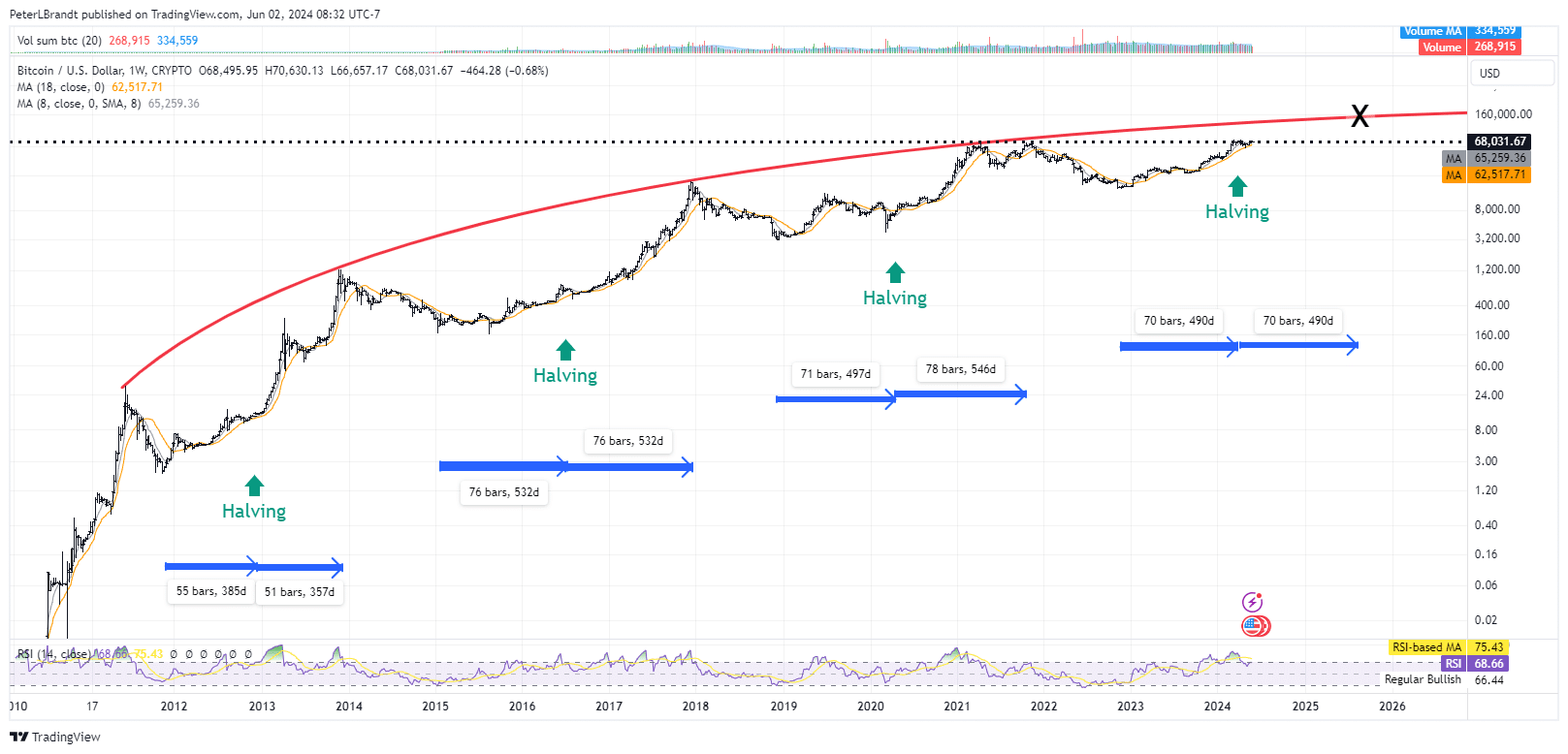

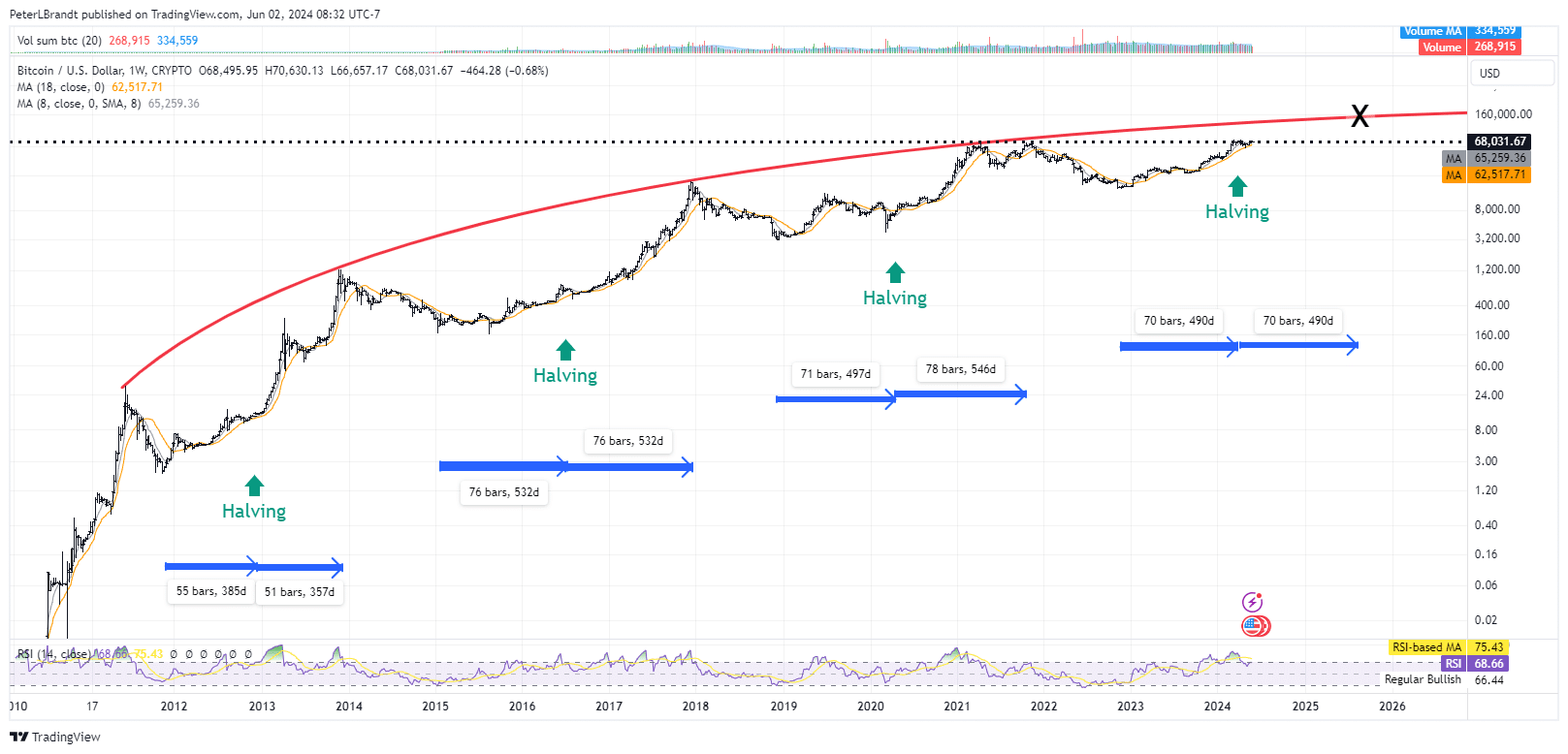

One other analyst, Peter Brandt, based mostly on customary historic information, capped the upside of this market cycle at $130K-$150K per BTC by August 2025.

Supply: X/Peter Brandt

Nevertheless, BTC entered a 3rd month of worth consolidation and should break above the vary to substantiate the uptrend momentum.