Members of the Aave neighborhood are pushing for a payment change proposal after the DeFi protocol’s annual revenues hit new highs this week.

On June 2, Aave liquidity committee member Matthew Graham reported that the protocol “averaged simply over $80 million in annual income from seven Aave v3 and v2 deployments” throughout a number of blockchain networks, together with Ethereum.

Stani Kulechov, the founding father of Aave, confirmed this milestone and stated:

“Aave DAO now earns $115 million yearly. Let that sink in for a second.”

These excessive yields should not surprising given the circumstances Crypto lately reported that Aave was one of many few decentralized purposes that crypto customers most well-liked over conventional blockchain networks.

Consequently, the spectacular revenues locally have reignited requires a price change proposal. A payment change permits a platform to allow or disable particular consumer charges, doubtlessly redistributing transaction-generated charges amongst platform individuals. Notably, a number of DeFi protocols, together with Uniswap, are contemplating initiating an initiative for his or her customers.

In the meantime, these calls come greater than a month after Marc Zeller, founding father of the Aave Chain Initiative, steered a price change proposal was in improvement. Zeller emphasised that the Aave DAO has a big revenue margin, which offers a monetary cushion for the following 5 years.

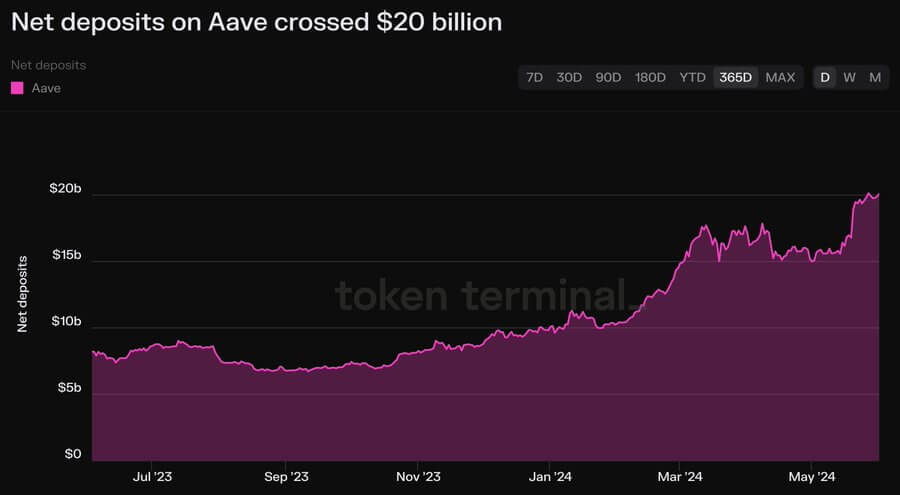

Deposits exceed $20 billion.

Based on knowledge from Token Terminal, the quantity of crypto deposited in Aave has surpassed $20 billion, a stage not seen for the reason that crash of Terra’s algorithmic stablecoin UST in 2022.

Market specialists stated the expansion of the protocol exhibits that the DeFi sector rapidly recovered from the lows of the 2022 bear market, which led to the collapse of a number of centralized lenders corresponding to Celsius, Genesis and others. Moreover, they stated the elevated liquidity displays rising investor curiosity in Ethereum, pushed by the optimism surrounding ETH Change Traded Funds (ETF) approvals.

Based on DeFillama knowledge, Aave is the most important crypto lending platform within the trade, based on the Ethereum community. The platform lately introduced plans to introduce a number of key initiatives, together with the launch of Aave V4, a brand new visible identification, and expanded DeFi functionalities for its customers.