- Market sentiment round BNB has improved over the previous few days.

- Most indicators seemed bullish on the coin.

After a week-long decline, BNB lastly got here again on observe because the coin’s day by day chart turned inexperienced. Notably, whereas that occurred, the coin’s value was consolidating inside a bull sample, which could permit the coin to achieve new highs within the coming days.

A bull sample on BNB’s chart

In response to CoinmarketCap, bears dominated the earlier week because the coin’s value dropped to $587 on the thirtieth of Might.

Nonetheless, bulls stepped up within the final 24 hours and pushed the coin’s value up by over 1.4%. On the time of writing, the coin was buying and selling at $613.41 with a market capitalization of over $90 billion, making it the fourth largest crypto.

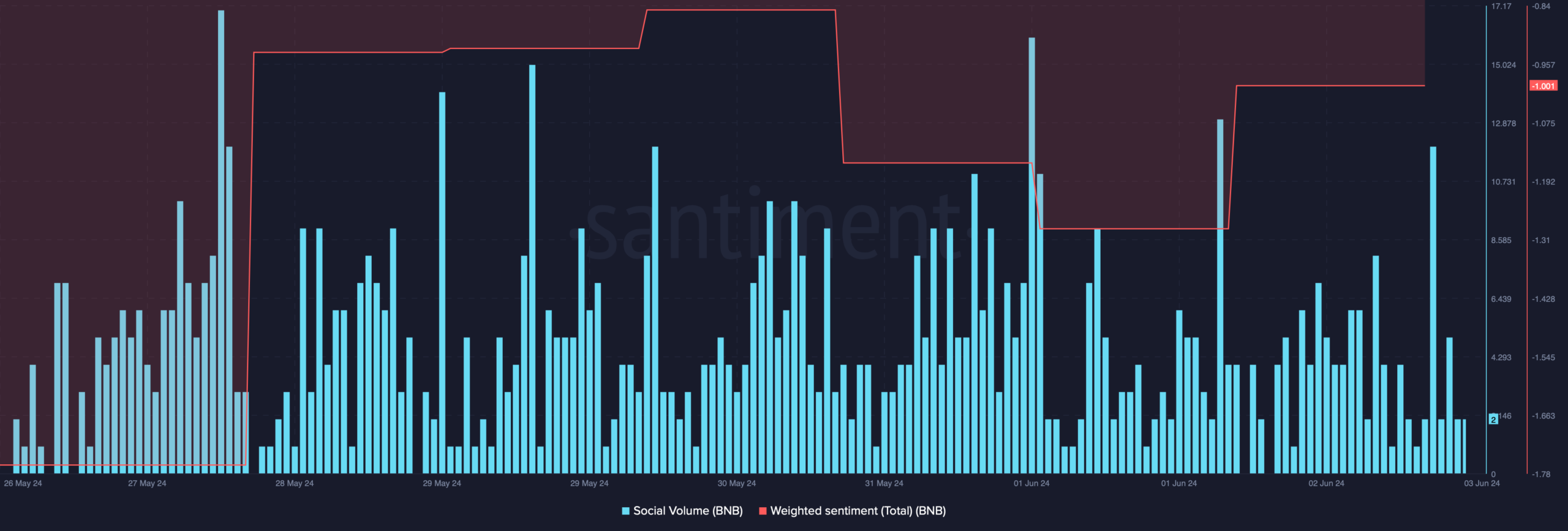

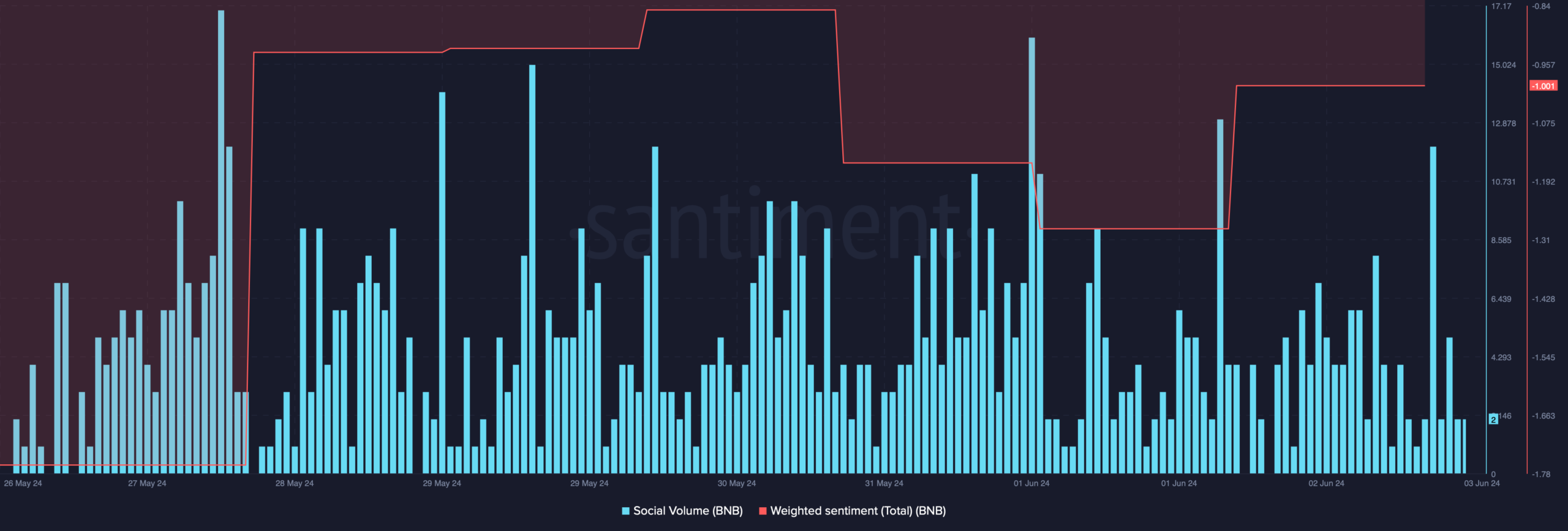

Due to the latest value uptick, the coin’s weighted sentiment has improved. This clearly reveals that bullish sentiment across the coin has elevated over the previous few days.

Its social quantity additionally remained comparatively excessive final week, reflecting BNB’s reputation within the crypto house.

Supply: Santiment

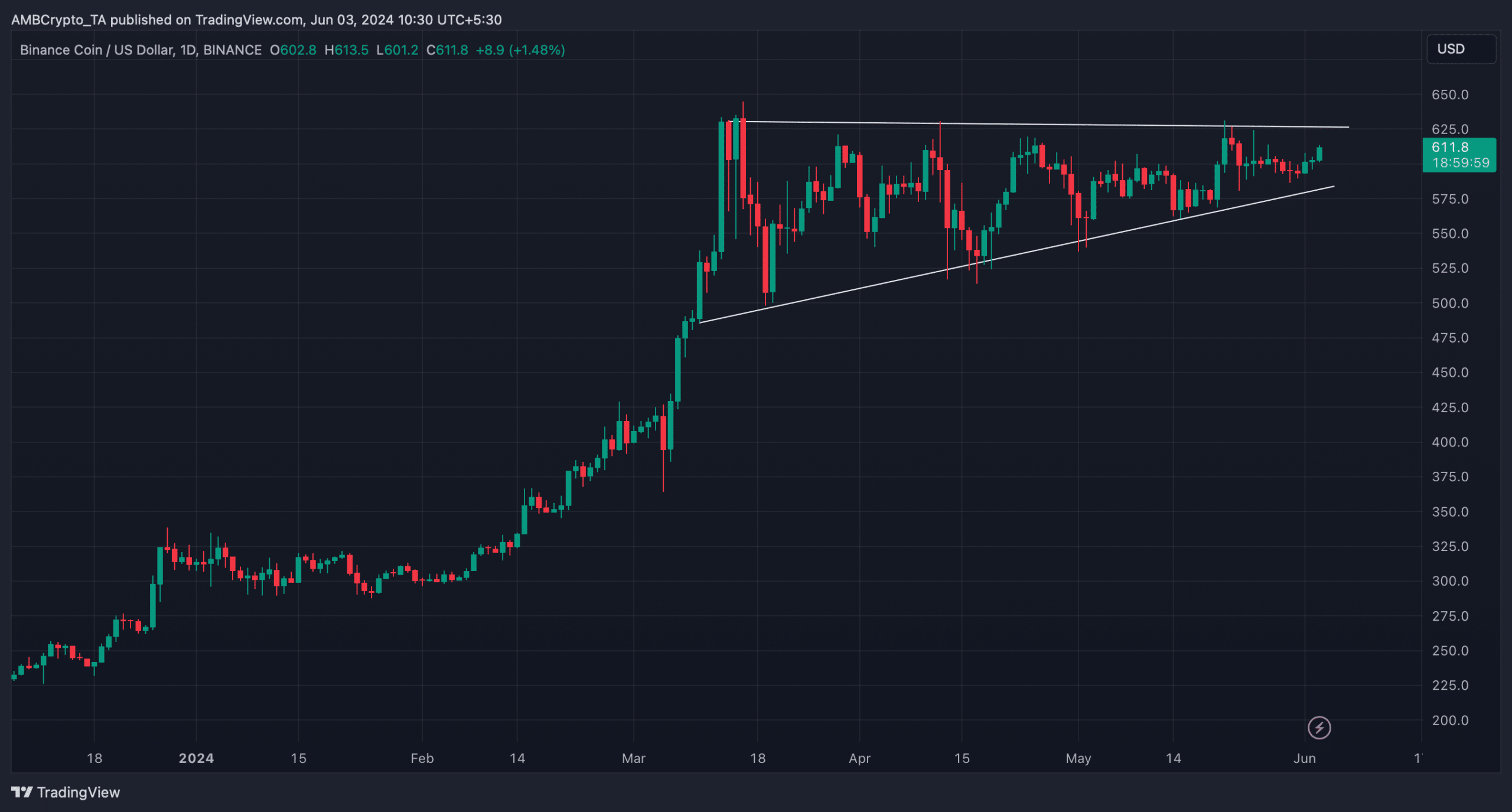

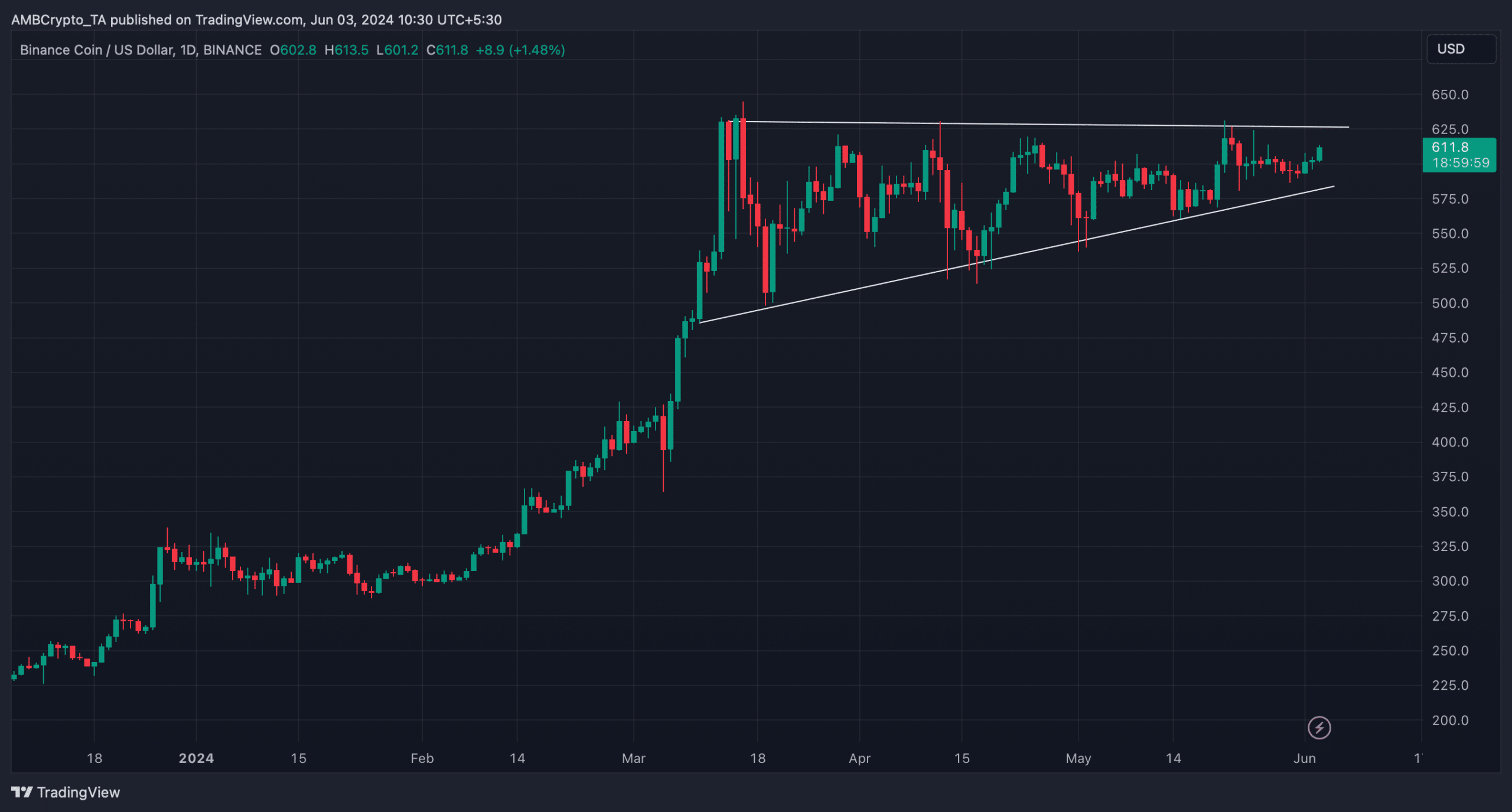

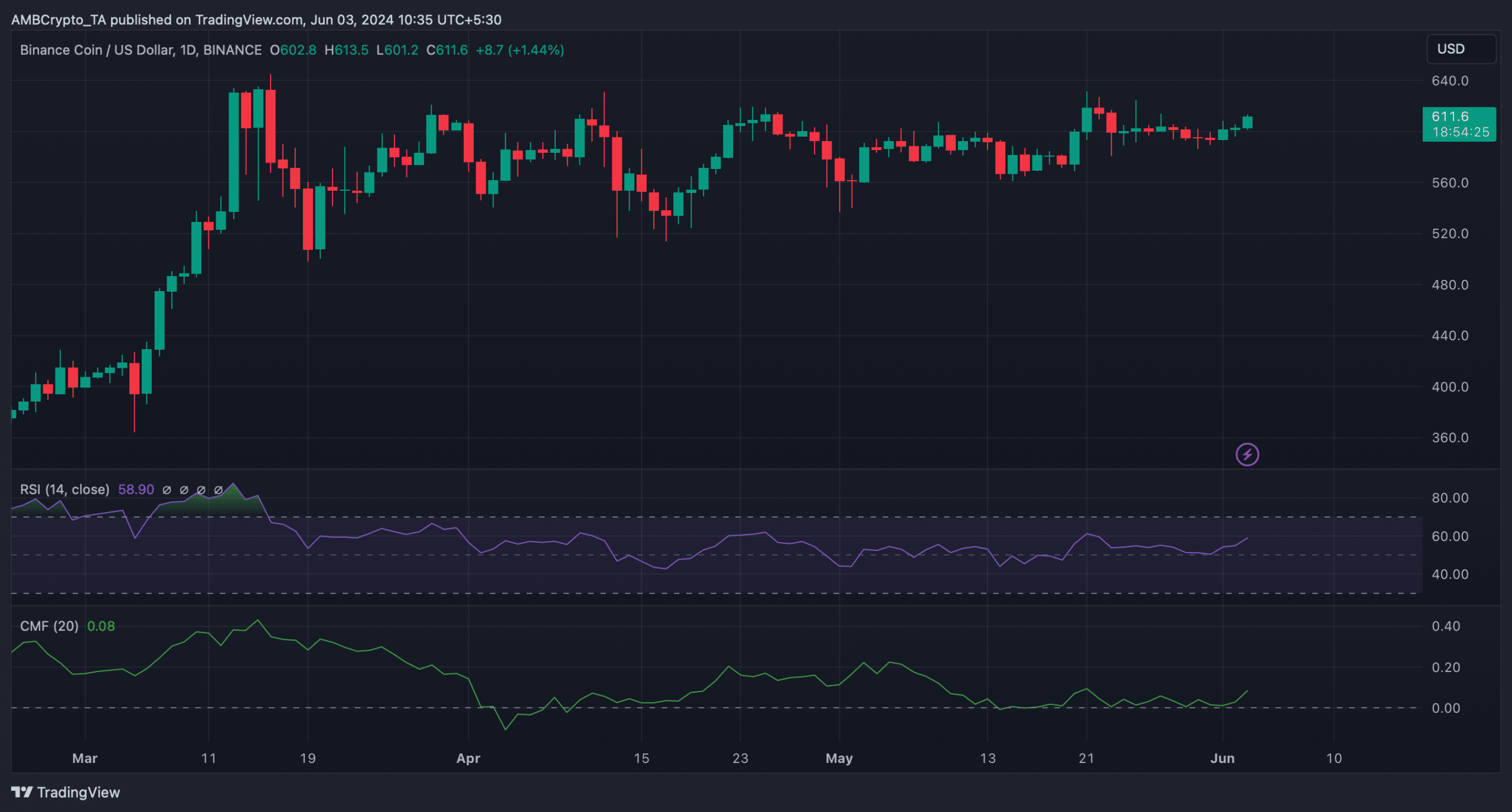

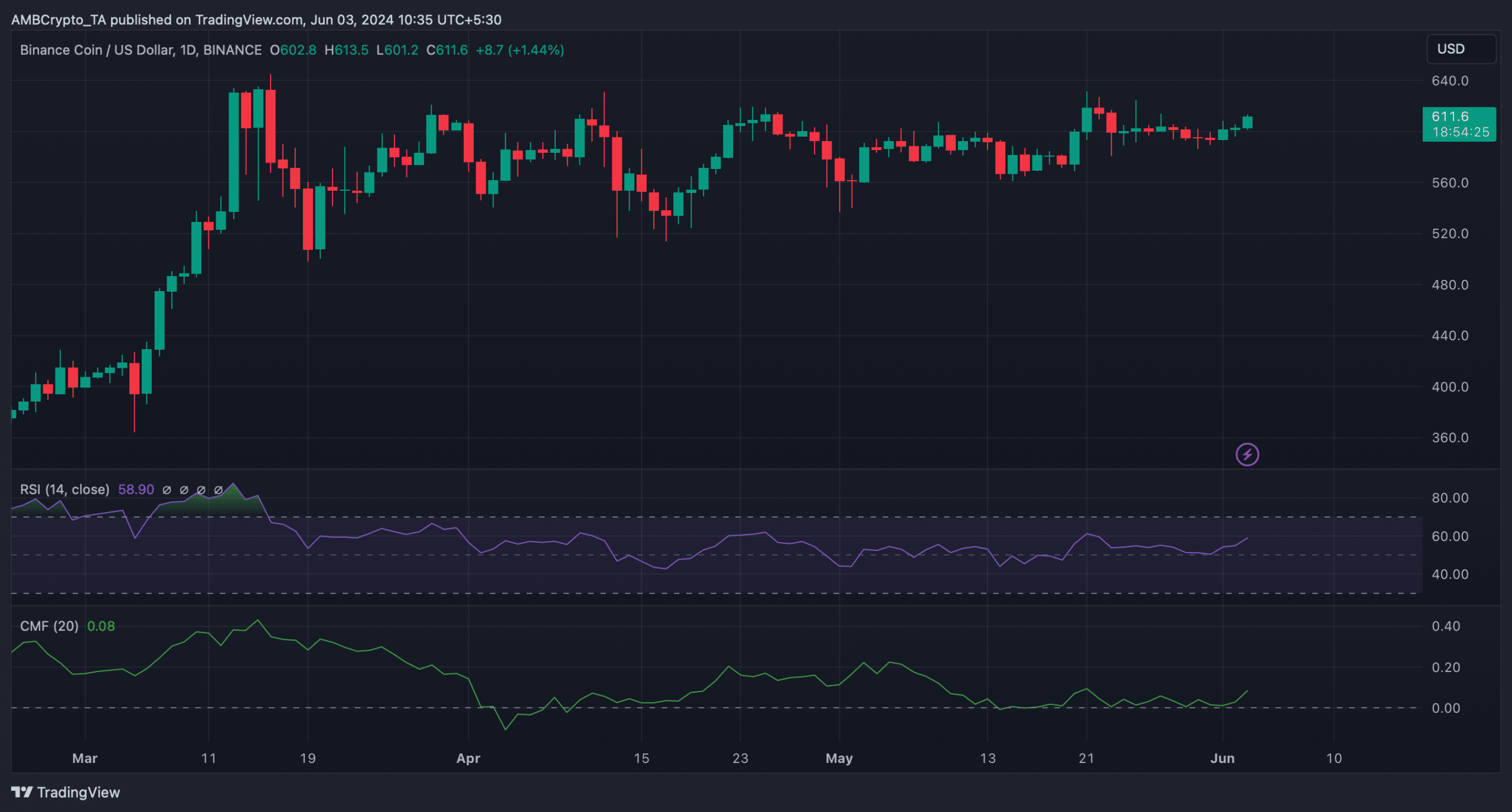

Whereas all this occurred, a bullish pennant sample fashioned on the coin’s day by day chart. The coin’s value entered the sample in March and since then has been consolidating inside it.

At press time, it was near testing the higher restrict of the sample. A profitable breakout may permit BNB to go above its March excessive over the approaching weeks.

Supply: TradingView

Is a rally attainable?

AMBCrypto then analyzed the coin’s on-chain metrics to verify the percentages of BNB efficiently breaking above the bullish pennant sample.

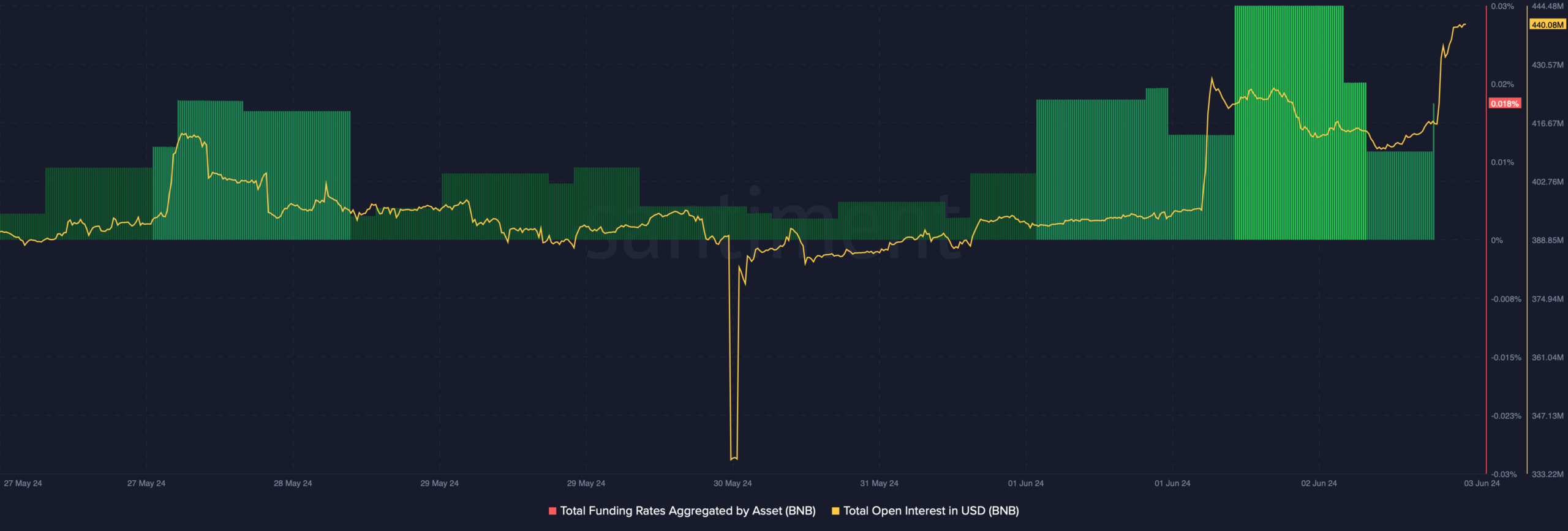

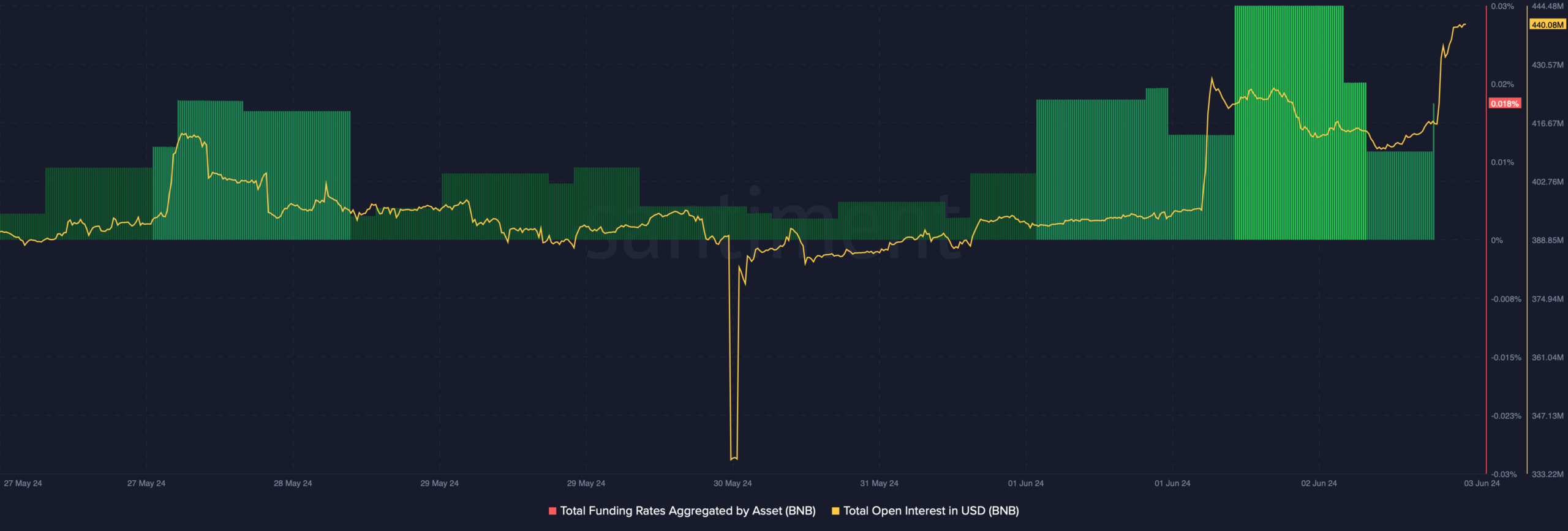

As per our evaluation of Santiment’s knowledge, BNB’s open curiosity elevated together with its value. Usually, an increase within the metric means that the probabilities of the on-going value development persevering with additional are excessive.

Nonetheless, BNB’s funding price elevated. As costs have a tendency to maneuver the opposite method than the funding price, there’s a chance of BNB turning bearish quickly.

On prime of that, BNB’s fear and greed index had a price of 61, which means that the market was in a “greed” section. Each time the metric hits that degree, it signifies a attainable value correction.

Supply: Santiment

Practical or not, right here’s BNB’s market cap in BTC phrases

We then took a have a look at the coin’s day by day chart to raised perceive whether or not a bullish breakout was attainable. In response to our evaluation, technical indicators seemed fairly bullish on the coin.

For instance, its Relative Energy Index (RSI) registered an uptick from the impartial mark. The Chaikin Cash Circulation (CMF) additionally adopted an identical development, hinting at a continued value improve.

Supply: TradingView